Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

BounceBit’s 2024 Roadmap Announced: Key Developments Post-Mainnet Launch

On May 20, one week after its mainnet launch, BounceBit, a Bitcoin restaking protocol, unveiled its detailed 2024 roadmap.

The roadmap highlights the company’s plans to enhance the integration of centralized finance (CeFi) with decentralized finance (DeFi), forming a hybrid known as CeDeFi.

BounceBit Aims to Merge the Best of CeFi and DeFi

BounceBit’s 2024 roadmap outlines a series of upgrades and new product offerings. These plans are designed to strengthen its ecosystem and improve user experience. The roadmap intends to optimize its blockchain infrastructure, enhance liquidity, and provide diverse yield-generating options for investors.

The project sees key issues in both sectors. Centralized platforms offer structure and accessibility, but they often conflict with crypto’s core values of transparency and decentralization. Conversely, DeFi provides direct market participation but struggles with smart contract security and scalability challenges.

Read more: CeFi vs. DeFi: Everything You Need To Know

By integrating the best aspects of CeFi and DeFi, BounceBit aims to democratize access to high-yield opportunities traditionally reserved for top asset management firms. The BounceBit Chain, the project’s blockchain infrastructure, ensures secure and efficient settlement and record-keeping. Users can earn staking rewards and participate in yield-generating activities using a dual-token proof-of-stake system.

Liquid Custody Tokens (LCT) play a central role in BounceBit’s ecosystem, bridging CeFi and DeFi. These tokens enable users to earn interest from CeFi while participating in Bitcoin staking and on-chain farming.

“All LCTs are backed 1:1 by equivalent assets in custody, and they stay there until the LCT is redeemed. Custody is effectively an aggregated pool of assets, in a passive state, until they are not,” the BounceBit team wrote in its roadmap.

The integrated ecosystem offers three yield types: CeFi yield from arbitrage and lending, staking rewards, and opportunity yield from engaging in the BounceBit chain ecosystem.

Additionally, BounceBit Chain will see major upgrades to improve performance and usability. These include optimized EVM execution, a shared security client module, a new mempool module for higher transaction throughput, and refined communication between EVM and Cosmos software development kit (SDK).

BounceBit also introduces BounceClub. This club focuses on providing CeDeFi as a service, allowing users to launch their own products using BounceBit’s infrastructure.

Read more: Which Are the Best Altcoins To Invest in May 2024?

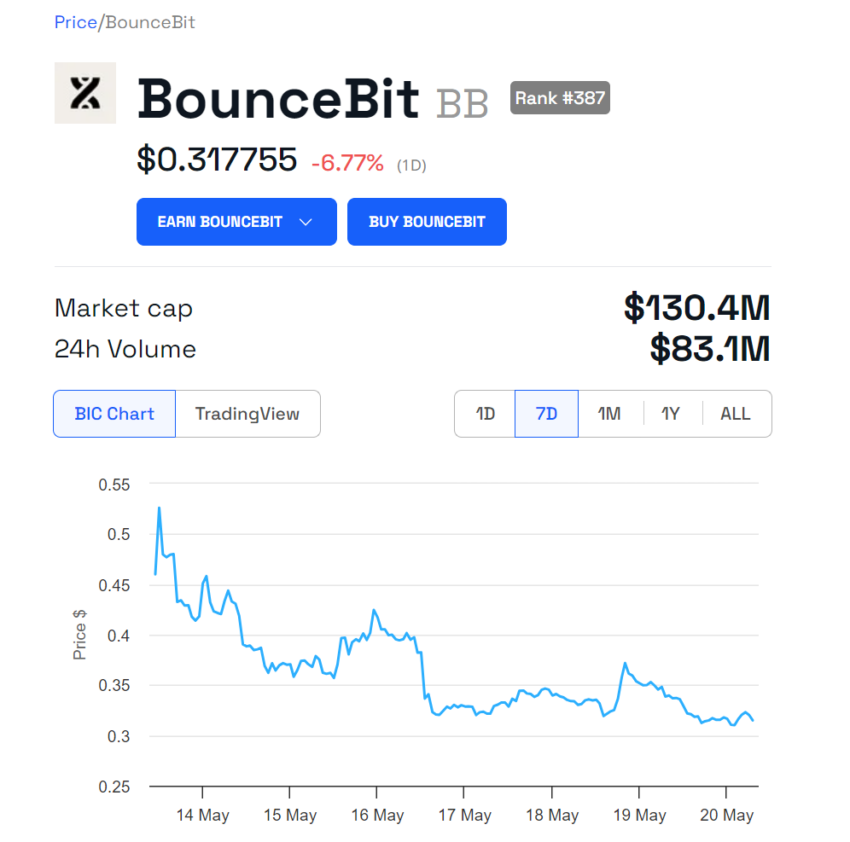

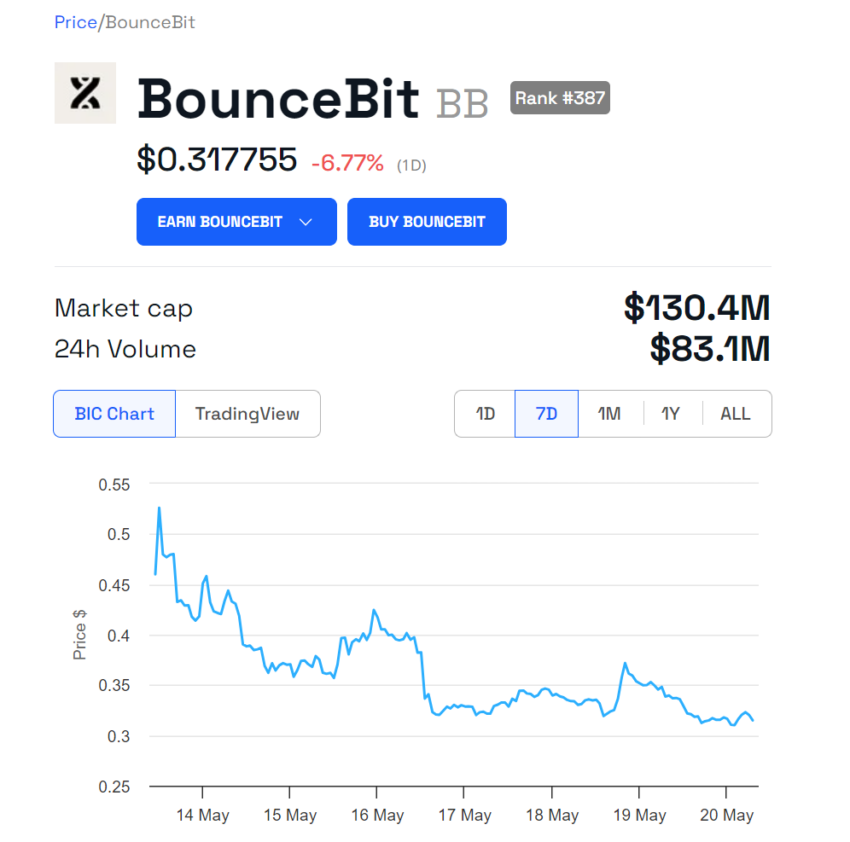

BB Price Performance. Source: BeInCrypto

BB Price Performance. Source: BeInCrypto

According to BeInCrypto’s previous report, BounceBit launched its mainnet on May 13, along with an airdrop of its native token, BB, which several crypto exchanges listed. Despite a current market capitalization of $130.4 million, BB’s price has decreased from $0.46 at launch to $0.31, reflecting a 6.77% drop in the last 24 hours.

The post BounceBit’s 2024 Roadmap Announced: Key Developments Post-Mainnet Launch appeared first on BeInCrypto.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

NYT Strands today — hints, spangram and answers for game #78 (Monday, May 20 2024)

We help you find today’s Strands answers with some useful hints and tips to win.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

This one bodyweight exercise strengthens your abs, obliques and hips — and boosts your metabolism

The lateral shoot through is a bodyweight exercise that develops balance, coordination, cardiovascular fitness and muscular endurance. Here’s how to do it.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

Save $30 on this dual USB-C and USB-A flash drive

Flash drives are a handy tool for transferring data and making sure your most important files remain secure. However, when you want to transfer data between devices with different ports, it becomes a real pain. Fortunately, this Dual USB-C + USB-A 3.2 High-Speed Flash Drive offers more flexibility than the average flash drive and it’s $30 off now.

This handy drive has a dual USB 3.2 and USB Type-C interface, giving you a wider range of compatible devices. You can plug and play in any device without a cable or software required and store up to 1TB of data on the drive with ultra-fast 20-30MB/S read and write speed. It’s made with a high-quality metal case that is waterproof, dust-proof, and resistant to drops, so it’s built for daily wear and tear.

Work more flexibly with your data. Right now, you can get the Dual USB-C + USB-A 3.2 High-Speed Flash Drive for 29% off $109 at just $77.99.

Dual USB-C + USB-A 3.2 High Speed Flash Drive – $77.99

See Deal

StackSocial prices subject to change.

Accessories

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

Why Is The Crypto Market Down Today?

The total crypto market cap (TOTAL) and Bitcoin’s (BTC) price took a short break over the weekend from the ongoing rally. Although the intra-day candlestick is green, the bearishness from the last two days has also been extended to today, keeping the overall growth minimal.

This has impacted Pyth Network (PYTH), which is currently experiencing a drawdown on the daily chart.

In the news today:-

- Genesis secures court approval to distribute $3 billion to its creditors, enabling the users impacted by the bankruptcy to receive 77% of their claims.

- Crypto exchange Kraken’s Global Head of Asset Growth and Management, Mark Greenberg, reassured that they have no plans to delist Tether (USDT) in Europe.

The Total Market Cap Is Facing Resistance

The total market capitalization is presently at $2.36 trillion, just under the resistance of $2.40 trillion. This resistance has been tested twice in the past, and TOTAL has failed to breach it.

This is the current situation, and TOTAL might also observe some struggle to breach it again. The dip noted over the weekend did not hurt the recent growth. However, the green candlestick from the intra-day trading did not initiate recovery either, keeping TOTAL at the same mark it was at two days ago.

Read More: Why do Hong Kong Spot Crypto ETFs Matter?

Total Crypto Market Analysis. Source: TradingView

Total Crypto Market Analysis. Source: TradingView

Extended bearish cues will only bring TOTAL down to $2.29 trillion, which has been a key support floor in the past.

Bitcoin’s Price Rise Halts

Bitcoin’s price is above $67,100 at the time of writing. The cryptocurrency witnessed a minor dip in the last two days, which resulted in the ongoing rise experiencing a short pause. The 1.26% growth observed today has recovered most of the dip, but Bitcoin is still performing only slightly better than yesterday.

The chances of BTC’s price action in the future is consolidation between $68,500 and $64,800. This will continue until either of the levels is broken through or below.

Read More: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, a fall below $64,800 will invalidate any chances of a bullish outcome. Instead. it could further extend the decline to $63,700.

Pyth Network Hits Four-Month Low

Pyth Network’s price has been consistently declining for the last two months. Following the cues of BTC and the rest of the market, PYTH fell by 13% on Sunday. As a result, the altcoin is trading at $0.38, which is above the key support of $0.35.

Read More: Cryptocurrency Coins vs. Tokens: What’s the Difference?

Pyth Network Price Analysis. Source: TradingView

Pyth Network Price Analysis. Source: TradingView

If this support is lost, the decline will continue. On the other hand, if PYTH bounces back from this support, a recovery to $0.46 is possible. Breaching this will invalidate the bearish thesis.

The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

Crypto Fraud Fallout: Finiko Executive Sentenced to 3 Years in Prison

The Vakhitovsky District Court of Kazan has sentenced Lilia Nuriyeva, a key participant in the notorious Finiko Ponzi scheme, to three years in prison.

Nuriyeva was found guilty of defrauding private investors and participating in an organized criminal community, reflecting the gravity of the charges brought against her.

How Crypto Ponzi Scheme Finiko Conducted $55 Million Scam

Finiko, often compared to the infamous MMM Ponzi scheme, lured investors with promises of high returns through a purportedly unique cryptocurrency and stock market trading system. The scheme, masterminded by Kirill Doronin, operated from 2018 until its collapse in 2021, leaving a trail of financial devastation.

According to the Ministry of Internal Affairs, the scheme caused over 5 billion rubles (~ $55 million) in damages.

The investigation revealed that Doronin and his accomplices traveled across Russia, conducting master classes to attract thousands of investors. They promised substantial returns through an “automatic profit generation system,” persuading people to invest by taking out loans and selling their homes.

Read more: 15 Most Common Crypto Scams To Look Out For

Initially, investors received dividends paid in Bitcoin, which they could withdraw. However, the launch of Finiko’s own cryptocurrency saw its value plummet within a month, wiping out investors’ savings.

In 2021, the Central Bank identified Finiko as a financial pyramid, listing it among companies with signs of illegal activity. Despite this, the scheme continued to attract significant investments until its abrupt collapse.

Offices nationwide closed, and the company’s website went offline. Doronin assured investors it was a technical glitch, but investigators later found that his associates had fled abroad with the funds.

One investor, Lyudmila Yamshchikova from Kazan, recounted her ordeal to the Russian outlet – Izvestia.

“Payments suddenly stopped. I invested nearly a million [rubles], intending to use the interest to pay off my mortgage. Half of the city was buying apartments, cars, and paying off loans. But then withdrawals were blocked,” Yamshchikova said.

Nuriyeva’s sentence was notably lenient due to a pre-trial agreement. She will spend only three years in the prison. Initially, she faced up to ten years in prison.

Lilia Nuriyeva at the Trial. Source: Izvestia

Lilia Nuriyeva at the Trial. Source: Izvestia

Currently, Doronin and nine other accomplices are in pre-trial detention. They face charges of organizing and participating in a criminal community and large-scale fraud. The General Prosecutor’s Office approved their indictment, and the case was sent to the Vakhitovsky Court on April 27.

Read more: Top Cryptocurrency Scams in 2024

The Financial Crimes and Enforcement Network (FinCEN) identified Finiko as one of Bitzlato’s top three receiving counterparties. Bitzlato, a Russian P2P exchange, saw its founder charged with money laundering by the US in 2023.

The post Crypto Fraud Fallout: Finiko Executive Sentenced to 3 Years in Prison appeared first on BeInCrypto.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

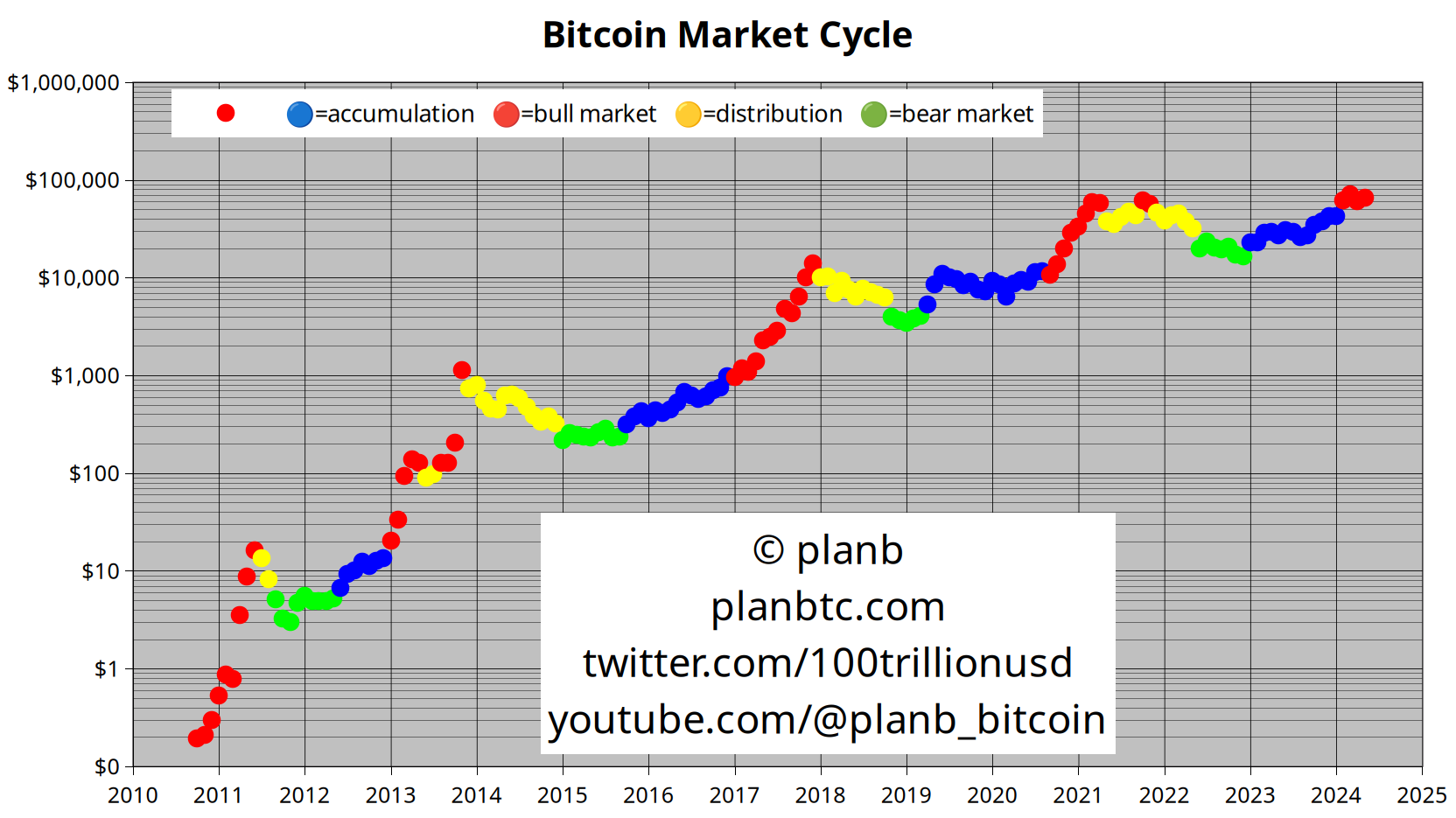

Quant Analyst PlanB Says Bitcoin Flashing ‘2017 Vibes,’ Hints at Final Chance To Accumulate BTC Below $70,000

Well-known quant analyst PlanB says that Bitcoin (BTC) looks the same as it did in 2017 before witnessing a meteoric ascent.

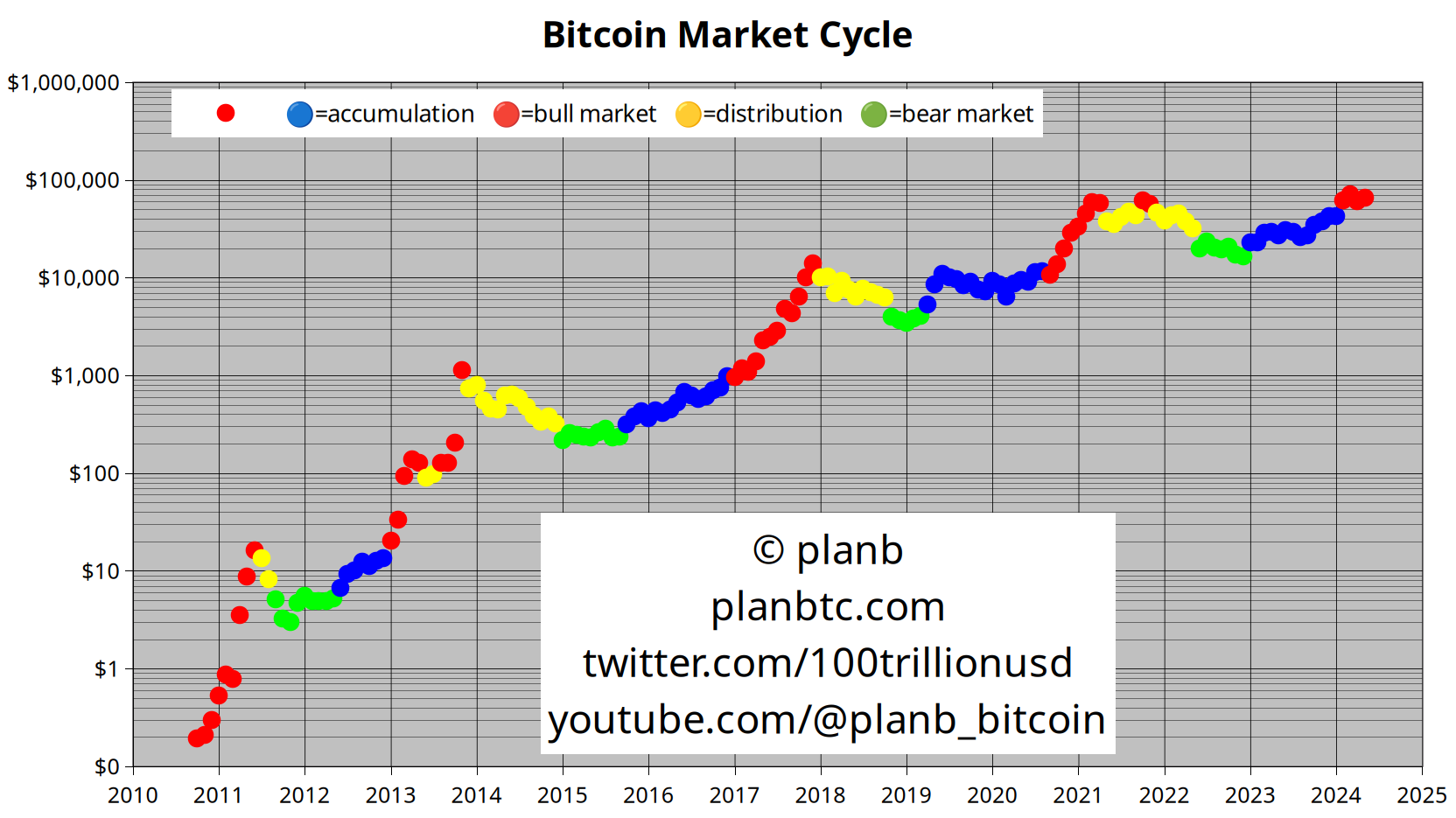

PlanB tells his 1.9 million followers on the social media platform X that BTC is currently four months into its bull market phase, indicated by the four red dots on his chart.

“2017 vibes.”

Source: PlanB/X

Source: PlanB/X

Based on PlanB’s chart, the leading cryptocurrency by market cap was trading at around $1,200 when it was at its fourth red dot in 2017 but quickly rallied to the $20,000 mark by the end of the year.

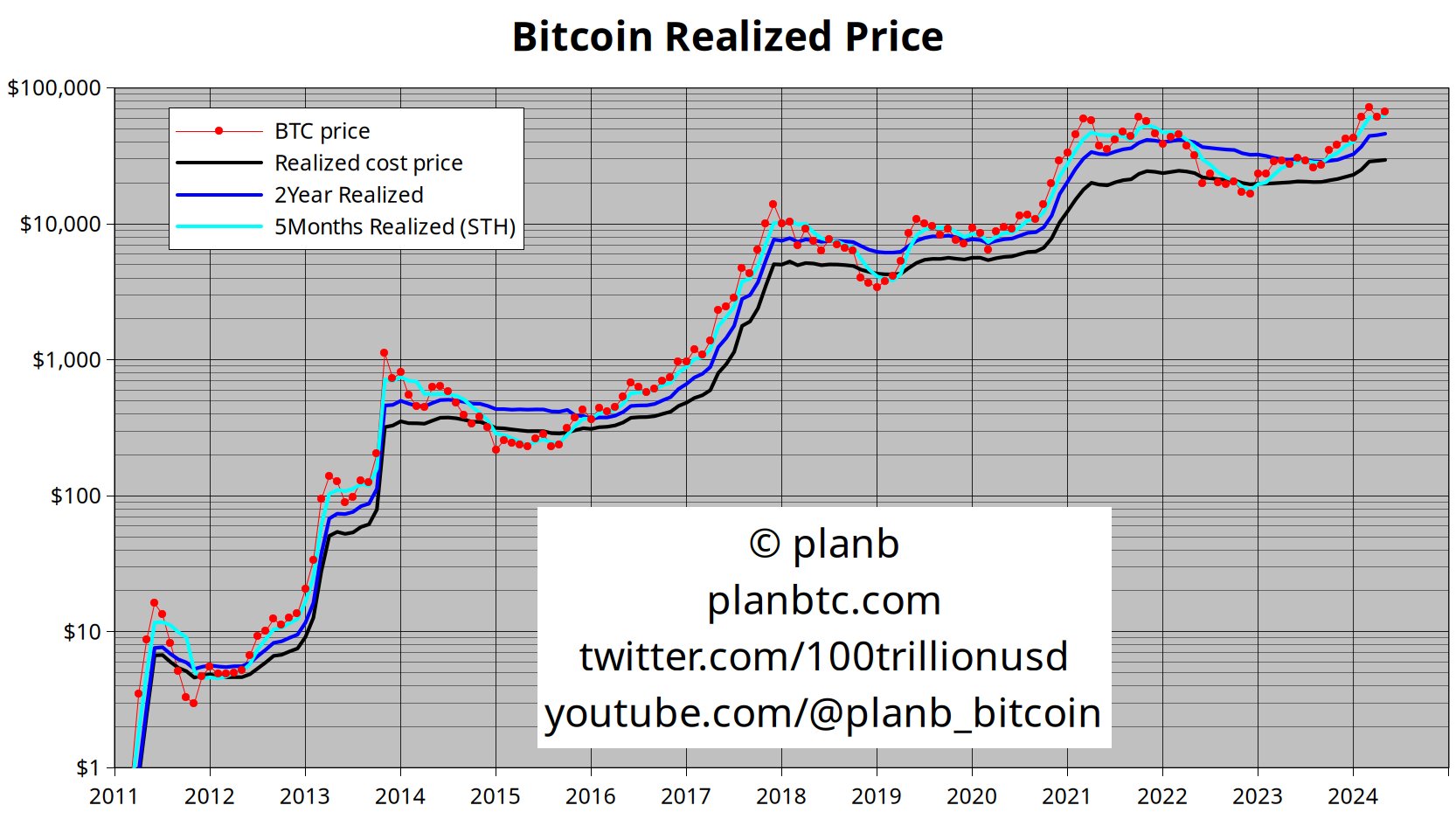

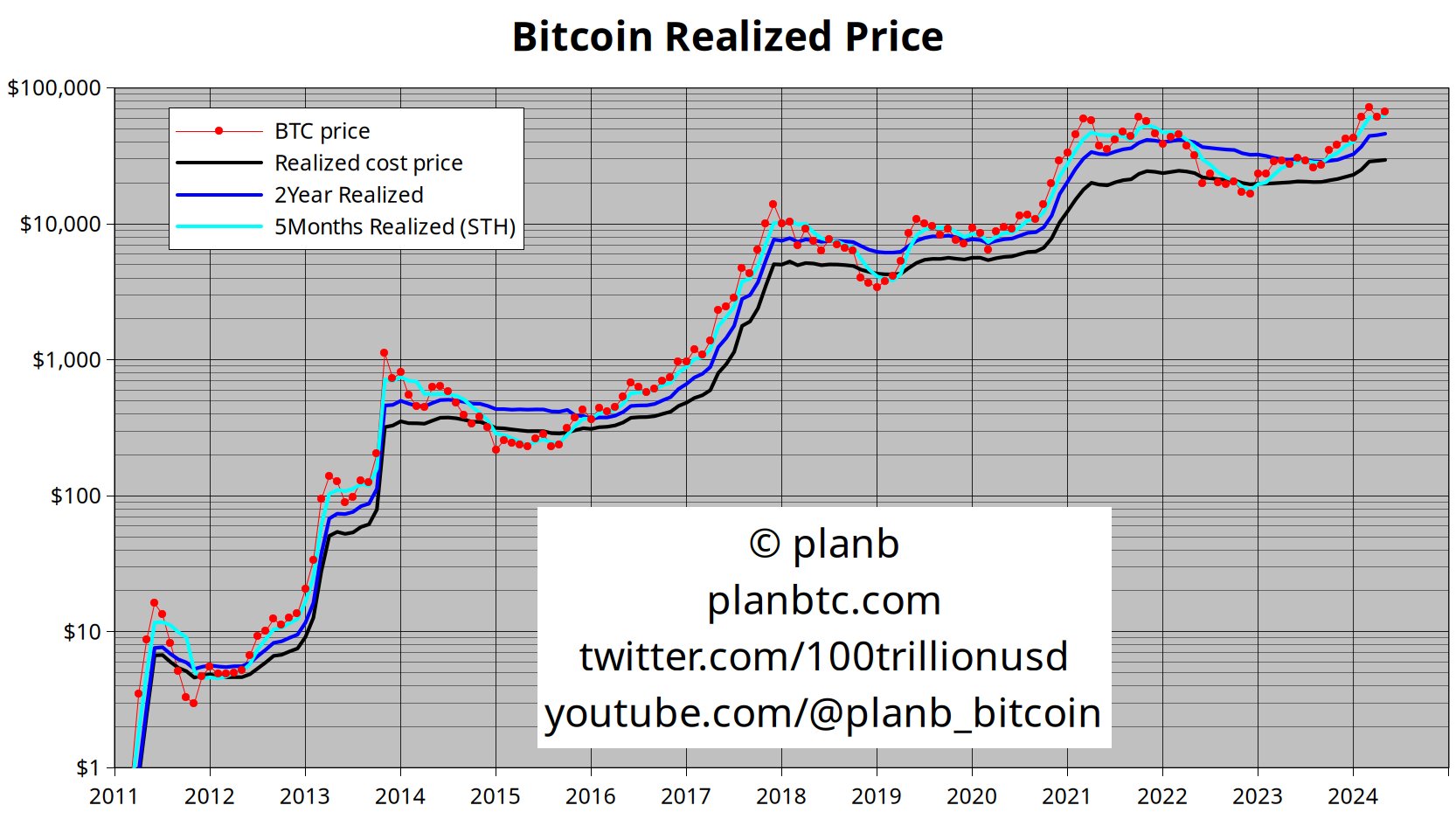

The quant analyst is also looking at different variations of Bitcoin’s realized cost price indicator, which measures the value of a given cohort’s coins at the price they were last transacted. PlanB’s chart shows three variations of the metric including the five-month, two-year and total realized cost price of BTC.

The analyst’s chart also shows that BTC’s price is above all three metrics, suggesting that we may be seeing the final days of BTC trading at current levels.

“Last chance to buy Bitcoin below $70,000?”

Source: PlanB/X

Source: PlanB/X

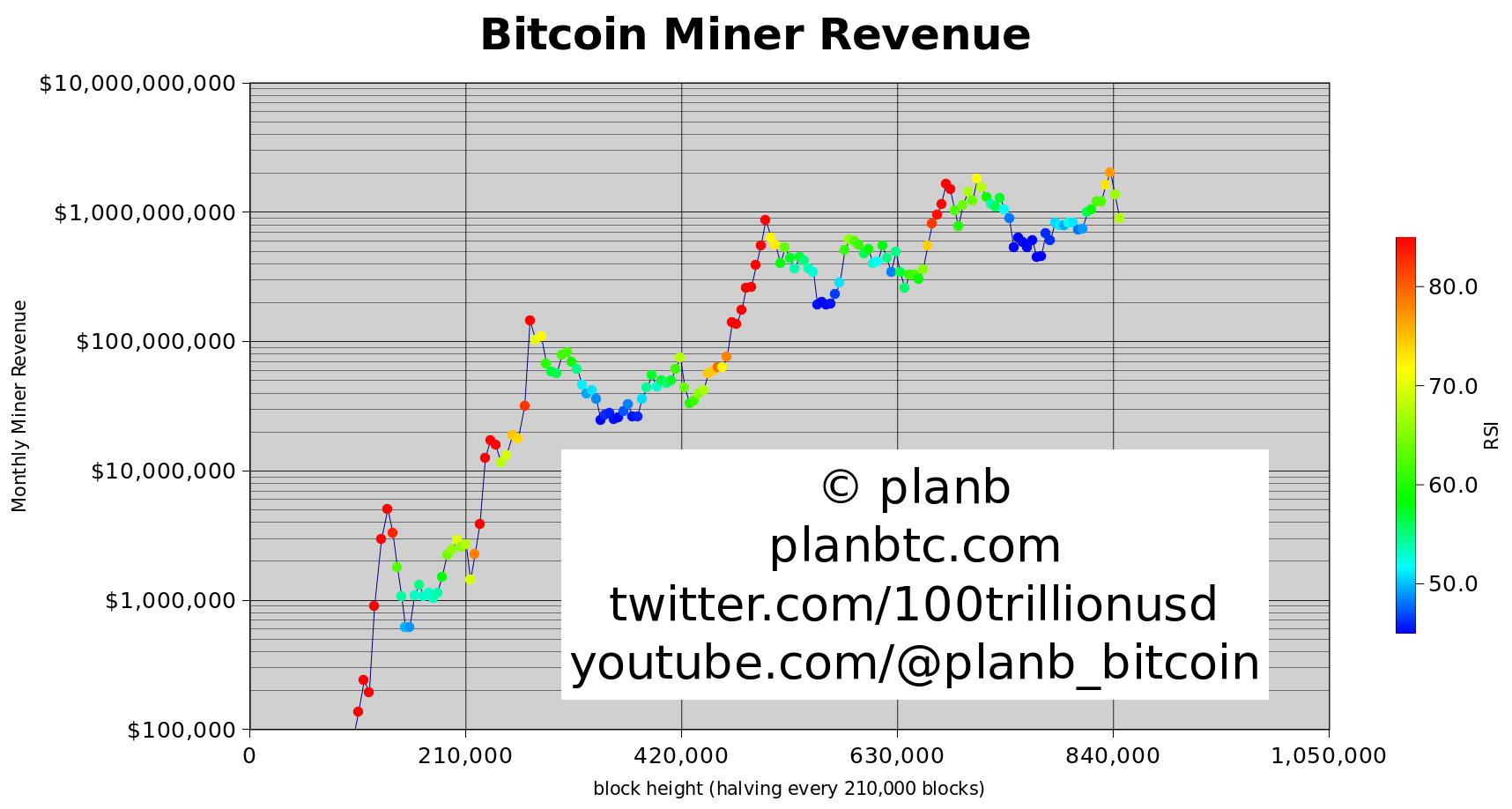

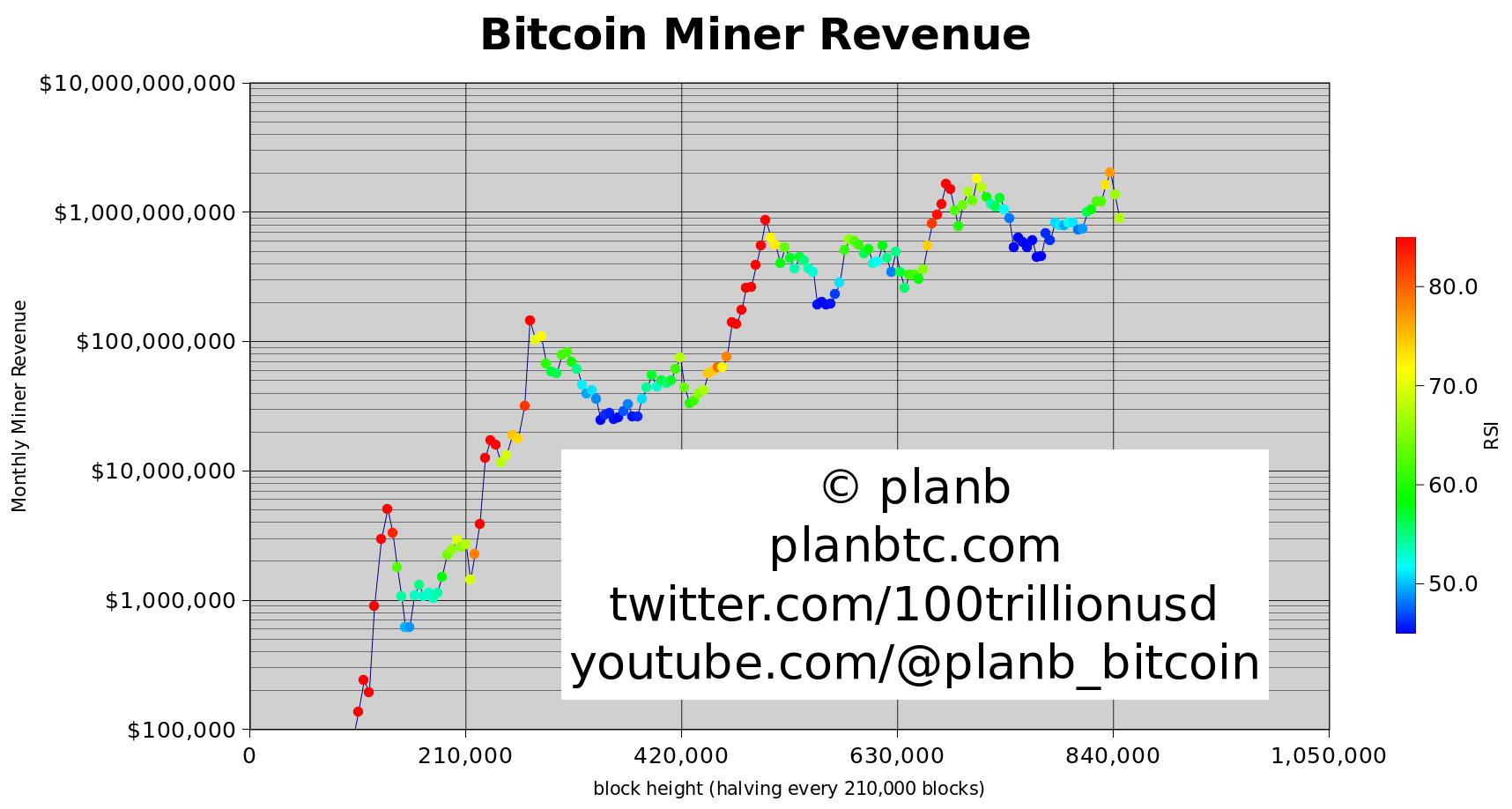

PlanB also says that based on the historical correlation between miner revenue and price action, BTC should go “vertical” later in 2024 as the industry’s revenue recovers from the halving.

“Historically, Bitcoin miner revenue recovers two to five months after a halving, and after that Bitcoin price goes vertical.”

Source: PlanB/X

Source: PlanB/X

At time of writing, Bitcoin is trading at $67,105.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Quant Analyst PlanB Says Bitcoin Flashing ‘2017 Vibes,’ Hints at Final Chance To Accumulate BTC Below $70,000 appeared first on The Daily Hodl.

Published in B&T Latest News

20 May, 2024 by The bizandtech.net Newswire Staff

Bitcoin Price Eyes $83K: Whales Fuel Bullish Outlook as BTC Price Targets ATH

The post Bitcoin Price Eyes $83K: Whales Fuel Bullish Outlook as BTC Price Targets ATH appeared first on Coinpedia Fintech News

As the digital asset industry marks exactly one month since the fourth Bitcoin (BTC) halving, the total cryptocurrency market cap held above $2.5 trillion on Monday, bolstered by the 10 percent BTC price pump last week. Bitcoin dominance continued to grow at the expense of the altcoin market, as depicted by the declining trend of the ETH/BTC pair on the weekly time scale.

According to the latest market data, Bitcoin traded slightly above $67,100 on Monday during the early Asian session. A sustained bullish sentiment will ultimately pump Bitcoin price to retest the recent all-time high (ATH) above $73k.

Bitcoin Whales on the Hunt

Tags: B&T Latest News

Tags: B&T Latest News

-->

BB Price Performance. Source: BeInCrypto

BB Price Performance. Source: BeInCrypto

Total Crypto Market Analysis. Source:

Total Crypto Market Analysis. Source:  Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:  Pyth Network Price Analysis. Source:

Pyth Network Price Analysis. Source:  Lilia Nuriyeva at the Trial. Source:

Lilia Nuriyeva at the Trial. Source:

Source:

Source:  Source:

Source:  Source:

Source:

Tags:

Tags: