Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Bitcoin futures break records with 29% OI surge in November

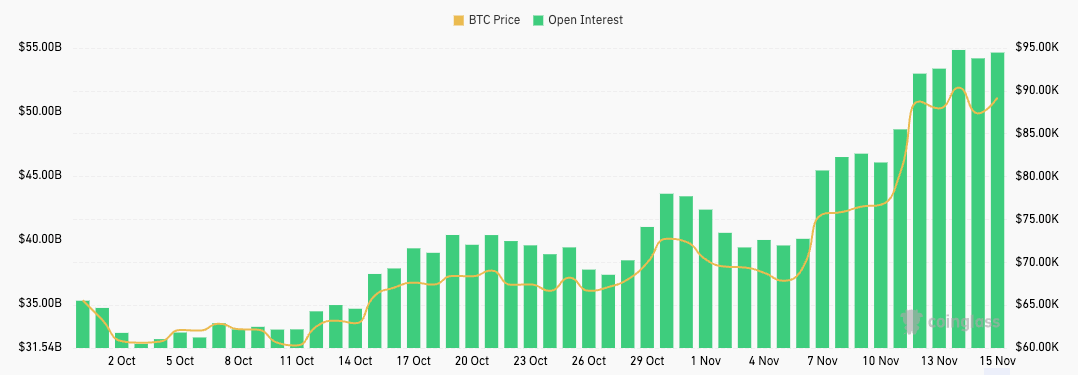

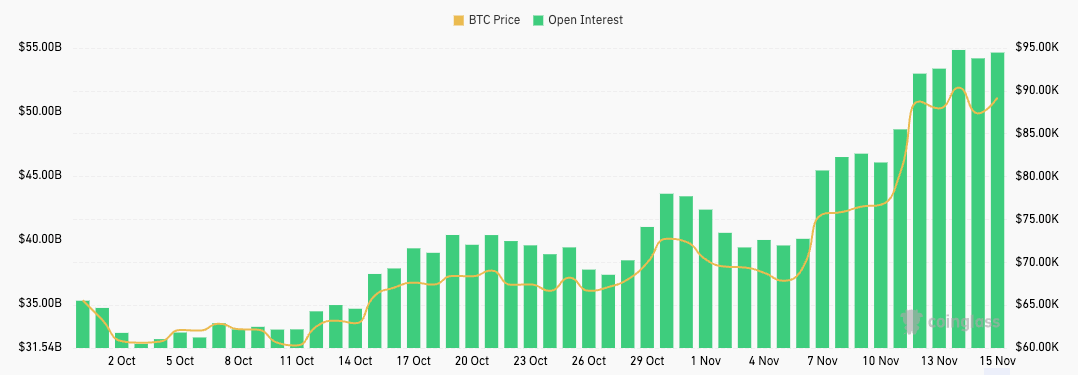

Bitcoin’s futures open interest grew from $34.68 billion on Oct. 1 to an all-time high (ATH) of $54.85 billion on Nov.14.

This increase of over 58% since the start of October and 29% since the beginning of November shows a significant influx of capital and increased trader participation, with much of this growth accelerating after the US election.

Graph showing Bitcoin futures open interest from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

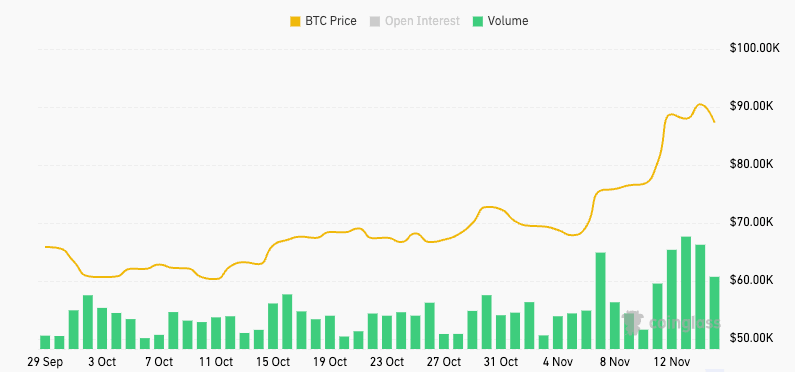

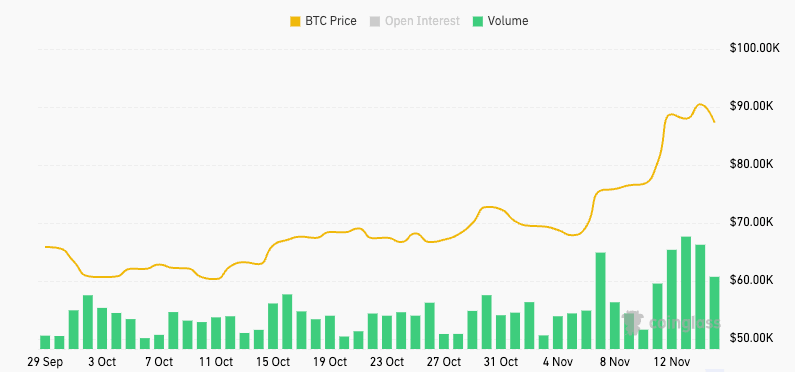

Futures also saw a dramatic increase in trading volume, with daily volume peaking at just over $207 billion on Nov. 13, marking the fourth-largest trading volume ever recorded. The surge in open interest and volume shows a significant increase in speculation and leveraged trading, an inevitable side-effect of a bull rally.

Graph showing Bitcoin futures trading volume from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures trading volume from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

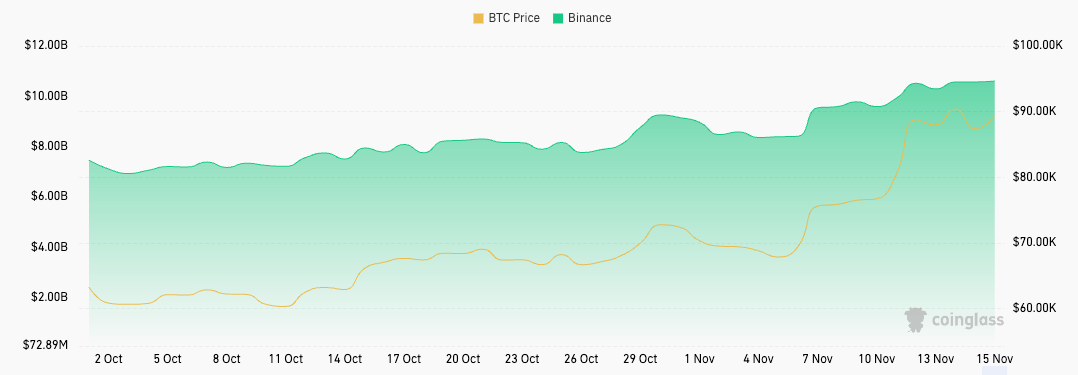

While Bitcoin’s derivatives are growing steadily, with both old and new exchanges becoming prominent players in the space, half of the market is still dominated by two platforms — CME and Binance. This is why the changes in their market share and growth trajectories often reveal nuances in market sentiment that aren’t that obvious when looking at the big picture.

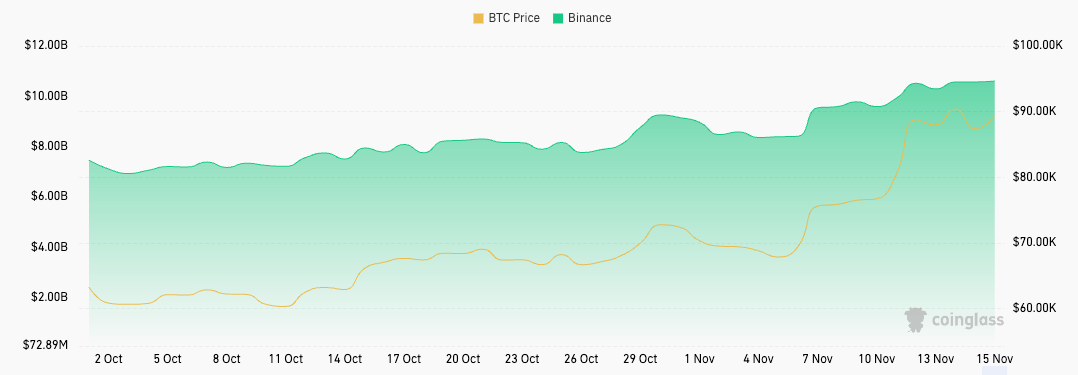

In the past 40 days, Binance accounted for a substantial portion of the total futures market, with its open interest increasing steadily from $7.47 billion on Oct.1 to a record $10.61 billion on Nov.15.

Graph showing Bitcoin futures open interest on Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest on Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

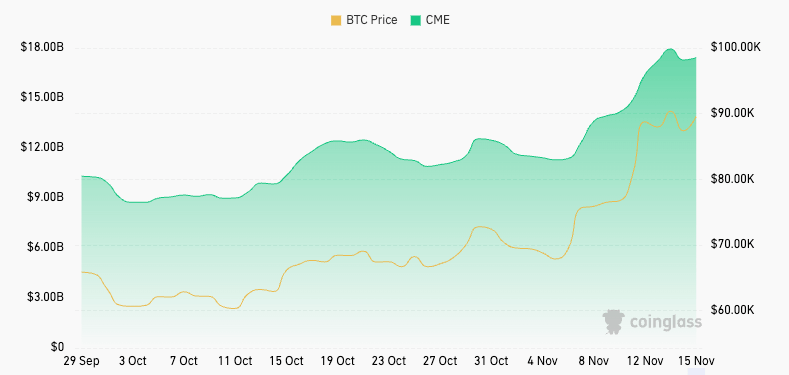

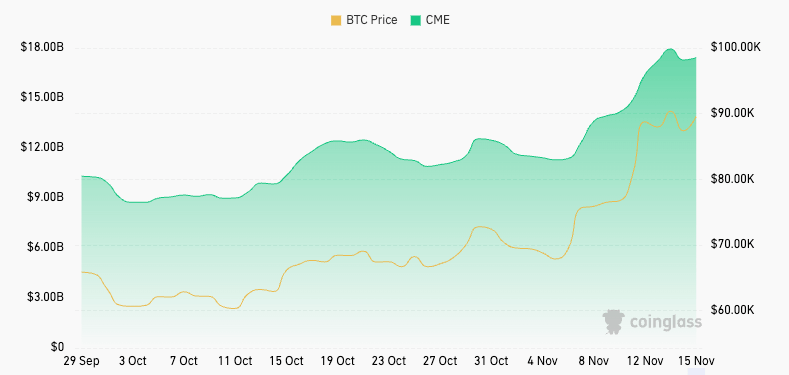

Meanwhile, CME exhibited even more aggressive growth, with its open interest rising from $9.93 billion to a peak of $17.94 billion within the same period.

Graph showing Bitcoin futures open interest on CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest on CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

The difference between CME and Binance’s market share shows what the market prefers.

Binance, catering to retail and speculative traders, benefits from its global accessibility, lower fees, and broader altcoin derivative offerings. In contrast, CME attracts a more risk-averse, regulation-focused cohort, with institutional investors favoring the exchange’s credibility.

The rise in CME’s open interest to nearly a third of the total market by Nov. 14 points to institutional capital fueling much of the rally. This institutional participation is a strong bullish signal, as it suggests confidence in Bitcoin’s medium- to long-term prospects rather than the speculative fervor often associated with retail.

The impact of the US election is evident in the data. Following Trump’s win on Nov. 5, Bitcoin’s price soared from $67,830 to a high of $93,500 by Nov. 12. Futures mirrored this enthusiasm as the $10 billion increase in open interest from Nov. 7 to Nov. 14 is a result of a surge in leveraged positions as traders rushed to capitalize on the bullish sentiment.

However, the drop in trading volume from $207.04 billion on Nov. 13 to $133.02 billion on Nov. 15 suggests some profit-taking and reduced momentum toward the end of this period, potentially hinting at traders consolidating gains.

Several additional observations can be made from this data. First, the sustained growth in Binance’s open interest indicates robust retail participation despite increased institutional presence in the market.

Second, the correlation between Bitcoin’s price rise and the dramatic increase in futures volume suggests that the spot market’s bullish momentum was amplified by speculative derivatives trading.

Lastly, the market’s preference for CME reflects growing institutional confidence in Bitcoin as a legitimate asset class, a crucial factor for long-term adoption.

The post Bitcoin futures break records with 29% OI surge in November appeared first on CryptoSlate.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

France vs New Zealand live stream: How to watch 2024 Autumn Internationals rugby online

All the ways to watch France vs New Zealand live streams from anywhere as Les Bleus go in search of a third straight win over the All Blacks.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Best Token Presale to Buy: RCO Finance Enters Final Weeks Blowing Past BlockDAG and Pepe Unchained

RCO Finance is gaining significant attention as a leading investment opportunity in the crypto token presale market, particularly as it approaches the final stages of its presale.

Some experts are touting it as the best token presale to buy, outpacing competitors like BlockDAG and Pepe Unchained, which are still in their presale phases. Here are several reasons to capitalize on the best token presale to buy now.

Best Presale Token to Buy: RCOF Beats BlockDag and Pepe Unchained With AI

It’s no longer hidden that many investors are excited about RCO Finance as one of the best token presales to consider, especially as it enters its final weeks and impressively outperforms competitors like BlockDAG and Pepe Unchained. However, one question remains: What factors drive RCO Finance to such remarkable heights?

One standout feature of RCO Finance is its innovative robo-advisor, which has everything an investor could need to navigate the market. This robo-advisor analyzes market tendencies, searches for potential financial investments, and can execute transactions independently—all while remaining under your control.

Another significant advantage of RCO Finance is its extensive trading options. It offers over 120,000 instruments, including cryptocurrencies, stocks, bonds, and Forex. This variety allows investors to diversify their portfolios and tap into multiple financial opportunities.

Moreover, RCO Finance also stands out from other trading platforms by eliminating the need for costly financial advice or complicated identity checks, making it accessible to a wider range of investors. To add another layer of security, the AI trading platform has partnered with SolidProof, a reputable blockchain security firm, to audit its smart contracts regularly.

BlockDAG’s Early Success and Future Potential

BlockDAG stands out by building a strong community and achieving remarkable success in its early fundraising efforts, raising $120 million. The current price of $0.022 reflects an impressive 2100% increase since its launch, making it a popular choice among cryptocurrency enthusiasts.

Traders are attracted to BlockDAG’s limited-time promotion, which offers a 100% bonus on purchases. This allows buyers to receive double the amount of BDAG coins, presenting an appealing investment opportunity. However, RCOF is still the best token presale to buy now.

Pepe Unchained’s Presale: A $24.6 Million Success Story

Pepe Unchained is set to be the first meme coin themed around Pepe with its blockchain. The ongoing presale has already raised an impressive $27 million, with the current price of its PEPU token at $0.01671.

Pepe Unchained tackles slow and costly Ethereum transactions with the “Pepe Chain,” offering lower fees and faster processing while using Ethereum wallets.

Key features include a block explorer, a bridge to Ethereum, staking options, and a decentralized exchange. However, RCOF is expected to outperform it as the best token presale to buy.

RCO Finance: The Best Token Presale To Buy Now?

With over $4.5 million raised in its ongoing presale, RCO Finance is making waves as it enters the final weeks of this phase. It quickly became a top choice for investors looking to buy new tokens. With more than 70 million tokens sold so far, it’s clear that RCO Finance is the best token presale to buy now.

Currently priced at $0.0559, RCOF will soon move to Stage 4, where the price will increase to $0.077. Analysts predict that once RCOF is officially listed, its token value could soar by as much as 10,000x, mirroring the explosive bull runs seen with Ethereum and Bitcoin.

Investing in RCOF presents the potential for significant financial gains from the presale and grants buyers a voice in the RCO Finance community. The best part? Investors can participate in exciting opportunities, such as a lucky draw with a chance to win up to $100,000.

What are you waiting for? Don’t miss out on the best token presale to buy!

For more information about the RCO Finance (RCOF) Presale:

Disclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

The post Best Token Presale to Buy: RCO Finance Enters Final Weeks Blowing Past BlockDAG and Pepe Unchained appeared first on The Merkle News.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Koala Mattress review: adjustable comfort on a budget

The standard model Koala mattress is an affordable way to get some slightly more premium features, and give your sleep the upgrade it deserves.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Mantra (OM) Price Hits All-Time Highs Amid Strong Uptrend

Mantra (OM) price has been on a strong upward trajectory, recently reaching a new all-time high and gaining nearly 20% over the past week. This surge has been supported by strengthening technical indicators, showcasing strong momentum and a clear uptrend.

The combination of bullish EMA alignment and favorable metrics like ADX and Ichimoku Cloud suggests the rally may extend further, with the potential for new highs in the coming days. However, if the uptrend loses momentum, OM could test key support zones that will determine the sustainability of its recent gains.

OM’s Uptrend Is Getting Stronger

The ADX for OM has climbed from nearly 16 to 26.48 in just one day, highlighting a significant increase in trend strength.

An ADX above 25 typically signals a strong trend, and this surge indicates that OM is transitioning from a weak or sideways market to a clear and potentially sustained movement.

OM ADX. Source: TradingView.

OM ADX. Source: TradingView.

ADX, or Average Directional Index, measures trend strength on a scale from 0 to 100. Values below 20 show weak trends, while values above 25 signal strength.

With OM’s ADX at 26.48, the market is confirming an uptrend, supported by growing momentum and a stronger directional push, suggesting further gains could be on the horizon.

Ichimoku Cloud Shows OM Trend Is Bullish

The Ichimoku Cloud chart for OM price shows a bullish trend forming. The price has broken above the cloud (Kumo), which typically signals an uptrend.

Additionally, the cloud ahead (Senkou Span A and B) is green, indicating positive momentum and potential support levels. The price staying above the cloud further supports the likelihood of continued upward movement.

OM Ichimoku Cloud. Source: TradingView

OM Ichimoku Cloud. Source: TradingView

The Tenkan-sen (conversion line) is above the Kijun-sen (base line), another bullish signal suggesting that short-term momentum is stronger than the longer-term trend.

The lagging span (Chikou Span) is also positioned above the price, confirming that recent price action strongly supports the current trend. Together, these elements highlight a strengthening bullish sentiment for OM.

OM Price Prediction: New Highs Soon?

Mantra’s EMA lines currently exhibit a strong bullish alignment, with the price trading above all of them and shorter-term EMAs positioned above the longer-term ones. OM is one of the leading coins in the real-world assets ecosystem today and could benefit heavily if this narrative keeps growing.

This structure reflects solid upward momentum, reinforcing the notion of a sustained uptrend. The recent price action supports this bullish outlook, as OM price has managed to maintain levels well above key EMA thresholds, which often serve as dynamic support during uptrends.

OM Price Analysis. Source: TradingView

OM Price Analysis. Source: TradingView

Combining insights from the ADX and Ichimoku Cloud metrics, OM’s recent breakout to a new all-time high of $1.85 could signal the start of an extended rally. If the bullish momentum continues, further attempts at new highs are plausible in the coming days, as the narrative around real-world assets (RWA) recovers traction.

However, if the uptrend falters and reverses, the OM price may test its first strong support zone around $1.35. Should this level fail to hold, the price could decline further, potentially reaching as low as $1.25, a critical area of support.

The post Mantra (OM) Price Hits All-Time Highs Amid Strong Uptrend appeared first on BeInCrypto.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Samsung ready to take on Meta Ray-Ban glasses with its own smart glasses — here’s when

Samsung is reportedly going to released its version of smart glasses in late 2025 with very familiar specs.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Court filings reveal Elon Musk blocked OpenAI’s ICO plans to protect its reputation

Elon Musk revealed in recent court filings that he personally intervened to stop OpenAI from launching an initial coin offering (ICO) in 2018, a move he claimed would have severely damaged the organization’s reputation.

Musk’s legal team disclosed the details in an amended lawsuit filed on Nov. 14, adding to the growing tensions between the billionaire and the AI research group he co-founded.

The filing alleged that OpenAI co-founders Sam Altman and Greg Brockman proposed the ICO to address the nonprofit’s financial struggles.

However, Musk, who served as co-founder and was a significant donor rejected the plan outright, warning that issuing a token would undermine trust in OpenAI and compromise its mission to develop safe artificial general intelligence (AGI).

Musk stated in the filing:

“It would simply result in a massive loss of credibility for OpenAI and everyone associated with the ICO.”

The decision highlighted internal tensions over how the organization could balance its ambitious goals with financial sustainability.

Origins and funding challenges

OpenAI launched in 2015 with the lofty goal of ensuring AGI benefits all of humanity.

Musk joined as a co-founder and contributed $44 million in funding while serving as co-chair of its board. The organization also attracted significant support from Silicon Valley’s elite, including Altman, who provided critical leadership and additional funding.

Despite these contributions, OpenAI struggled to sustain its operations financially by 2018. The proposed ICO, a popular fundraising method during the crypto boom of the time, aimed to generate significant capital but faced pushback from Musk, who feared it would conflict with OpenAI’s nonprofit values.

Court filings revealed that Musk even suggested merging OpenAI with Tesla to create a sustainable funding model. The proposed merger would have allowed Tesla’s AI resources to bolster OpenAI’s efforts while providing the nonprofit with a steady financial base.

However, the board did not pursue Musk’s idea, further straining relationships within the organization.

OpenAi’s shift

Musk left OpenAI’s board in February 2018, citing potential conflicts with Tesla’s own AI development projects. His departure marked a pivotal moment for the organization.

In 2019, OpenAI subsequently transitioned to a “capped-profit” model designed to attract substantial investment while limiting returns to stakeholders.

The shift enabled OpenAI to secure significant backing, including a $1 billion partnership with Microsoft that year. However, Musk’s lawsuit argues that this transition represented a departure from OpenAI’s original nonprofit mission and accuses the leadership of fraud and federal racketeering.

The amended complaint, filed in August, also added Microsoft as a defendant in the case, accusing the company of distorting the AI organization’s purpose through its financial involvement.

Meanwhile, OpenAI has filed a motion to dismiss the case, arguing that Musk’s claims are legally unfounded and are part of a broader strategy to gain a competitive advantage in the AI industry.

The post Court filings reveal Elon Musk blocked OpenAI’s ICO plans to protect its reputation appeared first on CryptoSlate.

Published in B&T Latest News

15 November, 2024 by The bizandtech.net Newswire Staff

Cardano (ADA) Could Soar by 55%, Price Reaches Crucial Level

The post Cardano (ADA) Could Soar by 55%, Price Reaches Crucial Level appeared first on Coinpedia Fintech News

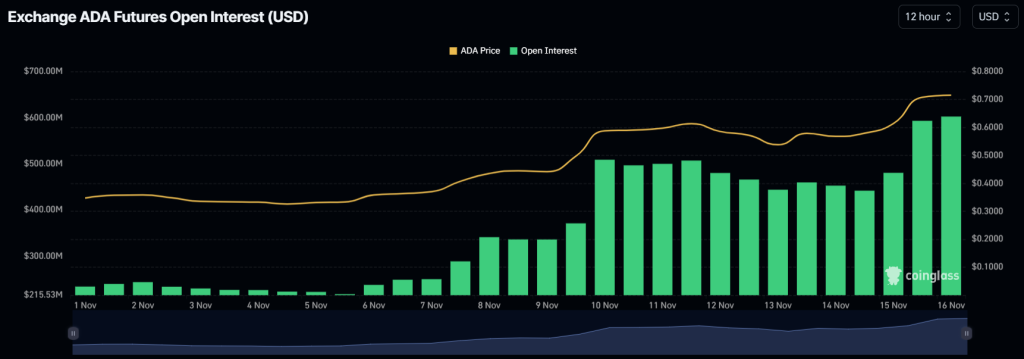

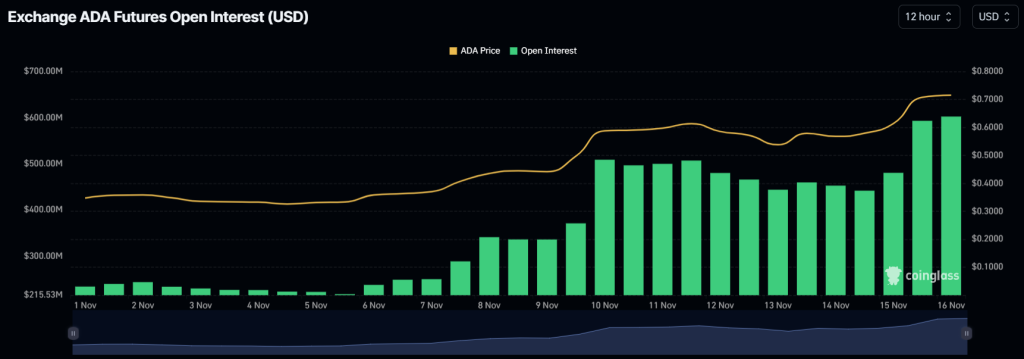

Cardano (ADA) is making headlines as it leads the market with a remarkable price surge, defying broader crypto trends. On November 16, 2024, while other assets struggled to gain momentum, the ADA price registered a significant price surge of 28%.

Cardano (ADA) Price Momentum and its 28% Gain

Meanwhile, the asset has experienced a 7% upward momentum in the past hour and is currently gaining significant attention from crypto enthusiasts. With this notable price rally, ADA is currently trading near $0.732. Additionally, the asset’s trading volume has jumped by 180% in the past 24 hours, highlighting heightened participation from traders and investors amid the ongoing rally.

ADA Technical Analysis and Upcoming Levels

With a significant price surge in the past 24 hours, the asset’s price has reached a crucial level. According to expert technical analysis, ADA has reached a crucial resistance level of $0.775 for the first time since March 2024. This notable rally follows a breakout after four days of small consolidation near a support level of $0.60.

Source: Trading View

Source: Trading View

Based on recent price action and historical momentum, if ADA breaches the resistance level and closes a daily candle above $0.80, there is a strong possibility that the asset could soar by 27% or 55%, reaching $1.01 or $1.23 in the coming days.

Looking at the current market sentiment and recent price action, it appears that ADA could reach this level in the coming days.

Bullish On-Chain Metrics

On-chain metrics further support ADA’s positive outlook. According to the on-chain analytics firm, its open interest has surged by 39% in the past 24 hours and 13% in the past four hours. This rising open interest suggests heightened participation and strong confidence among traders, resulting in a significant increase in open positions.

Source: Coinglass

Source: Coinglass

Notably, such a substantial rise in open interest at a crucial resistance level is considered a bullish sign for Cardano (ADA) in the long term. Additionally, ADA’s long/short ratio currently stands at 1.002, indicating strong bullish sentiment among traders.

Graph showing Bitcoin futures open interest from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass) Graph showing Bitcoin futures trading volume from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures trading volume from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass) Graph showing Bitcoin futures open interest on Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest on Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass) Graph showing Bitcoin futures open interest on CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures open interest on CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass) OM ADX. Source:

OM ADX. Source:  OM Ichimoku Cloud. Source:

OM Ichimoku Cloud. Source:  OM Price Analysis. Source:

OM Price Analysis. Source: