Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

Qubetics and SWFT Blockchain Join Forces – The Best Crypto Presale Just Levelled Up Amid Bitcoin’s Institutional Surge and Litecoin’s 22% Rebound

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

BDAG’s Keynote 3 Hyped, XRP Climbs & XLM Outlook Bright

XRP Seeks Record High & XLM Eyes $2 – BlockDAG’s Forthcoming Keynote 3 Sports a Hollywood Flair with $600M on the Horizon

The crypto market is showcasing exciting opportunities, with Stellar (XLM) aiming for a $2 value jump and XRP advancing towards a potential high of $4.75 following Ripple’s introduction of the RLUSD stablecoin.

BlockDAG (BDAG) takes center stage with its soon-to-be-released Hollywood-inspired Keynote 3. Already a major success in the crypto scene, BlockDAG’s presale has accumulated over $172 million, moved 17.5 billion coins, and achieved a remarkable 2240% ROI for early backers.

As BlockDAG readies for a significant Mainnet debut, it positions itself as the preferred Layer-1 choice for developers, meme coin fans, and traders. With the BDAG coin poised for a considerable uptick as Batch 26 comes close to selling out, it’s rapidly becoming one of the hottest cryptocurrencies available.

Stellar’s $2 Price Forecast: XLM on the Rise

Stellar’s price forecast is capturing attention with expectations of it reaching $2. Currently, at $0.40, Stellar has surged 172% in the past month and 342% over three months. Analyst EGRAG CRYPTO draws parallels to its 2020 leap of 3100% after surpassing the Exponential Moving Average (EMA). This time, predictions suggest a 360% increase to $2.27.

With resistance levels near $0.90 and $1, a bigger rally could be in store, though retracements might occur before achieving the $2 mark. Analysts advise monitoring continued momentum above $0.6355 to validate further upward movement per the XLM forecast.

XRP Targets New Highs Following RLUSD Debut

Post the launch of Ripple’s RLUSD stablecoin, XRP is exhibiting strong bullish trends. Currently priced at $2.41, XRP has reached critical resistance points at $2.58 and $2.92. Analysts contend that breaking these barriers may push XRP to a new all-time high of $4.75.

Crypto influencer AllinCrypto has noted substantial inflows into XRP, stating, “Even without a U.S. ETF, XRP is drawing significant capital, presumably from more institutionally oriented entities!” Additionally, XRP has confirmed a bullish flag pattern, which supports ongoing bullish forecasts.

BlockDAG’s Upcoming Keynote 3 is Going to Shatter Crypto Market

BlockDAG is transforming the domain of cryptocurrency presentations with its eagerly awaited Keynote 3, rumored to involve some of Hollywood’s top producers.

As a leading layer-1 blockchain, BDAG’s rapid ascent is driven by revolutionary technology such as WebAssembly (WASM) and Ethereum Virtual Machine (EVM) compatibility. Its presale has successfully gathered over $172 million through the sale of 17.5 billion coins. The price of BDAG coin in the current batch 26 is at $0.0234, marking a 2,240% rise from the first batch, rewarding early participants with a significant ROI.

The upcoming Keynote 3 is set to be an unprecedented event in the cryptocurrency sphere, timed to coincide with the much-anticipated launch of the network’s mainnet. A multi-million dollar sponsorship deal with the renowned Italian soccer team Inter Milan underscores BlockDAG’s expanding global influence.

With $172 million already secured, BlockDAG is on track to reach its $600 million presale target soon. This goal, coupled with the excitement for the Hollywood-inspired Keynote 3, is attracting a wave of new participants eager to engage with BlockDAG as it positions itself among heavyweights like Bitcoin and Solana.

BlockDAG’s dynamic ecosystem and strategic foresight continue to attract traders, offering a unique chance to be part of one of the most sought-after cryptocurrencies of recent times.

Highlights from This Week’s Top Cryptocurrencies

This week’s roundup of leading cryptocurrencies sees XRP and Stellar poised for significant breakthroughs, capturing the attention of the market.

However, the standout narrative remains BlockDAG, with its Hollywood-style Keynote 3 set to deliver a stunning revelation. With a robust $172 million from its presale, over 17.5 billion coins distributed, and an impressive 2240% ROI to its early participants, BlockDAG is hailed as a pioneer in the blockchain domain. As batch 26 nears completion and batch 27 promises even greater growth, those joining now could see exceptional returns in the near future.

- Presale: https://purchase.blockdag.network

- Website: https://blockdag.network

- Telegram: https://t.me/blockDAGnetworkOfficial

- Discord: https://discord.gg/Q7BxghMVyu

Disclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

The post BDAG’s Keynote 3 Hyped, XRP Climbs & XLM Outlook Bright appeared first on The Merkle News.

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

10 best Apple TV Plus shows of 2024 with 90% or higher on Rotten Tomatoes

Our guide on the ten best Apple TV Plus shows of 2024, and they all have at least 90% or higher on Rotten Tomatoes.

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

Santa Claus Rally 2024: Top stocks, trends, and smart trading tips

The Santa Claus Rally is back, and Wall Street is buzzing with holiday optimism. This annual stock market trend, known for delivering late-December gains, has kicked off with the S&P 500 and NASDAQ both climbing, led by tech giants like NVIDIA and Tesla. However, not all sectors are feeling the cheer, and the Federal Reserve’s cautious stance on rate cuts adds complexity to this year’s trading dynamics. Dive into the key highlights, what’s driving the rally, and how to position yourself for potential gains.

What is the Santa Claus Rally?

The Santa Claus Rally refers to a historical pattern where stocks tend to rise during the last five trading days of the year and the first two trading sessions of January. Since 1950, the S&P 500 has averaged a 1.3% gain during this period. Factors contributing to this trend include reduced trading volumes, holiday optimism, and year-end tax planning by investors.

What has happened in 2024?

Wall Street has kicked off the Santa Claus Rally with notable gains:

S&P 500: Up over 25% year-to-date, showing resilience after last week’s Fed-driven pullback.

NASDAQ: Rising roughly 1% in the shortened Christmas Eve session, with NVIDIA and Tesla leading the charge.

Bitcoin: Despite a record high of $108,000 earlier this month, Bitcoin has dropped 15%, dashing hopes for a crypto Santa Rally.

Tech stocks have been the standout performers, with Nvidia soaring 180% in 2024, while Tesla surged 4% on Christmas Eve. Consumer discretionary and tech sectors continue to drive market momentum, though health care has lagged behind.

What was different this year?

While equities are riding high, some familiar trends are missing:

Crypto slump: Bitcoin’s December drop contrasts with historical holiday gains in the cryptocurrency market.

Cautious FED: The Federal Reserve tempered market enthusiasm by signaling just two rate cuts in 2025, down from earlier expectations of four.

Fed Chair Jerome Powell noted, “It’s kind of common sense thinking that when the path is uncertain you go a little bit slower,” underscoring a cautious outlook amid persistent inflation concerns.

How to track the rally?

Key indicators to follow include:

Index Performance: The S&P 500 typically gains around 1.7% during the Santa Claus Rally.

Sector trends: Tech and consumer discretionary stocks are leading this year, while health care lags.

Crypto volatility: Watch for potential recovery in Bitcoin and altcoins post-Christmas.

Trading tips for 2024’s Santa Claus Rally

Investors can capitalize on this year’s rally by focusing on high-performing sectors and stocks:

Top picks: NVIDIA, Tesla, and Broadcom are showing strong momentum.

Consumer discretionary: Companies like Amazon and Apple often perform well during the holiday season.

Diversification: Dominic Pappalardo of Morningstar advises caution, noting, “Today’s extreme market reaction is being driven by extremely rich valuations.”

Looking ahead to 2025

Wall Street strategists remain optimistic about 2025, predicting another strong year for equities. However, potential inflationary pressures from new economic policies could introduce fresh challenges, making diversification and vigilance key for investors.

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

How did FED dodge recession in 2024 and will inflation rise?

The Federal Reserve accomplished what many thought was unattainable in 2024: a rare economic soft landing, reducing inflation without triggering a recession. Yet, as 2025 approaches, stubborn inflation and incoming policy shifts under President-elect Donald Trump are creating new uncertainties for the U.S. economy. FED Chair Jerome Powell’s cautious optimism is underscored by persistent price pressures, cautious rate cuts, and questions about the future impact of tariffs, tax changes, and geopolitical instability.

The Federal Reserve closed 2024 on a note of measured success, achieving an economic soft landing that avoided the recession many had feared. Elevated interest rates guided inflation downward while maintaining economic growth and relatively stable unemployment rates. This rare balance allowed the FED to begin cutting rates for the first time in over four years.

FED Chair Jerome Powell expressed satisfaction with the year’s results at a December press conference: “I think it’s pretty clear we have avoided a recession. The path down has been better than many predicted.” However, persistent inflation remains a concern, as it continues to hover above the FED’s 2% target, with policymakers projecting it will not reach that goal until 2027.

Rate cuts with caution

The FED enacted three rate cuts in 2024, starting with a significant 50-basis-point reduction in September, followed by smaller cuts later in the year. These moves signaled the central bank’s confidence in the economy’s stability while addressing inflation.

Yet, these actions were not without dissent. FED Governor Michelle Bowman opposed the September cut, arguing that inflation goals had not been fully achieved. “A larger policy action could be interpreted as a premature declaration of victory,” she warned. Cleveland FED President Beth Hammack also dissented in December, preferring a pause to ensure inflation was resuming its downward path.

Inflation and Trump policies

As President-elect Donald Trump prepares to take office, his proposals—ranging from tax cuts to tariffs—are expected to complicate the FED’s fight against inflation. Powell acknowledged the challenge, noting that FED officials have begun incorporating potential policy impacts into their forecasts. However, the exact implications of these policies remain unclear, as details on tariffs and other measures are still developing.

Despite these uncertainties, Powell emphasized the FED’s commitment to data-driven decisions. “We are not done cutting rates,” he said, “but we will proceed cautiously.”

The FED’s cautious stance on inflation has influenced market behavior. Gold prices, for example, fell sharply following Powell’s press conference, reflecting concerns over the slower pace of rate cuts and persistent inflation. Spot gold traded at $2,592 per ounce, marking a 2.05% daily decline.

Powell also addressed broader economic concerns, including geopolitical risks and the strain of high consumer prices. He highlighted that while inflation persists in sectors like housing, the U.S. economy has outperformed expectations. “The U.S. economy is performing very, very well, substantially better than our global peer group,” he said.

Looking ahead, the FED faces a complex 2025. Policymakers must navigate the dual challenges of persistent inflation and the potential economic shifts brought by the new administration. As Powell summed up; the outlook is pretty bright for US economy, but caution remains essential.

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

Bitcoin ETFs record over $1 billion outflows ahead of Christmas, contrasting Ethereum’s inflow surge

US spot Bitcoin and Ethereum ETFs are seeing varied market performance, signaling divergent investors’ interest in the top digital assets.

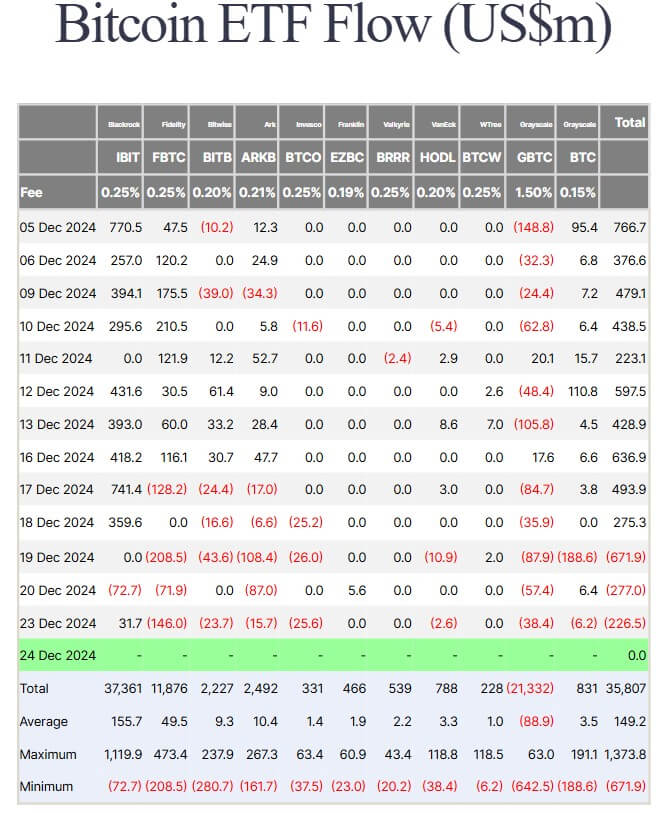

On Dec. 23, Bitcoin ETFs recorded their third straight day of outflows, totaling $226.5 million as investors adjusted their portfolios ahead of the festive period. The BTC ETFs have seen net outflows of more than $1 billion during this period.

Fidelity’s FBTC led the declines, losing $146 million. Grayscale’s Bitcoin Trust followed with $38.4 million in outflows, while Invesco’s BTCO saw $25.7 million in withdrawals. Bitwise’s BITB and ARK Invest & 21Shares’ ARKB reported combined outflows of $39.6 million.

Bitcoin ETF Flows (Source: Farside Investors)

Bitcoin ETF Flows (Source: Farside Investors)

However, BlackRock’s IBIT ETF stood out against the downward trend, attracting $31.6 million in inflows.

Despite the recent sell-offs, Bitcoin ETFs have netted $35.83 billion in inflows since their launch. The funds now hold 5.7% of Bitcoin’s total supply, valued at $105.08 billion, according to SoSoValue data.

Ethereum ETFs surge

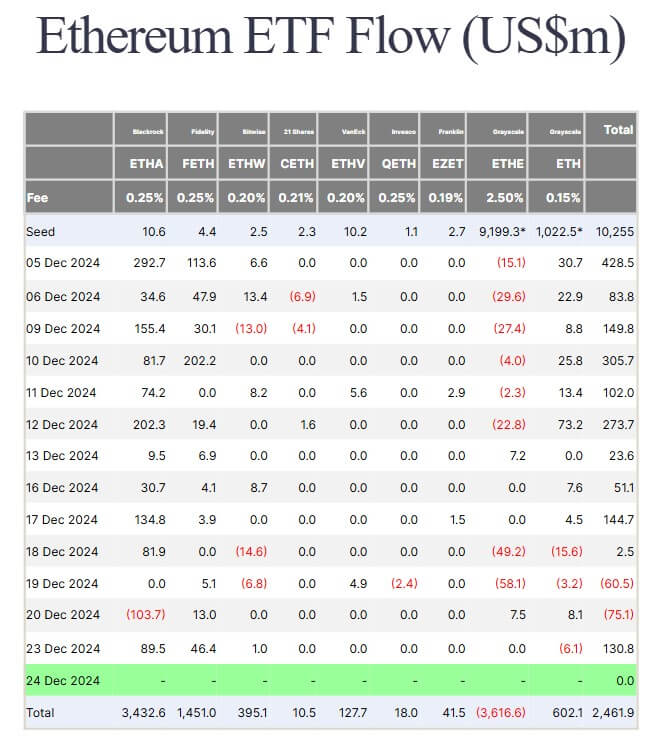

Ethereum ETFs painted a more optimistic picture, securing $130.8 million in inflows.

BlackRock’s ETHA led the way, with inflows reaching $89.5 million. It was followed by Fidelity’s FETH fund, which added $46.4 million in inflows, while Bitwise’s ETHW recorded modest gains of approximately $1 million.

Ethereum ETF Flows (Source: Farside Investors)

Ethereum ETF Flows (Source: Farside Investors)

However, other Ethereum ETFs saw minimal movement, except for Grayscale’s Ethereum Mini Trust, which experienced a $6.1 million outflow.

Despite this, Ethereum ETFs have collectively amassed over $2.46 billion in inflows since launch.

The post Bitcoin ETFs record over $1 billion outflows ahead of Christmas, contrasting Ethereum’s inflow surge appeared first on CryptoSlate.

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

How Etermax took Trivia Crack World to Meta Quest VR headsets

Etermax scored big with Trivia Crack, a mobile game that has had more than 800 million downloads. Now it’s moving into VR.Read More

Published in B&T Latest News 24 December, 2024 by The bizandtech.net Newswire Staff

My most anticipated games of 2025 | The DeanBeat

I’m going to keep this post short as Rachel Kaser is giving this topic the real treatment. I wanted to weigh in on my own list of the most anticipated games of 2025. The list is in reverse order and the No. 1 most anticipated game is at the bottom of this post. While a lot of this is subjective, it’s always critical for the game industr…Read More

I’m going to keep this post short as Rachel Kaser is giving this topic the real treatment. I wanted to weigh in on my own list of the most anticipated games of 2025. The list is in reverse order and the No. 1 most anticipated game is at the bottom of this post. While a lot of this is subjective, it’s always critical for the game industr…Read More