Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

The Mac Pro and Studio won’t get the M4 nod until mid-2025

A 2023 Mac Pro. | Photo by Amelia Holowaty Krales / The Verge

The Mac Studio and Mac Pro aren’t due for an upgrade to Apple’s M4 chip until the middle of next year. That means both machines will still be on Apple’s M2 generation this year, unlike all other Macs except the MacBook Air, Bloomberg’s Mark Gurman wrote to Power On subscribers today.

Throughout 2024, though, all of Apple’s laptops (except the MacBook Air) will move to the M4 chip that the company just gave the iPad Pro, Gurman writes. Amusingly, this herky-jerky chip upgrade cycle means that the iPad Pro is currently the single-core performance champ of Apple’s lineup — and it will continue to be for about another year, when compared to the Mac Studio and Mac Pro.

Screenshot: Geekbench

It’s not even close, according…

Continue reading…

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

Fintech Earnix Teams Up with Exavalu, a Digital Insurance Advisory Firm

Earnix, the global provider of AI-based SaaS pricing and rating solutions for financial services, and Exavalu, a global insurance digital advisory and system integration consulting firm, announced a partnership “to provide leading property and casualty insurance carriers with improved operational and analytical flexibility to accelerate… Read More

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

OpenAI Bosses: We Take Safety ‘Very Seriously’

OpenAI is trying to ease concerns following the departure of two safety executives.

Last week saw the resignation of Ilya Sutskever, co-founder and chief scientist of OpenAI, and Jan Leike, both of whom headed the company’s “superalignment team,” which was focused on the safety of future advanced artificial intelligence (AI) systems. With their departure, the company has effectively dissolved that team.

While Sutskever said his departure was to pursue other projects, Leike wrote on X Friday (May 17) that he had reached a “breaking point” with OpenAI’s leadership over the company’s central priorities.

He also wrote that the company did not give safety enough emphasis, especially in terms of artificial general intelligence (AGI), an as-yet-unrealized version of AI that can think and reason like humans.

“We are long overdue in getting incredibly serious about the implications of AGI,” Leike wrote. “OpenAI must become a safety-first AGI company.”

But Sam Altman and Greg Brockman, OpenAI’s CEO and president, wrote in a joint message on X Saturday (May 18) that they were aware of the risks and potential of AGI, saying the company had called for international AGI standards and helped “pioneer” the practice of examining AI systems for catastrophic threats.

“Second, we have been putting in place the foundations needed for safe deployment of increasingly capable systems,” the executives wrote.

“Figuring out how to make a new technology safe for the first time isn’t easy. For example, our teams did a great deal of work to bring GPT-4 to the world in a safe way, and since then have continuously improved model behavior and abuse monitoring in response to lessons learned from deployment.”

A report by Bloomberg News last week said that other members of the superalignment team had also left OpenAI in recent months, adding even more challenges. The company has appointed John Schulman, a co-founder specializing in large language models, as the scientific lead for the organization’s alignment work.

Aside from the superalignment team, OpenAI has other employees specializing in AI safety across a range of teams inside the company, that report said, as well as individual teams dedicated solely to safety. Among them is a preparedness team that analyzes and mitigates potential catastrophic risks connected to AI systems.

Meanwhile, Altman appeared on the “All-In” podcast earlier this month, expressing support for the creation of an international agency to regulate AI, citing concerns about the potential for “significant global harm.”

For all PYMNTS AI coverage, subscribe to the daily AI Newsletter.

The post OpenAI Bosses: We Take Safety ‘Very Seriously’ appeared first on PYMNTS.com.

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

LayerZero Labs CEO announces pause of Sybil ‘bounty-hunter’ process after influx of reports

After the latest stage of LayerZero’s upcoming airdrop led to chaos, LayerZero Labs’ CEO announced a temporary pause to the process.

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

Report: Crypto Spot Trading Slows in April

Cryptocurrency spot trading cooled last month for the first time in seven months.

It was a trend driven by a dwindling likelihood of interest rate cuts and slower inflows into U.S.-listed spot bitcoin exchange-traded funds (ETFs), Seeking Alpha reported Saturday (May 18), citing numbers from researcher CCData.

According to that data, spot market volume on exchanges such as Coinbase, Binance and Kraken fell by 32.6% to $2.01 trillion in April, while monthly derivatives trading volume declined by 24.1% to $4.57 trillion, its first drop in three months.

“This decline followed unexpected macroeconomic data, an escalation in the geopolitical crisis in the Middle East, and negative net flows from U.S. spot Bitcoin ETFs, leading major crypto assets retracing the gains they made in March,” CCData said.

Last month also saw bitcoin drop by almost 15%, falling below $60,000 and breaking a seven-month hot streak that included a record high of more than $73,000 in March.

As the report noted, this run was driven primarily by speculation surrounding last year’s regulatory approval of spot ETFs and the bitcoin halving event.

Last week, crypto custody firm Bakkt said that the Securities and Exchange Commission’s (SEC) approval of bitcoin ETFs will lead institutional investors to play a larger role in the cryptocurrency trading market.

The company’s earnings showed that in the first three months of the year, crypto trading volume climbed 324% compared to the prior quarter, “driven by exceptionally strong client trading activity,” the presentation said.

“As evidenced in our trading volumes in Q1, we’ve begun to see positive green shoots in the market and the overall demand environment improving, with more industry activity, higher coin prices and overall higher retail trading volume,” Andy Main, president and CEO of Bakkt, said during the company’s quarterly earnings call.

The institutional investors in this market are seeking a purpose-built crypto trading platform that will align with their needs and priorities, rather than the existing trading market that was built primarily for retail investors, Bakkt’s presentation said.

“The crypto trading industry has been built primarily for everyday retail investors who use a central limit order book trading structure,” Main said. “Meanwhile, institutional investors who are offering bitcoin ETFs are increasingly finding that the retail central limit order book structure is not meeting their large-scale needs.”

The post Report: Crypto Spot Trading Slows in April appeared first on PYMNTS.com.

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

Bitcoin (BTC) Mirroring Pre-Parabolic Rally That Led to Over 1,200% Gains in 2017, According to Crypto Analyst

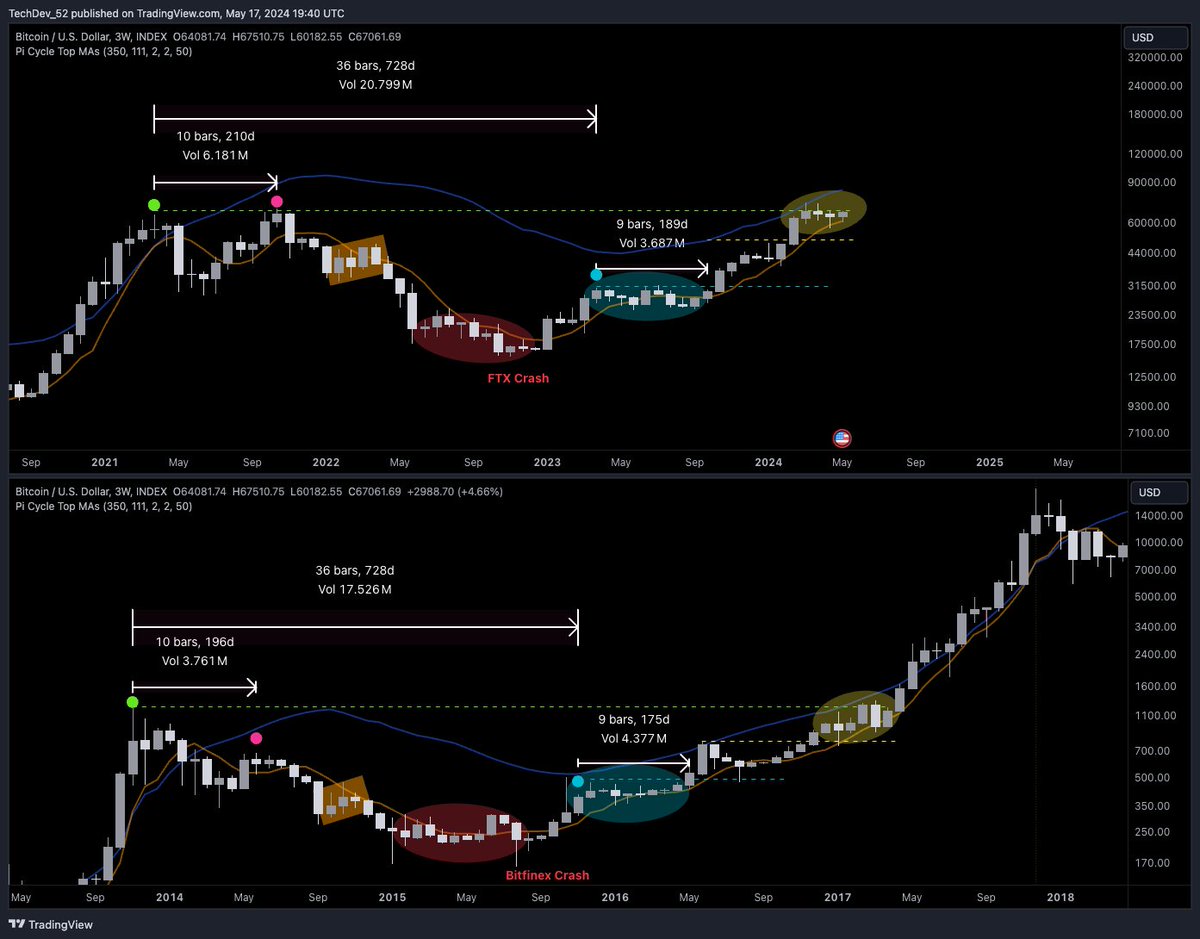

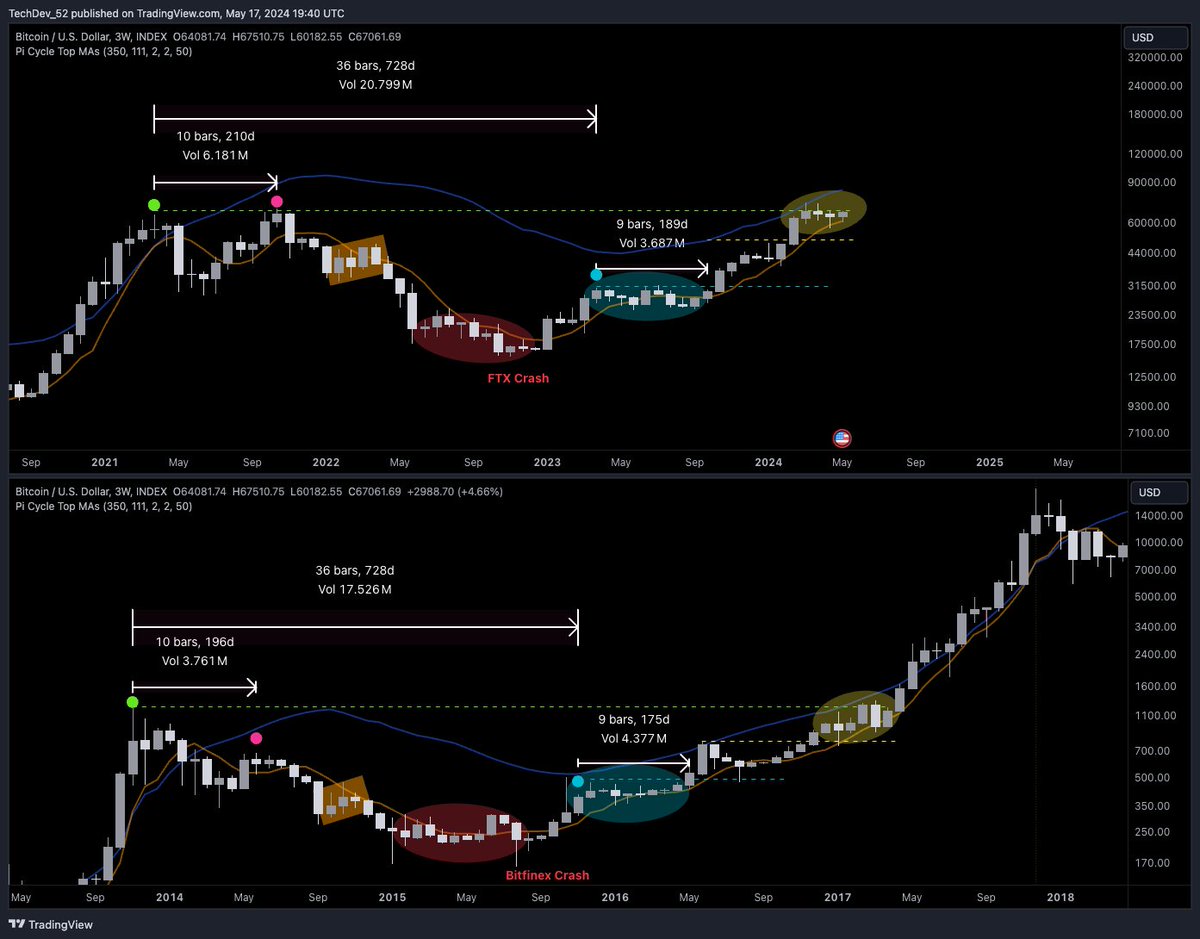

Bitcoin’s (BTC) current market structure looks similar to 2017, just before its massive 1,200% rally to its previous record high of $20,000, according to widely followed crypto analyst TechDev.

The pseudonymous analyst shares with his 450,000 followers on the social media platform X a chart that suggests the current market cycle has been strikingly reminiscent of the 2017 Bitcoin bull run.

TechDev’s chart highlights that both bear markets bottomed out during the crash of two major crypto exchanges, followed by repeated rallies and consolidation phases.

“The more things change, the more they stay the same.”

Source: TechDev/X

Source: TechDev/X

Looking at the trader’s chart, he seems to suggest that BTC is currently in a consolidation phase similar to 2017 when it was trading at around $1,500 before a parabolic run to a cycle high of $20,000.

At time of writing, Bitcoin is worth $67,060.

The analyst also looks at Bitcoin’s relative strength index (RSI), which aims to gauge the momentum of an asset. According to TechDev, Bitcoin has historically topped out when its RSI reaches the top of a long-term channel, which has not yet occurred.

“You’re in the green zone. Don’t waste it.”

Source: TechDev/X

Source: TechDev/X

TechDev is also looking at the OTHERS chart, which tracks the market cap of all crypto excluding the top 10 digital assets and stablecoins. Specifically, he’s looking at the chart’s stochastic RSI, moving average convergence divergence (MACD) and logarithmic Bollinger Band indicator.

The MACD is traditionally used to pinpoint reversals based on the convergence or divergence of moving averages, and the Bollinger Bands are meant to identify periods of impending sharp price movements based on volatility contraction.

According to the analyst, OTHERS, which is often used to gauge the strength of altcoins, has reached a “max compression” zone, suggesting that a big move to the upside is on the horizon. He also notes that the setup coincides with the return of “Roaring Kitty,” the leader of the movement that pumped the price of Gamestop (GME) in 2021.

“Roaring Kitty returns as this alt setup reappears.

There are no coincidences.”

Source: TechDev/X

Source: TechDev/X

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Bitcoin (BTC) Mirroring Pre-Parabolic Rally That Led to Over 1,200% Gains in 2017, According to Crypto Analyst appeared first on The Daily Hodl.

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

Funniest/Most Insightful Comments Of The Week At Techdirt

This week, both our winners on the insightful side come from our post about a facts-free op-ed defending the bipartisan bill to repeal Section 230. In first place, it’s Stephen T. Stone reiterating a rule that holds true:

Once more, with feeling:

No one can oppose Section 230 without lying about it.

In second place, it’s Strawb with a reply to the claim that Section 230 allows “blatant viewpoint discrimination”:

No, that’s the First Amendment. But keep telling Mike how he “doesn’t understand the law”.

For editor’s choice on the insightful side, we start out with a comment from Dan B about Ajit Pai supporting the TikTok ban:

What makes this weird, to me, is that this isn’t even good politics for him.

Trump is (currently) against the ban, as are a plurality of independent voters. On top of that, there are solid, non-crazy legal arguments that the ban is unconstitutional. So this would have been an opportunity for Pai to simultaneously suck up to Trump, help the Republicans’ chances in 2024, and… do the right thing.

Next, it’s Drew Wilson with a comment about the potential (or not-so-potential) sale of TikTok:

I’m with Mike on this. The likelihood TikTok getting sold is very low at this point. TikTok made it very clear that they aren’t selling. They have their litigation effort (along with creator litigation next to them) fully ahead of them at this point. It makes WAY more sense that both TikTok and the creators that use the platform to focus on the lawsuits they filed. If it’s looking unlikely that the lawsuit is going to win and they change their mind on selling afterwards, then we’ll talk, but that’s a LONG way down the road and, what’s more, that’s a very big “if”.

Over on the funny side, our first place winner is an anonymous comment from last week’s winners post, responding to the winning insightful comment from that week, which was itself a reply to a comment throwing around some legal nonsense and included the line “the irony is that your hallucinated ‘facts’ are more offensive than ChatGPT’s”:

Hey, good news. Humans are still better at hallucinating than AI. Who’da thunk it.

In second place, it’s Boba Fatt with a comment about the bogus takedowns of “Fuck the LAPD” shirts:

I predict a new T-shirt design

now with “and the LAPDF, too”

For editor’s choice on the funny side, we start out with a comment from i havent had coffee yet confessing a misreading of the headline on our post about “the streaming sector”:

I first read the title as “Screaming Sector Continues Its…” and assumed it was about maga/conservatives.

Finally, it’s an anonymous comment about the latest nonsense from the mayor of New York City:

Someone should just switch Eric Adams with Eric André one night just to see what happens.

That’s all for this week, folks!

Published in B&T Latest News

19 May, 2024 by The bizandtech.net Newswire Staff

DOJ Charges Two Chinese Nationals for Allegedly Laundering Proceeds of $73,000,000 ‘Pig Butchering’ Crypto Scam

The U.S. Department of Justice (DOJ) is charging two Chinese nationals for allegedly running a pig butchering crypto scam and laundering tens of millions of dollars.

In a new press release, the DOJ says that Chinese citizens Daren Li and Yicheng Zhang were the masterminds of the pig butchering scam, which involved sending unsolicited messages to individuals to build rapport as a means of ultimately introducing them to fraudulent crypto “investment opportunities.”

Using promises of huge returns, the duo would convince victims to open bank accounts in the name of shell companies and deposit money into them. The funds would then be transferred to a bank in the Bahamas before being converted into USDT, the largest stablecoin on the market.

Prosecutors say Li and Zhang laundered $73 million while the crypto wallet they found associated with the scam had received over $340 million worth of digital assets.

Says US Attorney Martin Estrada,

“Sophisticated financial scams such as these are a dangerous threat to the financial well-being of all Americans. While my office will continue to root out and punish these deceitful schemes, I encourage everyone to educate themselves on pig butchering and other kinds of financial fraud to protect their families against such predatory activity. Vigilance is key.”

Li and Zhang have been charged with conspiracy to commit money laundering as well as six counts of international money laundering. They could face up to 20 years behind bars for each count.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post DOJ Charges Two Chinese Nationals for Allegedly Laundering Proceeds of $73,000,000 ‘Pig Butchering’ Crypto Scam appeared first on The Daily Hodl.

Source:

Source:  Source:

Source:  Source:

Source: