In the financial world, few stories are captivated, like that of Keith Gill, also known as Roaring Kitty. This former financial analyst turned stock influencer sparked the 2021 GameStop (GME) short squeeze.

His actions shook Wall Street, capturing the global attention. After a significant hiatus, Gill has recently returned to social media, sparking renewed interest in both traditional and crypto markets.

Who is Roaring Kitty?

Known under the alias “DeepFuckingValue,” Gill became a hero on platforms like Reddit and YouTube. He was a vocal advocate for GameStop, a company that was largely considered faltering at the time. Many institutional investors and hedge funds had shorted GME, expecting its value to decline further.

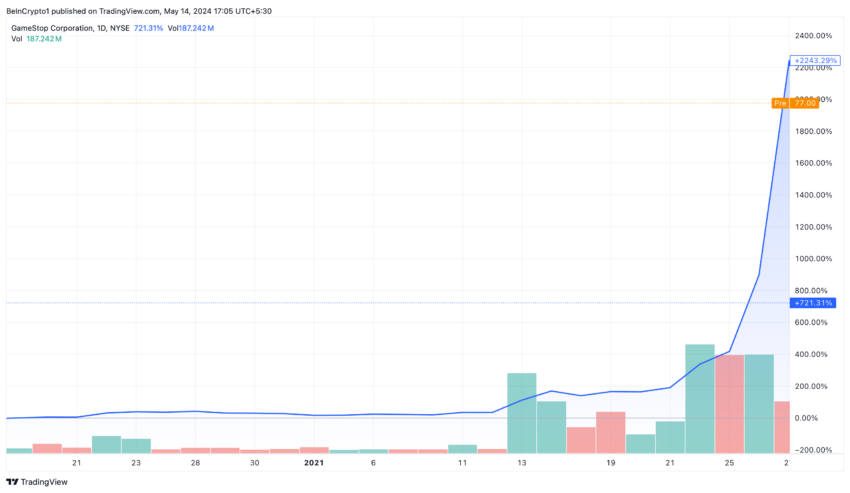

However, the narrative took a sharp turn when GME shares, initially valued at around $5.16, surged to exceed $490 in 2021. This price inflation was primarily driven by users from the r/WallStreetBets subreddit.

Gill’s posts there had inspired a collective action to trigger a short squeeze. This market maneuver occurs when rising stock prices compel short sellers to purchase shares at increasing rates, thereby escalating the stock price even further.

From an initial investment of $53,000, Gill’s stakes in GME soared to an impressive $48 million at the peak of the market upheaval. His significant role in this market anomaly brought him before Congress for testimony and was later depicted in the film “Dumb Money.”

Read more: GameStop NFT Marketplace: The Basics Explained

GameStop (GME) Price Performance in 2021. Source: TradingView

GameStop (GME) Price Performance in 2021. Source: TradingView

Will Cat-Theme Meme Coins Pump?

Upon his return to the public eye with an X (Twitter) post in mid-2021, Gill once again stirred the investment world. The post featured an image of a man intently using a video game controller. It quickly sparked discussions in stock investment circles and in the crypto domain.

Influencers like Andrew Tate announced shifts in their investment strategies, from Bitcoin to GameStop stocks and various meme coins. Tate said he would sell $500,000 in Bitcoin to invest in the latest GameStop short squeeze. Moreover, he put the ticker symbol of GME on his X bio.

I lost a lot of money attacking The Matrix during Gamestop.

Always been part of the resistance  Tags: B&T Latest News

Tags: B&T Latest News

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

ETH/BTC ratio falls 30% year-over-year amidst rising Bitcoin market dominance

Quick Take

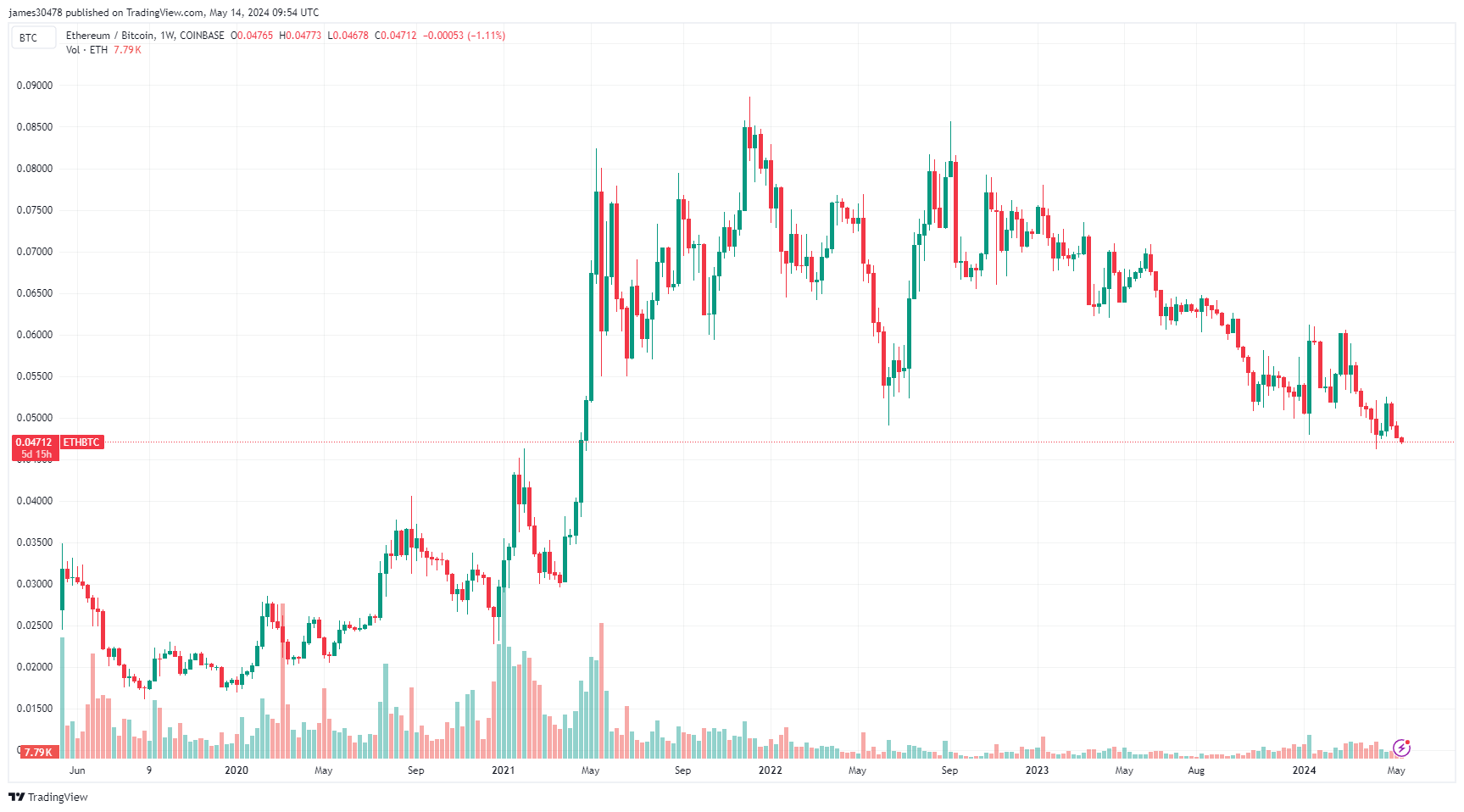

The Ethereum to Bitcoin (ETHBTC) ratio recently hit 0.046, a low not seen since April 2021, briefly revisiting levels from April 2024. This downward trajectory highlights Ethereum’s ongoing struggle against Bitcoin’s dominance in the digital assets market. The ETHBTC pair is down 30% in the past year and over 11% year-to-date.

ETHBTC: (Source: TradingView)

ETHBTC: (Source: TradingView)

Market movements are primarily driven by narratives and liquidity from central banks. Ethereum currently finds itself in an inflationary state, while the verdict on a potential Ethereum ETF in the US is looming, which could further impact its price.

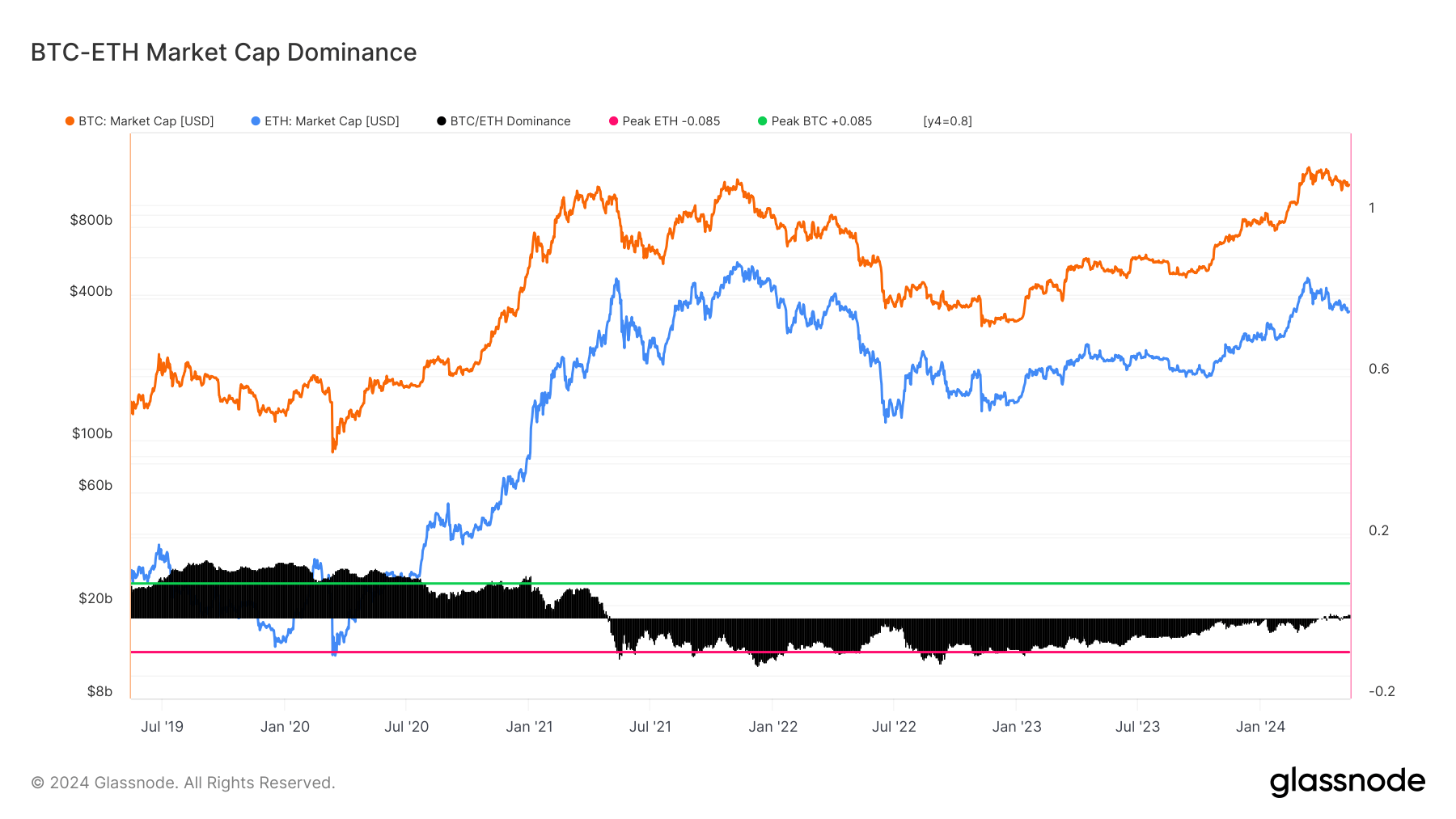

To gauge the macro trends between these top two digital assets, examine the BTC-ETH Dominance metric using Glassnode data. This oscillator tracks the relative market cap dominance of Bitcoin compared to the combined market cap of Bitcoin and Ethereum. It is calculated as: `Dominance = BTC Market Cap / (BTC Market Cap + ETH Market Cap) – 0.765`, with the 0.765 factor included to visualize the oscillator around a long-term mean.

BTC-ETH Market Cap Dominance: (Source: Glassnode)

BTC-ETH Market Cap Dominance: (Source: Glassnode)

In early April, Bitcoin dominance broke out against Ethereum for the first time since April 2021, a trend CryptoSlate had anticipated. Meanwhile, CryptoSlate expects Bitcoin’s dominance over Ethereum to continue trending higher in the coming months.

The post ETH/BTC ratio falls 30% year-over-year amidst rising Bitcoin market dominance appeared first on CryptoSlate.

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

Google RSAs in 2024: Everything you need to know

Responsive search ads (RSAs) are the bread and butter of Google Ads search campaigns. Launched in 2018 and originally a beta ad format, RSAs became the default ad format for search campaigns on June 30, 2022, when Google sunsetted Expanded Text Ads (ETAs).

The magic behind RSAs is that by providing multiple headlines and descriptions, Google Ads will test different combinations and determine which combinations work best. These combinations are also tailored to better match the search term of the individual searcher, providing ad content flexibility and improving relevancy.

Most PPC advertisers have transitioned away from using ETAs, and RSAs have become standard practice. However, there have been updates to RSAs you must be aware of. Here’s a rundown of everything you should know about RSAs in 2024.

3 headlines and 2 descriptions: A thing of the past

The concept of your RSAs displaying three headlines and two descriptions has gone out the window, with Google Ads recently shaking up how RSAs can appear in search results.

Single-headline ads are popping up more frequently in search results, and the system sometimes chooses to add a headline and the beginning of the description line.

What assets appear and where are based on whether or not the system predicts that performance will be improved by moving away from the “original” three headlines and two description format.

Above: An example of a Search ad with only one Headline and a headline featuring at the beginning of the description line.

Above: An example of a Search ad with only one Headline and a headline featuring at the beginning of the description line.

This takes more control away from the advertiser, as how RSAs appear can never be guaranteed. The responsive nature of this ad format means you don’t control which combinations are shown either.

As such, make sure your ads are coherent in any order and with any number of headlines and descriptions. For example, a sentence should not need to be covered over two descriptions, which would mean that both would need to appear and in the right order for it to make sense.

Dig deeper: Craft winning paid search ads: 4 best practices

Ad strength: The great debate

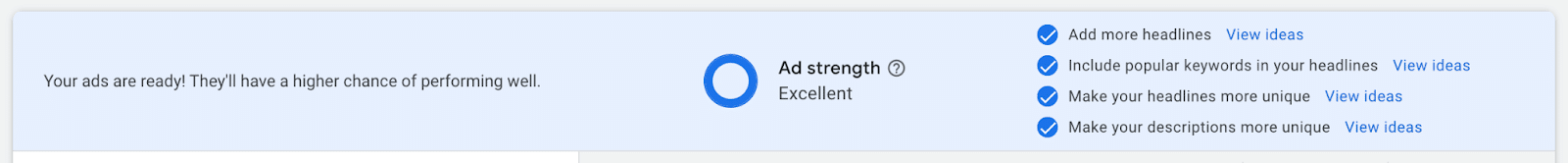

Ad strength is a diagnostic tool for advertisers to see how their RSA scores in terms of relevance, diversity of assets and quality. It can be found either by adding the Ad Strength column to your ads page, or in a blue box at the top of the box when creating or editing a RSA.

Above: When creating or editing a RSA, an Ad Strength score will show at the top of the box.

Above: When creating or editing a RSA, an Ad Strength score will show at the top of the box.

Ad strength provides a score (either Incomplete, Poor, Average, Good or Excellent); the higher the score, the more likely the system thinks the ad will be effective.

Google also provides recommendations and ideas on optimizing your ads to improve the score, such as including popular keywords and adding additional headlines.

After much online discussion, in April 2024, Google’s Ginny Marvin confirmed that Ad Strength is not used by Ad Rank, meaning that a low-scoring ad could still perform well. This was following concerns that a low Ad Strength would impact Ad Rank and, therefore, reduce visibility.

While Ad strength is not used for Ad Rank, improving the relevance and diversity of assets facilitates more combination creations, which opens up the opportunity to show more relevant ads in more auctions.

Get the daily newsletter search marketers rely on.

Business email address

Subscribe

Processing…

To pin or not to pin

There’s been an ongoing debate about whether pinning headlines and descriptions helps or hurts RSA performance. Case studies offer differing opinions, with some saying pinning boosts performance, while others report decreased visibility and CTR when they try it.

However, the general consensus is that pinning can impact the system’s ability to create effective asset combinations. The system is being instructed to put certain assets in certain positions, reducing its flexibility and responsiveness. Remember to pin sparingly and strategically whenever possible.

Advertisers might choose to pin assets despite the limitations it imposes because they want their company name in every ad, need to include a legal disclaimer or have strong historical data showing that an asset performs well for the account.

Campaign-level RSA assets

Another update from the beginning of 2024 is the ability to apply up to three headlines and two descriptions at a campaign level. This means these assets will be eligible to appear in any RSA within that campaign.

Above: Headlines and Descriptions can now be added at a campaign level

Above: Headlines and Descriptions can now be added at a campaign level

You can also pin these assets in certain positions and give them a start and end date, making them perfect for promotional periods or seasonal content.

Asset and combination performance report

While sadly not as thorough as most advertisers would like them to be, there are performance reports available for both individual assets and combinations.

To locate them, go to Campaigns > Ads > View asset details (Please note these instructions are based on the new interface design.)

Under the Assets section, you can find information including:

- How many impressions an asset has had during the set time.

- A Performance column, which compares how the asset performs compared to others of the same type within that ad group and rates it either Low, Good or Best.

If the rating is Learning, then that means that it still needs to receive more impressions to be ranked, usually around the 2,000-impression mark.

This report can help you identify which assets need to be improved or replaced based on your impression performance.

Under the Combinations section, you can see what types of asset combinations have been created and how many Impressions they have had.

This is a great opportunity to check your assets, as it allows you to see how they may be appearing in searches — and sometimes, the results can be unexpected.

Google Ads RSAs: The latest updates and best practices

While the foundation of responsive search ads hasn’t changed since they were launched, there have been plenty of developments in the background regarding reporting and best practices.

As Google Ads continues to emphasize the importance of AI-powered search, it will be interesting to see what the next few years will hold for search ads.

Dig deeper: 7 ways to elevate your responsive search ads

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

11. Octopus Energy

British-based power player Octopus Energy is seeking to disrupt traditional utilities with a tech-driven approach using AI, cloud computing and data analytics.

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

Bitcoin Slumps Hard, While the Rally Remains at the Foothill of a Major Explosion Aiming for $78,000

The post Bitcoin Slumps Hard, While the Rally Remains at the Foothill of a Major Explosion Aiming for $78,000 appeared first on Coinpedia Fintech News

The markets had come under bullish influence as Gamestop’s glory elevated the BTC price levels above $63,400 for a while. In no time, the price faced extreme selling pressure as the bears reacted to the bullish breakout. However, the extreme price and volume squeeze have been flashing bullish signals, which may initiate a fresh upswing in the coming days. Therefore, this indicates the Bitcoin price rally continues to remain under bullish influence and could trigger a fresh upswing soon.

The daily chart of Bitcoin suggests the price is stuck within a descending range but the larger perspective displays the formation of a bullish structure. Besides, the HTF of the rally shows the token about to accomplish a cup and handle pattern that could propel the price towards a new ATH, probably above $78,000 in the first few weeks of H2, 2024.

After undergoing a parabolic recovery, the BTC bulls have shown some weakness, forming the ‘handle’. Furthermore, the bulls have had the upper hand since the beginning of the year, mirroring the 2021 bull run. However, the bearish power surged shortly after that, and it does not appear to be repeating itself now. The Bears worked hard to reclaim dominance, but the Bulls have regained control since the beginning of the month.

On the other hand, the total daily transfer volume is flashing huge bullish signals, suggesting the possibility of the beginning of a fresh bullish spell.

Before the previous bull rallies, there were periods of deficient Bitcoin transfer volume, indicating the expectations of growth among the investors. Therefore, the BTC price appears to be at the foothill of a major upswing, which may transform into a bull rally soon. Previously, whenever the volume reached rock bottom levels, a strong bull run followed the rally. Therefore, a similar price action may be expected, provided the BTC price is required to secure some important resistance levels.

The Bitcoin price has again slumped below $62,000, but the technicals and the formed patterns suggest that the price may continue with the descending consolidation for a few more weeks. After achieving fresh bottoms, somewhere between $55,000 to $58,000, a fresh upswing may begin, attracting fresh liquidity. Once, the rally comfortably surpasses the neckline of the cup and handle pattern at $75,000, a breakout could elevate the levels beyond $78,000 in the second half of 2024.

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

GameStop (GME) Inspired Memecoin on Solana Network Rallies Over 300%

The post GameStop (GME) Inspired Memecoin on Solana Network Rallies Over 300% appeared first on Coinpedia Fintech News

After over three years of deafening silence, a renowned stock market influencer alias Roaring Kitty on the X platform resurfaced on Monday. Notably, the popular influencer is remembered for bringing together stock traders and short-squeezing GameStop Corp. Cl A (NYSE: GME) in 2021. Consequently, GME stock rallied around 100 percent before being trapped in a macro bearish trend.

The return of the stock market influencer on Monday via an X post triggered a bullish rally on GME shares. According to the latest stock market data, GME shares spiked nearly 100 percent in the past 24 hours to trade around $36.9 before trading was halted.

The Rise of GameStop-Inspired Meme Coins

With the trading of GameStop stock temporarily halted on traditional exchanges, the Solana (SOl) developers who created the meme coin dubbed GameStop (GME) have attracted major attention. The GME meme coin rallied more than 300 percent in the past 24 hours to trade around $0.0126 on Tuesday during the London session.

The small-cap meme coin has a robust bullish sentiment, as its daily average trading volume is more than double its market cap, suggesting high demand. According to market data provided by Binance-backed Coinmarketcap, the GME meme coin had a fully diluted valuation of around $87 million and an average 24-hour traded volume of approximately $176 million.

Similar Trend

The rise of GameStock stocks has influenced the development of meme coins on many other chains led by the Coinbase Global-backed Base network. According to market data provided by Coingecko, GME price on the Base network has risen nearly 500 percent in the past week to trade around $0.0379 on Tuesday.

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

Solana Price Set To Plunge! SOL Price To Retest $125 In May?

The post Solana Price Set To Plunge! SOL Price To Retest $125 In May? appeared first on Coinpedia Fintech News

The crypto market has displayed a sign of relief by adding approximately 2% to its market cap within the past day. Furthermore, the BTC price has successfully reclaimed the $62,000 mark, indicating an increase in the price action within the industry.

On the other hand, the SOL price failed to reclaim the $150 mark in spite of recording a jump of 5% within the past 24 hours, highlighting a strong bearish sentiment for the altcoin in the crypto space.

SOL Price Hints A Bearish Price Action:

Despite increased price volatility in the cryptocurrency industry, the Solana price continues trading in a closed range between $126.75 and $155.25 since mid-April, indicating a weak price action for the altcoin in the market.

Furthermore, the Solana (SOL) price has formed a symmetric triangle in the 1D time frame after facing repeated rejection at its resistance level of $155. Moreover, the altcoin is hovering close to its resistance trendline and is on the verge of testing it, the outcome of which is uncertain.

TradingView: SOL/USDT

Positively, the SOL price has added 4.89% with a trading volume of $2.38 Billion (+64.72%) within the past day after concluding the past four days on a bearish note, indicating a possibility of a bullish price action in the coming time.

However, the Simple Moving Average (SMA) acts as a resistance to the price chart, highlighting a bearish influence in the crypto industry. Moreover, the RSI hovers close to its neutral point and hints at a potential bearish convergence, suggesting a negative outlook for the SOL price this week.

Solana’s On-chain Sentiment:

The Solana Network recorded stable activity for the first two months. However, as the volatility in the market increased, the network experienced a significant jump in active addresses from 20.9 Million to 38.81 Million, a jump of 85.69% within a month.

Source: The Block

However, the active addresses recorded a drop of 6.72% to 36.2 Million during April, amid increased congestion issues in the Solana Network. The network has recorded an activity of 13.72 Million since the month started.

Will SOL Price Reclaim $200 Soon?

If the Solana price breaks out of the resistance trendline, the bulls will regain momentum and test its resistance level of $155.25. Furthermore, if the bulls hold the price at that level, it will prepare to test its upper resistance level of $180.75 during the upcoming weeks.

Negatively, if the bulls fail to regain momentum, the SOL coin price will plunge towards its support trendline this week. Moreover, if the bears continue to dominate the market, it will prepare to test its crucial support level of $126.75 this month.

Published in B&T Latest News 14 May, 2024 by The bizandtech.net Newswire Staff

N-PIK is getting ready for LBank Listing for PIK Token!

The post N-PIK is getting ready for LBank Listing for PIK Token! appeared first on Coinpedia Fintech News

What is PIK Token?

PIK Token is N-PIK’s cryptocurrency where you can play the blockchain casino and use it in many of the N-PIK’s evergrowing blockchain ecosystems! Since it is getting listed on LBank on May 16th and has only one day left to look into it before its listing, many investors are getting ready to get into the world of PIK tokens. So you should also watch out for the emergence of PIK listing! That is not the end. Also, BSC and SOL mainnets have been added, and Tron will soon be added to the N-PIK platform!

PIK ICO event is about to end!

Until May 15th, before the listing on LBank, the PIK token can be bought with a sale value of up to 3,000 USD worth! The amount of PIK for this ICO event is limited and is only one day away from being over! You’ll never know what is going to happen if you do not participate! For your convenience, it can also be bought with ETH worth up to 3,000 USD. One day and one opportunity left in your life!

Network additions going on at N-PIK!

Every day the convenience of users is increasing dramatically in N-PIK! Such as BSC network addition, fast customer service support and providing endless content and events for N-PIK participants! Deposit and withdrawal have never been smoother in the N-PIK space like today. Try it now and enjoy the casino and N-PIK events! So many events going on!

N-PIK understands that people want Free Airdrops, so they got them!

Register bonus giving out $55 worth of cryptocurrency, deposit bonus of up to double the amount deposited, draw events to give back the love of customers and much more is happening right now in N-PIK! Enjoy the casino, earn cryptocurrency and have fun with all the spectacular return-the-love events!

Dividends and Market Moving Force: Ex Staking!

Do you know that N-PIK has a system called Ex Staking that helps bring up the price of their PIK token by burning and burning until all the PIK tokens are burnt? This system will provide dividends for those who participated in Ex Staking, and PIK holders will benefit from the effect of burning PIK tokens! When all PIKs are burnt, the second version of PIK will appear like a phoenix to push up the healthy N-PIK ecosystem! On April 15th, a whopping 23.8% rate of return was achieved! That kind of yield is hard to see these days, so you should definitely check it out.

Ever-improving Blockchain Casino and Blockchain Ecosystem

Every day the platform is getting bigger, more users join the ecosystem, and the online community is eager to participate. It is not too late yet! With the LBank listing, the size of this ecosystem’s community will grow larger! Again, the date is set for May 16th for the amazing listing so check out N-PIK and decide for yourself if your time and money is worth it! Also, don’t forget to get the freebies! For example, $55 worth of cryptocurrency is given away right now when you simply register to the N-PIK platform and much more is given away in other events! Let’s go!

- Telegram group: https://t.me/NPIK_Official

- Twitter X : https://twitter.com/NPIK_official

- Youtube: https://www.youtube.com/@Soniccryptogaminguganda