Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Solana Price Analysis: Here are the Future Prospects for SOL Price

The post Solana Price Analysis: Here are the Future Prospects for SOL Price appeared first on Coinpedia Fintech News

The Solana price continues to trade within a narrow range but has maintained a decent ascending trend. The token has suppressed significant bearish interference, as the bulls have successfully maintained levels above critical support during bearish attacks. While market participants are optimistic about the upcoming trend, the SOL price has made a slightly different projection for itself.

The SOL price steadily rose above $150, marking the daily highs above $155 during the previous day’s trade. Unfortunately, the rally bowed down to the bears as it approached the day’s close and closed around $146 after testing lows below $145. On the other hand, the current day’s trade has begun below the previous day’s close, which is fluttering bearish flags over the crypto.

Therefore, is the SOL price poised to drop to the crucial support level of $133? Has the bullish impact of the token faded?

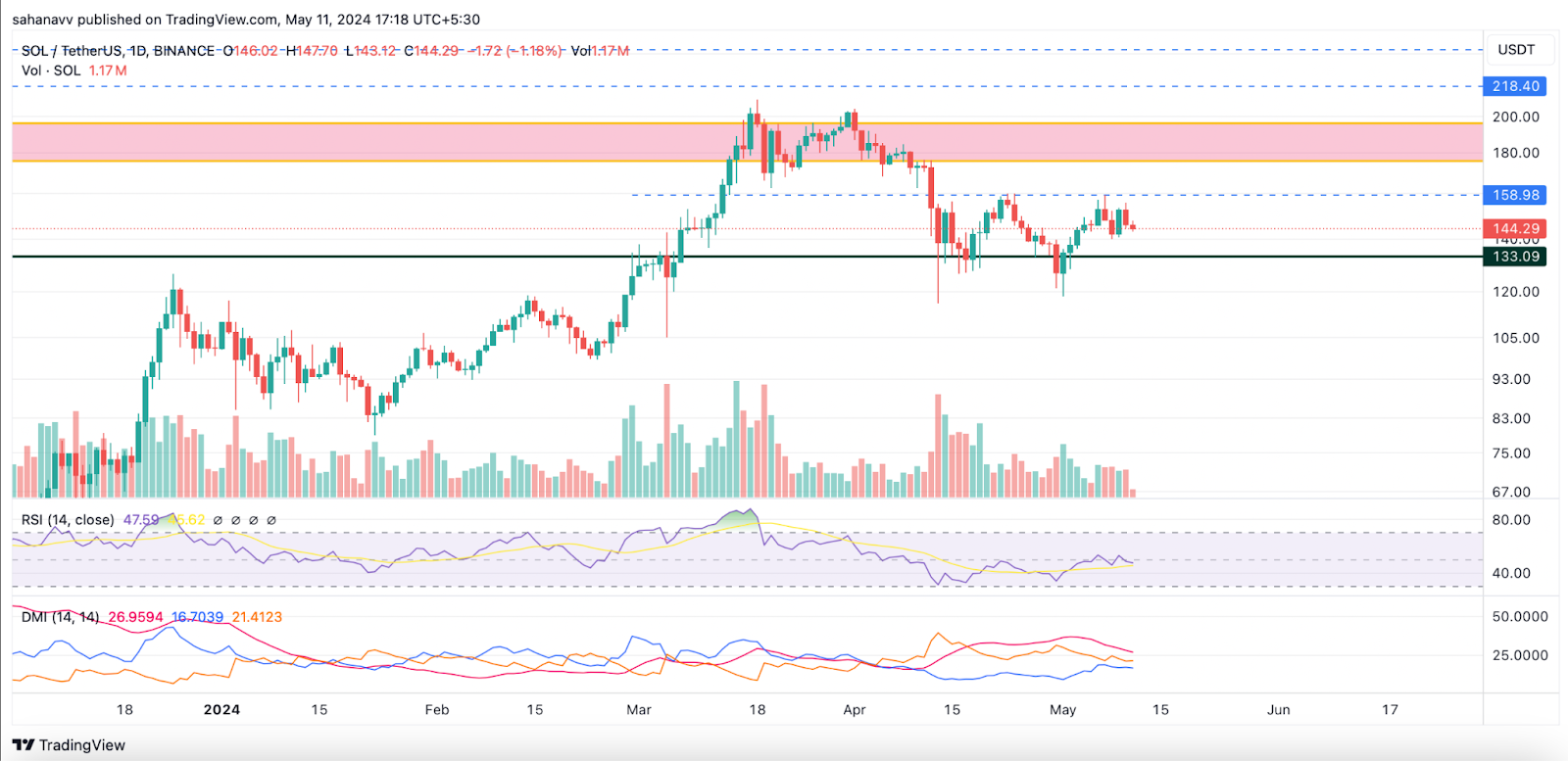

The above chart displays that the SOL price has formed a double bottom pattern, but instead of surpassing the neckline, the price is consolidating below the levels. This has been flashing bearish signals, which have been substantiated by the sluggish behaviour of RSI, which is failing to rise above average levels. On the other hand, the DMI levels are going parallel to each other, suggesting a diminished activity of both bulls and bears.

Therefore, the Solana price is believed to maintain a consolidated trend for a while and eventually test the interim lower support at $133 in the coming days. As the bulls have failed to rise above $155 to $158 a couple of times, their weakness may pave the way for the bears to slash the price. However, bulls have been defending the lower support in every bearish instance and hence a similar rebound can be expected, which could elevate the Solana price back to $158.

However, breaking above this barrier completely depends on market sentiments and the buying pressure that is expected to rise by then.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Bitcoin, Ethereum, And XRP Price Prediction: Is The Correction Phase Over?

The post Bitcoin, Ethereum, And XRP Price Prediction: Is The Correction Phase Over? appeared first on Coinpedia Fintech News

The crypto market has displayed significant price fluctuations over the past week following increased volatility in the crypto industry. Moreover, top crypto tokens continue their struggle to hold their respective value above their crucial support levels.

Furthermore, Bitcoin price has recorded a correction of 3.61% within the past seven days. Following in its footsteps the ETH price plunged 6.61%, whereas the XRP price lost 4.96% during the same time, highlighting a strong bearish sentiment in the industry.

Will the crypto industry record a bullish rebound during the upcoming week amid increased price volatility?

Bitcoin Price Displays A Bearish Price Action:

Despite increased price volatility in the crypto industry, the market leader, BTC price, has lost 3.47% within the past day and has recorded a drop of 1.93% in its 24-hour trading volume. Further, it has recorded a correction of 14.18% over the past 30 days.

TradingView: BTC/USDT

TradingView: BTC/USDT

Moreover, it has formed a symmetric triangle and continues to trade within it, indicating uncertainty in future price action. Furthermore, the EMA 50-day acts as a resistance to the price chart, highlighting a strong bearish sentiment in the cryptocurrency industry.

On the other hand, the technical indicator, MACD, shows a constant flatline in its 1D time frame, highlighting a weak price action for the market leader in the crypto space. However, the averages display a bearish convergence, suggesting a mixed sentiment in the crypto industry.

If the bulls regain momentum, the Bitcoin price will retest its resistance trendline of the symmetric triangle during the upcoming week. Conversely, bearish price action could result in the BTC token plunging toward its crucial support level of $60,000.

Ethereum Fails To Breakout Of Its Falling Channel Pattern:

The altcoin leader, Ethereum price, has continued trading in a falling channel pattern since mid-March, indicating a rising disinterest of investors in it. Moreover, the delayed approval of the Spot EthereumETF by the Securities and Exchange Commission (SEC) has been one of the prime reasons for this bearish price action.

TradingView: ETH/USDT

TradingView: ETH/USDT

The Simple Moving Average (SMA) has been constantly acting as a resistance to the ETH price chart, indicating a weak bullish influence in the crypto industry.

Moreover, the Relative Strength Index (RSI) has been constantly trading below the mid-point, indicating a rising disinterest of investors in this altcoin. Furthermore, the averages display a bearish curve, hinting at a negative price action in the coming time.

If the market pushes the price above the important resistance level of $3,017, the bulls will regain momentum and attempt to break out of its falling channel pattern. However, if the bears continue to dominate the market, it will plunge toward its low of $2,650 this month.

Ripple Token On The Verge Of A Breakdown:

The XRP price is repeatedly failing to regain momentum, resulting in the Ripple token recording a correction of 2.35% within the past day and approximately 5% over the past week. Moreover, XRP tokens Year-to-Date (YTD) return stands at -17.95%, highlighting a long-term bearish sentiment.

TradingView: XRP/USDT

TradingView: XRP/USDT

The Moving Average Convergence Divergence (MACD) shows a constant decline in the histogram, highlighting increased selling pressure within the crypto space. On the other hand, the averages show a bearish convergence in the 1D time frame, suggesting a negative outlook for the altcoin.

If the market experiences a bullish reversal, the Ripple price will attempt to retest its resistance level of $0.5340 during the upcoming week. On the contrary, if the bears continue to hold power, the Ripple token may fall toward its support level of $0.4790 by breaking down its triangle pattern.

Conclusion:

With the crypto industry concluding this week on a bearish note, the chances of a bullish recovery during the upcoming week have increased. Conversely, the market may record a delayed bullish price action if the BTC, ETH, and XRP prices fail to hold their values above their crucial support levels.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Michael Saylor’s Stark Warning: Altcoins Face Regulatory Risks

The post Michael Saylor’s Stark Warning: Altcoins Face Regulatory Risks appeared first on Coinpedia Fintech News

In a recent tweet, Michael Saylor, founder and chairman of MicroStrategy, issued a stark warning to cryptocurrency investors, likening his caution to the famous “Indiana Jones and the Last Crusade” scene where choosing wisely was paramount. Saylor, known for his strong advocacy of Bitcoin (BTC), highlights the importance of selecting BTC as the investment tool of choice.

Saylor’s Stark Warning

Saylor, a prominent Bitcoin maximalist, has been a vocal supporter of MicroStrategy’s consistent BTC purchases over the past four years. Now, he actively promotes Bitcoin daily on the X, underscoring his unwavering belief in the leading cryptocurrency.

Choose Wisely. #Bitcoin pic.twitter.com/4a5KVAts7X

— Michael Saylor (@saylor) May 10, 2024

(@saylor) May 10, 2024

However, the warning comes amidst a broader discussion about alternative cryptocurrencies (altcoins) and their regulatory status. Saylor has expressed skepticism about altcoins, labeling several, including XRP, SOL, ADA, and ETH, as potential unregistered securities.

Perhaps, he aligns with the SEC’s position on this matter, anticipating that all altcoins may eventually be classified as securities.

Bitcoin’s Regulatory Advantage Over Altcoins

Saylor’s belief in Bitcoin’s regulatory advantage stems from its recognized status as a commodity by the SEC and CFTC. This distinction positions Bitcoin more securely compared to altcoins, which face increasing scrutiny and potential classification as securities.

On the other hand, Ethereum’s regulatory standing has recently faced scrutiny, notably from SEC Chair Gary Gensler, signaling heightened oversight of altcoins and U.S. crypto exchanges. This regulatory spotlight underscores the challenges altcoins may encounter, contrasting with Bitcoin’s clearer regulatory path as a commodity.

Bitcoin Price Performance

Saylor’s warning reflects ongoing market volatility and underscores the challenges facing altcoins amid regulatory uncertainty, positioning Bitcoin as a safer harbor in the turbulent crypto landscape.

Over the past 24 hours, Bitcoin has experienced a 5% decline, dropping from $63,284 to around $60,300, driven by a bearish trend illustrated by a descending triangle pattern on the hourly chart.

Earlier coinpedia reported that crypto analyst Michael van de Poppe predicted a potential further decline for Bitcoin to a range between $55K and $52K if it fails to maintain its current trading range to $60,000.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

MarginFi To Launch Solana LST-Backed Decentralized Stablecoin This Month

MarginFi said XBY will be the first major decentralized stablecoin on Solana.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Forget dumbbells — build a strong back and biceps with these 3 upper-body barbell exercises

These five barbell exercises build stronger back and biceps muscles. Here’s how to do them, according to a personal trainer.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Memorial Day deals just went live — 11 early sales to shop this weekend

Memorial Day is still a few days out, but there are plenty of amazing deals happening now. I’ve picked the 11 best sales this weekend.

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Save $40 on this rugged outdoor speaker that’s ready for summer

Hitting the trail or the beach this summer? When you’re spending time outdoors, you want to have your soundtrack handy. So, rather than keep it to yourself with headphones, gear up with the TREBLAB HD77 Outdoor Rugged Wireless Speaker with TWS Support, which is $40 off for a limited time.

This durable speaker is equipped with DualBass subwoofers and TWS technology, delivering immersive 360º HD sound even in the most wide-open environments. It’s built for outdoor use, with an IPX6-rated waterproof design and shockproof protection — all while remaining portable enough to pack up easily. You can stream music via Bluetooth 5.0 or plug into the AUX port, giving you optimum versatility. Plus, with a 5,200mAh battery, you’ll have up to 20 hours of playtime so you won’t have to worry about it running out of battery in the middle of a beach day.

Bring your soundtrack anywhere this summer. Right now, you can get the TREBLAB HD77 Outdoor Rugged Wireless Speaker with TWS Support for 39% off $99 at just $59.99.

TREBLAB HD77 Outdoor Rugged Wireless Speaker with TWS Support – $59.99

See Deal

StackSocial prices subject to change.

Accessories

Published in B&T Latest News

11 May, 2024 by The bizandtech.net Newswire Staff

Crypto Whales Buy $5.56 Million in PEPE Amidst the Market Dip

Major crypto whales have capitalized on the current market downturn. They have acquired substantial amounts of the meme coin Pepe (PEPE), with transactions totaling approximately $5.56 million.

This activity coincides with a general decline in the crypto market.

Is Pepe Poised to Surge 51%?

Spot On Chain, an on-chain analysis platform, detailed that a prominent crypto whale, identified by the wallet address 0xa14, has been particularly active.

This investor withdrew 350.2 billion PEPE, valued at $2.93 million, from the crypto exchange Binance. This transaction marks the investor’s fourth in an ongoing series, bringing their total estimated profit from this trade to $1.63 million, a 15% increase.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

Furthermore, since March 14, 2024, this whale has withdrawn 1.449 trillion PEPE from Binance at an average price of $0.000007496, with total spending estimated at $10.86 million. Subsequently, deposits back into Binance amounted to 789.26 billion PEPE, acquired at an average price of $0.000008542, totaling $6.74 million. Currently, the investor holds 660 billion PEPE, valued at approximately $5.74 million.

“Previously, the whale had earned an estimated cumulative profit of $955,000 (+33.6%) from all 3 previous PEPE trading cycles. He has a win rate of 100%,” Spot On Chain mentioned.

Other significant traders have also been accumulating PEPE. According to Lookonchain, another investor, identified as 0xa4F, purchased 123.66 billion PEPE at $0.00000881, amounting to $1.09 million in USDC.

Similarly, wallet address 0x895 withdrew 101 billion PEPE, worth about $885,000, from Binance. Meanwhile, 0x24E3 invested $661,000 USDC to buy 74.5 billion PEPE at a rate of $0.000008873.

These acquisitions occurred as Bitcoin experienced a notable dip, dropping nearly 5% from $63,400 to $60,180 last Friday. Despite the broader market’s struggles, PEPE has shown resilience and a quick recovery, currently up nearly 7% from Friday’s low.

Additionally, PEPE’s recovery was supported on May 3 when it broke out from an inverse head and shoulders chart pattern, a bullish chart pattern. On May 8, the meme coin retested the neckline of this pattern at $0.00000785 and experienced an 11% bounce.

Market analysis suggests that based on the current chart pattern, PEPE could potentially surge up to $0.00001330, representing a 51% increase from its current market price.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

Pepe (PEPE) Price Performance. Source: TradingView

Pepe (PEPE) Price Performance. Source: TradingView

However, investors should closely monitor significant resistance at $0.00000890. A daily closing below $0.00000785 would invalidate this bullish trend, potentially signaling declines.

The post Crypto Whales Buy $5.56 Million in PEPE Amidst the Market Dip appeared first on BeInCrypto.

(@saylor)

(@saylor)

Pepe (PEPE) Price Performance. Source:

Pepe (PEPE) Price Performance. Source: