These movies will keep you on the edge of your seat

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

3 best psychological thrillers on Netflix you (probably) haven’t watched

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

The iPad Pro 2024 is the tablet I’ve been dreaming about for years

Apple’s latest high-end tablet has just made this screen snob extremely happy.

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

Meta adds more AI features for advertisers with new image and text generation tools

Meta is expanding its generative AI ad tools with more ways to create images and text — but not yet giving marketers carte blanche for creative automation.

Yesterday, Meta announced advertisers will be able to upload reference images to create AI-generated variations. For example, they can upload an image of a coffee mug and receive an array of options for using the same mug in new settings. Meta also is adding tools for using AI to generate headlines based on reference text and to create text overlays for images based on previous campaigns and products.

The new tools, which will be available through Meta’s Advantage+ Creative portal, build on other generative AI features for users and advertisers introduced in recent months. Marketers also will get more creative freedom in the coming months with the addition of text-based prompts to customize their options. Soon, Meta’s generative AI ads will be powered by its Llama 3 large language model, which debuted last month.

Continue reading this article on digiday.com. Sign up for Digiday newsletters to get the latest on media, marketing and the future of TV.

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

Reddit has big plans for search ads and a mixed feed as it adjusts to life as a public company

Reddit is now treading the well-worn path of many platforms before it: the quest to gather a large enough user base to attract brands without alienating its core audience.

This journey isn’t new; it’s been on this trajectory for the past six years. However, since going public in March, the pace has certainly picked up. The plethora of hires, introduction of new ad products, and agency tours that have ensued since then demonstrate just how rapidly the business is evolving. And with its first earnings update as a public company looming, it’s clear that Reddit will need to move even faster in the future.

Let’s kick off with the silver lining: daily active users skyrocketed to 82.7 million in the quarter, marking a 37 percent increase compared to the same period last year. With such a surge in user engagement, advertisers naturally followed suit. Over the same period, ad revenue surged by 39 percent, totaling an impressive $222.7 million.

Continue reading this article on digiday.com. Sign up for Digiday newsletters to get the latest on media, marketing and the future of TV.

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

Warner Bros. Discovery Sport and CNN International create marketplace for sports and political ad dollars

Sometimes, what’s old is new again. Warner Bros. Discovery seems to think so, as it has turned to programmatic guaranteed in its latest attempt to capture more ad dollars.

These types of deals form the backbone of a new marketplace called WBD Connect, which consolidates ad inventory across CNN International Commercial (CNNIC) and WBD Sports Europe.

Advertisers see these deals as a reliable way to reach audiences across multiple publishers, including CNN, Eurosport, Bleacher Report, and NBA.com, in a single campaign at a fixed rate. Publishers also prefer programmatic guaranteed deals over other programmatic methods, but because the reserved inventory helps them to forecast their ad revenue more accurately.

Continue reading this article on digiday.com. Sign up for Digiday newsletters to get the latest on media, marketing and the future of TV.

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

Future of TV Briefing: Upfront ad sellers prep performance-based pitches to address ad buyers’ ROI obsession

This week’s Future of TV Briefing looks at how TV and streaming ad sellers are looking to make more outcome-oriented pitches in this year’s upfront market.

- The upfront outcome outlook

- Amazon Prime Video’s new ad formats, Publicis Groupe’s measurement currency stance, MrBeast’s management move and more

The upfront outcome outlook

What are TV and especially streaming ads actually worth?

This is a member-exclusive article from Digiday. Continue reading it on digiday.com and subscribe to continue reading content like this.

Published in B&T Latest News 8 May, 2024 by The bizandtech.net Newswire Staff

Rethinking the manager career path: The Return podcast, season 3, episode 3

Subscribe: Apple Podcasts • Stitcher • Spotify

What does it look like when an organization doesn’t have any middle managers at all?

In our last episode, we spoke to Cary Cooper, a professor of organizational psychology and health at the University of Manchester, about the pitfalls of promoting an “accidental manager.” He doubled down on why the best player doesn’t always make the best coach, why proper management training is crucial, and how the younger generations are changing management.

Continue reading this article on digiday.com. Sign up for Digiday newsletters to get the latest on media, marketing and the future of TV.

Published in B&T Latest News 7 May, 2024 by The bizandtech.net Newswire Staff

Over $16 Billion on the Line: FTX’s Plan to Repay Creditors

On May 7, FTX Trading Ltd. and its associated debtors filed an updated Plan of Reorganization. They filed it with the United States Bankruptcy Court in Delaware.

The plan outlines a structured approach to repay creditors by liquidating nearly all assets held by FTX at the time of its downfall. This move marks a crucial step in resolving the financial turmoil following its November 2022 bankruptcy.

Unpacking FTX’s Financial Recovery and Repayment Proposals

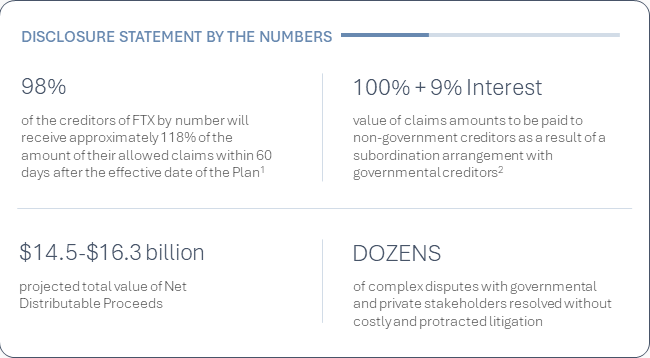

The reorganization strategy indicates that FTX has secured between $14.5 and $16.3 billion for repayment. The amount has been achieved through liquidating diverse assets, including those controlled by various global entities involved in the proceedings.

Despite the massive asset shortfall identified at the beginning of the bankruptcy, the plan ensures that non-governmental creditors will receive full payment. They will receive up to 9% interest from the start of the bankruptcy cases.

The strategy introduces a ‘convenience class’ for creditors with $50,000 or less claims. If the court approves, this arrangement is expected to enable 98% of such creditors to receive about 118% of their claim value. This will occur within 60 days of the plan’s activation.

However, it subordinates governmental creditors’ claims, permitting interest payments of up to 9% to primary customers and creditors classes from the start of the Chapter 11 cases until distribution. Additionally, certain creditors might receive extra payments from the Supplemental Remission Fund.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

FTX Latest Organization Plan. Source: X/FTX_Official

FTX Latest Organization Plan. Source: X/FTX_Official

A core component of the bankruptcy exit strategy involves a series of settlements with key stakeholders. This strategy aims to consolidate FTX’s position and simplify the repayment process.

These pending court-approved agreements include resolving a $24 billion IRS claim from before the Chapter 11 cases with a $200 million payment and a $685 million subordinated claim. Furthermore, the Plan proposes subordinating post-Chapter 11 Internal Revenue Service (IRS) tax claims and similar claims from the Commodity Futures Trading Commission (CFTC).

These subordinated claims will fund supplemental payments to certain creditors and customers through a special fund, pending further details.

The Plan also outlines a potential arrangement with the Department of Justice (DOJ). This arrangement will distribute over $1.2 billion in forfeiture proceeds to creditors without extra costs or delays. It confirms settlements with the Ad Hoc Committee of Non-US Customers, Class Action Claimants, and the Official Committee of Unsecured Creditors, giving customers special priority.

Another settlement allows FTX.com customers to resolve their claims either in Chapter 11 or in the liquidation of FTX Digital Markets, Ltd. This arrangement offers similar financial outcomes. Lastly, a previously approved settlement with BlockFi, FTX’s largest creditor, is included.

In its official statement, John J. Ray III, Chief Executive Officer and Chief Restructuring Officer of FTX, expressed his gratitude regarding this plan.

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors. On behalf of FTX’s independent Board of Directors, I want to extend our deepest appreciation to the numerous governmental agencies. […] Finally, I want to thank all the customers and creditors of FTX for their patience throughout this process,” Ray stated.

Read more: Who Is John J. Ray III, FTX’s New CEO?

As FTX moves forward with its proposed plan, the role of the US Bankruptcy Court becomes crucial. A late June hearing will let Judge John Dorsey review and potentially approve the voting procedures and disclosure statement. Moreover, this decision will gauge the repayment plan’s effectiveness and fairness.

This development follows the tokens sell-offs from the FTX estate, like Solana. BeInCrypto reported the estate began its second tranche of token sales, pricing each between $85 to $110. Despite the discount to the current market prices, demand remains high, with firms like Galaxy and Pantera Capital participating.

The post Over $16 Billion on the Line: FTX’s Plan to Repay Creditors appeared first on BeInCrypto.