Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

Navigating the Web3 startup landscape with limited funds

The following is a guest post by Nischal Shetty, co-founder and President at Shardeum.

The bull market has shown signs of its arrival as the ecosystem looks forward to a market revival, which has been awaited for two years. In Web3, bear markets are generally considered the best time to build so that the products can withstand all adverse conditions and still learn to thrive and scale. However, sentiment plays an important role in crypto, meaning builders/consumers are far more optimistic about products when the market is up.

New builders will be more encouraged to build something from scratch amidst the larger optimism to reach an equally enthusiastic lot of consumers. So those who have spent the last two years understanding the market dynamics and studying the token movements closely might have a tougher time creating something as the funding landscape has become less generous in the past year. With several projects collapsing and others unable to live up to their initial hype, investors have tightened their pockets.

According to Crunchbase data, In the first two quarters of 2023, funding dipped by 78% and 76%, respectively, compared to the same period in 2022. The Block further reported that in 2023, VCs injected $10.7 billion into crypto startups, a 68% decrease from the $33.3 billion in 2022.

Funding for Web3 startups has become scarcer, and venture capitalists have grown increasingly cautious. New BUIDLers must adapt their strategies to build and scale their startups with minimal seed funding.

Leveraging Open Source Tools and Communities

Utilizing open-source tools and building communities is at the core of building a Web3 startup with limited funds. Platforms like Ethereum, Polkadot, and Cosmos offer decentralized infrastructure and protocols, although their gas fees are somewhat concerning and not as friendly for beginners. Engaging with the open-source community fosters collaboration, learning, and contribution.

People with various expertise can come together, and if they are truly passionate about building something from scratch, they can reach into their pockets and pool in funds to help the initiative take off before revenues come in. Additionally, starting as a DAO right from the start will provide more autonomy to the community, where each individual can claim a stake in a certain number of tokens in exchange for contributing to the project. They can reap the benefits of the staked tokens later when they rise in value.

This could be a great start to developing a Minimal Viable Product (MVP) and avoid unnecessary expenses. By identifying the essential features that address the immediate needs of the target audience, startups can prioritize development efforts and obtain valuable user feedback. This iterative approach allows for continuous improvement without significant financial outlay.

Creating Sustainable Growth Strategies

Scaling a Web3 startup on a shoestring budget requires a shift towards sustainable growth strategies. Rather than relying on costly marketing campaigns, startups should focus on organic growth through community-building and word-of-mouth referrals. Engaging with potential users on social media platforms and attending industry events can generate traction without hefty financial investments.

Organizing meet-ups in different cities with interested communities who can also grow the ecosystem can help raise awareness and enable different members to help scale new projects. Exploring grant programs and hackathons tailored for Web3 startups can provide a much-needed lifeline. Many organizations offer funding opportunities for innovative projects, while hackathons offer exposure and potential funding for standout ideas. =

These initiatives enable startups to showcase their skills and ideas to potential investors while mitigating financial constraints. Creating strategic alliances with existing and well-established startups can amplify resources and overcome limitations. By collaborating with complementary ventures, startups can share costs, pool resources, and leverage each other’s expertise. This collective approach fosters innovation and problem-solving and expands market reach without substantial financial investments.

Additionally, seeking mentorship from industry leaders who have built bootstrapped products can be a great way to tap into practical experiences and real-time feedback on the industry pulse.

Embracing the ethos of bootstrapping and iteration is crucial for Web3 startups with minimal funds. Instead of solely relying on external funding, startups can self-fund or use revenue generated from early adopters to fuel growth. Continuously iterating on the product based on user feedback ensures progress toward the vision while conserving financial resources.

In conclusion, while securing substantial funding may pose challenges for Web3 startups, it is not an insurmountable barrier. By leveraging open-source tools, developing a lean MVP, prioritizing sustainable growth, tapping into grant programs and hackathons, fostering collaborations, and embracing bootstrapping and iteration, entrepreneurs can navigate the Web3 landscape with limited funds. With resilience, adaptability, and strategic planning, success in the Web3 space is within reach, even with modest resources.

The post Navigating the Web3 startup landscape with limited funds appeared first on CryptoSlate.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

Billion-Dollar Bank Facing Class Action Compliant After Data Breach Exposes Customers’ Names, Social Security Numbers and Other Sensitive Information

A US bank is facing a proposed class action lawsuit for allegedly failing to protect its customers’ sensitive personal information and suffering a massive data breach.

SouthState Bank, which has over $45 billion in assets, is being hit with a class action lawsuit led by plaintiff Latonya Gore in Florida, filings show.

The suit concerns a February 2024 data breach that compromised the banks’ clients’ full names, financial account numbers and Social Security numbers.

SouthState is accused of negligently failing to take adequate and reasonable measures to ensure its data systems were protected against unauthorized intrusions, failing to take standard and reasonably available steps to prevent the breach and failing to provide its customers prompt and accurate notice of the incident.

The plaintiffs allege hackers have already use the personal information that was released in the breach to engage in identity theft. They also argue there remains a high risk that the hackers can commit other crimes like opening bank accounts, taking out loans or obtaining fake driver’s licenses in the victims’ names.

While SouthState reportedly issued a letter to customers regarding the breach, the plaintiffs argue it left out virtually all the important information.

Says the lawsuit,

“Despite defendant’s intentional opacity about the root cause of this incident, several facts may be gleaned from the notice letter, including:

a) that this data breach was the work of cybercriminals;

b) that the cybercriminals first infiltrated defendant’s networks and systems, and downloaded data from the networks and systems, and

c) that once inside defendant’s networks and systems, the cybercriminals targeted information including plaintiff’s and class members’ Social Security numbers for download and theft.”

The plaintiffs are seeking damages, which include the need have to constantly monitor their financial and personal records for years to come, the lawsuit says.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Billion-Dollar Bank Facing Class Action Compliant After Data Breach Exposes Customers’ Names, Social Security Numbers and Other Sensitive Information appeared first on The Daily Hodl.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

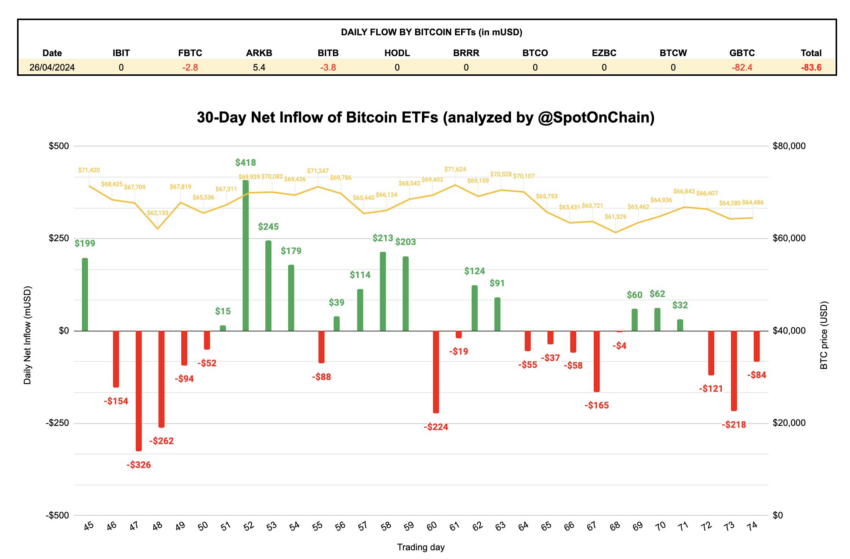

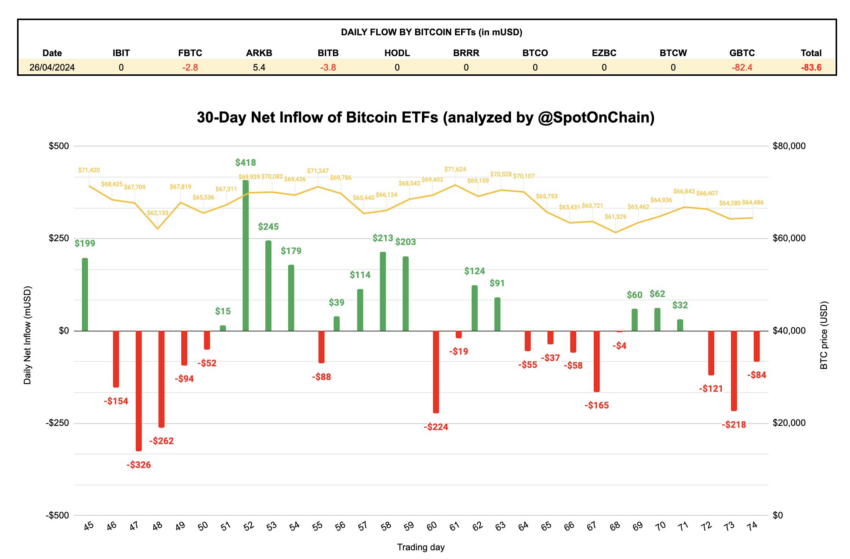

BlackRock Bitcoin ETF Faced Zero Inflows for 3 Consecutive Days

BlackRock’s Bitcoin ETF experienced three consecutive days without any new investments. This starkly contrasts other Bitcoin ETF investment products, which saw significant outflows totaling $328 million.

The iShares Bitcoin Trust (IBIT) had enjoyed a streak of 71 days with continuous inflows before this recent trend of no new investments.

Explaining BlackRock’s Zero Inflows

Due to the current zero flow trend, some community members have interpreted it as indicative of diminishing investor interest in Bitcoin. However, Bloomberg ETF analyst James Seyffart explained that the pattern was common within the broader ETF market.

Zero flows manifest when there is no notable difference between the supply and demand for an ETF. According to Seyffart, this disparity must be substantial enough to trigger the creation or redemption of ETF shares, a process executed in units.

Market makers only intervene in the underlying market when the discrepancy surpasses a certain threshold.

“Minor mismatches will see the market makers handle trading of shares just like they would a stock. But it needs to be lopsided—more than a creation unit in either direction for market makers to tap the APs/underlying market,” Seyffart added.

Therefore, the absence of inflows in BlackRock IBIT’s ETF does not suggest a lack of trading activity. Instead, it indicates that the net flow is not significant enough to warrant the creation or redemption of units.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETF Net Flows. Source: Spot On Chain

Bitcoin ETF Net Flows. Source: Spot On Chain

Another Bloomberg ETF expert, Eric Balchunas, corroborated this notion, citing the iShares MSCI Emerging Markets ETF EEM, which saw $70 billion in volume between mid-January and mid-April despite registering zero daily flows.

However, the lack of inflows into BlackRock’s Bitcoin ETF has impacted BTC’s price, which has remained stagnant during the past week.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Crypto analyst Skew noted that Bitcoin remains within a defined range between $72,000 and $61,000, with a point of correction (PoC) or mid-range pivot at $66,000. The analyst highlighted specific interest price levels for continued observation at the March low of $61,598 and the previous week’s low of $63,498.

“PoC is often an inflection zone for trends so backtesting from above or retesting from under can be important contextually how the market trades around a PoC often with other respectful confirmations leads to the next move by this I mean failure to auction higher or lower with respectful flows is often great confirmation to close out of trades or getting into trades,” Skew explained.

The post BlackRock Bitcoin ETF Faced Zero Inflows for 3 Consecutive Days appeared first on BeInCrypto.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

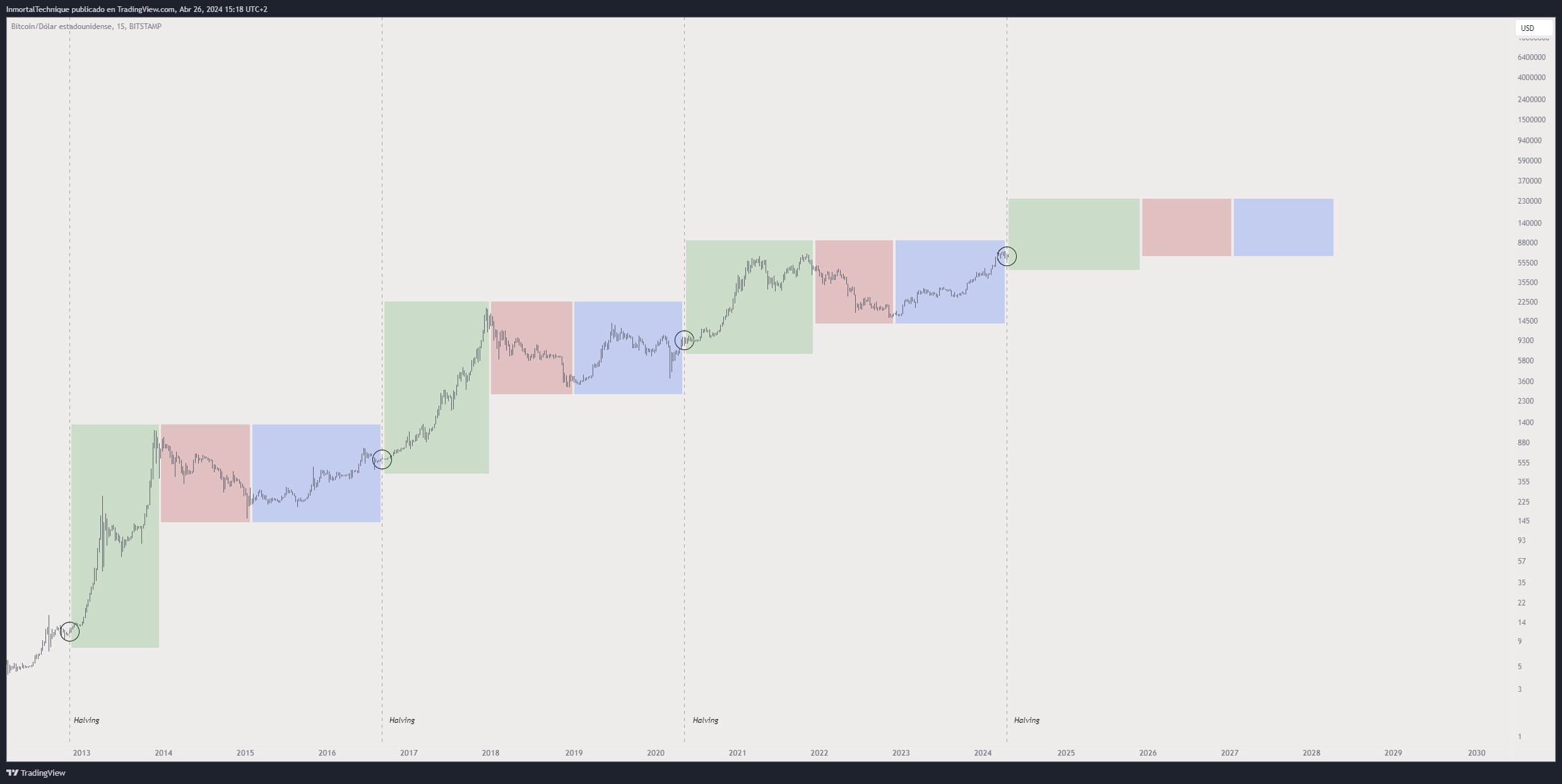

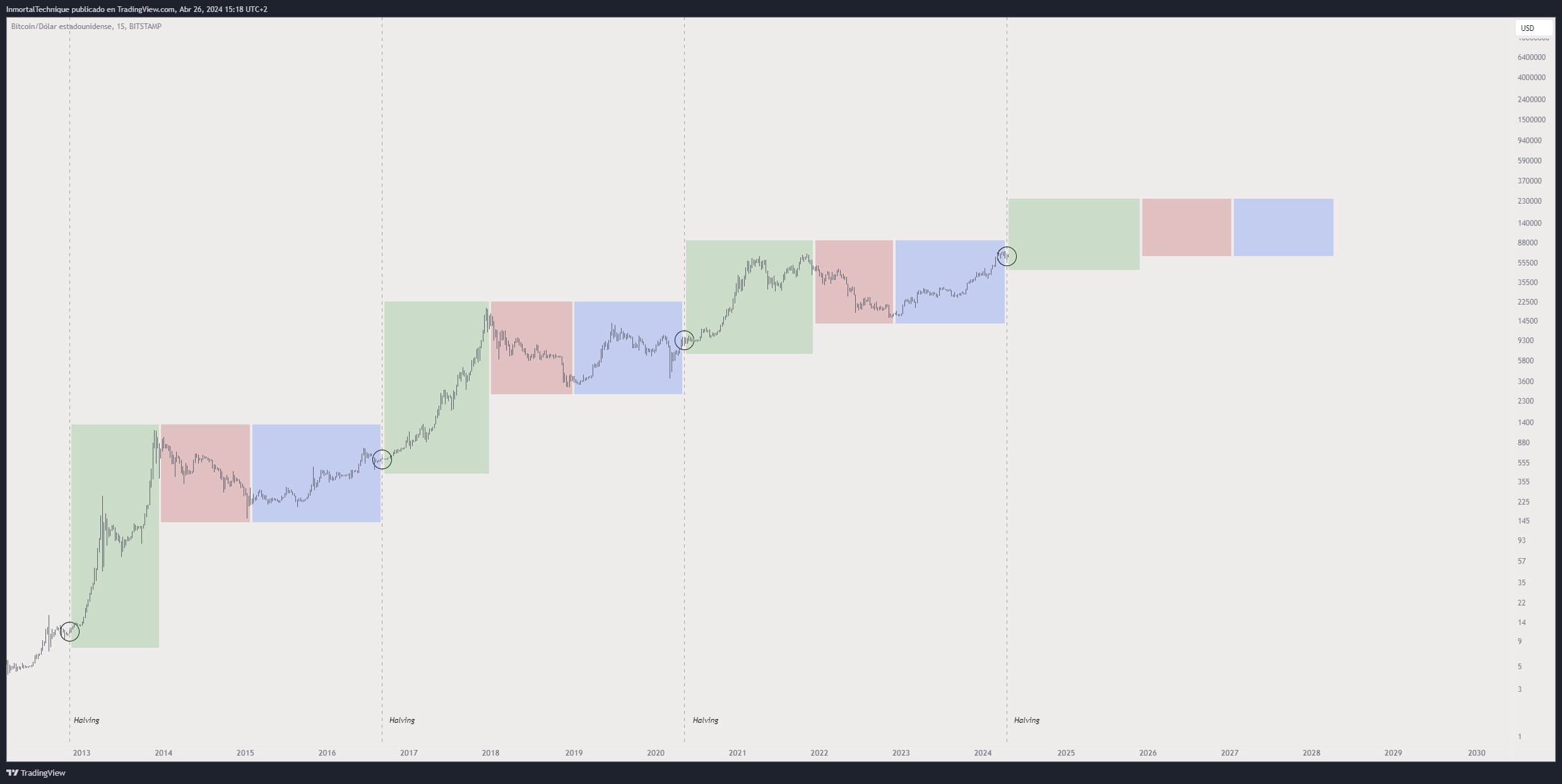

Crypto Trader Says Bitcoin Presenting ‘Generational’ Opportunity, Unveils Bull Market Price Target for BTC

A closely followed crypto strategist thinks that Bitcoin (BTC) is presenting a golden opportunity to long-term holders.

Pseudonymous analyst Inmortal tells his 212,900 followers on the social media platform X that he sees Bitcoin rallying to a fresh all-time high in the coming weeks.

According to the trader, the current Bitcoin consolidation is giving long-term BTC bulls a chance to accumulate at a level that offers a very favorable risk-to-reward ratio.

“Generational long entry

BTC.”

Source: Inmortal/X

Source: Inmortal/X

Based on the trader’s chart, he appears to predict that Bitcoin will rally to as high as $76,000 in the near term as long as support at $60,000 holds.

The analyst also thinks that Bitcoin will not end its rally below $80,000, and believes BTC can print gains of as much as 119% from current levels before the bull market hits its highest note.

“Three KEY IDEAS ON BTC:

1. We are NOT early, but if you already have bags, I think we still have a trend to ride.

2. I don’t think we will go as high as people think.

3. The expansion above the previous all-time high is still to come…

$120,000 -$140,000, in my opinion.”

Source: Inmortal/X

Source: Inmortal/X

At time of writing, Bitcoin is trading at $63,650.

Aside from Bitcoin, Inmortal is also bullish on one crypto subsector. The analyst says that crypto projects focused on tokenizing real-world assets (RWA) will likely witness huge bursts to the upside in the coming months.

“The hype around game-fi and AI (artificial intelligence) narratives is rotating to RWA.

I think RWA narrative will explode in the second half of this 2024.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sensvector/PurpleRender

The post Crypto Trader Says Bitcoin Presenting ‘Generational’ Opportunity, Unveils Bull Market Price Target for BTC appeared first on The Daily Hodl.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

What is the Beautyrest Harmony mattress and should you buy it in Memorial Day sales?

We take a closer look at the Beautyrest Harmony affordable hybrid mattress to see if it’s worth your money in Memorial Day sales.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

DOJ Opposes Dismissal of Tornado Cash Case, Worrying Crypto Traders

The US Department of Justice’s stance against Roman Storm’s motion for dismissal, the developer of Tornado Cash, has raised worries in the crypto market.

In a court filing on April 26, the DOJ explained why it believes the Tornado Cash co-founder should be held accountable for the alleged crimes.

Crypto Community Alerted at DOJ’s Opposition

The DOJ had accused developers Roman Storm and Roman Semenov of several charges related to creating Tornado Cash, a crypto-mixing service. The charges include conspiring to commit money laundering, operating an unlicensed money transmitter, and violating sanctions imposed by OFAC.

Due to the severity of these allegations, the authorities said that the jury should determine the nature of Tornado Cash’s service. It further argued against Storm’s attempt to dismiss the indictment by presenting his version of the service’s operation.

Moreover, due to a lack of fund control, the authorities challenged Storm’s claim that Tornado Cash was not a money-transmitting business. The DOJ asserts that controlling funds is not a prerequisite for being deemed a money-transmitting business.

“The definition of ‘money transmitting’ in Section 1960 does not require the money transmitter to have ‘control’ of the funds being transferred. The definition exends to ‘transferring funds on behalf of the public by any and all means,’” The DOJ legal team stated.

Read more: What Are Crypto Mixnets? A Look At Improving Privacy In Web3

This DOJ stance has stirred concerns within the crypto industry. Several community experts warned that the outcome of the Tornado Cash case could significantly impact the sector. Custodia Bank’s CEO, Caitlin Long, highlighted the DOJ’s broadened definition of money transmitters as a “shift” that contradicts existing FinCEN guidance.

Amanda Tuminelli, Chief Legal Officer of Fund DeFi, also criticized the DOJ’s position. The lawyer pointed out technical inaccuracies and misapplications of law in the filing.

“The DOJ’s opposition to Roman Storm’s motions to dismiss and suppress evidence in the Tornado Cash case is filled with technical inaccuracies, obvious disdain for privacy and emerging technology, and misapplication of the law,” Tuminelli added.

Similarly, Freedom.Tech editor Seth suggested that the government aims to target self-custody in the long term. He cited instances from the DOJ’s opposition that indicate this intention.

“It seems clear to me in reading through this that the DOJ seeks to widen the net on what can be considered an MSB, allowing them to apply the subsequent regulations (and potential prosecution) to apply to anyone who makes it easier to use cryptocurrency, especially if any level of privacy is involved,” he concluded.

Meanwhile, this community backlash against the DOJ comes as the US government escalates its enforcement efforts against crypto. Last week, BeInCrypto reported that the authorities arrested the co-founders of Samourai Wallet, a crypto mixer.

The post DOJ Opposes Dismissal of Tornado Cash Case, Worrying Crypto Traders appeared first on BeInCrypto.

Published in B&T Latest News · Business Features

28 April, 2024 by The bizandtech.net Newswire Staff

Crypto Exchange Executives and 29 Other People Accused of Running $24,560,000 Fraud Scheme in Taiwan: Report

Authorities in Taiwan are reportedly accusing crypto exchange executives and dozens of others of running a multimillion-dollar crypto scam.

According to a new report by the Taipei Times, prosecutors are charging 32 people with fraud allegedly related to the ACE crypto exchange, recommending 20-year sentences for the four operators of the trading platform.

Those arrested include David Pan and Lin Keng-hong, the founders of the ACE crypto exchange platform, and Wang Chen-huan, the chairman of the firm. The Taiwanese government says that the scheme defrauded about 1,200 out of $24.56 million.

Prosecutors say the suspects started encouraging others to purchase virtual currencies, including the native asset of the ACE exchange – starting in 2019.

Though Pan and Lin told investors the plan was to turn ACE into the premier crypto trading platform in Taiwan, the value of its native asset greatly decreased and investors were subsequently unable to convert the digital asset back into Taiwanese dollars, according to the report.

However, prosecutors say that the suspects manipulated the price of assets on the platform as a means of drawing in more investors.

Wang is accused of receiving $5.5 million and reinjecting about half of that back into ACE as a means of bolstering asset prices, deceiving traders in the process.

Prosecutors are recommending 20 years for Pan and Lin and 12 years for Wang, according to the report.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Crypto Exchange Executives and 29 Other People Accused of Running $24,560,000 Fraud Scheme in Taiwan: Report appeared first on The Daily Hodl.

Published in B&T Latest News

28 April, 2024 by The bizandtech.net Newswire Staff

Ethereum (ETH) Battles Momentum Woes, Shiba Inu (SHIB) Gears Up for May 2nd Hard Fork, While Furrever Token (FURR) Sees Hype Surge in Presale

The post Ethereum (ETH) Battles Momentum Woes, Shiba Inu (SHIB) Gears Up for May 2nd Hard Fork, While Furrever Token (FURR) Sees Hype Surge in Presale appeared first on Coinpedia Fintech News

Amidst the turbulent waters of the crypto markets, Ethereum (ETH), Shiba Inu (SHIB), and Furrever Token (FURR) each navigate their own challenges and opportunities. Ethereum (ETH) grapples with momentum woes, while Shiba Inu (SHIB) prepares for a pivotal hard fork on May 2nd. However, amidst this volatility, Furrever Token (FURR) presents a compelling proposition to investors, boasting the potential for highly lucrative 15X returns. As these digital assets traverse the rough seas of the cryptocurrency world, investors remain intrigued by the unfolding stories and possibilities within this dynamic landscape.

Ethereum (ETH) Faces Regulatory Challenges Amidst Price Consolidation

Ether finds itself confined between $3,209 and $3,056, with dwindling hopes for a Spot Ether ETF approval casting shadows on risk appetite leading up to May 23rd. Moreover, the expanded regulatory war waged by the SEC within the Ethereum ecosystem validates investors’ hesitations. An optimistic scenario for ETH targets $3,436 upon closures above the 20-day Exponential Moving Average (EMA), with subsequent aims at $3,679 and beyond $4,000. For bears, closures below $3,056 could trigger declines towards $2,852 and $2,700, with the anticipated rejection decision in May likely favoring bearish pressure. The ongoing battle between the SEC and the Ethereum community doesn’t appear to be resolving swiftly.

The regulatory agency’s investigation into ties between the Ethereum Foundation and crypto companies leaves intentions ambiguous. Days where Ethereum, via the Foundation, faces allegations of centralization and consequent securities labeling might not be far off. Amidst these challenges, Ethereum trades at approximately $3,147.84, marking a 1.5% increase since yesterday, adding complexity to its already intricate narrative.

Shiba Inu (SHIB) Readies for Shibarium Upgrade Amidst Price Fluctuations

Shiba Inu (SHIB) faces a 3.15% decline, trading at approximately $0.00002437, as investors await the Shibarium upgrade slated for May 2nd. The official announcement underscores the significance of the update in streamlining user interaction with the Ethereum-based layer-2 scaling platform. Promising faster block processing and predictable transaction fees, the update aims to address concerns regarding Shibarium’s unstable performance since launch.

While the community welcomes the upgrade, dissatisfaction lingers over the manual burn mechanism for SHIB. Despite a 2.5% increase in the past 24 hours to $0.0000255, some investors believe an automated burning mechanism could positively impact SHIB’s price by reducing its supply. Amidst these sentiments, investors explore new meme coins, reflecting the ongoing evolution within the crypto landscape.

Investors Turn to Furrever Token (FURR) Amidst Disappointing Performances of ETH and SHIB

As Ethereum (ETH) and Shiba Inu (SHIB) struggle with price fluctuations and regulatory challenges, investors are increasingly turning their attention to Furrever Token (FURR) for potentially better returns and a more engaging experience. FURR, with its unique approach centered around cute cat imagery and a vibrant community, presents a refreshing alternative amidst the unsatisfactory performances of ETH and SHIB.

Furrever Token (FURR) offers investors a whimsical and enjoyable experience unlike traditional cryptocurrency projects. With its mission to infuse the crypto space with an irresistible dose of cuteness, FURR provides users with a unique platform where they can engage with adorable cat-themed stickers, emojis, and visuals. This light-hearted approach resonates with investors seeking a break from the serious tone of ETH and SHIB, leading to a surge in interest in FURR.

Moreover, Furrever Token (FURR) boasts a strong community-driven ethos, with active admins and moderators on its official Telegram channel, ensuring a positive and supportive environment for all members. The project has raised over $1 million in just two months, demonstrating significant investor confidence and interest in its vision. The presale stages of FURR offer investors the opportunity to participate in the project’s growth, with up to 15X returns promised after its launch.

With its official website furrevertoken.com and dedicated support email, support@furrevertoken.com, Furrever Token (FURR) provides investors with easy access to information and assistance. The current price of FURR is $0.000648, with expectations for it to rise further as investors seek refuge from the underwhelming performances of ETH and SHIB. As ETH and SHIB investors flock towards FURR, the project continues to gain momentum, positioning itself as a promising contender in the competitive crypto landscape.

Discover the Most Exclusive Presale Opportunity of 2024 Now:

Furrever Token Official Website

Visit Furrever Token Presale

Join Official Telegram Group

Follow Official X Account

Bitcoin ETF Net Flows. Source:

Bitcoin ETF Net Flows. Source:

Source:

Source:  Source:

Source: