Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Trailers of the week: Minecraft, Elio, and Alien: Earth

A still from the latest A Minecraft Movie trailer. | Screenshot: YouTube

This week, I went to a theater to watch a showing of the black-and-white version of Johnny Mnemonic, starring Keanu Reeves. Old-heads like me may recall it as a bad mid-90s cyberpunk film (written by William Gibson!) about a data courier whose brain is the storage medium, but who had to have his childhood memories erased to make space for the work.

I hadn’t seen it since I was a kid, and you know what? It’s still not a good movie. But if you ignore the plot holes, mostly awful acting, and terrible pacing, it’s at least very cool to look at. Also, I had totally forgotten about Ice T’s turn as J-Bone, leader of the Lo-Tek underground. It was fun enough, but it was weird to hear the theater audience erupt with applause at the end, though,…

Continue reading…

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Celero Commerce Bolsters Retail Presence With Precision Payments Purchase

Tennessee-based financial services firm Celero Commerce has acquired electronic payments technology provider Precision Payments.

With the deal, announced in a news release earlier this month, Celero’s annual card processing volume in North America is expected to surpass $28 billion.

Based in Sarasota, Florida, and founded in 2009, Precision provides electronic payment solutions for small and medium-sized businesses (SMBs). According to the release, the company bolsters Celero’s presence in the “multilane retail industry” and widens its network of sales professionals serving local communities in North America.

“Throughout our 15-year journey, we have remained focused on helping local businesses thrive,” said Joel King, founder of Precision. “Joining Celero provides our clients with access to an expanded range of innovative products and services that will improve our ability to support their growth.”

PYMNTS explored the challenges facing SMBs earlier this month in a panel discussion with a pair of payments experts, Sarah Acton, chief customer officer at BILL, and Becky Munson, CPA, CITP, partner and CAS practice leader at EisnerAmper.

The question posed to them: How can digital innovations help these small businesses unlock their own unique advantages, while also streamlining financial operations and fortifying their resilience?

Their answer? “Automation, automation, automation.”

SMBs have for years depended on manual, paper-based processes, a habit that Acton and Munson argued is becoming unsustainable.

“Automation is here to stay,” Acton said, adding that “for more and more businesses who are not adopting technology … my worry is they get left behind.”

Munson stressed that automation has gone from being a luxury for larger companies to a necessity for SMBs.

“Our clients are looking for efficiency and productivity, but they’re also battling ‘app fatigue.’ … They’re paying for more than they can manage, and they need solutions that deliver real impact,” she said.

Automating financial workflows, such as payables, receivables and expense management, can provide better control over cash flow — the “lifeblood” of SMB’s operations.

Both Acton and Munson agreed that digital transformation is critical to SMBs’ ability to adapt and thrive in the modern marketplace.

“The pace of change can feel like a runaway train,” Munson said, pointing out that SMBs, focused on key business tasks, struggle to stay on top of new tech.

Acton echoed this sentiment, saying automation provides a lifeline for SMBs to get back control and shift time toward growth initiatives.

Celero’s acquisition of Precision Payments follows last year’s purchase of Finical, a Dallas-based provider of electronic payments technology.

As PYMNTS wrote, that acquisition was designed to enhance Celero’s capabilities and let it process approximately $25 billion in annual card volume.

The post Celero Commerce Bolsters Retail Presence With Precision Payments Purchase appeared first on PYMNTS.com.

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

NYT Strands today — hints, spangram and answers for game #267 (Sunday, November 25 2024)

We help you find today’s Strands answers with some useful hints and tips to win.

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Shared Fraud Intelligence Boosts Protection: LexisNexis Risk Solutions

According to the latest Global State of Fraud and Identity Report from LexisNexis Risk Solutions, banks and online retailers can significantly improve their ability to capture hard-to-detect high-risk fraudulent transactions by combining shared fraud intelligence into their risk assessments. Examples include a US bank that… Read More

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

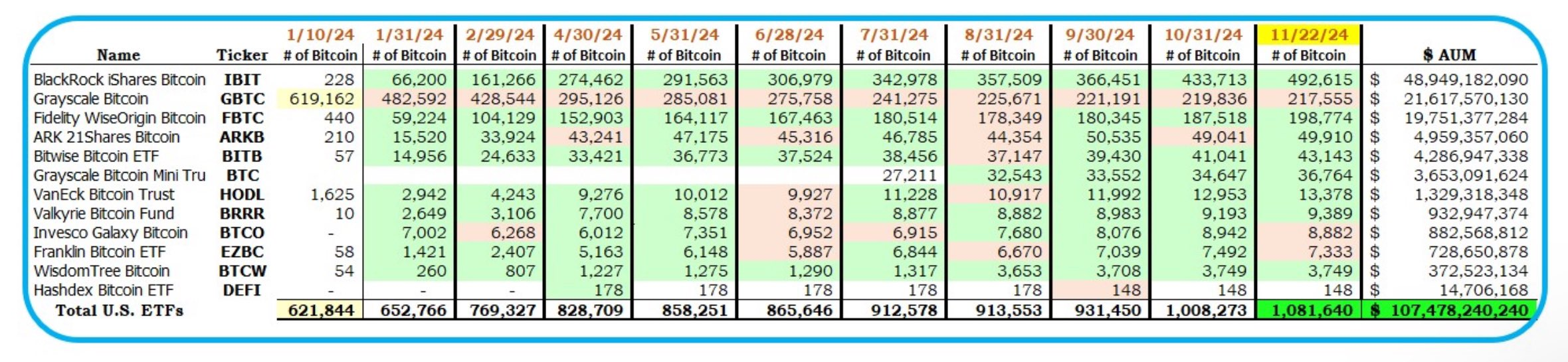

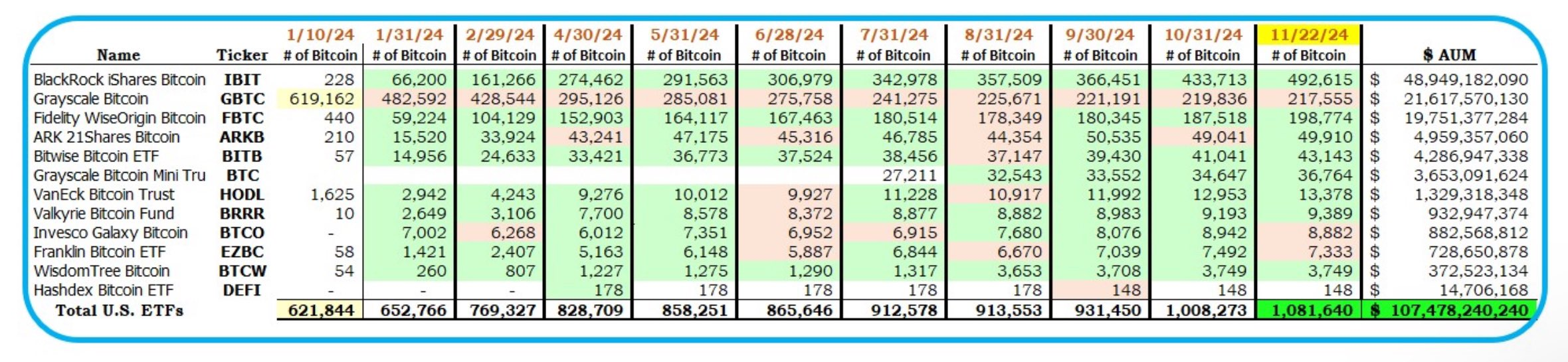

Spot Bitcoin ETFs on Track to Overtake Satoshi’s BTC Holdings by Year-End

Spot Bitcoin exchange-traded funds (ETFs) in the US are nearing a major milestone. They are set to become the biggest BTC holders in the world, even surpassing the amount held by Bitcoin’s creator, Satoshi Nakamoto.

Additionally, they are catching up to gold ETFs in total net assets.

Bitcoin ETFs on The Verge of Surpassing Satoshi Nakamoto’s BTC Stash

Since their launch in January, US spot Bitcoin ETFs have grown significantly. According to crypto analyst HODL15Capital, these funds now hold about 1.081 million Bitcoin, just below Nakamoto’s estimated 1.1 million.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is believed to own approximately 5.68% of the total Bitcoin supply. These holdings, valued at over $100 billion, place Nakamoto among the world’s wealthiest individuals — if they are alive and a single person.

However, Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that ETFs are now 98% of the way to overtaking Nakamoto. He predicted that if the current pace of inflows continues, this could happen by Thanksgiving.

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good. If next 3 days are like the past 3 days flow-wise it’s a done deal,” Balchunas stated.

Bitcoin ETFs Data. Source: X/HODL15Capital

Bitcoin ETFs Data. Source: X/HODL15Capital

SoSoValue data shows inflows into these ETFs grew by around 97% week-on-week to $3.3 billion over the last five trading days, with BlackRock’s iShares Bitcoin Trust (IBIT) contributing $2 billion. This surge coincides with the introduction of options trading for these products, which many believe is attracting more institutional investors.

Meanwhile, Bitcoin ETFs are also narrowing the gap with gold ETFs, which currently hold $120 billion in assets under management (AUM). According to Balchunas, Bitcoin ETFs manage $107 billion and could overtake gold ETFs by Christmas.

These bullish predictions reflect Bitcoin’s exceptional performance in 2024. The top cryptocurrency has surged nearly 160% since January, trading near the $100,000 landmark. In addition, its $1.91 trillion market capitalization now exceeds that of silver and major corporations like the state-owned oil company Saudi Aramco.

However, BTC still lags behind gold, which remains the world’s largest asset with a market capitalization of more than $18 billion.

The post Spot Bitcoin ETFs on Track to Overtake Satoshi’s BTC Holdings by Year-End appeared first on BeInCrypto.

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Social Media Startup Bluesky Sees 300% Post-Election User Jump

Elon Musk’s social media loss has — so far — not been Mark Zuckerberg’s gain.

Following the election of Donald Trump earlier this month, users began fleeing X, the social media platform owned by the Trump-supporting Musk.

But as the Financial Times (FT) reported Saturday (Nov. 23), the biggest beneficiary of that exodus isn’t the Meta-owned Threads — conceived as an alternative to Twitter before its name change to X — but rather the upstart social platform Bluesky.

Since election day, usage of Bluesky’s app in the U.S. and Great Britain jumped by nearly 300% to 3.5 million daily users, the FT said, citing data from Similarweb. This influx was driven by academics, journalists and left-leaning politicians leaving X.

Before the election, Threads had five times the number of daily U.S. users as Bluesky, but that number has since shrunk, with Threads now just 1.5 times larger than Bluesky.

As the FT notes, Bluesky’s growth comes after Meta CEO Zuckerberg chose to scale back the prominence of political content across its apps, which also include Facebook and Instagram.

It was a move widely viewed as an attempt to stay out of politics and avoid being involved in free speech debates. And while Trump had once labeled Meta “an enemy of the people” and threatened Zuckerberg with imprisonment, he has since said he liked Zuckerberg “much better now” because he was “staying out of the election.”

Bluesky was initially funded by Twitter founder Jack Dorsey. The platform had been invite-only until earlier this year, and jumped in popularity when that requirement was dropped.

While Bluesky had been in development long before Musk began his bid to purchase the platform once known as Twitter, the site happened to launch as the billionaire rolled out a series of unpopular changes on X.

When Bluesky began accepting members, it began to be viewed as a Twitter alternative, like Threads and Mastodon before it. But in the case of Bluesky, users aren’t subject to the whims of an algorithm, as PYMNTS wrote in a 2023 report on the advent of text-based social media platforms.

Meanwhile, this month saw a report from The Information that Meta was planning to add advertising to Threads, an initiative being led by the company’s Instagram team, with a small number of companies set to begin advertising in January.

Reached for comment by PYMNTS, a spokesperson for Meta said: “Since our priority is to build consumer value first and foremost, there are no ads or monetization features currently on Threads.”

The post Social Media Startup Bluesky Sees 300% Post-Election User Jump appeared first on PYMNTS.com.

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Dyson Black Friday sales just dropped — 7 deals I’d get now starting from $249

Save hundreds on Dyson’s top-rated vacuums in these seven killer Black Friday deals.

Published in B&T Latest News

24 November, 2024 by The bizandtech.net Newswire Staff

Trump Considering ‘Pretty Significant’ Changes to CFPB

President-elect Donald Trump and congressional Republicans are reportedly considering sweeping changes to the Consumer Financial Protection Bureau (CFPB).

The GOP hopes to curtail the powers and funding of the CFPB, the Washington Post reported Sunday (Nov. 25), putting them in the same camp with banks, credit card and mortgage lenders and other big financial companies.

These financial institutions, the report noted, have been battling the CFPB under Democratic control, particularly regulations against things like “junk fees.”

Rohit Chopra, the Democrat who heads the bureau, has aggressively pursued efforts to help consumers switch banks and avoid overdraft fees. Republicans have opposed these works, accusing the CFPB of regulatory overreach.

Now, with their party in control of the White House, Senate and House, there are signs of the Republican plan to impose new limits — some of them permanent — on the CFPB’s power.

“There will be a pretty significant change from the direction the agency has been going in, and I think in a positive way,” said Kathy Kraninger, who oversaw the CFPB during Trump’s first term, and now serves as CEO of lobbying group the Florida Bankers Association.

Sources told the Post that aides on Trump’s transition team have begun considering candidates to lead the CFPB and would scale back its oversight. Republican lawmakers, meanwhile, have proposed changing the bureau’s leadership structure and funding source.

Democrats, meanwhile, argue that abolishing the CFPB altogether would draw criticism from the public at large, pointing to the bureau’s popular work in stamping out scams and saving consumers money.

“The CFPB is here to stay,” said Sen. Elizabeth Warren, D-Mass, who led the agency during the Obama administration. “So I get there’s big talk, but the laws supporting the CFPB are strong, and support across this nation from Democrats, Republicans and people who don’t pay any attention at all to politics, is also strong.”

As PYMNTS wrote earlier this month on the morning after Trump was elected, the Supreme Court has ruled that the CFPB’s funding mechanism is constitutional, “in effect short-circuiting some conservative lawmakers’ efforts to raise existential questions about the bureau and pave the path toward its shuttering.”

That report also noted that one of the biggest unanswered questions related to the CFPB and the new administration is the fate of the open banking rule, which was finalized and subsequently challenged in court by the Bank Policy Institute and the Kentucky Bankers Association in October.

The CFPB argued that the rule promotes competition among banks by providing consumers with control over their data and making that data portable so that people can more easily switch financial service providers if they wish.

“Banks have pushed back, charging that data-sharing has poorly defined parameters of liability and the compliance timelines are onerous,” PYMNTS wrote. “They also allege that the CFPB has overstepped its legal authority.”

The post Trump Considering ‘Pretty Significant’ Changes to CFPB appeared first on PYMNTS.com.

Bitcoin ETFs Data. Source: X/

Bitcoin ETFs Data. Source: X/