Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

BlackRock’s Bitcoin ETF (IBIT) Continues To Hit Zero Inflow! Here’s What It Means For BTC Price

The post BlackRock’s Bitcoin ETF (IBIT) Continues To Hit Zero Inflow! Here’s What It Means For BTC Price appeared first on Coinpedia Fintech News

After a 71-day streak of continuous inflows, BlackRock’s Bitcoin ETF, IBIT, has experienced a sudden stop with no new inflows. This sudden halt has raised concerns among investors, especially as Bitcoin consolidates around the $64,000 level. Many analysts view this as a bearish indicator for Bitcoin’s price, suggesting that the cessation of inflows from a leading Bitcoin ETF issuer could plunge buying demand. This decline in demand may make it challenging for Bitcoin to hold its recovery rally following the recent halving event.

Blackrock ETF Sees No Buying Demand

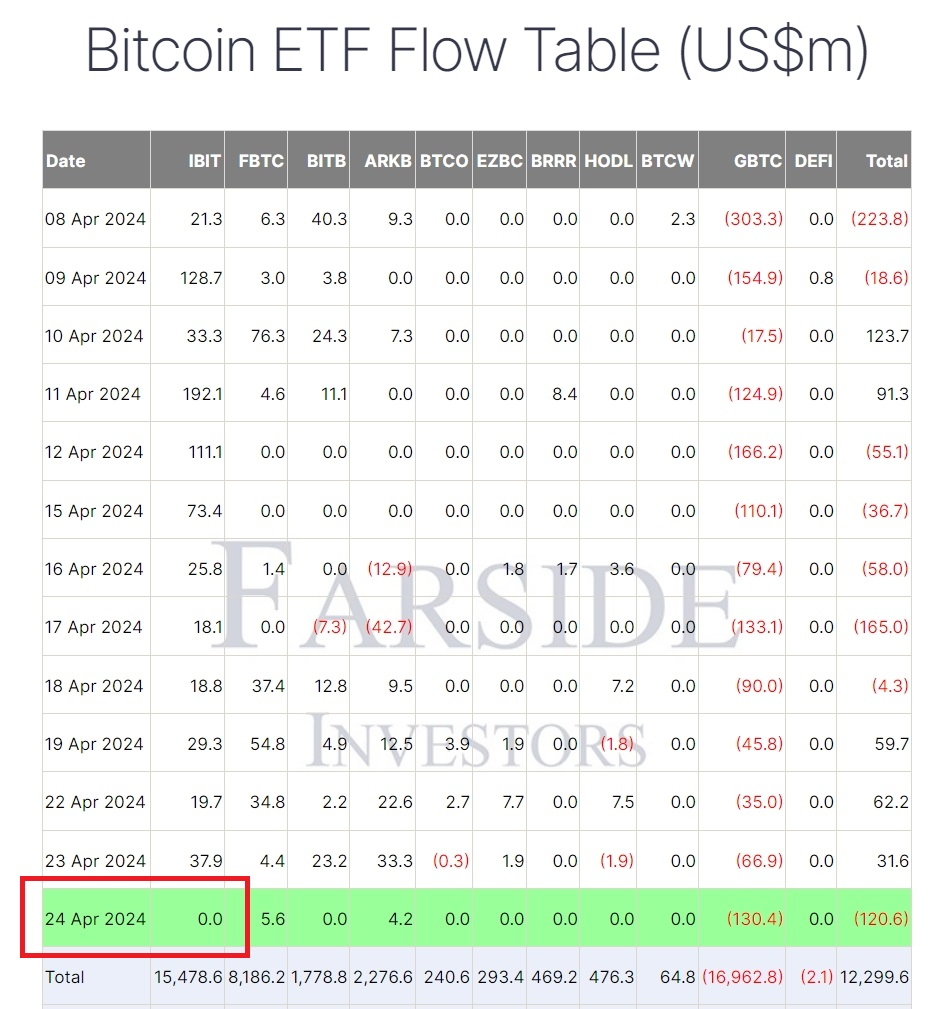

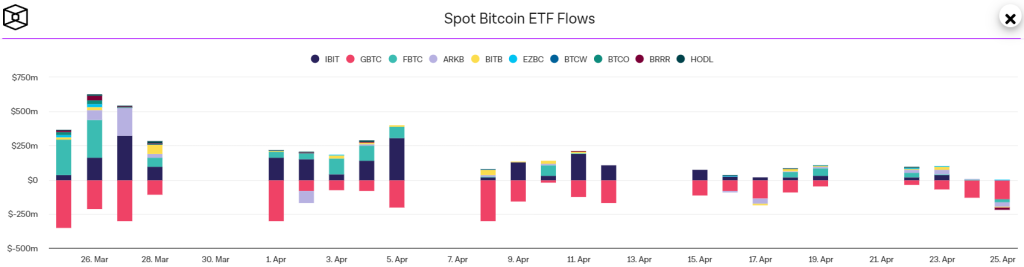

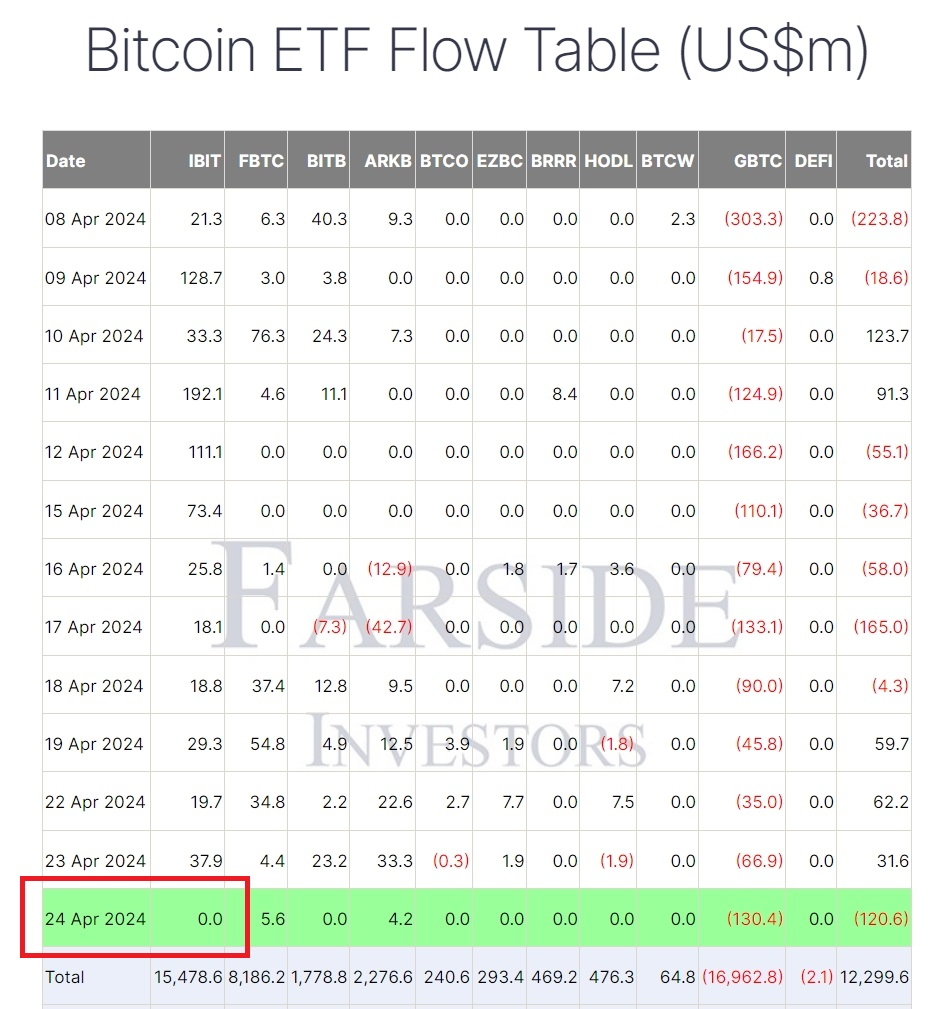

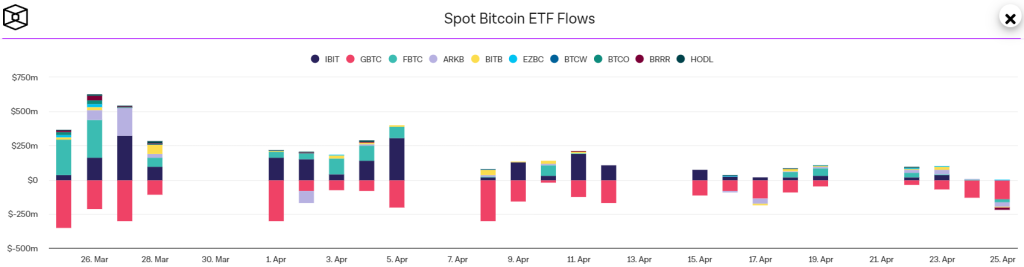

BlackRock’s spot Bitcoin ETF had maintained a remarkable streak of net inflows since its launch on January 11th. However, according to data from Farside Investors, this streak of 71 consecutive trading days with net inflows has now come to an end.

On Wednesday, the iShares Bitcoin Trust (IBIT) recorded zero net flows, breaking a record for a newly launched ETF. While IBIT’s performance was historic for a newly established fund, Bloomberg Intelligence analyst Eric Balchunas noted that other ETFs had longer streaks after establishing themselves over months and years in the market.

IBIT’s streak of inflows reached 71 days on Tuesday, making it the 10th longest streak of all time, as reported in an X post by Balchunas. However, according to data from Farside Investors, net inflows into IBIT came to a halt on Wednesday. On 25 April, IBIT again witnessed zero inflow volume, according to data from The Block.

On the same day, only the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Ark 21Shares Bitcoin ETF (ARKB) experienced minor inflows, whereas the Grayscale Bitcoin Trust ETF (GBTC) recorded net outflows amounting to $130 million.

The conclusion of IBIT’s streak follows two consecutive weeks of net outflows for the 11-fund segment. However, its recent zero inflow volume might not have a big impact on Bitcoin as the sentiment is supported by several other bullish metrics including the recent halving.

Inflow Volume Might Rebound In The Coming Weeks

The flow of funds into US spot Bitcoin ETFs has experienced a significant decline in the second quarter. During the first quarter, the peak inflows were observed in February, totaling $6 billion, followed by March with $4.6 billion. January saw $1.5 billion as the market acquainted itself with the new products.

However, ETF inflows for April in Q2 only amounted to $170 million. This raises the question: is the demand for BTC ETFs declining?

Bitwise CIO Matt Hougan disagrees. In a weekly memo addressed to investment professionals, Hougan asserted that the potential for additional inflows remains high in the coming months.

Yesterday marked the first time since its inception that FBTC experienced outflows, amounting to $22.6 million. Concurrently, other funds such as Ark Invest’s ARKB, Bitwise’s BITB, and Valkyrie’s BRRR also saw outflows of $31.3 million, $6 million, and $20.2 million, respectively.

Furthermore, Grayscale’s GBTC, which has been on a 73-day streak of outflows since its conversion from a Bitcoin Trust, witnessed withdrawals totaling $139.4 million. The sole ETF to see inflows was managed by asset manager Franklin Templeton, receiving investments of $1.9 million.

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

Post-Halving Outlook: Ripple & Cosmos Investors See DeeStream (DST) as a Path to 70X Gains in Streaming Innovation

The post Post-Halving Outlook: Ripple & Cosmos Investors See DeeStream (DST) as a Path to 70X Gains in Streaming Innovation appeared first on Coinpedia Fintech News

Bitcoin (BTC) halving has historically ushered in new all-time highs for the leading asset, triggering altcoins to register new peaks. While large-cap cryptocurrencies have been considered safe investments, investors know that big gains come from buying presale or low-cap projects early.

With the impact of the recent halving event yet to take place, investors are interested in new cryptocurrencies to invest in. The Ripple (XRP) and Cosmos (ATOM) communities have banded together to invest in DeeStream (DST), a pioneering decentralized streaming platform. This article looks at why DeeStream (DST) is a good cryptocurrency to buy for Ripple (XRP) and Cosmos (ATOM) investors.

Ripple (XRP) CTO: XRP Grew 1,500% in 7 Years

David Schwartz, Chief Technology Officer of Ripple (XRP), recently corrected a holder that the cross-border payment asset, stating that it has gained 1,500% over the past years. Ripple (XRP) has been around for some time and even partially a court case against the U.S. SEC in 2023. Over the past year, Ripple (XRP) has gained 18%, helping it maintain its place in the top 10 list of the largest cryptocurrencies by market cap.

However, some analysts are worried that Ripple (XRP) may fail to register a new peak in this bull run. Ripple (XRP) is trading at $0.5368 at press time, down 86% from its all-time high. Ripple (XRP) could see further price growth if it wins its case against the SEC.

Cosmos (ATOM) is On the Recovery Path After Gaining 4% in a Week

Cosmos (ATOM), a project claiming to solve the ‘hardest problems’ facing the blockchain industry, has offered reprieve to its investors after showing signs of recovery. At press time, Cosmos (ATOM) carries a price of $8.93, a 4% increase over the past week. This comes after Cosmos (ATOM) fell 24% in the past month, alongside the rest of the market.

Cosmos (ATOM) is committed to tackling blockchain scalability head-on, underscoring its dedication to fostering a more interconnected and efficient decentralized ecosystem. Investors hope Cosmos (ATOM) could break the $14 level in Q2. This is because Cosmos (ATOM) peaked at $14.2 in Q1, and a move above this price could trigger a sustainable uptrend.

DeeStream (DST) Lures Investors with Prospects of 70X Gains

DeeStream (DST) is drawing investors like a magnet because of its potential for 70X gains before the blow-off top of this cycle. This is mainly because DeeStream (DST) has a compelling value proposition as it builds a decentralized streaming platform. The DeeStream (DST) platform comes at a time when content creators and users feel that streaming needs to be decentralized.

On the DeeStream (DST) platform, users can enjoy freedom of speech, lower fees, and instant payouts. Content creators will easily monetize their content, making it their go-to platform for sharing content.

Investors have joined the DeeStream (DST) presale to buy DST tokens for only $0.06, paving the way for a minimum of 70X gains.

Find out more about the DeeStream (DST) presale by visiting the website here.

Published in B&T Latest News · Business Features

26 April, 2024 by The bizandtech.net Newswire Staff

Enticing Profit Potential on Milei Moneda Presale Has Forced the Hands of XRP and Ethena Investors

The post Enticing Profit Potential on Milei Moneda Presale Has Forced the Hands of XRP and Ethena Investors appeared first on Coinpedia Fintech News

TLDR

- XRP’s altcoin price has been facing setbacks due to the SEC vs Ripple standoff.

- Ethena’s USDe yield farming gains are pretty unrealistic; traders are wary of investing in ENA’s stablecoin protocol.

- Milei Moneda’s ($MEDA) presale edges closer to launch day; more investors welcome $MEDA investments.

Legal battles are not the best experiences for any token looking to join the top altcoins in the crypto-verse; you can ask BNB. Now Ripple (XRP) is trading sideways partly because of its elongated drama with the SEC, and investors are starting to jump ship to Milei Moneda ($MEDA). On the other hand, Ethena’s (ENA) yield APY makes investors wary of investing.

At any rate, $MEDA tokens are one of the best cryptos to invest in this month. Here’s more on the presale.

Economize Like Milei: Invest in $MEDA!

XRP Faces Resistance Amid Ripple’s Legal Battles

Ripple has been fighting the Securities and Exchange Commission (SEC) for over two years regarding unregistered XRP offerings. Last year, a New York judge ruled in favor of Ripple, partially resolving the issue. While the price surge helped XRP rise to the top of the DeFi crypto list, the legal tension only got worse.

Now, the SEC is demanding a $2 billion fine from Ripple, with the hearing slated for April 22, 2024. The next few days are crucial for Ripple’s DeFi coin price, and although XRP is getting significant interest, all that could change depends on the Supreme Court ruling.

Ripple has shown remarkable resilience, although traffic on the XRP ecosystem has dipped in favor of other top DeFi coins. Despite the increased open interest in Ripple and XRP’s coin value, many investors are taking their holdings elsewhere for the bull run this year.

ENA Could Be Going down the Same Path as Terra

Ethena enjoyed a stellar entry into the crypto-verse, employing airdrops and effective publicity to drive ENA’s value to over 100% just days after the launch. The last week was topsy-turvy for the ENA token; however, ENA shed some 33% of its altcoin price before recovering 10%, just as the market closed on Friday.

The price movements might not be enough to take Ethena off the list of the top 10 altcoins to buy, but the declining investor confidence might hurt ENA’s progress. Ethena is offering its users a 37% APY on their USDe investments in the protocol.

Investors have been wary of high profits since Terra, the last platform to do that, crashed quite suddenly soon after starting the yield farming policy. Ethena has its work cut out convincing its traders, and ENA’s ranking among the best DeFi coins depends heavily on it.

Milei Moneda Sees More DeFi Enthusiasts Join the $MEDA Presale

$MEDA is up for grabs, as the presale offers users a chance to join one of the most promising new ICOs ever to launch. Milei Moneda’s profits are apparently irresistible as more users hop on the presale train.

On profits, we have those attached to the presale–we’ll get to that in a bit–and the big ones. The big ones are long-term, requiring you to HODL your $MEDA tokens after they go live. Where will the profits come from, you ask?

Milei Moneda is one step ahead of you there! $MEDA intends to host the best DeFi projects, offering crypto traders real value instead of hot air and memes. And those DeFi projects will be born in the Milei Moneda community, where innovation and dedication are the only watchwords.

So, when the user traffic starts streaming in, your long-term $MEDA investments will return significant profits. The presale is still live and in Stage 2, and here’s your best chance for a bullish 2024.

You can get your Milei Moneda tokens for $0.0125 and lock in 60% ROI for May 21 when it launches on Uniswap at the launch price of $0.020.

Got $MEDA curiosity? Visit or chat on Telegram for the inside scoop. Fast, fun, and informative!

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

Bitcoin core developer says Runes ‘exploit design flaws’

Bitcoin core developer Luke Dashjr has criticized the Runes protocol, suggesting it exploits a fundamental design flaw within the blockchain network.

In an April 26 post on X (formerly Twitter), Dashjr delineated the disparity between Ordinal Inscriptions and the Runes protocol in how they interact with the network. He clarified that while Ordinals capitalize on vulnerabilities within the blockchain, the Runes protocol operates within the framework of the network’s design flaws.

He explained further:

“Ordinals are a 9-vector attack that exploit vulnerabilities in Bitcoin Core, Runes are “only” a 5-vector attack that actually technically follow the “rules”.

Ordinals are a novel form of digital assets, akin to NFTs, etched onto satoshis, which are the smallest units of Bitcoin. Their emergence last year marked Bitcoin’s foray into NFTs, sparking notable interest within the crypto community.

On the other hand, Runes are fungible tokens introduced on the day Bitcoin completed its fourth halving. Post-launch, these tokens significantly congested the network, leading to a surge in transaction fees.

Notably, Dashjr has long been critical of both asset types, asserting that they deviate from BTC’s core principles and contribute to blockchain spam. Last year, he labeled Ordinals as a bug and spearheaded initiatives to address them through bug fixes.

Filtering Runes transaction

In light of his opposition, Dashjr proposed methods for filtering Runes transactions.

He said:

“To filter Runes spam using either Bitcoin Knots or Bitcoin Core, the only approach right now is to set datacarriersize=0 in your bitcoin.conf file (or the equivalent GUI option in Knots only).”

However, early indications show that miners are not following his advice. Ocean Mining, a decentralized mining pool where Dashjr serves as the CTO, recently mined its first post-halving block, with over 75% of its transactions coming from the Runes protocol.

In their defense, several miners cited the lucrative revenue stream from Runes transactions as their reason for processing them.

The post Bitcoin core developer says Runes ‘exploit design flaws’ appeared first on CryptoSlate.

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

How This Crypto Trader Turned Meme Coin Trading Into a $22 Million Success Story

In the crypto ecosystem, a few astute traders stand out by skillfully navigating the meme coin market. One such crypto trader, known by the Solana Name Service username “paulo.sol,” has recently amassed over $22.8 million in profits.

His strategic acumen in trading Solana-based meme coins, such as Dogwifhat (WIF), Jeo Boden (BODEN), and Bonk (BONK), has captivated the crypto community.

How Crypto Trader Navigated the Solana Meme Coin Market

Paulo.sol’s remarkable journey began with his timely investments in these meme coins. According to the on-chain analytical platform Lookonchain, his strategy focused on timing the market’s significant movements rather than entering the coins’ initial offerings.

His approach paid off handsomely, starting with Bonk (BONK), which he began purchasing on November 11, 2023. By buying low and selling high, he earned approximately $6.28 million.

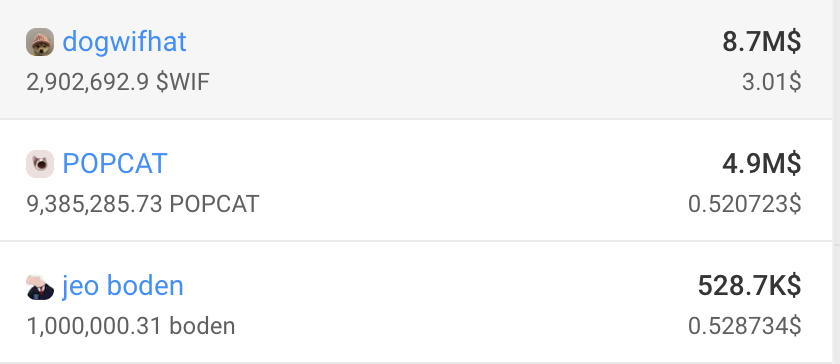

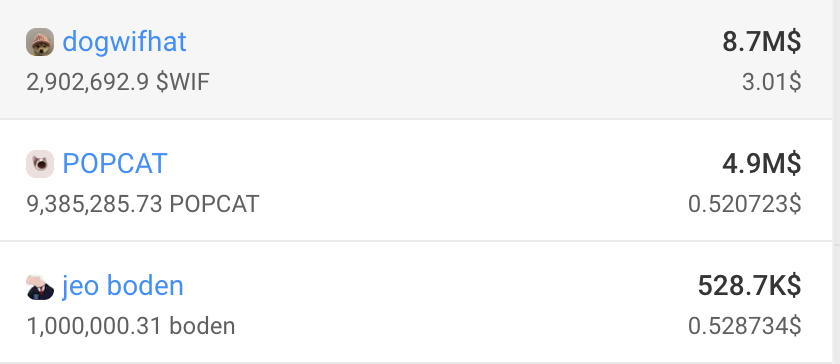

Subsequently, paulo.sol achieved similar success with WIF and BODEN, securing profits of $9.51 million and $7.04 million, respectively. Currently, he holds 1 million BODEN valued at $528,700 and 2.9 million WIF worth $8.7 million.

Moreover, his recent acquisition of Popcat marks another significant investment. He now holds 9.3 million Popcat tokens, valued at $4.9 million, making it his second-largest holding.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

Top 3 Largest Holdings of paulo.sol. Source: Solscan

Top 3 Largest Holdings of paulo.sol. Source: Solscan

Crypto community lauds paulo.sol for his bold and effective trading maneuvers.

“Don’t call him lucky, he has more conviction than others,” crypto analyst Zia ul Haque said.

Nevertheless, paulo.sol’s story is part of a larger narrative that includes both successes and cautionary tales within the meme coin trading sphere. For instance, another trader made headlines in January by capitalizing on the initial excitement around WEN tokens. This trader turned a $125,500 investment into a $1.60 million profit through WEN tokens within just 14 hours.

Additionally, in December 2023, another trader earned $1.5 million in five days by trading WIF.

These stories of profitable trades contrast starkly with numerous accounts of significant losses, underscoring the high-risk nature of meme coin trading. While the successes are alluring, they are accompanied by many tales of financial distress, highlighting meme coins’ speculative and unpredictable nature.

Read more: 11 Best Solana Meme Coins to Watch in 2024

Traders should exercise proper risk management and invest only what they can afford to lose. The rapid rises, and sudden falls characteristic of meme coin markets demand a disciplined approach. It is crucial to prioritize financial safety over the temptation of quick profits.

The post How This Crypto Trader Turned Meme Coin Trading Into a $22 Million Success Story appeared first on BeInCrypto.

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

Massive Best Buy weekend sale is live — here’s 17 deals I’d get on OLED TVs, headphones, laptops and more

Best Buy’s new 3-day sale is here. Check out the 17 deals I’d buy and get them before they’re gone.

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

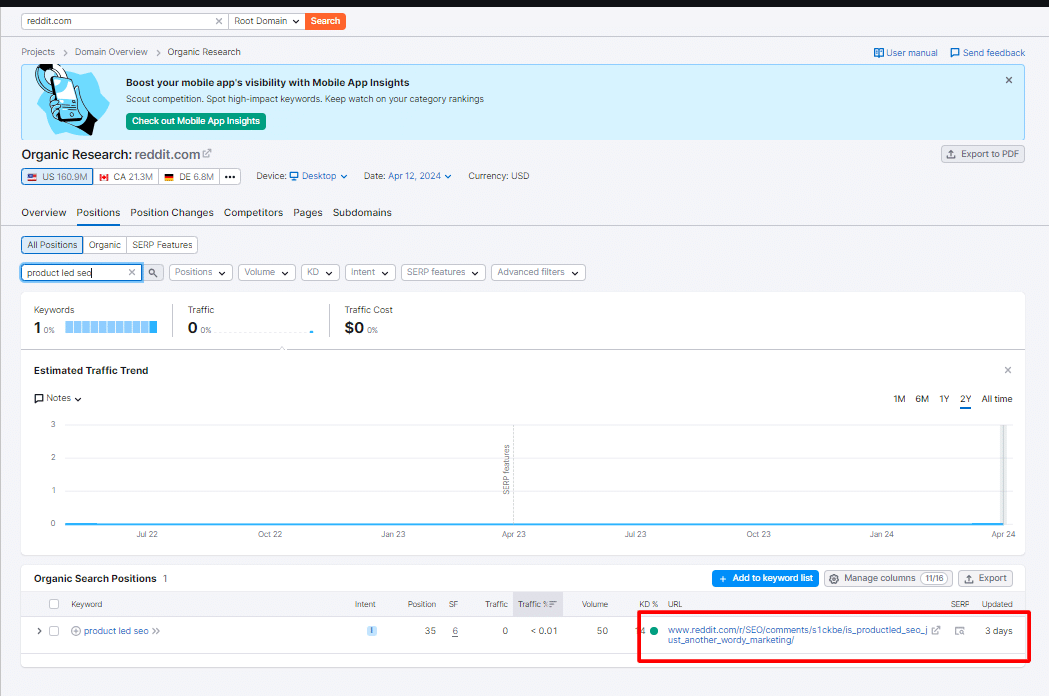

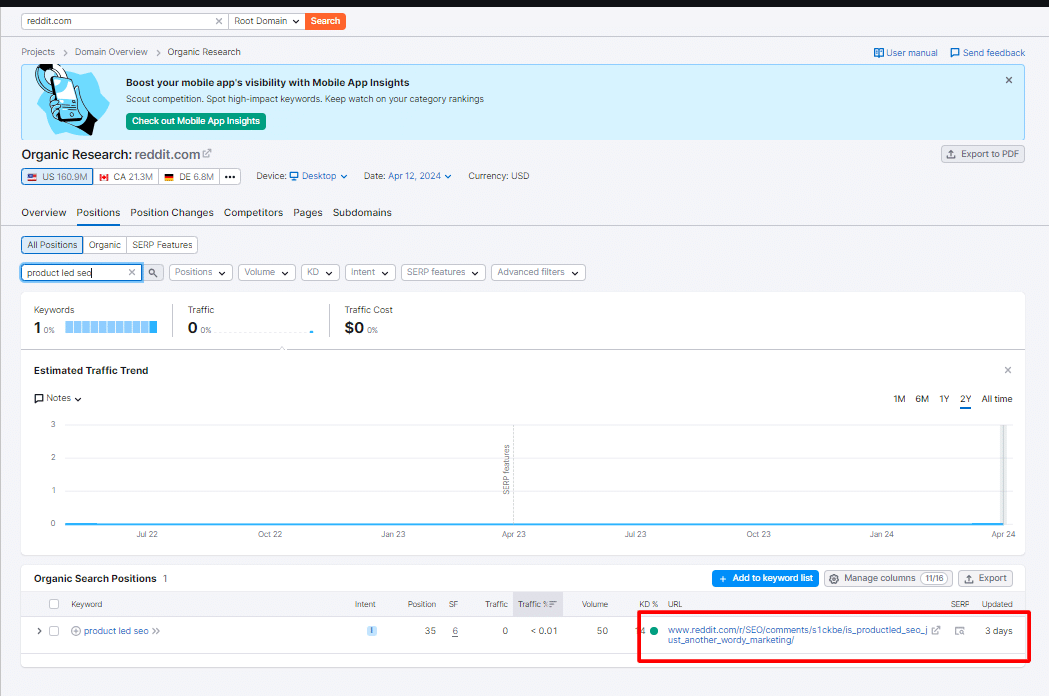

How to launch a product-led SEO strategy

Today’s SEO landscape is fraught with uncertainty, marked by:

Keeping your website strategy tied to traditional notions like keyword research based on search volume is a recipe for a slow but certain death.

But what are your options?

One possible escape route is product-led SEO, which focuses your strategy on your customers’ needs, pains and desires.

This article will help you transition from a keyword-focused to a customer-centric SEO strategy, offering practical tips for integrating both approaches effectively.

5 steps to kickstart your product-led SEO strategy

1. Identify your customer

One fundamental mistake many SEO experts make is focusing on the website and forgetting about the customers.

Remember, keywords don’t make purchases; people do (or at least for now). This is why focusing solely on keyword research or technical audit won’t do the job. You need to know who is your ideal customer persona.

There are many ways to do this. The easiest one is to talk to your colleagues from the marketing department and see if they have this already.

If you know a colleague from another department who would likely use your product, spend a day shadowing them or conducting an in-depth interview. Discover where they go online for information and learning, what factors they consider when making decisions and their biggest daily challenges.

You can also visit the GA4 Demographics report for information about age, country and interests. Take the last with a grain of salt as your website might have attracted the wrong users.

Lastly, create a profile of your ideal customer. You can easily start with HubSpot’s Make My Persona tool.

Dig deeper: Do personas REALLY matter in content marketing?

2. Dive into your data

SEO often overlooks the valuable data gathered by customer-facing departments like sales and support.

Platforms such as Salesforce and Microsoft Dynamics offer rich insights into customer needs and behaviors, making them essential tools for SEO. Access to these platforms and their reports can significantly enhance SEO strategies.

The challenge with these tools is that navigation through the data directly in them could be a real pain. So, the easiest way to start is to create a report with the important information within the tool and then export it in CSV format.

Many organizations face restrictions on exporting CRM data due to privacy concerns. Always verify that your reports exclude personal identification information, such as emails, phone numbers, names and company details. Your goal is the information put in by your sales team, like a summary of the conversation or a description of the lead’s situation.

After exporting, you have a few options depending on the size:

- Read it manually.

- Cluster it with the help of a Python script.

- Or ask ChatGPT to do the heavy lifting.

As you look for repeating patterns in how your customers speak, you can also use simple tools like TagCrowd and then search for the words that are repeated the most in your initial report.

The end result of this exercise should be a document with three columns:

- Users’ pain point/challenge.

- Customers’ voice or how your customers have described this challenge.

- Information on how many times each challenge was mentioned.

Or if we need to translate these three into a more SEO-friendly language:

- Topics.

- Keywords related to the topics.

- Search volume.

Unfortunately, the data in your CRM platforms can often be insufficient.

In these cases, you need to expand your research beyond your company. One way to do this is through review platforms.

Dig deeper: An SEO guide to audience research and content analysis

Get the daily newsletter search marketers rely on.

Business email address

Subscribe

Processing…

See terms.

3. Read customer reviews

If someone spent 30 minutes of their lives writing a review of your product, they either love it or hate it a lot. In either case, these users have given you valuable information.

While you can’t do much for those who hate some of the features and functionalities, you can analyze the rest for reasons to believe in your product and the pains you have resolved in their lives.

Most platforms provide ways to export your reviews in CSV format. The analysis process afterward could be similar to the one for the data in your CRM. You can even ask ChatGPT to make a SWOT analysis for your product and identify your strengths and weaknesses.

Review platforms offer more than just access to customer feedback. They provide valuable insights and real-life examples for content creation. Additionally, they grant access to competitor reviews, enhancing competitive analysis.

Collecting initial data for your competitors might require more in-depth knowledge of Python, an extra budget for a third-party tool, a browser extension or a lot of manual work. Regardless of the method, the outcome will provide valuable insights into how customers perceive your competitors.

Extract the use cases and real-life situations from these reviews, and if your product covers them, make sure that you show them in your content. Remember to uphold ethical standards and avoid making claims without verifiable evidence.

4. Expand your knowledge with forums

SEO professionals recently expressed frustration about Google’s preference for websites such as Reddit and Quora. These platforms thrive on content generated by real users, making them valuable for Google’s algorithms. Utilize this content to benefit your SEO strategy.

One way to start analyzing them is to use traditional keyword research tools like Semrush, Ahrefs, etc. You just need to check the domain and all the keywords it ranks for, then look for keywords related to your content.

With this approach, you will end up with a list of pages ranking for relevant keywords. Some might be concrete conversations, others communities. You can then easily expand them manually.

Once you are ready with your list, you need to extract the information. You can do this with:

- A web scraping browser extension (there are many different options).

- A website crawler with the capability to extract information (like Screaming Frog).

- Or a tool like Sheetsmagic which directly puts your information in Google Sheets.

The analysis can be done again with the help of AI or Python, or you can go through it manually. This time, you will receive one extra level of information – potential titles for your future content.

Merge insights from customer conversations, your own data and reviews to discover alignments with your ideal customer persona. This integration forms the backbone of your tailored SEO strategy, and the result will be your product-led content calendar and SEO plan.

Dig deeper: Advanced tactics to maximize the SEO value of user-generated content

5. Create content that answers your customer’s questions

To make this content work, you must answer your customers’ questions and give them solutions to their challenges while showing how your product/service fits into the picture.

Your blog should not become a duplicated version of your documentation; rather, it should present the features and capabilities of your product in a more storytelling manner.

Turn the customer examples you collected into compelling stories. Ideally, include quotes from real customers. If quotes are unavailable, use supporting statistics. Companies like PWC, EY, Deloitte, Accenture and McKinsey publish tons of research that you can use for inspiration.

Dig deeper: What is helpful content, according to Google

Aligning SEO with your product’s value proposition

Starting your product-led SEO journey is not difficult, and it could be eye-opening to learn why customers choose your product.

Your strategy shouldn’t be static. Once you establish the basics, it should evolve with your audience’s changing needs.

Only by always learning and changing can you ensure that you build lasting engagement and drive growth. Your customers are leading the way, but you must be dedicated to following them.

Published in B&T Latest News

26 April, 2024 by The bizandtech.net Newswire Staff

New Google Pixel 8a leaked renders leave absolutely nothing to the imagination

The Google Pixel 8 should launch very soon, and these leaked renders show the phone from all angles.

Top 3 Largest Holdings of paulo.sol. Source:

Top 3 Largest Holdings of paulo.sol. Source: