Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

XRP Price Prediction for November 27

The post XRP Price Prediction for November 27 appeared first on Coinpedia Fintech News

XRP, the native token of Ripple, appears to be moving sideways after experiencing a notable rally in the past weeks. As of today, November 27, 2024, XRP, along with the overall cryptocurrency market, has been experiencing a price decline.

Some refer to this as a price correction, while others believe the decline is driven by escalating geopolitical tensions between Ukraine and Russia.

Despite notable price drops in the majority of cryptocurrencies, XRP appears to remain stable, holding above the crucial support level of $1.35. This stability is supported by recent political developments, speculation surrounding Gary Gensler’s (SEC) upcoming resignation, and ETF-related speculation.

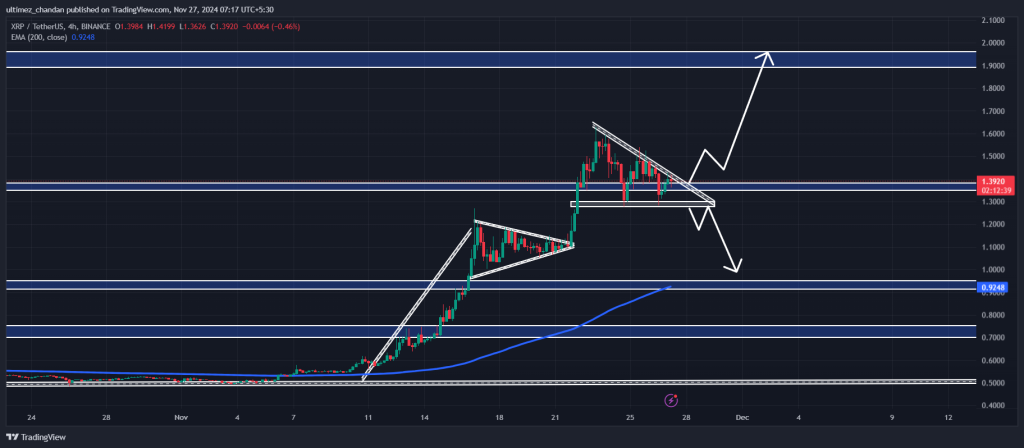

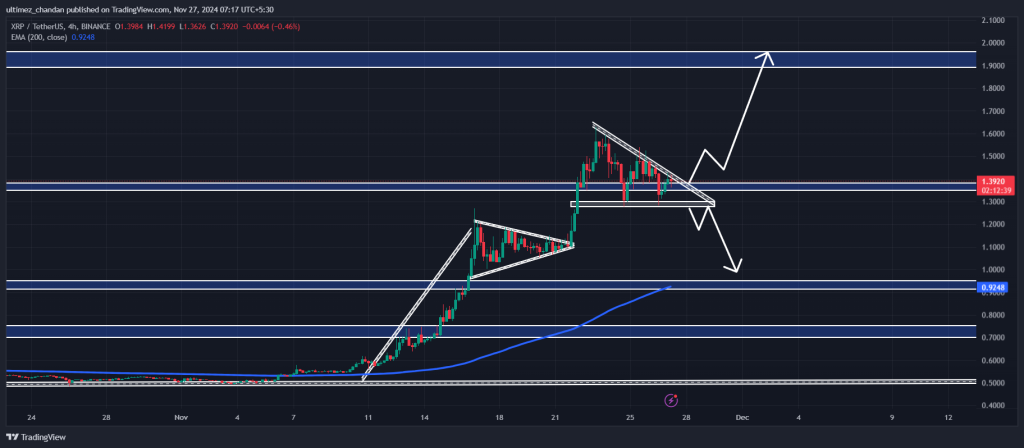

XRP Technical Analysis

According to expert technical analysis, XRP appears to be forming a descending triangle pattern on the four-hour time frame, finding support at the $1.30 level. However, on the daily time frame, the token seems to be consolidating within a tight range. This price correction mirrored past consolidations, during which the altcoin formed a symmetrical triangle pattern and thereafter experienced a 50% upside rally.

Source: Trading View

Source: Trading View

This time, however, traders and investors anticipate a similar upside rally from the altcoin if it successfully breaks out of this pattern.

XRP Price Prediction

Based on recent price action, if XRP breaches the descending trendline of the descending triangle, there is a strong possibility of a 42% upside rally in the coming days. Conversely, if XRP fails to hold the support level of $1.30 and breaches it, a 25% price drop could occur in the days ahead.

On the positive side, the asset still maintains its position above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. Meanwhile, its Relative Strength Index (RSI) suggests there is room for further upside potential in the coming days, as the value is below 70 and currently stands at 50.25.

Current Price Momentum

At press time, XRP is trading near $1.34 and has experienced a price decline of 4.5% in the past 24 hours. During the same period, its trading volume has dropped by 18%, indicating reduced participation from traders and investors amid a shift in market sentiment.

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

Inside the Stream: CTV Ad PREVIEW: 2024 Reveals Key Market Drivers

Earlier this week VideoNuze held its Connected TV Advertising PREVIEW: 2024 virtual, featuring 19 industry executives speaking on 5 different sessions. In today’s podcast Colin and I discuss some of the key market drivers and themes we consistently heard.

There are many reasons to be optimistic about CTV’s future growth, but also some challenges the industry faces. Across the sessions a theme we heard was that despite CTV’s rapid growth, it’s still relatively early in its evolution, with a lot of room for making CTV ads far more valuable than traditional TV’s 30-second format.

(Note all of the session videos will be posted to VideoNuze early next week for on-demand viewing)

Listen to the podcast to learn more (27 minutes, 11 seconds)

Browse all previous podcasts

Subscribe to Inside the Stream

Apple Podcasts Google Podcasts Spotify Amazon Music RSS

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

Nordstrom’s Digital Sales and Enhanced Customer Experience Drive Growth in Q3

While digital sales continued to perform well at Nordstrom, enhancements to the overall customer experience paid off as well, according to CEO Erik Nordstrom.

“In the third quarter, our efforts to enhance the customer experience continued to resonate, enabling growth in net and comparable sales, margin expansion, and an increase in our customer base,” Nordstrom said during the company’s third-quarter earnings call Tuesday (Nov. 26).

“Both Nordstrom and Nordstrom Rack delivered 4% comparable sales growth. We’re particularly encouraged that our online business sustained its momentum, with digital sales growth of over 6%. Customers responded to newness in our selection of the brands that matter most to them, driving positive total company net sales growth for the fourth consecutive quarter.”

The third quarter showed improved spend across all income cohorts, Nordstrom said, adding “customer health metrics look good. Customer trips and average order per trip improved across both banners.”

CFO Cathy Smith praised the customer metrics for the third quarter.

“Our efforts to improve the customer experience are taking hold, as evidenced by the strength of our top line,” she explained. “In the third quarter, we again grew our customer count, reported an increase in customer trips, and expanded our margins.”

Digital sales grew 6.4% in the third quarter, representing the sixth consecutive quarter of sequential improvement, and 34% of total sales during the quarter. Nordstrom’s net sales increased 4.6%, to $3.34 billion, while total company comparable sales rose 4%.

The growth of Nordstrom’s digital business is a testament to the retailer’s focus on enhancing its customer experience. Nordstrom has also made key investments in its digital platforms, such as enhancing its website and app to improve the customer experience. Erik Nordstrom emphasized the importance of aligning business strategies with customer preferences.

“As an omnichannel retailer, we have to be prepared to serve customers when, where, and how they want to shop, and service is always our No. 1 priority,” he said. “Our customers define what good service is. … For our customers that prefer to shop online, we aim to make the experience seamless and engaging through technology.”

Operational optimization is another priority for Nordstrom as it seeks to maintain its momentum. Improvements in the supply chain have not only helped reduce operating expenses but have also increased the speed of order fulfillment.

“Faster fulfillment and delivery of items drove an over 40% improvement in the speed of customer returns in the third quarter,” Nordstrom said. “Returns that come in faster mean that we can process, inspect, and get the items back into our inventory in a sellable condition in less time, increasing the product’s overall full price exposure.

“Throughout the year, the supply chain team’s efforts have also supported our new Rack store openings successfully. More recently, they have positioned us well heading into holiday in terms of inventory flow, staffing and shipping capacity.”

Despite some challenges, including a slight slowdown in sales at the end of October, Nordstrom officials remain optimistic about the upcoming holiday season. Smith noted that while the external environment remains uncertain, the company’s ability to execute its strategies across both banners and provide great customer service puts it in a strong position to succeed.

The post Nordstrom’s Digital Sales and Enhanced Customer Experience Drive Growth in Q3 appeared first on PYMNTS.com.

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

CryptoQuant CEO Says Ethereum Rival Has Achieved Strong Market-Product Fit Hosting $60,000,000,000 in USDT

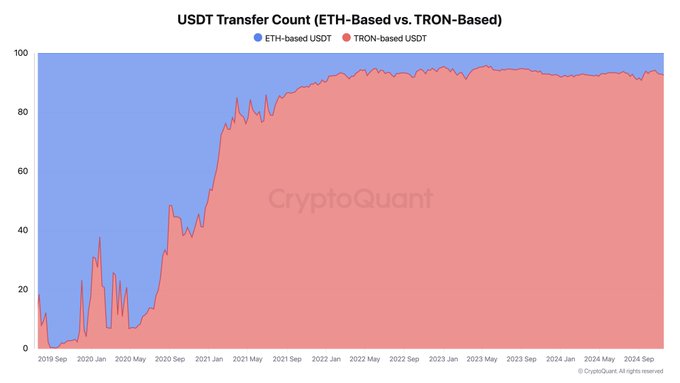

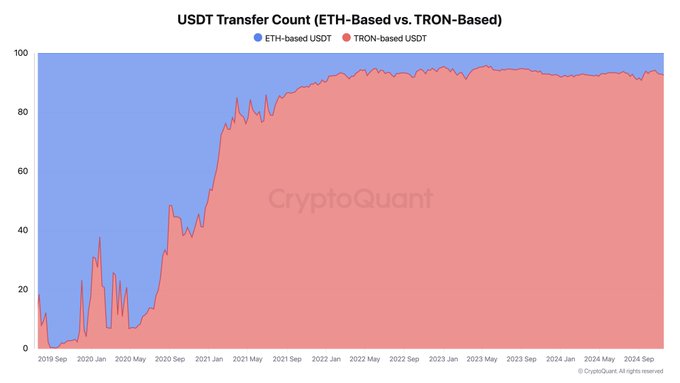

An Ethereum (ETH) competitor has captured a massive share of USDT stablecoin transactions, according to the chief executive of the analytics firm CryptoQuant.

Ki Young Ju says on the social media platform X that the value of the USDT hosted on Tron (TRX) is now more than three times the layer-1 blockchain’s market cap.

“TRX has achieved strong product-market fit in stablecoin use cases.

TRON blockchain processes 92% of USDT transactions and hosts $60 billion in USDT, yet TRX market cap is only $17 billion.

TRX-based USDT is widely used in global trade by offering low-cost, fast stablecoin remittances.”

Source: Ki Young Ju/X

Source: Ki Young Ju/X

Justin Sun founded the Tron network in September 2017, and the project’s mainnet launched in May 2018.

Ki Young Ju says Sun has built “the biggest global stablecoin trade remittance system.”

“I’m not being paid to say this, nor do I own TRX, but I think that he has made a significant impact in the field of stablecoins and done something right.”

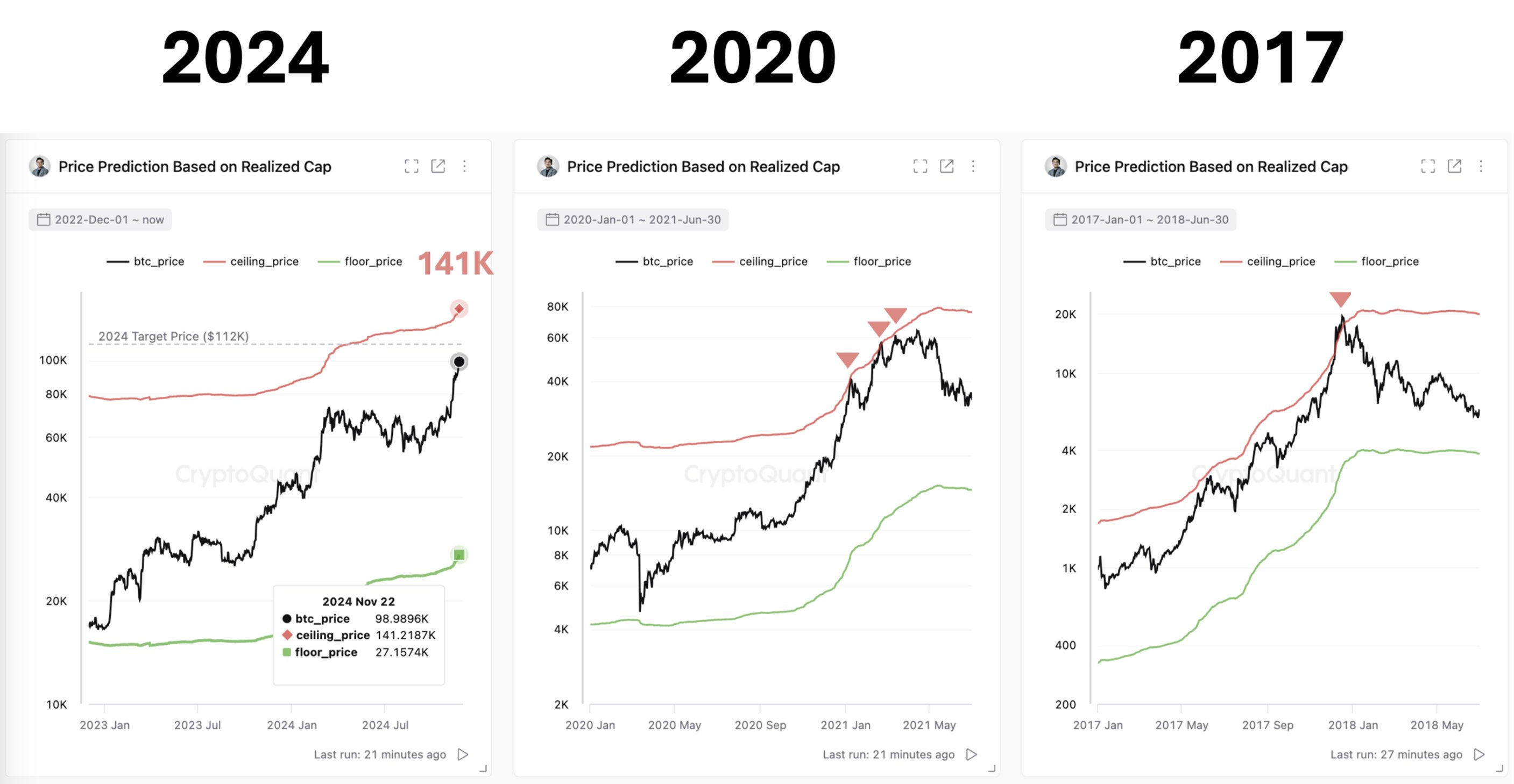

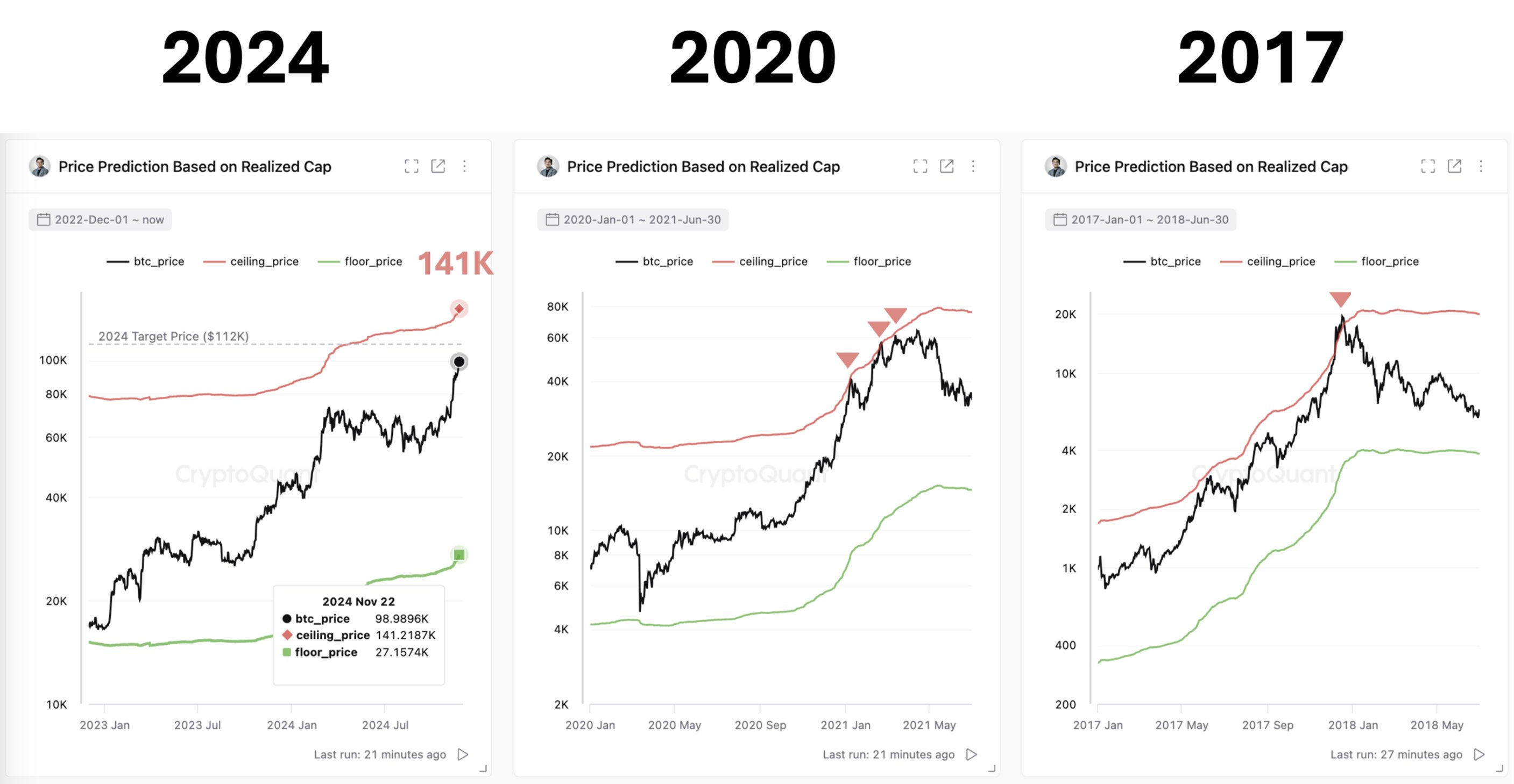

Turning to Bitcoin (BTC), the CryptoQuant CEO says it is “too early” to characterize the flagship digital asset as being in bubble territory.

Ki Young Ju says that the market capitalization of Bitcoin has not risen significantly compared to its realized capitalization. Bitcoin’s realized capitalization is determined by calculating the total value of all existing BTC at the price of the last recorded on-chain movement.

“Historically, the market cap tends to exceed the realized cap in bull markets, reaching its peak as retail investors jump in. In bear markets, the market cap often dips below the realized cap.”

Source: Ki Young Ju/X

Source: Ki Young Ju/X

On Bitcoin’s likely price trajectory, the CryptoQuant CEO says,

“Based on the current realized cap, it could rise to $141,000. The realized cap has been steadily increasing every day.”

Bitcoin is trading at $98,223 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post CryptoQuant CEO Says Ethereum Rival Has Achieved Strong Market-Product Fit Hosting $60,000,000,000 in USDT appeared first on The Daily Hodl.

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

Porsche is holding on to gas cars for a bit longer

Photo by Sean O’Kane / The Verge

Porsche is not ready to turn in its gas caps for charging ports just yet. The company reportedly plans to launch more internal combustion engine models due to a slowdown in EV sales, according to Automotive News Europe. The automaker’s CFO, Lutz Meschke, told the outlet, “What is clear is that we are sticking with the combustion engine for much longer.”

As Car and Driver notes, he also said there’s a “clear trend in the premium luxury segment” that is leaning towards gas engines, and as a result, Porsche will “react” in its product cycle.

Porsche sells two pricey electric vehicles: the Taycan and the recently launched Macan. It planned to bring more EV-only models, including a Cayenne 718 and a new high-performance SUV. But now Meschke…

Continue reading…

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

AWS and Philips Collaborate to Migrate Health Systems to Cloud

Health technology company Royal Philips and Amazon Web Services (AWS) have expanded their strategic collaboration to offer Philips’ integrated diagnostics portfolio in the cloud.

Having already transitioned 150 sites across North America and Latin America to Philips HealthSuite Imaging on AWS, Philips and AWS will now collaborate to accelerate that migration of health systems to the cloud and to expand the migration to Europe, the companies said in a Tuesday (Nov. 26) press release.

The Philips integrated diagnostics portfolio includes radiology, digital pathology, cardiology and artificial intelligence (AI) visualization solutions, according to the release.

“We’re working closely with clinicians to ensure workflows become more efficient and give back valuable time to healthcare providers,” Royal Philips CEO Roy Jakobs said in the release. “Collaborating with AWS helps us to innovate faster and deliver better care for more people.”

Philips’ cloud-based solutions offer a unified view of patient data that comes from different diagnostic sources and provide remote access to diagnostic, reporting and workflow orchestration tools, according to the release.

The company is also exploring ways to use generative AI to automate routine tasks and optimize workflows by, for example, allowing clinicians to use conversational language to create and revise reports that support diagnosis and quality of care, per the release.

“The collaboration between Philips and AWS gives healthcare providers scalable, secure-by-design cloud-enabled solutions to accelerate healthcare innovations,” AWS CEO Matt Garman said in the release.

“Combining Philips’ healthcare informatics portfolio with AWS generative AI capabilities gives clinicians access to imaging insights so they can deliver more effective and efficient care to patients anywhere, anytime, with best-in-class security and privacy.”

In another, separate collaboration, AWS and GE HealthCare teamed up to help clinicians improve diagnoses using AI. GE HealthCare will use AWS as its cloud provider, with plans to use the company’s healthcare and generative AI services to increase diagnostic and screening accuracy, improve outcomes, and provide greater access and equitable care.

In July 2023, AWS debuted a tool called AWS HealthScribe, saying the tool uses speech recognition and generative AI to generate clinical documentation. The tool helps clinicians save time summarizing patient visits by automatically creating transcripts, extracting details such as medical terms and medications, and creating summaries from doctor-patient discussions.

The post AWS and Philips Collaborate to Migrate Health Systems to Cloud appeared first on PYMNTS.com.

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

Trump’s AI Czar and the Wild West of AI regulation: Strategies for enterprises to navigate the chaos

For enterprise executive decision-makers, the uncertain environment around AI regulation poses both significant risks and hidden opportunities, join us on Dec. 5 in Washington D.C. for a discussion delving into this.Read More

For enterprise executive decision-makers, the uncertain environment around AI regulation poses both significant risks and hidden opportunities, join us on Dec. 5 in Washington D.C. for a discussion delving into this.Read More

Published in B&T Latest News

26 November, 2024 by The bizandtech.net Newswire Staff

Bitcoin could fall to $88,000 before making another attempt to break $100,000 – Glassnode

Bitcoin (BTC) can visit the zone below $88,000 before resuming its push towards the $100,000 threshold if further downside is registered, according to a Glassnode report.

The report highlighted a critical “air gap,” as BTC’s rapid rally has left minimal trading activity between $76,000 and $88,000, creating an underdeveloped price range that could draw market focus if the current pullback persists.

However, this price action is natural in price discovery phases, which often involve cycles of rallies, corrections, and consolidations to establish stable price ranges. Observing supply distribution during price discovery phases is fundamental to revealing supply and demand zones that could affect Bitcoin’s trajectory.

As Bitcoin navigates price discovery territory, the report emphasized the role of LTHs in returning previously dormant supply to liquid circulation. While the $100,000 milestone remains within reach, the market may require a re-accumulation phase to digest profit-taking pressures and sustain upward momentum fully.

Parallels with March

The current rally mirrors patterns seen during the March rally when significant supply re-accumulation at lower levels supported Bitcoin’s ascent to a new high.

A key driver of Bitcoin’s price action has been the behavior of Long-Term Holders (LTHs), who have realized record profits amid increased liquidity. Since September, this cohort has distributed approximately 507,000 BTC, with profit-taking rates surpassing those observed during March.

Glassnode’s LTH Liveliness metric indicates heightened spending activity, signaling that most distributed coins were acquired relatively recently rather than being held for years.

LTHs are currently realizing $2.02 billion in daily profits, a new record, and robust demand must occur to absorb the supply redistribution.

Moreover, the report warns of the necessity of further consolidation to maintain equilibrium in the market.

Sell-side forces

The Sell-Side Risk Ratio, which measures realized profit and loss volumes against the market’s size, is nearing high-value territory, indicating intensified profit-taking.

However, the report noted that the current ratio is still below peaks in prior bull markets, suggesting that demand remains resilient enough to absorb the selling pressure.

Analyzing the composition of the supply sold, the document revealed that coins aged 6 months to 1 year dominate current sell-side pressure, accounting for 35.3% of total realized profit.

These coins, likely accumulated after exchange-traded fund (ETF) launches, suggest investors use a “swing-trade” strategy to capitalize on recent market momentum.

Additionally, profit-taking is uniform across various return brackets, with realized gains ranging from $7.2 billion to $13.1 billion across different percentage groups. This consistency highlights a strategic “chips-off-the-table” approach, where investors with lower cost bases secure profits while maintaining long-term exposure.

The post Bitcoin could fall to $88,000 before making another attempt to break $100,000 – Glassnode appeared first on CryptoSlate.

Source:

Source:  Source: Ki Young Ju/X

Source: Ki Young Ju/X

For enterprise executive decision-makers, the uncertain environment around AI regulation poses both significant risks and hidden opportunities, join us on Dec. 5 in Washington D.C. for a discussion delving into this.

For enterprise executive decision-makers, the uncertain environment around AI regulation poses both significant risks and hidden opportunities, join us on Dec. 5 in Washington D.C. for a discussion delving into this.