Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Binance Listing Sends SLERF and SCRT Prices To New Height

The post Binance Listing Sends SLERF and SCRT Prices To New Height appeared first on Coinpedia Fintech News

Binance’s recent listing of SLERF and Secret (SCRT) tokens on Binance Futures has created a buzz in the crypto market. The tokens began trading with 75x leverage starting November 21, igniting a surge in their prices. SCRT saw a 30% price increase, hitting $0.41 before settling at $0.34, signaling renewed investor confidence. The altcoin is now eyeing the $0.37 resistance level for further gains, though any drop below $0.30 could hinder its bullish momentum. Meanwhile, SLERF skyrocketed by 47%, reaching $0.429, as investor interest peaked.

Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Bitcoin’s Soaring Price Triggers Over $482 Million in Crypto Liquidations

The post Bitcoin’s Soaring Price Triggers Over $482 Million in Crypto Liquidations appeared first on Coinpedia Fintech News

Bitcoin’s ongoing surge toward the $100,000 mark has caused a wave of liquidations across the crypto market. In just 24 hours, more than $482 million worth of positions were liquidated, leaving many traders feeling the heat. Meanwhile, around 166,000 traders were caught up in this massive sell-off, with Bitcoin’s recent gains fueling the chaos.

Bitcoin Takes the Lead in Liquidations

Bitcoin is leading the charge in the current rally, pushing its price to a new all-time high of nearly $98,363. As Bitcoin continues to climb, traders who bet against it (short traders) are seeing significant losses.

In the last 24 hours alone, short traders lost over $99 million, while long traders, who are betting on the price to go higher, lost around $27 million. This notes that the volatility traders are facing as they try to predict Bitcoin’s next move.

According to data from CoinGlass, the entire crypto market, liquidations have reached a total of $482 million, with $273 million coming from long positions and $212 million from shorts.

Ethereum Follows Bitcoin’s Lead

Ethereum, the second-largest cryptocurrency, is also feeling the pressure. While Ethereum hasn’t seen as severe liquidations as Bitcoin, it’s still been impacted. In the past 24 hours, Ethereum saw $70 million worth of liquidations.

The price of Ethereum is currently around $3,240, up a small amount from the previous day, but it’s still far from its all-time high of nearly $4,900. Despite Bitcoin’s impressive performance, Ethereum is down about 33% from its peak.

What’s Next for the Market?

With Bitcoin’s price continuing to rise, many traders are wondering if more liquidations are on the way. Companies like MicroStrategy have been buying up Bitcoin at a rapid pace, and that seems to be pushing the price even higher. This means more traders might be forced out of their positions if Bitcoin keeps climbing.

As Bitcoin moves toward the $100,000 mark, it’s clear that the crypto market is far from stable. Traders are betting big, but when things go wrong, the losses can be massive.

Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Microstrategy Not Overvalued, Instead Has A Lot Of Runway, Says Charles Edwards

The post Microstrategy Not Overvalued, Instead Has A Lot Of Runway, Says Charles Edwards appeared first on Coinpedia Fintech News

In the latest development, MicroStrategy, which is the largest publicly traded corporate holder of Bitcoin, has witnessed its stock surge by a massive 94% year-to-date (YTD), driven by Bitcoin’s rally above $97,000. Strikingly, with 331,200 Bitcoin on its balance sheet, valued at around $32 billion, MicroStrategy now has an impressive $15.51 billion in unrealized gains.

Notably, the rise in MicroStrategy’s stock reflects the increasing integration of cryptocurrencies into traditional finance and growing investor demand for Bitcoin-backed equities. MSTR’s year-to-date performance has outperformed major tech stocks, including Apple by 21%, Amazon by 24% and Tesla by 6%.

However, despite its strong performance, MicroStrategy’s reliance on Bitcoin exposes it to market volatility. A substantial drop in Bitcoin’s price could quickly bring down the company’s valuation and stock price.

Is Microstrategy Overvalued?

While many in the market are of the opinion that MicroStrategy is overvalued, Charles Edwards, the founder of Capriole Investments has a different opinion.

In a latest X post, he explained how it is not overvalued. He noted that at $106B market cap and a 70% premium to MSTR’s Bitcoin NAV, it could not be undervalued. He underscored that with the current bull run going strong, if this Bitcoin cycle is anything like the last (and even if its worse) and if Saylor keeps buying, then MSTR has a lot of ‘runway’.

The Key Requirement

However, he noted the key requirement for it to happen is that Saylor needs to buy Bitcoin more aggressively the wider their NAV premium is. The firm recently announced its $42 billion acquisition plan, also known as the 21/21 plan. However, Charles notes that the plan will not work anymore as the market has already priced it in. Therefore, he noted that we should be looking for upwards of $50 billion over the next year.

While that may seem like a lot, Charles pointed out that Saylor has already raised $9.6B in the last 9 days alone. Bitcoin will soon be over $2 trillion, and there’s a massive audience of bond traders that can’t access Bitcoin due to their investment mandate, Charles remarked.

Saylor Needs To Raise More Capital

Notably, the US bond market is $50T, which is more than 25 times the size of Bitcoin. He highlighted that currently, MSTR is one of the only vehicles that gives bond traders exposure to Bitcoin. With MSTR issues being constantly oversubscribed, there is a massive of demand here for the best-performing bonds in the world.

“So yes, as this Bitcoin bull cycle unfolds, it’s easy to imagine a measily $50B being allocated to capture some of that upside via MSTR. Not to mention the capital-raising potential from equity issues as well,” Charles explained.

He believes that Saylor needs to keep busy over the next year to actively close the premium by raising more capital, but provided he does, there’s potential for MSTR equity yet. Either way, he noted that there is a massive Bitcoin buyer in the market that is about to go into overdrive.

Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Rising $0.08 Crypto Targets $25, Ripple Bull Worries It Will Overtake XRP in Market Ranking

The post Rising $0.08 Crypto Targets $25, Ripple Bull Worries It Will Overtake XRP in Market Ranking appeared first on Coinpedia Fintech News

Especially after its recent jump beyond the $1 mark, XRP has been among the most discussed cryptocurrencies available. With a significant market capitalization of $60.54 billion, XRP ranks sixth in market performance as of writing according to CoinMarketCap. But a growing rival costing just $0.08 questions its supremacy, aiming at an ambitious $25. Rexas Finance (RXS), this new coin, is attracting interest and raising questions as a Ripple Bull worries it will overtake XRP in market ranking.

Ripple’s Recent Momentum and Challenges

Positive developments in XRP’s long-standing legal fight with the SEC and growing acceptance of cross-border payments have propelled its latest upswing. Its capacity to outperform the $1 mark is evidence of investor faith in its technological and application value.

Ripple’s leadership in the market comes under further examination as competing altcoins become more well-known. This is particularly true in light of growing tokens like Rexas Finance (RXS), which presents a new angle in the crypto scene by combining creative real-world asset (RWA) tokenizing with a user-friendly ecosystem.

The Rise of Rexas Finance (RXS)

With its emphasis on transforming actual asset tokenization, Rexas Finance (RXS) has become a major participant in the crypto space. Rexas Finance creates new opportunities for investors by letting users easily tokenize and exchange tangible assets including real estate, art, and goods. Its easy-to-use interface makes the usually difficult RWA tokenizing process simpler, therefore enabling both people and companies.

The Presale success of Rexas Finance is one of the main elements driving its momentum. As of writing, RXS is in stage 6 and costs $0.08; hence, she has already raised more than $9.25 million. This performance draws attention to the increasing curiosity with investors considering the token as a game-changing endeavor. Moreover, the choice to turn away venture capital money despite several offers emphasizes the team’s dedication to guarantee that the public comes first in this transformation.

In the crypto space, trust is absolutely important, hence Rexas Finance has reinforced its position by doing a Certik audit. This certification guarantees the dependability and security of the smart contract and code for the project, therefore strengthening investor confidence. Further helping to drive the price momentum of RXS is its placement on CoinMarketCap and CoinGecko, which gives the project more visibility and credibility. Though it seems audacious, Rexas Finance’s aggressive price objective of $25 is not wholly unrealistic. The creative application of the token in RWA tokenization fits the increasing trend of combining blockchain technology with conventional assets.

As demand for asset-backed tokens rises, this special niche market RXS finds exponential expansion. As RXS gets greater acceptance and forms more alliances, crypto analysts believe its value may explode quickly. Given its existing price of $0.08, an increase to $25 would be an incredible return for present investors. Ripple bulls, some of which are growing more worried that Rexas Finance will outperform XRP in market rankings, have taken notice of this prospect.

Could Rexas Finance (RXS) Overtake XRP?

XRP is still the market leader with solid foundations, hence it is impossible to overlook Rexas Finance’s explosive climb. From retail traders to institutions seeking exposure to tokenized assets, the RXS ecosystem offers a special value that can draw a varied spectrum of investors. For smaller investors looking for strong returns, its lower entry fee also appeals. The Ripple Bull worries that RXS’s creative strategy and upward trajectory could someday let it exceed XRP in market capitalization. Should Rexas Finance meet its $25 price target, it will create a lot of market interest and maybe increase its market capitalization over that of Ripple.

Token competitiveness keeps getting more fierce as the crypto market develops. Long a major player, XRP’s position is under attack from creative entrants like Rexas Finance (RXS). With its $25 pricing goal and emphasis on RWA tokenization, RXS could upend the current quo and ascend the market ranks. The decision between XRP and RXS could come down to risk tolerance and development possibilities for investors. Rexas Finance is a chance to enter early on as a rising star, even while XRP provides stability and a track record. It would be interesting to watch whether Rexas Finance can meet its lofty targets and upset the current market hierarchy as the presale moves forward and the token picks more traction.

For more information about Rexas Finance (RXS) visit the links below:

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Bitcoin Cash Price Prediction 2024 – 2030: Is Bitcoin Cash The Best Investment for 2024?

The post Bitcoin Cash Price Prediction 2024 – 2030: Is Bitcoin Cash The Best Investment for 2024? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the Bitcoin Cash token is $ 493.46132302

- BCH crypto price may reach a potential high of around $435 by the end of 2024.

- Bitcoin Cash price, with a potential surge, may reach up to $2,090 by the end of 2030.

Bitcoin Cash is a quick-to-react altcoin that can react to any significant price movements in the biggest crypto, Bitcoin. With Bitcoin crossing the $98k mark momentarily, BCH price witnesses a massive 8.46% surge this week.

“Will Bitcoin Cash go up further?” Is this the question playing on your mind? Or perhaps you’re pondering, “Bitcoin Cash, is it a good investment?”

We bring you our Bitcoin Cash price prediction for 2024-2030 to answer these questions. Our BCH price prediction covers technical analysis, on-chain analysis, significant upgrades, and partnerships that can prove bullish for Bitcoin Cash.

Table of contents

Overview

CryptocurrencyBitcoin CashTokenBCHPrice $ 493.46132302  10.55% Market Cap $ 9,766,281,175.9868Trading Volume $ 1,993,429,512.0453Circulating Supply 19,791,381.25All-time High$4,355.62 Dec 20, 2017All-time Low$75.08 Dec 15, 201824 HighComing soon24 LowComing Soon

10.55% Market Cap $ 9,766,281,175.9868Trading Volume $ 1,993,429,512.0453Circulating Supply 19,791,381.25All-time High$4,355.62 Dec 20, 2017All-time Low$75.08 Dec 15, 201824 HighComing soon24 LowComing Soon

BCH Coin Price Prediction November 2024

In the daily chart, BCH shows a falling-edge breakout gaining momentum. After consolidating in October, it crossed the 23.60% Fibonacci level at $387 and surged 61.30% from $321 to $519, breaching the 50% Fibonacci level at $493 with a bullish engulfing candle.

Golden crossover between the 50-day and 200-day EMAs supports the rally, with a positive 100-day and 200-day EMA crossover. Narrowly avoided a bearish crossover, maintaining a bullish alignment. Immediate resistance is at $541, with $608 and $694 next. The 1.27 Fibonacci level at $803 is a potential December 2024 target. Key supports are $493 and $446.

MonthPotential Low ($)Average Price ($)Potential High ($)November$336$418$500

Bitcoin Cash Price Prediction 2024

As Bitcoin flirts with the $60K mark, this momentum could be just the ticket for a Bitcoin Cash price jump in 2024. Similarly, Bitcoin Cash (BCH) has recently shown a promising rise, close to surpassing the $350 mark for impressive growth.

A bullish trend reversal to undermine the ongoing correction phase can drive the Bitcoin Cash (BCH) coin price to $435.51 by the end of 2024. However, on the flip side, the Bitcoin Cash price might bottom out at $250.

YearPotential Low ($)Average Price ($)Potential High ($)2024$250$625$1500

BCH Price Prediction 2025

The year 2025 could signal growth for BCH, with prices potentially oscillating between a low of $592 and a high of $711. The average price during this period could stand at $651.

Year Potential Low ($)Average Price ($)Potential High ($)2025$692$1151$1711

Discover our in-depth Yearn.Finance (YFI) Price Prediction and see what the future holds for this DeFi powerhouse.

Bitcoin Cash (BCH) Price Prediction 2026 – 2030

Bitcoin Cash Price PredictionPotential Low ($)Average Price ($)Potential High ($)2026$1793.11$2022.81$2805.872027$2646.31$3054.97$3601.342028$3039.51$3747.65$4545.742029$3596.78$449.87$5374.272030$4137.11$5196.47$6292.56

Bitcoin Cash Price Targets 2026:

For the year 2026, Bitcoin Cash Price Prediction forecasts a low price of $1793.11, an average price of $2022.81, and a high of $2805.87.

BCH Price Forecast 2027:

In 2027, Bitcoin Cash Price Prediction projects a low price of $2646.31, an average price of $3054.97, and a high of $3601.34.

Bitcoin Cash Price Projection 2028:

As per Bitcoin Cash Price Prediction 2028, BCH may see a potential low price of $3039.51. Meanwhile, the average price is predicted to be around $3747.65. The potential high for BCH price in 2028 is estimated to reach $4545.74.

BCH Price Prediction 2029:

Looking ahead to the Bitcoin Cash Price prediction 2029, Bitcoin Cash is expected to have a low price of $3596.78. With an average price of $449.87, the BCH price will make a high of $5374.27.

Bitcoin Cash (BCH) Price Prediction 2030:

Finally, by 2030, Bitcoin Cash Price Prediction anticipates a low price of $4137.11, an average price of $5196.47, and a high of $6292.56.

Market Analysis

Firm Name202420252026Long Forecast$314$231$148DigitalCoinPrice$536$632$879Trading Beasts$366$222–

*We have made a table that includes the possible price prediction for the same token made by other crypto analysts on their respective platforms. The targets mentioned above are the average targets set by the respective firms.

CoinPedia’s Bitcoin Cash Price Prediction

Coinpedia’s analysis suggests that Bitcoin Cash could potentially emerge as a more affordable version of Bitcoin.

If Bitcoin Cash gains some hype in the coming months, then the BCH price can reach $435.51 in 2024. On the flip side, BCH price price can drop to $250 by the end of 2024.

We expect the BCH price to create a new 2024 high of $435 by 2024.

Year Potential Low ($)Average Price ($)Potential High ($)2024250342.5$435

Bitcoin Cash Price Sentiments

Bitcoin Cash started the year at $259 and is up by 38% in terms of YTD growth.

Also Check Out: UniSwap Price Prediction 2024, 2025, 2030: Will UNI Coin Price Record New Yearly High Soon?

FAQs

How high could BCH’s price surge by the end of 2024?

The price of BCH could surge to its potential high of $1500 by the end of 2024.

What could be the maximum price of BCH in the next 3 years?

According to our Bitcoin Cash price prediction, BCH’s price could hit the maximum trade value of $711 by the end of 2025.

How much is 1 Bitcoin cash worth?

At the time of publishing, the price of 1 BCH was $352.

What Is Bitcoin Cash?

Bitcoin Cash is a hard fork of Bitcoin, that aims at a decentralized peer-to-peer electronic cash system. Without relying on any central governing authority.

Is Bitcoin Cash a good investment in 2024 amidst newer higher-performing entrants?

Bitcoin Cash is an underrated investment with a high chance of performing in 2024.

What are the advantages of Bitcoin Cash over Bitcoin?

Bitcoin Cash focuses on resolving two of the major limitations of Bitcoin, which are scalability and transaction fees.

BCH

BINANCE

Published in B&T Latest News

21 November, 2024 by The bizandtech.net Newswire Staff

Top AI Development Companies In 2025

AI will assist businesses more in 2025. It brings advanced features that make work easier. AI helps improve decision-making. The latest trends show that AI is now part of every industry. In software solutions, AI can handle large amounts of data. This allows businesses to create better strategies. It also helps in offering personalized experiences to customers. Because of these benefits, many companies are now looking for AI development firms.

How We Created The List Of Top Artificial Intelligence Companies

Our list isn’t complete, but it includes app development companies that meet key standards. Here’s how we selected them:

Industry Experience: All companies on our list have at least 5 years of experience. This ensures they are reliable and can deliver quality results. Five years is enough time for a company to prove their worth.

Skilled Engineers: We chose companies that hire talented and experienced developers. These companies have strong teams and systems to work together well.

Client Feedback: We only include companies with strong reviews. We check their profiles on Clutch to make sure each one has an overall rating of at least 4.5 stars. Positive feedback shows that clients are happy with the work.

Quality of Work: We also look at the companies’ past projects. Their portfolios give us a clear idea of the quality of their work. We pay attention to their tech stacks, methods, and project results.

Range of Industries Served: We want companies with experience in multiple industries. Companies that have worked in 3–4 industries are more likely to understand various challenges. This helps reduce time to market and avoids common obstacles.

Innovation: We look for companies that stay up-to-date with new ideas. Their creativity and design processes make them stand out.

Fair Pricing: We prefer companies with reasonable rates. We avoid companies that charge too little or seem to compromise on quality.

Top AI Development Companies To Invest in 20251. Kryptobees

Kryptobees is a well-known AI development company in 2025. It is an offshore company that provides custom AI services. Kryptobees develops secure and scalable AI products. The company is skilled at identifying business needs and creating smart solutions. It works on complex challenges across industries like healthcare and automotive. The company focuses on creating powerful AI tools. It uses technologies like PyTorch and TensorFlow. The company uses AI algorithms, machine learning, and natural language processing.

Many top companies trust Kryptobees for enterprise-grade solutions. You can hire AI developers from Kryptobees to create solutions that fit your business goals. The company also uses GANs. It supports businesses on their AI journey. They serve sectors like finance, supply chain, medical, retail, automotive, and media. They provide custom AI and ML solutions based on project needs. They fulfill AI vision for their clients. They deliver high-quality AI solutions. The company has elite AI engineers. They offer competitive pricing.

2. C3 AI

C3 AI is a well-known software company. It has been around for almost twenty years. The company is skilled in developing AI and mobile app solutions. It helps businesses in different industries. C3 AI’ team is good at using AI frameworks like PyTorch and Keras. It specializes in AI solutions. It has expertise in NLP and Convolutional Neural Networks. They also use advanced tools such as DALL-E and OpenAI. The company has worked with big clients like Yale, Panasonic, Infosys, and Hitachi. Many businesses trust C3 AI for its innovative solutions.

3. H20.AI

H20.AI is good in the AI development field. The company has multiple AI services. These services help businesses grow and improve. H20.AI builds AI solutions like finance modeling. The company has simple steps for hiring developers. It offers flexible engagement models. Businesses can hire pre-vetted AI developers. H20.AI handles all aspects of AI work. It also improves business processes and strengthens cybersecurity. The company uses tools like Convolutional Neural Networks and decision trees. Their clients include ESPN, Siemens, 3M, and McKinsey & Company.

4. Openstream.AI

Openstream.AI is a leading software development company. It focuses on maintaining digital competitiveness for its clients. The company uses AI to help businesses stay ahead. Openstream.AI specializes in building models for training, serving, and monitoring. It works with advanced AI tools. The company also uses techniques like Convolutional Neural Networks and NLP. Some of its clients include MagicBricks, Yale, Panasonic, and Orange Business Services. It serves sectors such as healthcare, finance, and education. It also works with retail, hospitality, and gaming industries.

5. SumatoSoft

SumatoSoft is another AI development company to consider in 2025. It is an offshore company that offers smart software solutions, including mobile apps. SumatoSoft uses machine learning models to automate operations. These models also help improve data processes. The team at SumatoSoft is made up of experienced AI developers. They use tools like PyTorch and TensorFlow to create AI services. The company works with industries like finance. SumatoSoft creates customized AI solutions using Scikit-learn. The company has worked with well-known companies like Toyota, LPSolutions, and Dexai Robotics.

6. Markovate

Markovate leads in AI development. The company focuses on digital product development powered by AI and blockchain. It creates innovative AI solutions for businesses. Markovate’s team uses technologies like NLP, Convolutional Neural Networks, and Generative AI. The company works with clients like Nestle, Dell, and Bell. Markovate follows an agile approach in its projects. Their experts specialize in predictive modeling and natural language processing. This makes Markovate a growing choice for AI development services. Their strong focus is on AI, blockchain, and big data.

7. Talentica Software

Talentica Software stands out because it attracts highly skilled engineers. These engineers come from prestigious universities. They work closely with clients to meet time and cost constraints. Talentica Software has worked with many startups. They deliver innovative cloud and AI solutions. Their work includes generative AI, machine learning, NLP, and image processing. Talentica focuses on several AI solutions. Machine learning is used for investment portfolio management. Predictive maintenance is achieved with NLP. Talentica Software works across many industries. They serve the finance, medical, advertising, marketing, consumer products, IT, and media sectors. Talentica offers a startup-friendly development process. Talentica Software tailors its workflow to help startups grow.

8. ELEKS

ELEKS is a leading AI development company in Europe. Based in Estonia, the company has a global presence. It serves enterprises around the world. ELEKS is known for delivering projects on time without delays. ELEKS focuses on enhancing latent AI with skilled experts. They use computer vision and AI for end-to-end tire management. ELEKS works with various industries. ELEKS delivers products oriented to the client’s needs. They unify enterprise ecosystems by combining software skills with industry expertise. ELEKS is known for never missing a deadline. They have a strong global presence with teams in over 20 cities. Their quality assurance and testing processes are robust. They employ over 2,000 skilled developers.

9. First Line Software

First Line Software is a well-known app developer. Many clients worldwide trust them to create solutions. These technologies speed up the development process. The team of experts at First Line Software follows agile methodologies. This allows them to adjust quickly to changing customer needs. First Line Software offers many AI-driven solutions. They have created AI-powered search engines for internal document searches. They also developed intelligent website assistants using generative AI. Other tools include an AI system for requirements analysis and a retail shopper behavior analytics tool. They have also worked on e-government projects like child benefit applications. First Line Software is known for its consultative approach.

10. Softarex

Softarex is an AI solutions company. Softarex specializes in data science, AI, and machine learning. It uses natural language processing to improve software’s human language interactions. The company is skilled in GANs and Convolutional Neural Networks. It also designs AI models like DALL-E. The team at Softarex creates AI solutions for industries like banking, logistics, consumer goods, and manufacturing. Their adaptive methods allow them to quickly respond to the demands of each project. They use distributed agile development to deliver projects efficiently. A team of veteran experts oversees all developments.

How To Pick The Best AI Development Company1. Search for Developers

Look for AI companies that match your project needs. You can use Google, forums, or business directories like Clutch. Trade events and recommendations from your network can also help you find the right developers.

2. Assess AI Expertise

Check the developer’s AI technology skills. Look for experience in areas like conversational AI, predictive analytics, image processing, or recommendation systems. Each project may require different skills, so ensure the company has the right tech stack.

3. Review Development Approach

Choose a developer who can test and validate ideas quickly. Find out how they build prototypes, proof of concepts, and MVPs. Make sure they’re open to making changes as needed. We use Agile methods to help startups launch quickly.

4. Look at Client Feedback

Check reviews and past projects before making a decision. If the developer doesn’t share client feedback, that’s a red flag. Pay attention to feedback about communication, support, and the quality of their work.

5. Conduct an Interview and Finalize

Talk to the developer’s team to understand their expertise and workflow. A conversation will help you see if they are a good fit for your project. Their communication style matters. Once you’re confident, draft a contract.

Conclusion

These AI Development companies are leaders in AI research and development. A Suitable AI Development company creates new AI products and builds smart algorithms. Their work will help industries grow and thrive. If you desire to invest in AI, now is the ideal time to team up with the best AI development company.

Top AI Development Companies In 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

Published in B&T Latest News · Business Features

21 November, 2024 by The bizandtech.net Newswire Staff

Why is Real Estate Tokenization the Next Big Thing in Property Investment?

Unlocking the Future of Property Investment with Digital Ownership and Blockchain Innovation.

Real estate tokenization is emerging as a game-changer in the property investment landscape, offering a revolutionary approach that combines the power of blockchain technology with the real estate market. By converting property assets into digital tokens, tokenization makes it possible for investors to buy, sell, or trade shares of a property much like stocks or bonds. This fractional ownership model lowers the barriers to entry, allowing more people to invest in high-value real estate, even with limited capital.

It also provides greater liquidity, as investors can quickly trade their tokens on a secondary market, making it easier to buy or sell property shares. Furthermore, tokenization streamlines transactions, cutting down on paperwork and reducing the need for intermediaries, which can lower transaction costs. As a result, real estate tokenization opens up global investment opportunities, enabling a wider range of people to participate in what was traditionally an exclusive market. With its potential to democratize property ownership and enhance liquidity, real estate tokenization is poised to reshape the future of property investment.

Table of ContentWhat is Real Estate Tokenization?

Why Real Estate Tokenization Matters?

Growing Role of Tokenization in Real Estate in 2025

The Process of Investing in Tokenized Real Estate

How to Start a Real Estate Tokenization Business?

How Much Does Tokenization Cost in Real Estate?

Is Tokenization the Future of Real Estate?

ConclusionWhat is Real Estate Tokenization?

Real estate tokenization is the process of converting real estate assets into digital tokens using blockchain technology, allowing these assets to be divided into smaller, tradable units. Each token represents a fraction of ownership in a physical property, such as a residential or commercial building. This process makes it possible for multiple investors to own a share of a property without needing to purchase the entire asset. Tokenization increases liquidity by enabling investors to buy, sell, or trade property shares on digital platforms, often with lower transaction costs and faster execution times than traditional methods.

The real estate tokenization market, valued at USD 2.81 billion in 2023, is expected to grow significantly, reaching approximately USD 11.80 billion by 2031. This growth, fueled by cutting-edge blockchain technology, is projected to result in a strong compound annual growth rate (CAGR) of 9.91% from 2024 to 2031.

It also provides greater transparency, as blockchain ensures that all transactions are securely recorded and accessible for verification. With tokenized real estate, investors can diversify their portfolios with smaller amounts of capital, making property investment more accessible to a broader audience. Additionally, tokenization eliminates the need for intermediaries like banks or brokers, further reducing costs and improving efficiency. As the technology evolves, real estate tokenization has the potential to revolutionize the property investment market, offering more flexibility, transparency, and global investment opportunities.

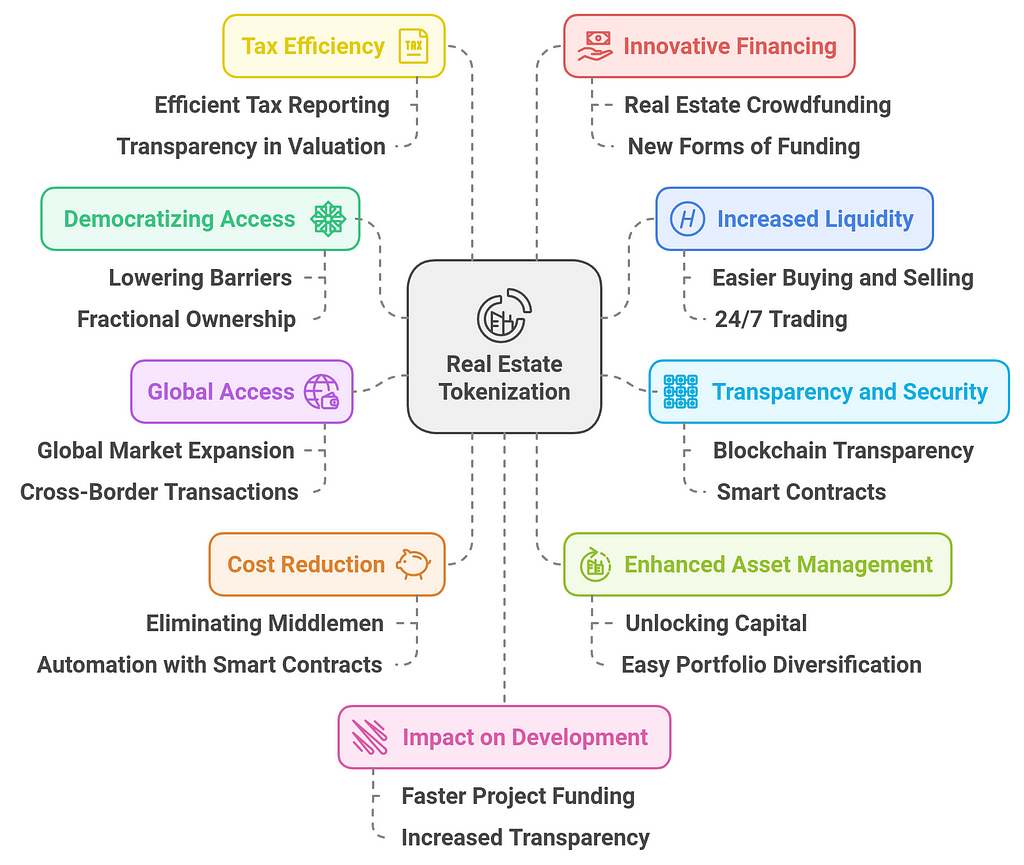

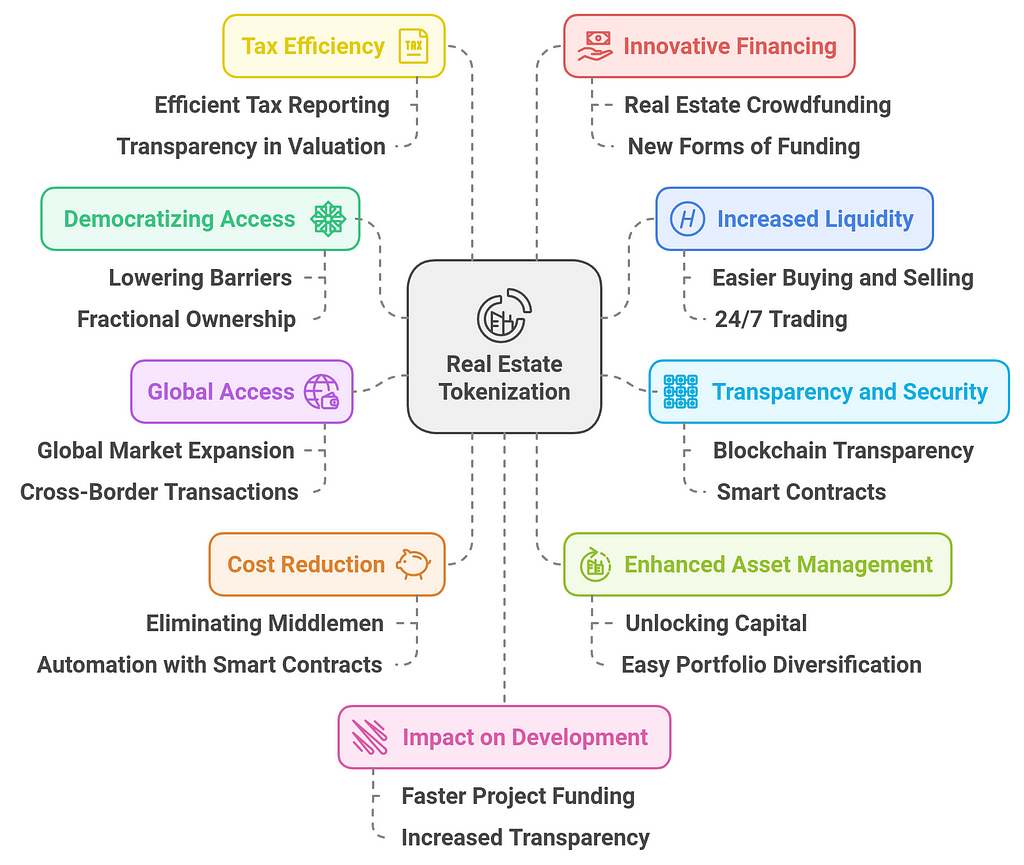

Why Real Estate Tokenization Matters?

Real estate tokenization is gaining traction as an innovative way to democratize access to real estate investments, enhance liquidity, and improve transparency in the real estate sector. Tokenizing real estate refers to converting ownership or a portion of ownership of a property into digital tokens using blockchain technology. These tokens represent a share in the value of the property, making it easier to trade and invest in real estate assets. Here’s why real estate tokenization matters:

1. Democratizing Access to Real Estate Investment

1. Democratizing Access to Real Estate Investment

- Lowering Barriers to Entry: Traditionally, real estate investments have required significant capital, making them accessible mainly to wealthy individuals or institutional investors. Tokenization allows smaller investors to buy fractional ownership of high-value real estate assets. This opens up opportunities for a broader range of people to invest in real estate, potentially leading to a more inclusive and diverse investment landscape.

- Fractional Ownership: Tokenization divides the ownership of real estate into smaller, tradable units, which means people can invest in a fraction of a property. This allows investors to own a share of large, expensive properties (e.g., commercial buildings or luxury apartments) without needing to purchase the entire asset.

2. Increased Liquidity in the Real Estate Market

- Easier Buying and Selling: Real estate traditionally has low liquidity because transactions are complex, time-consuming, and require large sums of money. Tokenized real estate can be bought and sold much more easily and quickly on blockchain platforms. This improved liquidity can attract more investors, both small and large, who are interested in the flexibility to enter and exit investments with relative ease.

- 24/7 Trading: Unlike traditional real estate markets, where buying or selling takes time and is constrained by business hours, tokenized real estate can be traded 24/7 on digital platforms, giving investors more flexibility and convenience.

3. Transparency and Security

- Blockchain Transparency: Real estate tokenization is based on blockchain technology, which is decentralized, transparent, and immutable. All transactions are recorded on the blockchain, making it easy to verify ownership, track the transfer of assets, and ensure that the property is free from encumbrances. This reduces the chances of fraud, disputes, and errors that can occur in traditional real estate transactions.

- Smart Contracts: Tokenized real estate transactions can be executed using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts reduce the need for intermediaries (such as brokers or lawyers), speeding up the process and lowering transaction costs, while ensuring that the terms are automatically enforced.

4. Global Access and Cross-Border Investment

- Global Market Expansion: Real estate tokenization opens up the global market for real estate investment. Investors from anywhere in the world can participate in tokenized real estate transactions without the complexities of international property laws, currency conversions, or geographical barriers. This enables greater diversification of investment portfolios for individuals and institutional investors alike.

- Cross-Border Transactions: Blockchain technology enables faster and cheaper cross-border transactions compared to traditional methods, which can involve high fees, delays, and currency exchange risks. Tokenization can make international real estate investment more accessible and efficient.

5. Cost Reduction and Efficiency

- Eliminating Middlemen: Traditional real estate transactions involve many intermediaries, such as brokers, lawyers, and notaries, which add layers of costs and delays. Tokenization can reduce or eliminate the need for many of these intermediaries, thus lowering transaction fees and speeding up the process.

- Automation with Smart Contracts: By using smart contracts, many manual tasks involved in the purchase, sale, and management of properties can be automated, reducing administrative costs and minimizing the potential for human error.

6. Enhanced Asset Management and Liquidity for Property Owners

- Unlocking Capital: Property owners can raise capital by tokenizing their real estate holdings and selling fractional ownership in the form of tokens. This can help developers or owners of large properties to unlock capital for new investments or business ventures without needing to sell the entire property.

- Easy Portfolio Diversification: With tokenized real estate, property owners can easily diversify their portfolios by adding fractional investments in different types of properties or geographic locations. This reduces the risk associated with holding only one property or asset class.

7. Tax Efficiency and Simplified Transactions

- Efficient Tax Reporting: Real estate tokenization can simplify tax reporting. Blockchain records all transactions, making it easy to track gains, losses, and other taxable events. Tokenized assets can streamline the tax filing process by providing clear, real-time data on ownership and asset movements.

- Transparency in Property Valuation: The blockchain ledger can also provide real-time updates on property values, offering greater transparency and reducing discrepancies in property valuation.

8. Innovative Financing Opportunities

- Real Estate Crowdfunding: Tokenization allows for the creation of decentralized real estate crowdfunding platforms, where numerous small investors can collectively fund a real estate project. This model creates new financing opportunities for developers and property owners while providing small investors with access to lucrative real estate investments.

- Access to New Forms of Funding: Developers and property owners can tap into a broader pool of capital through tokenized real estate offerings. Tokens could be structured in various ways (e.g., equity-based, debt-based) to meet the needs of different types of investors, providing more flexibility in terms of financing.

9. Potential for Innovation in Real Estate Investment Products

- New Investment Vehicles: Real estate tokenization opens the door to the creation of new investment vehicles that cater to different risk appetites. For example, investors could choose between tokenized shares in commercial properties, residential units, or even niche real estate sectors like vacation rentals or industrial spaces.

- Customizable Investment Options: Investors can choose how much they want to invest in a particular property, the type of return they’re seeking (e.g., dividends from rental income or capital appreciation), and the level of risk they are willing to take. This makes real estate investments more flexible and customizable.

10. Impact on Property Development

- Faster Project Funding: Tokenization can expedite the process of raising capital for real estate development projects. Developers can tokenize a project and sell fractional ownership to multiple investors, allowing them to access the funding needed for construction and development more quickly.

- Increased Transparency for Stakeholders: Tokenization ensures that all stakeholders (e.g., developers, investors, lenders) can see the exact status of a project, its financing, and how funds are being used, ensuring greater accountability and trust.

Real estate tokenization represents a revolutionary shift in how property is bought, sold, and invested in. By utilizing blockchain technology, tokenization enhances transparency, liquidity, and accessibility while lowering barriers for both investors and property owners. This could transform the real estate market, making it more efficient, accessible, and attractive to a global pool of investors. For both developers and investors, tokenization offers new opportunities for growth, diversification, and financial innovation in the real estate space.

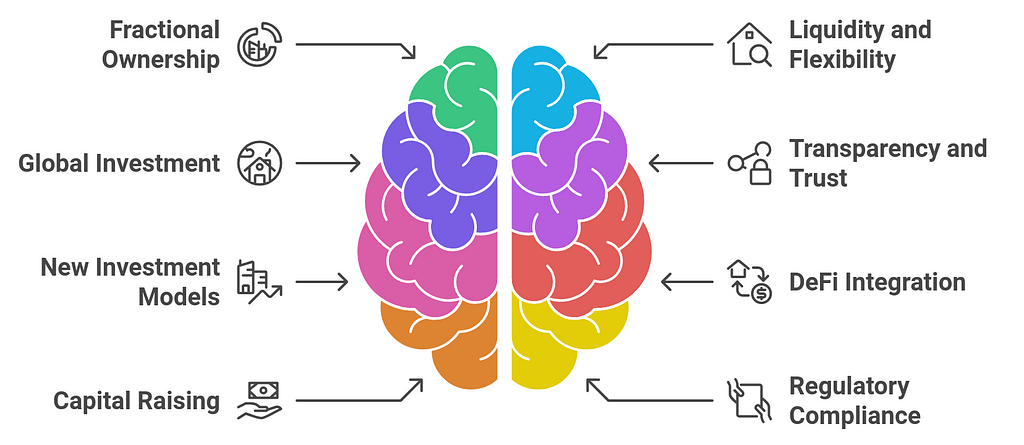

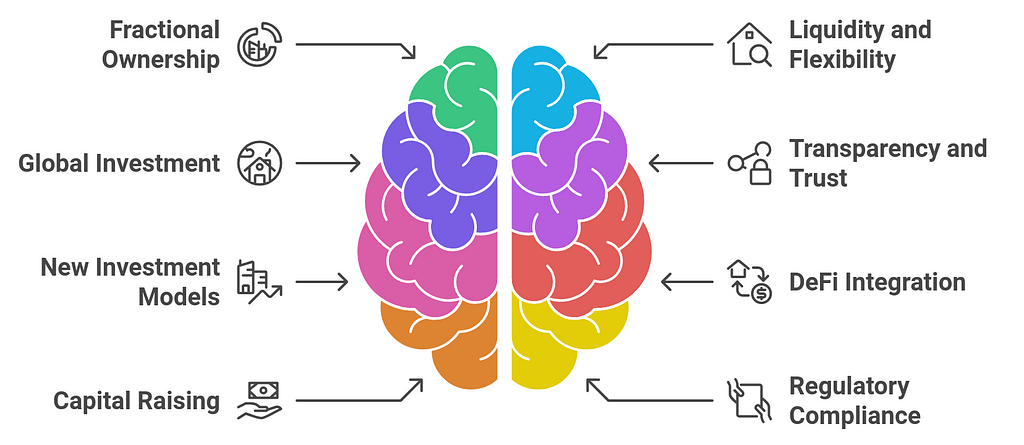

Growing Role of Tokenization in Real Estate in 2025

As we approach 2025, tokenization in real estate is expected to play an increasingly pivotal role in transforming the industry, offering new ways to invest, manage, and trade property assets. By leveraging blockchain technology, tokenization provides an efficient, secure, and transparent method for converting real estate ownership into digital tokens. These tokens represent fractional ownership of a property, which can be bought, sold, or traded on blockchain-based platforms. Here are some key aspects of the growing role of tokenization in real estate in 2025:

1. Mainstream Adoption of Fractional Ownership

1. Mainstream Adoption of Fractional Ownership

- Wider Access for Small Investors: As tokenization continues to gain traction, it will become a mainstream option for investors seeking to enter the real estate market with less capital. Fractional ownership through tokens allows small investors to purchase portions of high-value properties (such as commercial buildings or luxury residential units) with minimal investment, making real estate more inclusive and democratizing access to property markets.

- Diverse Property Types: Tokenization will expand beyond traditional residential and commercial properties to include more niche real estate types like vacation homes, short-term rental properties, industrial spaces, and even agricultural land. This will give investors more opportunities to diversify their portfolios.

2. Enhanced Liquidity and Flexibility

- Real-Time Trading: Tokenized real estate will increasingly be traded on blockchain platforms, providing investors with the ability to buy or sell ownership shares in real estate properties in real time. This addresses one of the key challenges of traditional real estate investments, which can take months to liquidate due to the complex nature of transactions.

- 24/7 Market Access: Unlike traditional stock or real estate markets that operate on fixed schedules, tokenized real estate platforms will allow for round-the-clock trading. This shift will give investors more flexibility and convenience, removing geographical and time barriers in real estate investments.

3. Globalization of Real Estate Investment

- Cross-Border Investment Opportunities: Tokenization allows investors to participate in real estate markets around the world, overcoming geographic limitations. With real estate tokens, a person in Asia can easily invest in a property in Europe or North America without the complexities of foreign currency exchange, legal hurdles, or intermediaries.

- Reduced Transaction Costs: Blockchain technology eliminates the need for many traditional intermediaries (e.g., brokers, lawyers, notaries), which often add high fees and delays to real estate transactions. This reduction in transaction costs will make global investments more accessible and efficient.

4. Improved Transparency and Trust

- Blockchain’s Immutable Record: Tokenization leverages the security and transparency of blockchain technology. All transactions involving real estate tokens are publicly recorded and immutable, creating an audit trail that enhances trust among investors. This transparency can help reduce fraud, errors, and disputes, which are common in traditional real estate markets.

- Smart Contracts for Automation: Smart contracts can be used to automate transactions, ensuring that terms are executed automatically when predefined conditions are met. For example, rental income can be distributed to token holders based on a predetermined schedule, and property transfers can occur without the need for manual intervention. This enhances trust and reduces the administrative burden.

5. New Investment Opportunities and Models

- Real Estate Crowdfunding Platforms: Tokenization will give rise to new models of real estate crowdfunding, where groups of investors can collectively fund a development project or purchase a property. With tokenized ownership, these platforms will enable easier and faster investments, allowing smaller stakeholders to pool their capital for large projects.

- Customizable Investment Vehicles: Tokenized assets can be structured in various ways to meet different investor needs. For example, tokens could represent equity stakes, debt, or even hybrid forms of investment. This flexibility will allow developers to tap into a broader pool of capital and investors to choose investment opportunities that align with their risk profile and financial goals.

6. Integration with Decentralized Finance (DeFi)

- Leveraging DeFi for Real Estate: Tokenized real estate will increasingly integrate with decentralized finance (DeFi) ecosystems. Investors could use tokenized property assets as collateral to secure loans or participate in liquidity pools that offer yield or interest. This integration will make real estate more liquid and financially accessible, even for individuals without large capital.

- Tokenized Real Estate as Collateral: As DeFi continues to grow, tokenized real estate assets could be used as collateral for borrowing or lending. This opens up new avenues for financing property purchases and development projects, creating a more dynamic real estate market.

7. Impact on Property Development and Capital Raising

- Faster Access to Capital: Tokenization enables property developers to raise capital more quickly by issuing tokens representing fractional ownership in a project. Rather than waiting for traditional financing (e.g., bank loans, private equity), developers can tap into a global pool of investors interested in fractional ownership, speeding up the funding process.

- Increased Transparency in Fund Allocation: Tokenization offers clear and transparent tracking of how funds are used in property development projects. Investors will have real-time visibility into the progress of a project and how their funds are being allocated, enhancing accountability and reducing the risk of mismanagement.

8. Regulatory Clarity and Compliance

- Increased Regulatory Frameworks: As tokenization becomes more mainstream, governments and regulators will likely establish clearer frameworks for tokenized real estate transactions. This regulatory clarity will help further legitimize tokenization, making it more attractive to institutional investors and larger real estate companies.

- Compliance with KYC/AML Standards: In response to concerns over fraud and money laundering, tokenization platforms will increasingly implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This will ensure that the tokenization process remains secure and compliant with financial regulations, which will boost investor confidence.

9. Improved Real Estate Asset Management

- Automated Asset Management: Tokenization will allow for greater automation in the management of real estate assets. For example, smart contracts can manage rent payments, distribute dividends to token holders, and track the financial performance of a property in real-time.

- Enhanced Property Reporting: Blockchain records can provide detailed data on property valuations, rental income, and other performance metrics. This transparency will give investors better insights into the performance of their investments and help them make more informed decisions.

10. Sustainability and Green Investment

- Access to Sustainable Properties: Tokenization could provide a platform for investing in sustainable, green real estate projects. Investors increasingly want to align their investments with their values, and tokenization allows them to easily identify and invest in properties that meet environmental and sustainability criteria.

- Environmental Impact Tracking: Blockchain’s ability to track and record data could be used to verify the sustainability of a property, such as energy efficiency, carbon emissions, or waste management practices. This could make it easier for investors to support eco-friendly and socially responsible real estate projects.

By 2025, tokenization is set to revolutionize the real estate sector, offering a new level of flexibility, liquidity, transparency, and efficiency. With its ability to lower barriers to entry, streamline transactions, and create more diverse investment opportunities, tokenization is poised to change the way investors and property owners engage with the real estate market. As blockchain technology matures and regulatory frameworks evolve, tokenized real estate will likely become a significant and mainstream component of the global investment landscape, driving innovation and growth in the sector.

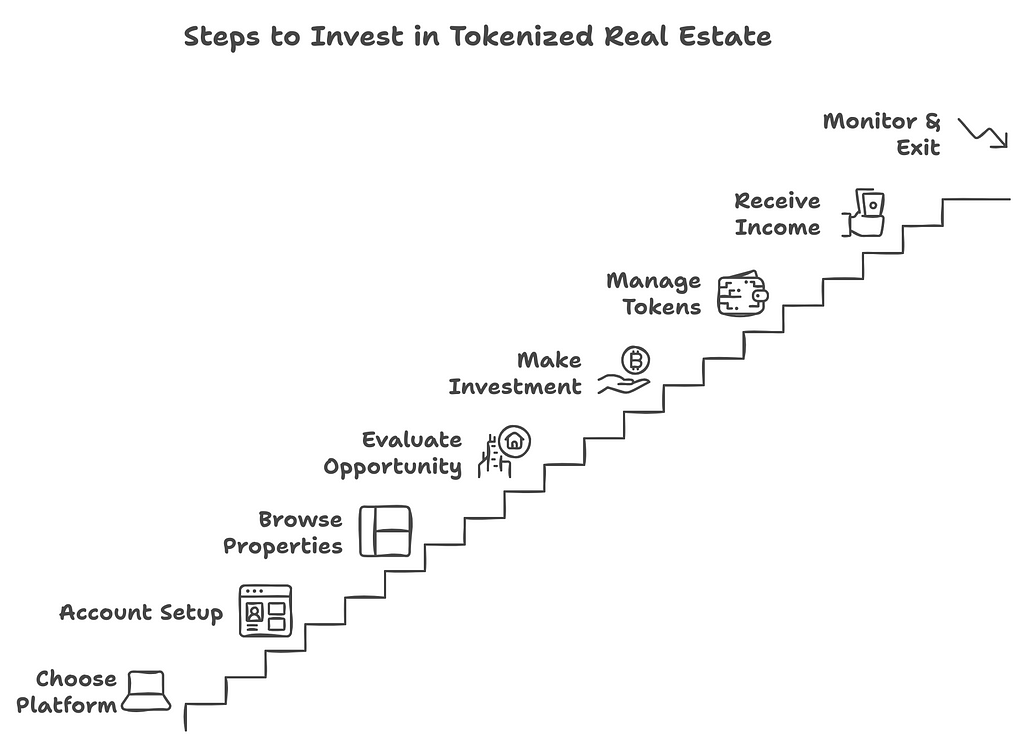

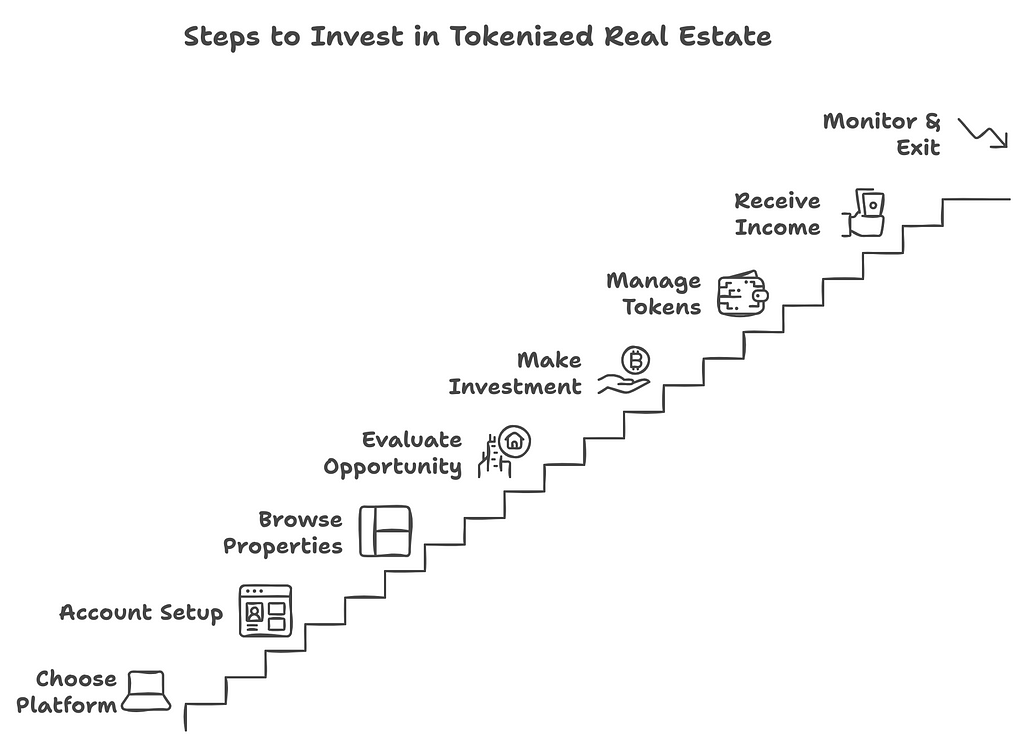

The Process of Investing in Tokenized Real Estate

Investing in tokenized real estate is a relatively new but growing concept that allows investors to participate in real estate markets through blockchain technology. The process involves purchasing digital tokens that represent fractional ownership of a property, typically through a platform that facilitates real estate tokenization. Here’s a step-by-step guide to the process of investing in tokenized real estate:

1. Choose a Tokenization Platform

1. Choose a Tokenization Platform

- Research and Select a Platform: The first step is to choose a reliable and reputable tokenization platform. These platforms offer the infrastructure to tokenize real estate assets, allowing investors to buy, sell, and trade property tokens. Examples include platforms like RealT, SolidBlock, and tZERO.

- Verify Legitimacy and Security: Ensure the platform adheres to regulatory standards and offers robust security features (e.g., encryption, multi-factor authentication). Review the platform’s reputation, reviews, and the types of real estate projects they tokenize.

2. Create an Account and Complete KYC/AML Verification

- Account Setup: To start investing in tokenized real estate, you need to create an account on the platform. This usually involves providing basic personal information such as name, email address, and phone number.

- KYC/AML Process: Most tokenization platforms require investors to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification processes. This typically involves submitting identification documents (e.g., passport, driver’s license) and sometimes proof of address. This is to ensure compliance with regulations and prevent fraud.

3. Browse Available Tokenized Properties

- Property Listings: Once your account is set up and verified, you can browse a list of available tokenized real estate properties. These properties might include residential buildings, commercial real estate, vacation properties, or other types of real estate.

- Investment Information: Each listing will provide detailed information about the property, such as its location, value, expected returns, historical performance, and how many tokens are available for sale. There may also be details on the property’s legal status, maintenance, and management.

4. Evaluate the Investment Opportunity

- Investment Amount: Tokenized real estate allows you to purchase fractional ownership, meaning you don’t need to buy the entire property. You can invest a small amount relative to the total value of the property. Review the minimum investment requirement and evaluate whether the amount aligns with your budget and investment goals.

- Risk Assessment: As with any investment, assess the risk factors involved. Research the property’s location, market trends, rental potential, and any potential legal or regulatory issues. Tokenized real estate may carry risks related to the management of the property, market volatility, or platform reliability.

- Return on Investment (ROI): Understand the expected ROI, which could come in the form of rental income distributions or capital appreciation. Some platforms provide projected income based on past performance or comparable properties, while others might offer insights into the property’s future appreciation potential.

5. Make the Investment

- Select Tokens: Once you’ve identified a property you’d like to invest in, you can select the number of tokens you wish to purchase. Each token typically represents a fractional share in the property, and the price per token is usually set based on the property’s value and the number of tokens issued.

- Payment Method: Tokenized real estate platforms often allow you to pay for tokens using cryptocurrencies (like Bitcoin or Ethereum) or fiat currencies (like USD or EUR). Some platforms may offer integrations with wallets or payment gateways to facilitate transactions.

- Transaction Confirmation: After making the payment, the transaction is recorded on the blockchain. You will receive confirmation of your token purchase, and the tokens will be transferred to your digital wallet.

6. Ownership and Management of Tokens

- Digital Wallet: Once the transaction is complete, the tokens representing your fractional ownership in the property will be stored in your digital wallet. The wallet may be hosted on the tokenization platform or managed by a third-party provider.

- Smart Contract Management: Many tokenized properties use smart contracts to manage various aspects of the investment. For example, rental income might be automatically distributed to token holders, or capital appreciation may be reflected in the token’s market value. Smart contracts ensure that the terms of the investment are executed automatically and transparently.

- Real-Time Tracking: You will have access to real-time data on your tokenized property investment through the platform’s dashboard. This may include updates on rental income, property value fluctuations, maintenance, and other important metrics.

7. Receiving Dividends or Rental Income

- Income Distribution: Depending on the platform and the type of real estate tokenized, you may receive periodic rental income or dividends based on the amount of tokens you own. This income is usually distributed according to the terms set in the smart contract.

- Direct Deposit or Digital Wallet: Rental income and dividends can be distributed to your digital wallet, either in cryptocurrency or fiat. Platforms often offer the option to withdraw your income directly to a bank account or reinvest it in more tokens.

8. Monitor the Investment

- Property Updates: Regular updates regarding the property’s management, rental status, maintenance, and performance are typically provided on the platform. This allows investors to stay informed about how their investments are performing.

- Market Trends: Stay updated on the real estate market trends and the specific property’s performance. This will help you make informed decisions regarding holding, selling, or reinvesting in the tokens.

9. Selling or Exiting Your Investment

- Token Sale or Transfer: If you wish to sell your tokens or exit your investment, you can typically list the tokens for sale on the same platform or on a secondary market (if supported). Some platforms allow direct peer-to-peer token transfers, while others may facilitate token sales through their marketplace.

- Liquidity and Exit Strategy: Liquidity depends on the platform and the demand for the specific property’s tokens. While tokenized real estate is more liquid than traditional real estate, it may still take time to find a buyer, especially if the property is illiquid or in a niche market. Consider your exit strategy and the potential for capital appreciation when deciding whether to sell your tokens.

10. Tax Considerations

- Tax Obligations: As with any investment, the income and capital gains you earn from tokenized real estate investments may be subject to taxation. Tax regulations can vary depending on your location and the platform you use, so it’s important to consult a tax advisor who is familiar with blockchain and tokenized assets.

Investing in tokenized real estate in 2025 offers a unique opportunity to participate in the real estate market with greater liquidity, lower capital requirements, and enhanced transparency. By following these steps selecting a platform, evaluating opportunities, making the investment, and managing your tokens you can enter the world of tokenized real estate and enjoy the benefits of fractional ownership in high-value properties. As the market matures, tokenized real estate investments will continue to evolve, potentially offering even more advanced features such as automated portfolio management, enhanced secondary markets, and broader access to global real estate markets.

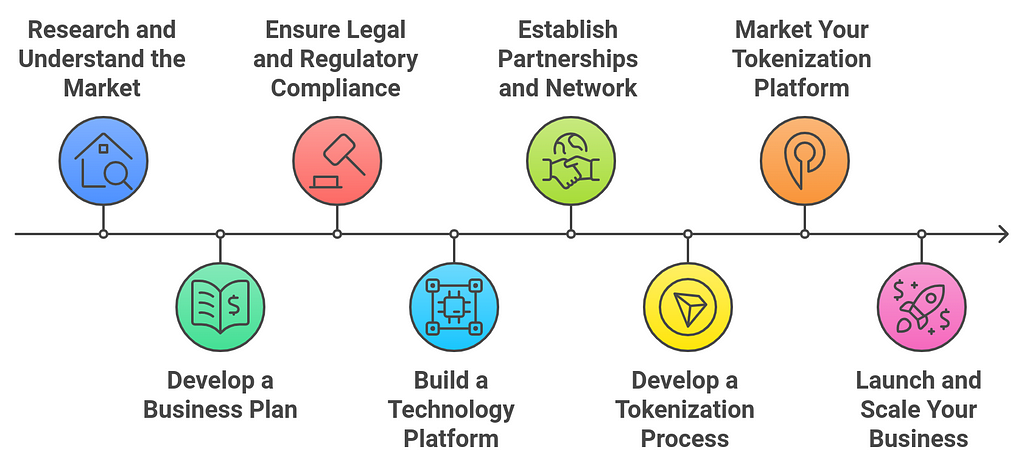

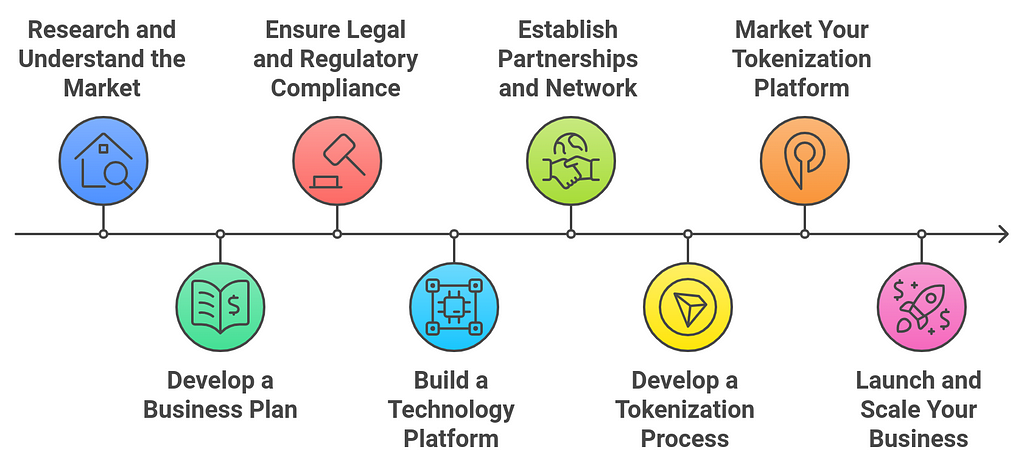

How to Start a Real Estate Tokenization Business?

Starting a real estate tokenization business requires a strategic approach, a strong understanding of blockchain technology, and a focus on legal and regulatory compliance. The real estate tokenization business involves converting real estate assets into digital tokens that can be bought, sold, and traded on blockchain platforms. This emerging sector combines the real estate market with blockchain innovation to offer new investment opportunities.

Here’s a step-by-step guide to help you start a real estate tokenization business:

1. Research and Understand the Market

- Market Understanding: Before starting, thoroughly understand the real estate tokenization market, including how blockchain works in the real estate sector. This includes understanding the benefits of tokenization such as fractional ownership, liquidity, and transparency, as well as the challenges, such as regulatory hurdles and the technology required.

- Target Market: Define your target marketwill you focus on residential, commercial, or industrial properties? Will you cater to high-net-worth individuals, retail investors, or institutional investors? Research the demand for tokenized real estate in your chosen market segments and geographic areas.

2. Develop a Business Plan

- Define Business Model: Determine how your business will operate. Will you focus on tokenizing existing properties, helping developers tokenize new projects, or creating a marketplace for trading tokenized properties? Define the value proposition you offer to clients whether it’s streamlining the investment process, reducing transaction costs, or offering global access to real estate.

- Revenue Streams: Decide how your business will generate revenue. Some options include charging property owners a fee to tokenize their assets, collecting transaction fees on trades or sales, or earning a percentage of the rental income from tokenized properties.

- Investment Strategy: Outline your strategy for sourcing properties to tokenize. Will you work with developers, individual property owners, or institutional investors? Will you focus on specific property types or geographic areas?

- Financial Projections: Develop detailed financial projections, including initial startup costs (e.g., technology infrastructure, legal fees, marketing), operating expenses, and anticipated revenue streams. This will help guide your business decisions and attract investors or partners.

3. Ensure Legal and Regulatory Compliance

- Legal Framework: Real estate tokenization operates in a highly regulated space, especially when dealing with securities laws and financial regulations. Consult with legal experts specializing in blockchain, securities law, and real estate to understand the regulatory requirements in your country or region.

- Tokenized Real Estate as Securities: In many jurisdictions, tokenized assets may be classified as securities. Therefore, your business must comply with securities laws such as the U.S. Securities and Exchange Commission (SEC) guidelines or similar regulatory bodies worldwide. This may involve registering with regulators, ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, and following data privacy regulations.

- Smart Contracts and Agreements: Work with legal professionals to develop legal contracts and smart contracts that govern the tokenized real estate transactions, outlining the rights and obligations of token holders, income distributions, and token transfers.

- Real Estate Laws: Ensure compliance with real estate laws in your target markets, such as property rights, land ownership, and the process for transferring property ownership.

4. Build a Technology Platform

- Blockchain Infrastructure: Choose a blockchain platform to host your tokenized real estate assets. Popular options include Ethereum, Tezos, Binance Smart Chain, or Solana. These blockchains support the creation and transfer of digital tokens, smart contracts, and decentralized applications (DApps).

- Develop a User-Friendly Platform: Build or partner with a development team to create a secure and user-friendly platform where clients can tokenize their properties, investors can browse tokenized real estate assets, and transactions can be executed seamlessly. The platform should include features like a secure wallet for token holders, property listings, and investment dashboards.

- Smart Contracts: Develop smart contracts to automate various functions of tokenized real estate, such as property transfers, income distributions, and ownership rights. Ensure that the smart contracts are secure, transparent, and meet the legal requirements for property ownership and transactions.

- Integration with Payment Systems: Incorporate payment gateways to allow for the easy exchange of fiat or cryptocurrency for real estate tokens. Integration with digital wallets and blockchain networks is essential for smooth transactions.

5. Establish Partnerships and Network

- Partnerships with Property Owners and Developers: Form relationships with property developers, real estate owners, and institutional investors who are interested in tokenizing their real estate assets. You’ll need to convince them of the benefits of tokenization, such as increased liquidity, fractional ownership, and easier capital raising.

- Collaboration with Legal and Regulatory Experts: Collaborate with legal experts who specialize in blockchain, real estate, and securities law to ensure your tokenization process complies with regulations in all relevant jurisdictions.

- Technology Partnerships: If you’re not able to develop the platform in-house, consider partnering with blockchain technology providers or working with existing real estate tokenization platforms to get started. This could save time and resources in building out the necessary infrastructure.

- Investors and Funding: Secure funding to develop the platform, cover legal expenses, and market your services. This could involve seeking venture capital, partnering with investors, or launching a crowdfunding campaign for your tokenization business.

6. Develop a Tokenization Process

- Tokenizing Real Estate: Develop a process for converting real estate assets into digital tokens. This process will likely involve appraising the property, creating a legal framework for the asset, determining the number of tokens to issue (and their price), and working with blockchain developers to mint the tokens.

- Fractional Ownership: Decide how much of each property will be tokenized and how fractional ownership will work. Will tokens represent an equal share of ownership, or will they be structured differently? Ensure the process is transparent and well-documented for investors.

- Security and Compliance: Use blockchain’s security features to protect token ownership and ensure that token holders have the proper rights and access to the property. Each transaction and token issuance should be fully traceable on the blockchain.

7. Market Your Tokenization Platform

- Create a Marketing Strategy: Develop a comprehensive marketing plan to promote your tokenization platform to property owners, investors, and developers. Use digital marketing tactics such as SEO, social media, email marketing, and content marketing to attract both users and investors.

- Educational Content: Since tokenization is a relatively new concept, offer educational content such as blog posts, webinars, and whitepapers that explain the benefits of tokenization, how it works, and why it is an attractive option for real estate investors.

- Networking and Events: Attend industry conferences and events on blockchain, real estate, and tokenization to connect with potential clients, partners, and investors. These events are valuable opportunities to network and demonstrate your expertise in the field.

8. Launch and Scale Your Business

- Beta Testing: Before fully launching, conduct a beta test of your platform with a small group of users to ensure that it functions correctly, is user-friendly, and meets security standards. Gather feedback to refine the platform and processes.

- Launch the Platform: Once the platform is fully developed, tested, and legally compliant, launch it to the public. Focus on attracting property owners and investors to use your service.

- Customer Support: Provide excellent customer service to guide users through the process of tokenizing real estate, investing in tokens, and managing their assets. Create a support team to address user inquiries and issues promptly.

- Scale the Business: Once established, consider expanding your platform to offer tokenization for different types of properties or entering new geographic markets. Leverage partnerships with more developers, real estate agents, and institutional investors to grow your business.

Starting a real estate tokenization business in 2025 requires a combination of legal expertise, blockchain technology knowledge, and a strong understanding of the real estate market. With the right platform, partners, and strategy, you can build a business that offers a cutting-edge way for investors to access real estate opportunities and for property owners to unlock liquidity. By focusing on compliance, transparency, and innovative technology, your real estate tokenization business can take advantage of a rapidly growing market and transform the way people invest in real estate.

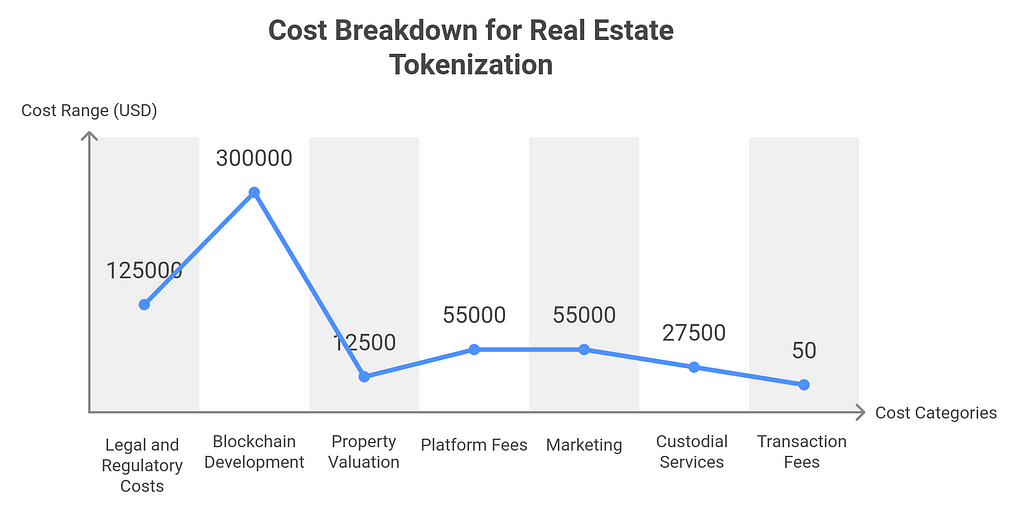

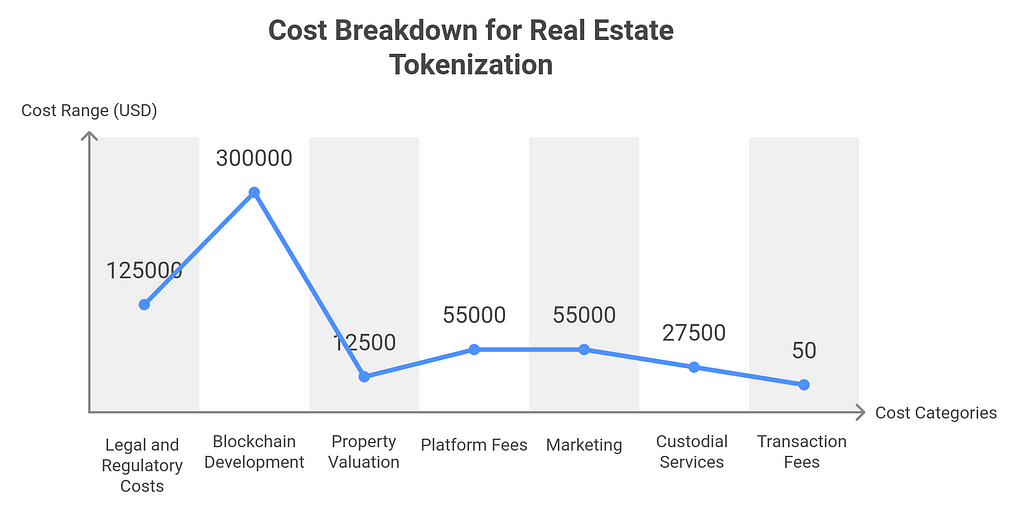

How Much Does Tokenization Cost in Real Estate?

The cost of tokenizing real estate can vary widely depending on several factors, including the complexity of the project, the size of the property, the jurisdiction, and the technology used. Tokenization involves several key steps, each of which can incur different costs, such as legal fees, blockchain development, regulatory compliance, and platform fees. Here’s a breakdown of the potential costs and duration involved in real estate tokenization:

1. Legal and Regulatory Costs

1. Legal and Regulatory Costs

- Legal Fees for Structuring the Tokenization: Legal work is essential in tokenizing real estate, especially in ensuring compliance with securities laws, drafting smart contracts, and preparing offering documents. Legal fees can include:

- Drafting legal frameworks for tokenization

- Compliance with securities laws (e.g., Reg D, Reg A+, or other local regulations)

- Creating investor agreements and contracts

Cost Range: $50,000 to $200,000+ Duration: 2 to 6 months (depending on jurisdiction and complexity)

Notes: Legal costs are often one of the largest expenses in tokenization, as the process requires lawyers who specialize in both real estate and blockchain technology to ensure the tokens comply with local and international securities regulations.

2. Blockchain Platform Development and Smart Contract Creation

- Blockchain Development: Developing the platform to manage the tokenized assets can be costly, especially if you want a custom-built platform with user-friendly features for investors and property owners.

- Smart Contracts: Smart contracts are the digital agreements that facilitate transactions, payments, and transfers on the blockchain. These require developers to write, audit, and deploy.

Cost Range:

- Platform development: $100,000 to $500,000+ (for a custom-built platform)

- Smart contract creation: $10,000 to $50,000+ Duration: 3 to 9 months (for a fully functional, custom platform)

Notes: If you’re using an existing tokenization platform (e.g., Polymath, Harbor, or RealT), the costs for platform development may be significantly lower, as you’re leveraging an existing solution.

3. Property Valuation and Appraisal

- Property Appraisal Fees: Before tokenization, a professional property valuation is necessary to determine the property’s market value, which will be divided into tokens. This is critical for determining the token price.

Cost Range: $5,000 to $20,000 per property (depending on the property’s size and location) Duration: 1 to 2 weeks

Notes: Property appraisers must be independent and certified to ensure compliance with legal requirements, especially when dealing with fractional ownership.

4. Platform Fees and Ongoing Maintenance

- Tokenization Platform Fees: If you’re using a third-party tokenization platform, they will charge fees for listing and tokenizing the property. These fees can vary based on the platform and the level of service.

- Ongoing Maintenance: There will also be ongoing fees for platform maintenance, security, and updates to ensure the platform remains secure and compliant.

Cost Range: $10,000 to $100,000+ annually (depending on platform and scale) Duration: Ongoing

Notes: These costs are typically recurring, as the platform will need to handle transactions, updates, and customer support.

5. Marketing and Investor Outreach

- Marketing Costs: Attracting investors to buy tokens involves marketing efforts like creating a website, producing educational content, advertising, and engaging in outreach. These efforts are necessary to promote the tokenized asset to a broader audience.

Cost Range: $10,000 to $100,000+ Duration: 1 to 3 months for initial marketing campaigns

Notes: Marketing costs vary depending on the complexity of your marketing strategy and the type of real estate asset being tokenized.

6. Custodial and Administrative Services

- Custody Services: You may need custodial services to manage the underlying real estate assets, ensuring that the property is legally held in a way that aligns with the tokenized shares. These services could be provided by a third-party firm or integrated into the platform.

Cost Range: $5,000 to $50,000 per year (depending on the size and complexity of the assets) Duration: Ongoing

Notes: Some tokenization platforms offer custody services as part of their overall package, which can reduce these costs.

7. Transaction Fees

- Blockchain Transaction Fees: Depending on the blockchain platform used (e.g., Ethereum, Binance Smart Chain), there will be transaction costs (gas fees) for creating and transferring tokens.

Cost Range: Typically low per transaction, ranging from a few cents to $100+ per transaction (depending on blockchain and network congestion) Duration: Per transaction (ongoing)

Notes: These fees are lower than traditional real estate transaction fees but should be considered in the cost structure.

Total Estimated Costs for Tokenizing Real Estate

- Small/Low-Value Property: Tokenizing a smaller property or single-unit asset might cost between $100,000 and $300,000 in total, depending on the complexity.

- Mid-Range Property: For a larger property or a more complex project with multiple investors, the cost may range from $300,000 to $800,000+.

- Large, High-Value Property: For large commercial developments or multi-property tokenization projects, costs can easily exceed $1 million, especially if you’re building a custom platform or requiring significant legal and compliance work.

Duration

The overall duration to complete the tokenization process for real estate typically ranges from 3 to 12 months, depending on the complexity of the project, the property involved, and regulatory requirements. Smaller or simpler projects could be tokenized more quickly (3–6 months), while large-scale or complex properties may take longer (6–12 months or more).

Tokenizing real estate can be a costly and time-consuming process, but the potential benefits such as fractional ownership, liquidity, and global access to real estate investmentscan make it a highly attractive option for both property owners and investors. The costs will vary based on the scale and complexity of the project, but a budget of $100,000 to $1 million or more is typical for tokenizing real estate assets, with a timeline of several months to a year.

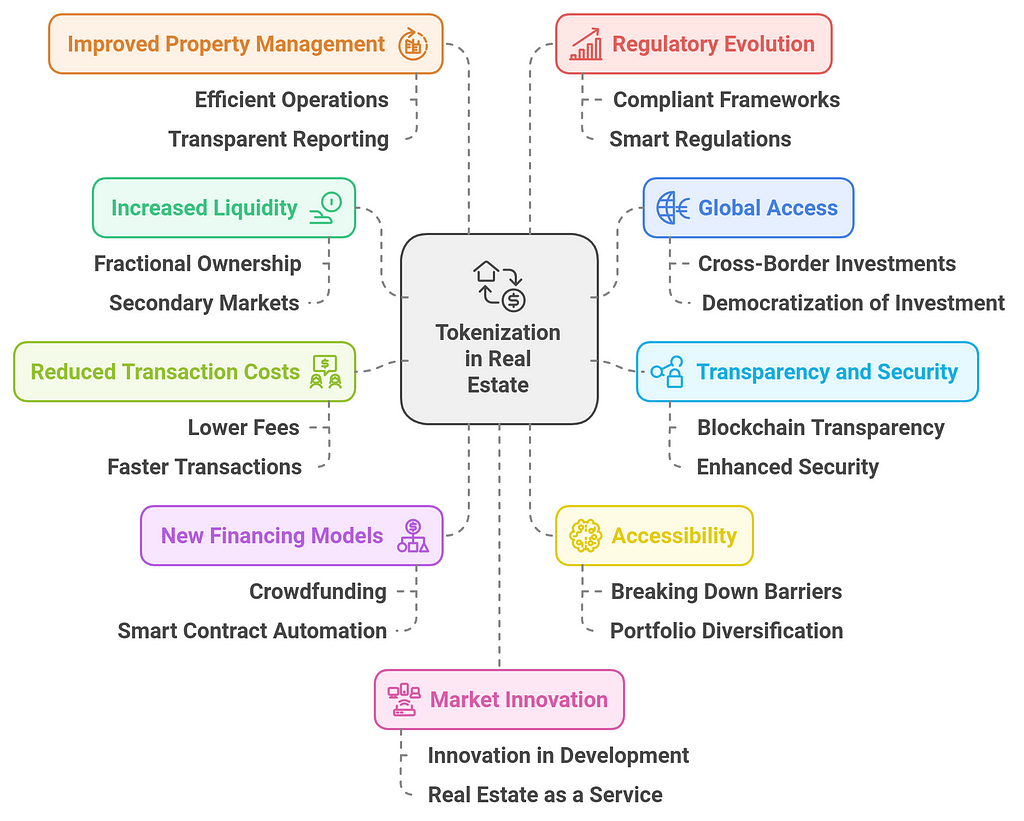

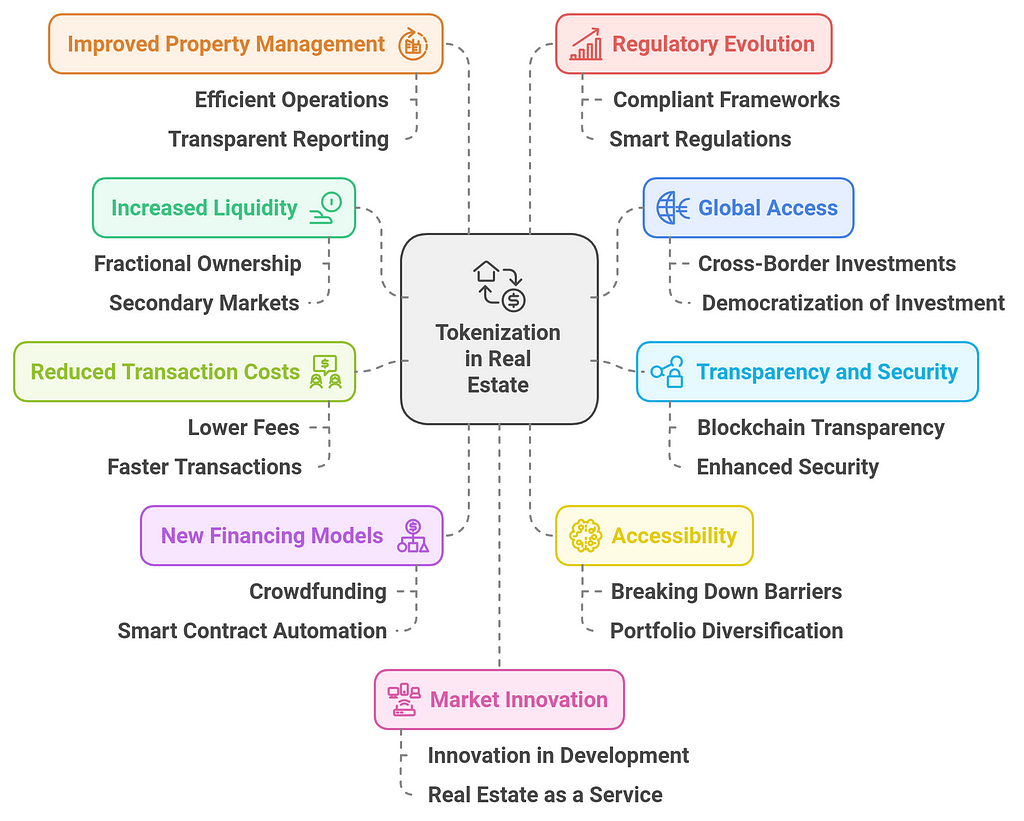

Is Tokenization the Future of Real Estate?

Yes, tokenization is increasingly seen as a significant part of the future of real estate. The integration of blockchain technology into the real estate sector has the potential to revolutionize how properties are bought, sold, and managed. Tokenization allows real estate assets to be broken down into smaller, tradable units, known as tokens, which represent fractional ownership of a property. This offers numerous advantages that could reshape the industry over the next decade. Here’s why tokenization is considered the future of real estate:

1. Increased Liquidity

1. Increased Liquidity

- Fractional Ownership: Tokenization allows real estate to be split into smaller units (tokens), making it accessible to a wider range of investors. This fractional ownership eliminates the need for large capital outlays typically required for real estate investment, opening up the market to retail investors.

- Secondary Markets: Blockchain enables the creation of secondary markets where tokens can be traded, which increases liquidity compared to traditional real estate investments that are often illiquid. Investors can buy and sell tokens more easily, enabling faster exits and more dynamic investment opportunities.

2. Global Access to Real Estate

- Cross-Border Investments: Tokenization removes geographic barriers, enabling international investors to access real estate markets around the world. Whether you’re interested in high-value properties in New York or emerging markets in Asia, tokenized real estate allows seamless cross-border transactions, which is a game-changer for global investment.

- Democratization of Investment: Investors from different parts of the world can buy tokens representing properties in markets they would otherwise be unable to access due to regulatory constraints or lack of local knowledge.

3. Transparency and Security

- Blockchain’s Transparency: Blockchain technology provides an immutable ledger of transactions. Each token and its ownership are recorded on a public blockchain, providing a transparent record of ownership, transaction history, and asset performance. This transparency can help reduce fraud, disputes, and other risks associated with real estate transactions.

- Enhanced Security: Real estate tokenization offers improved security due to the inherent characteristics of blockchain technology. Tokenized assets are less susceptible to fraud, and the use of smart contracts can automate processes like transfers and rental distributions, ensuring that all parties adhere to agreed terms.

4. Reduced Transaction Costs

- Lower Fees and Intermediaries: Tokenization reduces the reliance on intermediaries such as brokers, banks, and title companies, which typically charge high fees in traditional real estate transactions. The automation provided by smart contracts can streamline processes such as property transfers, tax management, and income distributions, reducing the cost of doing business.

- Faster Transactions: Blockchain transactions occur much faster than traditional real estate transactions, which can take weeks or months. Tokenized transactions can be completed in a matter of hours, accelerating the buying, selling, and transferring processes.

5. Unlocking New Financing Models

- Crowdfunding and Syndication: Tokenization can enable new forms of crowdfunding and real estate syndication, where multiple small investors pool their resources to invest in larger, more expensive properties. Tokenization simplifies the management of these collective investments, making it easier to distribute income and handle investor relations.

- Smart Contract Automation: By automating financial and legal agreements via smart contracts, tokenization can create more efficient financing models. Investors could automatically receive rental income, profit shares, or interest from real estate assets, all tracked through blockchain.

6. Accessibility and Lower Minimum Investment

- Breaking Down Barriers: Traditional real estate investments often require significant capital upfront, which limits access to only wealthier individuals or institutional investors. Tokenization lowers these barriers, allowing people to invest with smaller amounts, potentially as little as a few hundred dollars.

- Portfolio Diversification: Investors can diversify their portfolios by purchasing fractions of multiple properties, reducing exposure to risk compared to investing in a single real estate asset. This increased diversification can be particularly attractive to smaller investors.

7. Improved Property Management