The Chelsea vs Tottenham live stream sees Blues boss Mauricio Pochettino welcoming his old side to Stamford Bridge. Here’s how to watch from anywhere.

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

Chelsea vs Tottenham live stream: How to watch Premier League game online

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

Pike Finance admits to error following $1.7 million exploit, denies fault of USDC

On May 1, DeFi protocol Pike Finance corrected its description of a recent exploit and said it was not caused by a USDC vulnerability, as previously stated.

According to the company’s latest statement:

“The term ‘USDC vulnerability’ was inaccurate for summarizing last week’s exploit.”

Instead, weaknesses in Pike’s contract functions, particularly issues related to the handling of transfers on Circle’s Cross-Chain Transfer Protocol (CCTP), allowed the incident to occur.

It added that the root cause of the exploit was unrelated to the “functionality and robustness” of Circle’s USDC enabled by CCTP or Gelato — a smart contract automation protocol.

Pike Finance originally admitted full responsibility in its explanation of the first April 26 attack, noting the exploit was a “consequence of the protocol [team’s] improper integration” of third-party technologies and that the responsibilities for certain checks lay “solely on Pike as an integrator.”

However, when retrospectively referring to the first attack following the April 30 incident, it misleadingly said it may have been related to a “USDC vulnerability.”

Each attack led to sizeable losses for Pike Finance.

The April 30 attack saw the theft of 99,970.48 ARB, 64,126 OP, and 479.39 ETH. The incident resulted in a loss of $1.7 million, according to Certik data.

The earlier April 26 attack involved the loss of 299,127 USDC on Ethereum, Arbitrum, and Optimism, according to Pike Finance statements.

Cause of each attack

The first attack on April 26 resulted from functions related to USDC transfers on CCTP as automated by Gelato. The vulnerability allowed attackers to change the receiver’s address and amounts, which Pike Finance processed as valid due to its improper integration of the features.

Pike Finance said that its auditing partner, OtterSec, informed it of the issue. The protocol added that it was unable to address the vulnerability before the attack.

The second attack occurred after Pike Finance upgraded its spoke contracts to pause the network. The update ultimately caused the contract to behave as if it were uninitialized, allowing attackers to upgrade the contract, bypass admin access, and withdraw funds.

Pike Finance is one of many DeFi projects that have fallen victim to exploits. However, April showed reduced losses from scams and exploits, according to recent reports.

The post Pike Finance admits to error following $1.7 million exploit, denies fault of USDC appeared first on CryptoSlate.

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Solana (SOL) co-founder Raj Gokal is naming two blockchains that have a head start in the sovereign blockchains crypto sub-sector.

At a TOKEN2049 panel discussion, Gokal says that Avalanche (AVAX) and Cosmos Hub (ATOM) are “the clear winners” with regard to sovereign blockchains.

A sovereign blockchain is typically under the control of a single entity, unlike public blockchains such as Bitcoin (BTC) which are decentralized.

According to Gokal, Cosmos Hub and Avalanche have some differences that set them apart.

“Cosmos is an old-school project and it’s not that coordinated. I think Avalanche brings the coordination and the ability for developers to configure their own chains how they want. So I like that about their design. And obviously, it’s a function of Emi’s [Gün Sirer] DNA and his great vision as a founder.”

On the Avalanche founder Emin Gün Sirer, Gokal further says,

“I think Solana loves competition. We love fierce competition, we love honest competition from people who have ferocity about the ideas they’re bringing to the table.

And I think Emin is probably the most ferocious layer-1 [blockchain] founder that I know. And he never backs down from a fight. But he will shake your hand behind the stage and he’s friends with everyone. And he’s been very supportive of a lot of founders.

So I think as an individual I have a lot of respect for Emin and what he’s brought to the space.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains appeared first on The Daily Hodl.

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

Celestia (TIA) Price Targets $7 as Investors Pull Back

Celestia (TIA) is prone to further correction after consistently forming red candlesticks over the past few days. The saving grace is that investors are not too keen on saving the altcoin either.

The most likely outcome for TIA is a five-month low since it follows the cues set by Bitcoin, which dropped below $60,000.

Celestia Investors Save Their Money

Celestia’s price decline resulted from the crypto market noting a bearish couple of days in the previous month. However, the broader impact has been on the traders who have opted to withdraw from the asset for now.

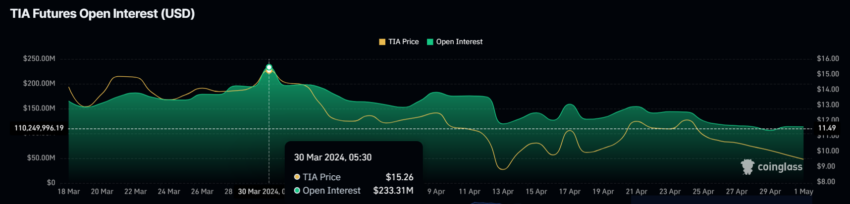

This is noted in the decline in the Open Interest (OI), which in the past month has been reduced by 50%. At the start of March, a total of $233 million worth of shorts and long contracts were opened in the market. This has since come down to $113 million, less than half of the original OI.

This shows that the investors only focus on profitable actions, which could take a while.

Celesita Open Interest. Source: Coinglass

Celesita Open Interest. Source: Coinglass

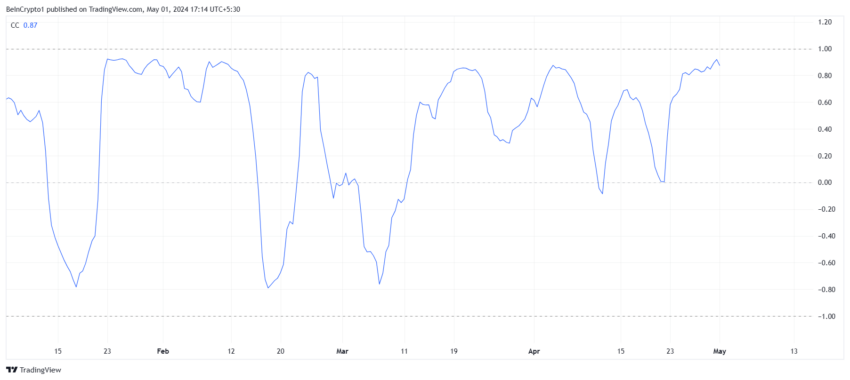

The reason behind this delay is the correlation that TIA shares with Bitcoin. A high correlation of 0.96 exhibits a tethered price action of both assets, with TIA following BTC’s cues. Currently, the world’s largest cryptocurrency is witnessing a bearish outlook, with Bitcoin’s price trading below $60,000.

Further decline in BTC is anticipated, and the condition of Celestia’s price is also the same. Thus, the altcoin could observe some drawdown in the coming days.

Celestia Correlation with Bitcoin. Source: TradingView

Celestia Correlation with Bitcoin. Source: TradingView

TIA Price Prediction: Drop to $7

Celestia’s price is testing the support marked at $9.2, which could fail to hold, resulting in a price correction to the next area of support at $8.3. But if this level breaks, it would validate the bearish thesis, causing the TIA price to correct further and hit $7.

Read More: Top 10 Aspiring Crypto Coins for 2024

Celestia Price Analysis Source: TradingView

Celestia Price Analysis Source: TradingView

However, if the $8.3 support floor holds strong enough to prevent a decline, TIA could bounce back. Reclaiming the $10 would wipe out half the losses noted and invalidate the bearish thesis.

The post Celestia (TIA) Price Targets $7 as Investors Pull Back appeared first on BeInCrypto.

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

DOJ launches probe into Block’s compliance history following allegations of lapses

Fintech giant Block is under scrutiny by federal prosecutors from the Southern District of New York following allegations of significant compliance failures involving its main business units — Square and Cash App, NBC News reported on May 1.

Federal prosecutors launched the probe after a former employee disclosed numerous lapses in the company’s transaction monitoring systems.

According to sources familiar with the matter, the former employee provided federal prosecutors with internal documents indicating that Square processed transactions with entities in nations under US sanctions, such as Cuba, Iran, Russia, and Venezuela.

Additionally, the documents allege that Block facilitated multiple crypto transactions for groups linked to terrorism, with these activities essentially going unreported to government agencies as mandated by law.

According to the report, the former employee alleged that Square and Cash App failed to collect and assess customer information adequately, hindering proper risk assessment. The former employee also claims the firm failed to rectify its procedures even after becoming aware of the breaches.

Multiple alleged failures

Block’s Square business unit allegedly failed to conduct customer due diligence on international merchant sellers and wrongfully reimbursed funds frozen for sanctions violations.

Furthermore, Block allowed new customers of Square and the consumer-focused service Cash App to transact even after they triggered sanctions alerts.

Square allegedly handled transactions involving entities in sanctioned countries, including Cuba, Iran, Russia, and Venezuela. Meanwhile, Block allegedly handled crypto transactions for terrorist groups.

The transactions were executed via credit cards, cash, and Bitcoin.

Block allegedly did not report the relevant transactions to the US government as required and did not correct its practices when alerted of the issues. Block’s senior management and board of directors supposedly knew of the various compliance failures.

Block also allegedly failed to collect sufficient information from Square and Cash App customers for risk assessment purposes. An outside consultant found nearly 50 deficiencies in Block’s internal systems, used for monitoring suspicious activity, rating customer risk, and screening sanctions violations.

Internal upheaval

A spokesperson for Block said the company has a “responsible and extensive compliance program,” and it “continually” addresses “emerging threats” and regulatory issues. Block also stated that its decision to hire an outside consultant demonstrates its commitment to compliance and said that 50 deficiencies are “not unusual.”

The firm also told the news outlet that it had already voluntarily reported thousands of the questionable transactions flagged by the former employee to the Office of Foreign Assets Control (OFAC), which later issued a no-action letter indicating that the regulator would not pursue administrative action against the firm.

However, the former employee claims the company failed to report “thousands” of other transactions.

According to NBC, the revelations have led to significant internal upheaval within Block, with recent announcements of unexpected board member departures further stirring concerns about the company’s governance and compliance culture.

Federal regulators and law enforcement continue to monitor the situation closely, as further investigations could lead to substantial penalties and necessitate comprehensive reforms within the company’s operations.

Alongside its support for traditional payments, Block is known for its extensive work with crypto. The company’s Cash App features support for Bitcoin, and it recently launched the Bitkey hardware wallet. It also has a crypto-mining initiative underway.

The post DOJ launches probe into Block’s compliance history following allegations of lapses appeared first on CryptoSlate.

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

CoreWeave raises $1.1B to expand its GPU cloud infrastructure network

CoreWeave’s new $1.1 billion investment will help bring its GPU cloud infrastructure to more places worldwide in support of AI development.Read More

CoreWeave’s new $1.1 billion investment will help bring its GPU cloud infrastructure to more places worldwide in support of AI development.Read More

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

Unity appoints ex-Zynga exec Matthew Bromberg as CEO

Game engine maker Unity has appointed Matthew Bromberg, former COO of Zynga, as its new CEO.Read More

Game engine maker Unity has appointed Matthew Bromberg, former COO of Zynga, as its new CEO.Read More

Published in B&T Latest News 1 May, 2024 by The bizandtech.net Newswire Staff

68% of Main Street SMBs Leveraging Social Media See Increasing Revenues

Since April 2021, most Main Street small to mid-sized businesses (SMBs) in the U.S. have been experiencing significant growth.

In fact — according to PYMNTS Intelligence’s latest SMB Growth Monitor Report, “Main Street Small Business Growth Exceeds GDP for First Time in Two Years — growth in 2023 was so strong it reversed a two-year trend in which Main Street SMB growth trailed nominal GDP growth.

In 2021, the nominal GDP growth was 12% — nearly three times the 3.2% growth rate these SMBs reported. And although nominal GDP growth dropped the following year to 7.1%, it still outpaced the 5.5% growth rate Main Street SMBs reported in 2022.

The growth Main Street SMBs saw last year was especially evident in those businesses operating in the hospitality sector. Thanks in a large part to consumers embracing a post-pandemic peace of mind, hospitality-focused SMBs saw revenues climb by 11% in 2023.

And although no other Main Street SMB doing business in other sectors could match the earnings that hospitality businesses reported, PYMNTS Intelligence did note that many Main Street SMBs saw improved earnings by investing in innovation.

For instance, those SMBs that broadened the types of payments they accepted (both in-store and online) did better than those with narrower payment options. Those Main Street SMBs reporting growth in 2023 accepted an average of 6.4 payment types, while those reporting decreasing revenues last year accept 4.7 payment types.

Similarly, those Main Street SMBs that provide customers with access to more sales channels also appear to be the ones who are seeing increasing revenues.

Simply put, by offering consumers more ways to close deals, businesses are giving them more ways to spend their money. Those Main Street SMBs that enable shopping via websites and social media channels (in addition to their in-person retail locations), report seeing increasing revenues as a result. Those efforts to diversify their sales to include online shopping are paying off: Since January 2023, online sales account for 55% of Main Street SMBs’ sales.

As the chart illustrates, Main Street SMBs with increasing revenues are more likely to sell their products online than those businesses with decreasing revenues. Businesses with growing revenues are more likely to reach their customers via social media (68%), mobile apps (27%) and websites (60%) than businesses with stagnating or decreasing revenues.

As social media selling is prominent among SMBs with increasing revenue, it seems that some Main Street SMBs are innovating to catch those customers who are perpetually online — and finding success.

The post 68% of Main Street SMBs Leveraging Social Media See Increasing Revenues appeared first on PYMNTS.com.