Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

Haliey Welch Says She’s Ready To Cooperate and Uncover Truth After HAWK Investors File Lawsuit Against Project

A 22-year-old social media influencer accused of pulling a crypto rug pull scam says she’s ready to cooperate and uncover the truth after a class action lawsuit was filed against her.

In a new thread on the social media platform X, Haliey Welch – known as the “Hawk Tuah” girl after a clip of her went viral earlier this year – says she’s fully committed to resolving the issue.

“I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community. I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the truth, hold the responsible parties accountable, and resolve this matter.”

Welch recently launched HAWK, a Solana (SOL)-based memecoin that lost 95% of its value just a few hours after its launch, leading to accusations of her conducting a rug pull scam.

A rug pull scam is when the creators of a new token intentionally inflate its price and then sell the large amounts they are holding, causing the asset to plummet and leaving investors holding the bag.

Earlier this week, New York-based Burwick Law said it filed a federal lawsuit against Welch on behalf of HAWK investors.

“This case involves claims related to investor protections under federal law and the HAWK TUAH memecoin HAWK launched on December 4, 2024.”

HAWK is trading for $0.00003409 at time of writing, a 2.1% decrease on the day. At its peak, it was valued at $0.00008917.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Haliey Welch Says She’s Ready To Cooperate and Uncover Truth After HAWK Investors File Lawsuit Against Project appeared first on The Daily Hodl.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

$4,500,000 To Be Handed Out With No Strings Attached As US Country Prepares To Launch Guaranteed Income Pilot Program: Report

A Californian county is preparing to launch a multi-million dollar guaranteed income pilot program, according to a new report.

The Richmond Confidential says Contra Costa County has allocated funds for a guaranteed income pilot program giving up to $1,000 per month to 250 residents for a period of one and a half years.

The program, which could kick off by the end of 2025, will target homeless residents, young people transitioning from foster care, low-income households with young kids and newly released convicts.

Contra Costa County’s Board of Supervisors allocated funding for the guaranteed income pilot program last month.

The funding will be drawn from a countywide sales tax known as Measure X that was approved by voters in the 2020 general election. Revenue generated from a statewide criminal justice reform bill is also another source of the program’s funding.

Currently, Contra Costa County officials are fleshing out the program’s details including the selection and application processes of potential participants.

The report cites Measure X Community Advisory Board member Rachel Rosekind, who says the pilot program aims to transform lives.

“The idea is to really make a transformative investment in our residents. And so to think about all the different ways to do that in terms of how long, how much, who are we investing in.

We want to really uplift and change not just the lives of these residents, but the lives of their families, the fabric of their communities.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $4,500,000 To Be Handed Out With No Strings Attached As US Country Prepares To Launch Guaranteed Income Pilot Program: Report appeared first on The Daily Hodl.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

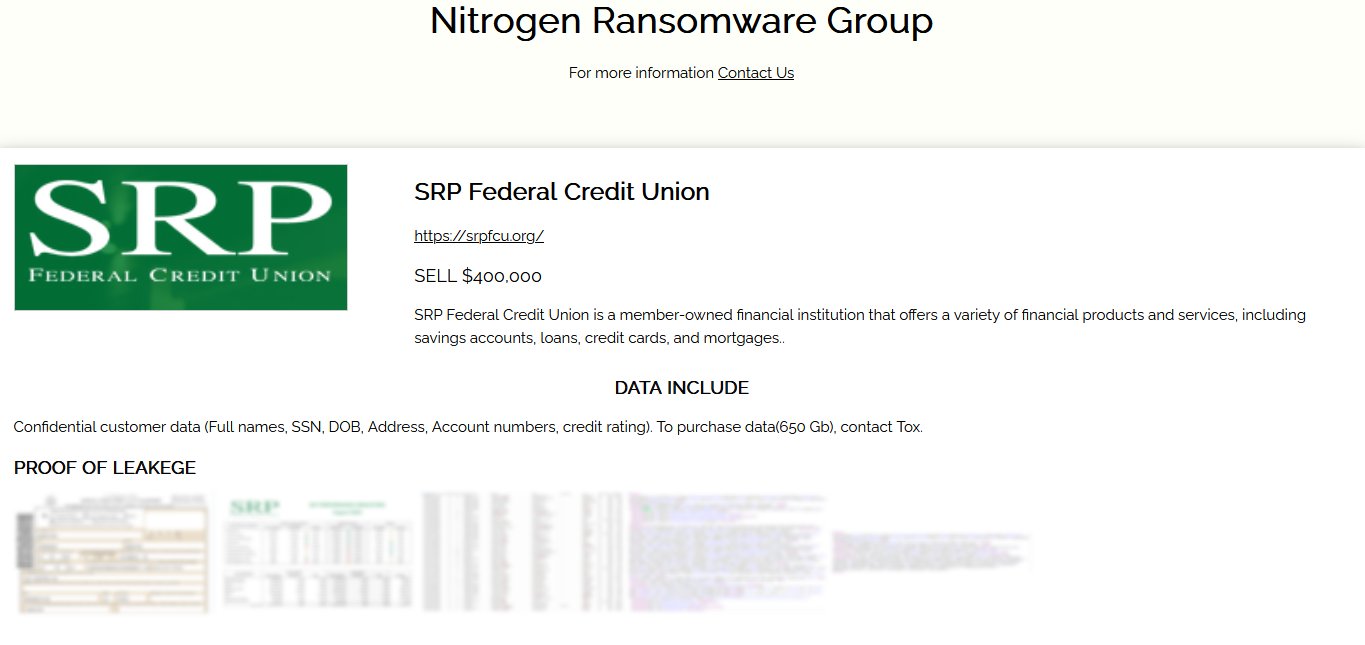

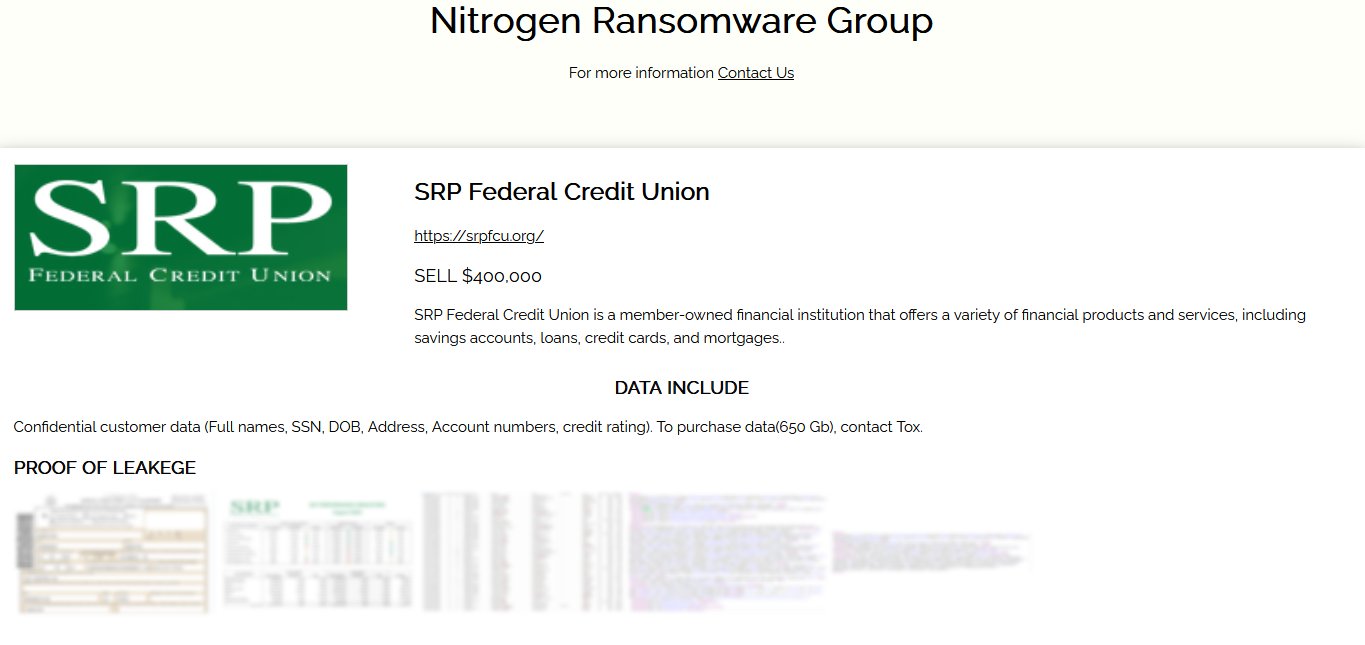

240,000 Credit Union Customers Exposed As Hackers Access Trove of Sensitive Data: Report

A South Carolina credit union says 240,000 customers have been exposed in an apparent cyberattack.

SRP Federal Credit Union, one of the largest in the state with over $1.6 billion in assets as of 2022, filed breach notifications with regulators in Maine and Texas on December 13th, The Record reports.

A law enforcement investigation discovered hackers had accessed the bank’s internal systems multiple times between September 5th and November 4th, 2024. SRP says the hackers “potentially acquired certain files from our network during that time.”

While SRP hasn’t publicly stated what specific information was stolen from them, The Record reports that the credit union told Texas regulators that Social Security numbers, driver’s license numbers, dates of birth and financial information like account numbers as well as credit or debit card numbers are compromised.

According to cyber security management and threat analysis firm Hackmanac, a well-known ransomware group called Nitrogen took credit for the attack, which claimed to also have customers’ full names and credit ratings.

“Nitrogen ransomware group claims to have breached SRP Federal Credit Union.

Allegedly, 650 GB of confidential customer data, including full names, SSNs, DOBs, addresses, account numbers, and credit ratings, were exfiltrated.”

Source: Hackmanac/X

Source: Hackmanac/X

Despite Nitrogen’s claims, SRP has not said whether it was a ransomware attack, and reportedly told regulators that the hack didn’t impact its online banking system or core processing systems.

Earlier this year, Nitrogen took credit for six other victims, including five US firms and one Canadian company, according to Hackmanac.

Several law firms are now investigating claims from SRP customers in regard to the breach.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post 240,000 Credit Union Customers Exposed As Hackers Access Trove of Sensitive Data: Report appeared first on The Daily Hodl.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

Russia, India and South Africa Say BRICS Not Seeking to Weaken US Dollar: Report

Three BRICS countries are uniting in sending a message to President-elect Donald Trump about the economic bloc’s alleged de-dollarization efforts.

Last year, reports surfaced that BRICS is creating a common currency backed by gold and potentially additional precious metals and assets in an effort to circumvent USD.

But now, there’s an apparent reversal.

Russian diplomat Sergey Ryabkov says BRICS is willing to sit down with Trump to clarify that the group of economically aligned nations has no intention to undermine the US dollar’s status as the world’s reserve currency, reports state-owned agency TASS.

“We are ready to explain to Trump, or anyone else, that we are not encroaching on the dollar. We are drawing conclusions from the irresponsible and fundamentally flawed policy that Washington has pursued in this area under successive administrations, not excluding Mr. Trump’s first administration.”

Fellow BRICS nation India is also expressing the same sentiment. External Affairs Minister S Jaishankar says it would be detrimental for India to join any effort that seeks to erode the dollar’s strength given that the US is its biggest trading partner.

“Where the BRICS remarks were concerned, we have said that India has never been for de-dollarization, right now there is no proposal to have a BRICS currency. The BRICS do discuss financial transactions… The US is our largest trade partner, we have no interest in weakening the dollar at all.”

And South Africa says reports about the development of a BRICS currency designed to dethrone the US dollar have been misinterpreted.

“Recent misreporting has led to the incorrect narrative that BRICS is planning to create a new currency. This is not the case. The discussions within BRICS focus on trading among member countries using their own national currencies.”

The statements issued by Russia, India and South Africa come after Trump issued an ultimatum against BRICS earlier this month, saying that the US will not sit idly while a group of nations come after the dollar.

“The idea that the BRICS Countries are trying to move away from the dollar while we stand by and watch is OVER. We require a commitment from these countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar or, they will face 100% tariffs, and should expect to say goodbye to selling into the wonderful US economy.

They can go find another ‘sucker!’ There is no chance that the BRICS will replace the US dollar in international trade, and any country that tries should wave goodbye to America.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Russia, India and South Africa Say BRICS Not Seeking to Weaken US Dollar: Report appeared first on The Daily Hodl.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

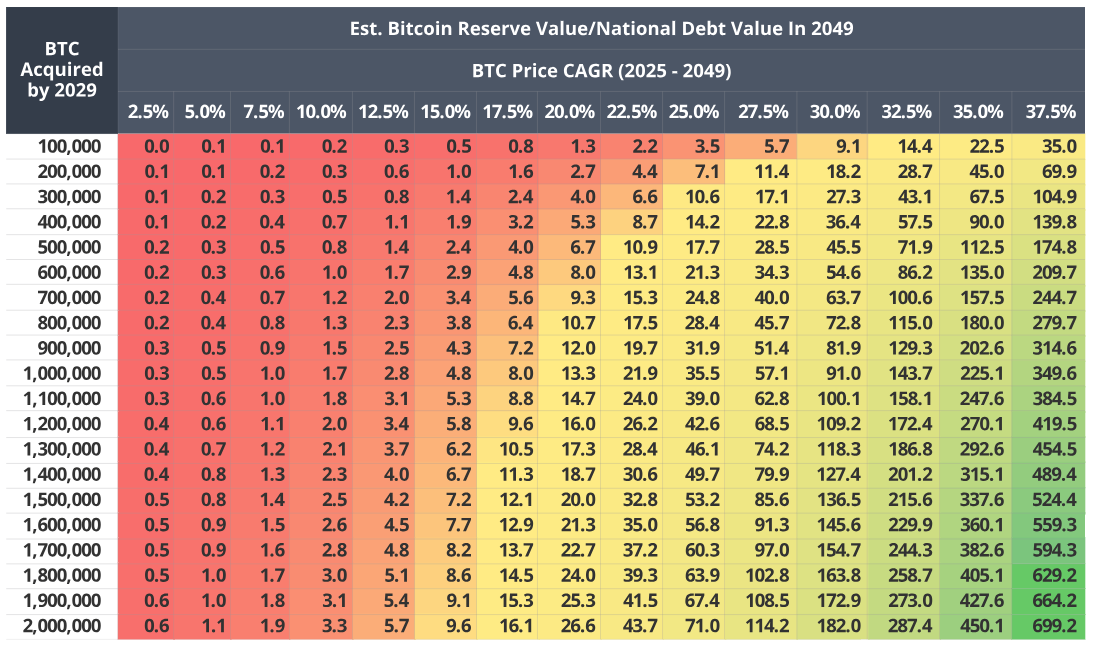

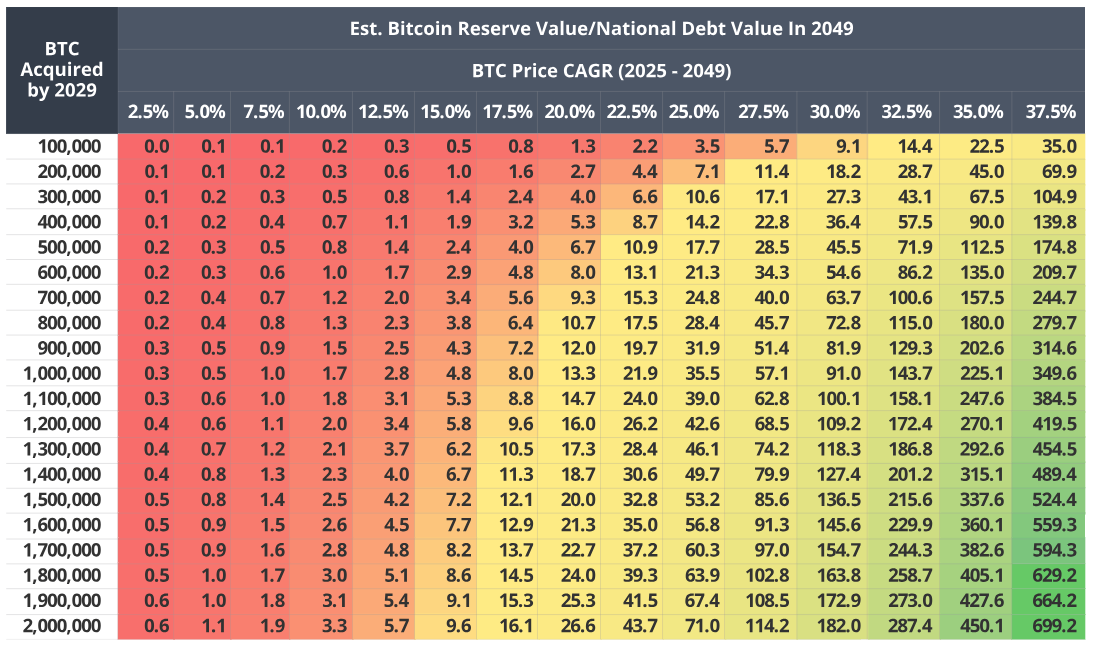

VanEck Argues That a Strategic Bitcoin Reserve Could Slash US Debt 36% by 2050

VanEck, a leading asset management firm, has recently projected that the United States could significantly cut its national debt by as much as 36% by 2050 through adopting a Strategic Bitcoin Reserve.

This initiative aligns with Senator Cynthia Lummis’s Bitcoin Act, which advocates for the US to amass 1 million bitcoins within the next five years. The lawmaker argues that such a reserve could place future generations on a more stable financial footing, free from debts they did not accrue or benefit from.

How a Bitcoin Reserve Could Transform US Debt Management by 2050

VanEck’s analysis supports this strategy, predicting that such an investment could cut national liabilities by an estimated $42 trillion by 2049. This projection assumes a consistent debt growth rate of 5% and an annual bitcoin appreciation rate of 25%.

In this scenario, Bitcoin’s value would skyrocket to over $42 million, making it a substantial player in the global financial arena by 2049.

“Assuming today’s $900 trillion of total global financial assets compound at 7.0% from 2025 – 2049, Bitcoin would represent 18% of global financial assets in this scenario,” the firm added.

US Bitcoin Reserve Value/National Debt Value in 2049. Source: VanEck

US Bitcoin Reserve Value/National Debt Value in 2049. Source: VanEck

Mathew Sigel, VanEck’s head of research, emphasized Bitcoin’s potential role in reshaping the global financial landscape. He suggested that Bitcoin might become the leading settlement currency in global trade – presenting an alternative to the US dollar – especially for countries seeking to sidestep US sanctions.

“It’s very possible bitcoin will be widely used as a settlement currency for global trade by countries who wanted to avoid the parabolic increase in USD sanctions that have been imposed,” Sigel wrote.

To kickstart this ambitious project, VanEck recommends several preliminary measures, including stopping the sale of Bitcoin from US asset forfeiture reserves.

Furthermore, they suggest that adjustments could be made under President Donald Trump’s incoming administration, such as revaluing gold certificates to their current market prices and using the Exchange Stabilization Fund to make initial Bitcoin purchases.

Indeed, these steps could help establish the reserve quickly without waiting for extensive legislative approval.

However, the proposal has met with some skepticism. Venture Capitalist Nic Carter has questioned whether a Bitcoin reserve would genuinely bolster the US dollar. Meanwhile, Peter Schiff proposes an alternative of the creation of a new digital currency called the USAcoin.

“The US could save a lot of money by creating USAcoin. Just like Bitcoin, the supply can be capped at 21 million, but with an upgraded blockchain to make USAcoin actually viable for use in payments,” Schiff suggested.

The post VanEck Argues That a Strategic Bitcoin Reserve Could Slash US Debt 36% by 2050 appeared first on BeInCrypto.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

All of Canoo’s employees are reportedly on a ‘mandatory unpaid break’

Image: Canoo

Days after furloughing dozens of its employees without pay, EV startup Canoo told the remainder of its staff they will be on a “mandatory unpaid break” through at least the end of the year, TechCrunch reported Friday. A company email seen by the outlet said employees would be locked out of Canoo’s systems by the end of Friday, with their benefits continuing through the end of this month.

The report follows Canoo’s announcement last week that it was idling its Oklahoma factories and furloughing employees while it worked “to finalize securing the capital necessary to move forward with its operations.” As TechCrunch notes, the company reported that it had only about $700,000 left in the bank last month.

Also on Friday, the company announced a 1-for-20 reverse stock split, effective December 24th. Canoo says the consolidation aims to keep its stock listed on the Nasdaq exchange and attract “a broader group of institutional and retail investors.”

Canoo was founded in 2017 to sell electric vans and trucks to adventure-seeking customers but has mostly only ever made vehicles for the US government. As The Verge’s Andrew Hawkins wrote last year, analysts have warned of its risk of insolvency as it’s teetered on the edge of running out of cash since 2022. Canoo has lost a steady stream of executives since then, including all of its founders and, more recently, its CFO and general counsel.

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

Independent Advisor Solutions Teams Up with Alternative Assets Firm Apollo

Independent Advisor Solutions Inc. —a wholly owned subsidiary of Wellington-Altus Financial Inc. —is pleased to announce a retail partnership with Apollo (NYSE: APO), a provider of alternative assets and retirement solutions. This latest collab aims to reinforce Independent Advisor Solutions’ dedication to forming deep relationships… Read More

Published in B&T Latest News

22 December, 2024 by The bizandtech.net Newswire Staff

Tether Planning To Launch Own AI Platform Next Year, According to CEO Paolo Ardoino: Report

Stablecoin company and USDT issuer Tether is reportedly planning to venture into the artificial intelligence (AI) space.

Tether CEO Paolo Ardoino is unveiling Tether’s vision to launch a platform that will enable people to interact with artificial intelligence using their mobile phones, reports Bloomberg.

Tether plans to launch the AI platform in the first quarter of 2025 as the company rakes in net profits of more than $10 billion this year.

Ardoino says at least half of the profits will be allocated to AI and other investments next year.

“Next year we plan to deploy at least half of the profits in investment. Our investment is just at the beginning.”

Data from CoinMarketCap shows that USDT now has a market cap of about $140 billion, up by nearly $50 billion this year. Demand for the dollar-pegged asset surged as the crypto market rallied with Bitcoin (BTC) breaching the six-digit mark.

In a report published earlier this month, Tether says the number of wallets holding USDT rose by 71% in 2024.

The firm says that at the start of Q4 2024, there were 109 million on-chain wallets holding USDT– more than twice the number of wallets holding Bitcoin. USDT also remains the leading stablecoin in terms of adoption with four times more wallets than all other stablecoins combined.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Tether Planning To Launch Own AI Platform Next Year, According to CEO Paolo Ardoino: Report appeared first on The Daily Hodl.

Source:

Source:

US Bitcoin Reserve Value/National Debt Value in 2049. Source:

US Bitcoin Reserve Value/National Debt Value in 2049. Source: