Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on What gardening zone am I in? Here’s how to check

What gardening zone am I in? Here’s how to check

Knowing what gardening zone you are in can help you choose the best plants for where you live, ensuring they have the best chance to thrive and survive.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Hong Kong’s leading bank, HSBC, is set to expand its footprint in tokenization of real-world assets. This move aims to provide customers with innovative digital products.

As part of its strategic plan, HSBC seeks to position the city as a forefront runner in digital finance, reinforced by recent government initiatives to increase public access to digital assets.

HSBC Wants to Stay Away From Crypto

This strategic expansion was highlighted following the introduction of the HSBC Gold Token. It stands as the first retail product of its kind in Hong Kong.

At a recent media roundtable, HSBC CEO Noel Quinn shared insights into the advantages of tokenization.

“Tokenisation is a more efficient trading mechanism and provides liquidity to that asset. In theory, you can tokenize anything. The key criterion for me is whether there is substance behind the token. Has it got predictability? Does it exist?,” Quinn said.

Tokenized products digitally represent assets on blockchain platforms. This method allows direct access for investors or distribution through intermediaries. The Securities and Futures Commission of Hong Kong has recognized that the tokenization of real-world assets is essential for modernizing trading and financial practices.

Read more: What is Tokenization on Blockchain?

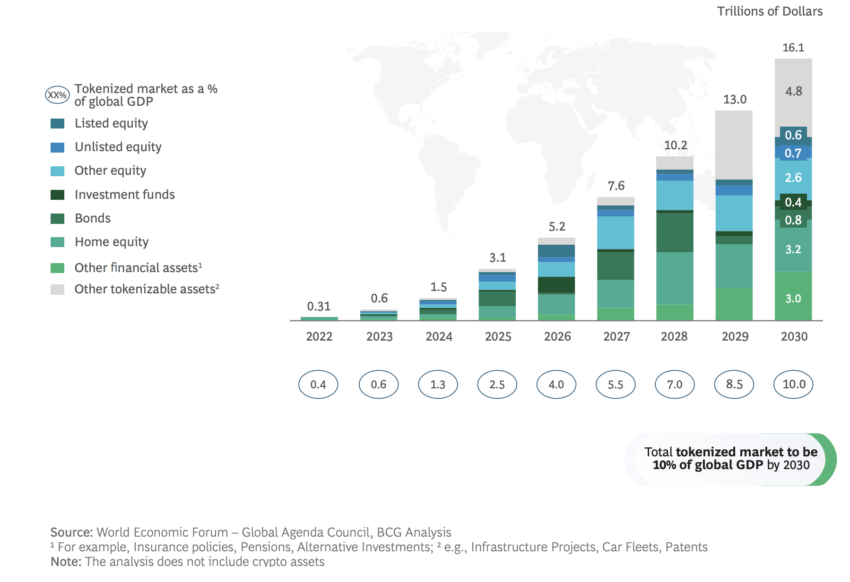

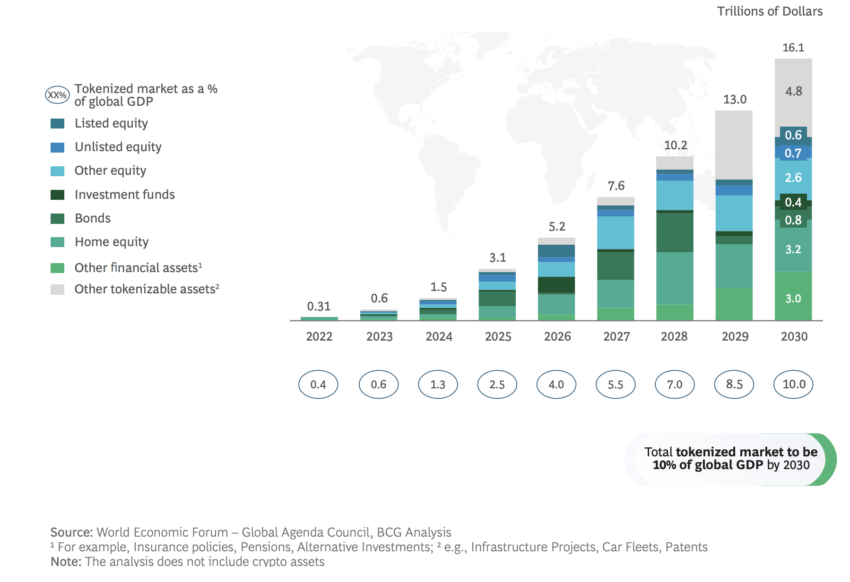

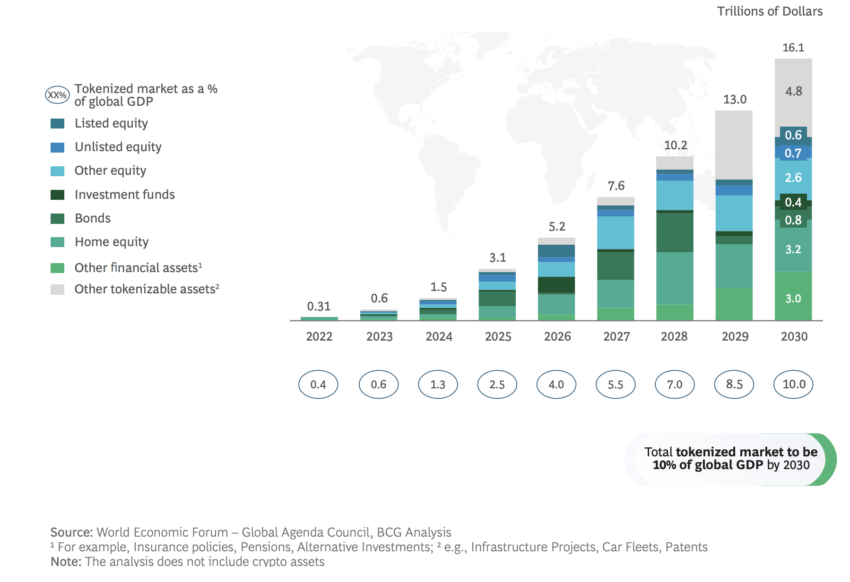

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Focusing on tangible assets such as gold and bonds, HSBC deliberately avoids cryptocurrencies.

“A cryptocurrency may be based on similar technology but is more volatile and unpredictable. HSBC would be staying away from crypto,” Quinn argued.

However, public blockchains like Ethereum require cryptocurrency to maintain transparency and decentralization. These are critical for powering decentralized financial systems, contrasting with the centralized models of traditional banks.

Moreover, as a part of a broader global movement, the Bank for International Settlements (BIS) and seven central banks have embarked on Project Agorá. This project aims to merge digital and traditional financial systems to optimize global financial operations.

The project addresses long-standing inefficiencies in cross-border payments by integrating tokenized commercial and central bank funds on a unified ledger. It enhances financial controls like anti-money laundering efforts.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Simultaneously, UK Finance is advancing its experimental ledger pilot to track banking payments involving major banks like Barclays, Lloyds, and Citigroup. This pilot is a step towards a commercial system that could use tokenized assets to make cross-border transactions smoother, faster, and more secure.

The post Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy appeared first on BeInCrypto.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on The best Amazon AU deals in April 2024

The best Amazon AU deals in April 2024

We’ve rounded up the top Amazon deals this week, from Amazon devices to phones, computing gear, home appliances, wearables and more.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

A widely followed on-chain analyst thinks that Bitcoin (BTC) bears are about to get wiped out following last week’s crypto correction.

Analyst Willy Woo tells his 1.1 million followers on the social media platform X that the most recent Bitcoin retracement to $60,000 flushed out leveraged longs.

Woo says he doesn’t see Bitcoin going down in a straight line as he believes that BTC bulls will defend the “formidable” short-term holder (STH) at $59,000. According to the analyst, the odds are higher that BTC will bounce and liquidate traders who shorted at around $70,000.

“We flushed out long leverage down to $60,000.

To liquidate lower, price would have broken the formidable $59,000 STH support, and a strong sign of a bear market.

More likely short liquidations to $71,000-$75,000 is next.

Short-term price is a walk of liquidations.”

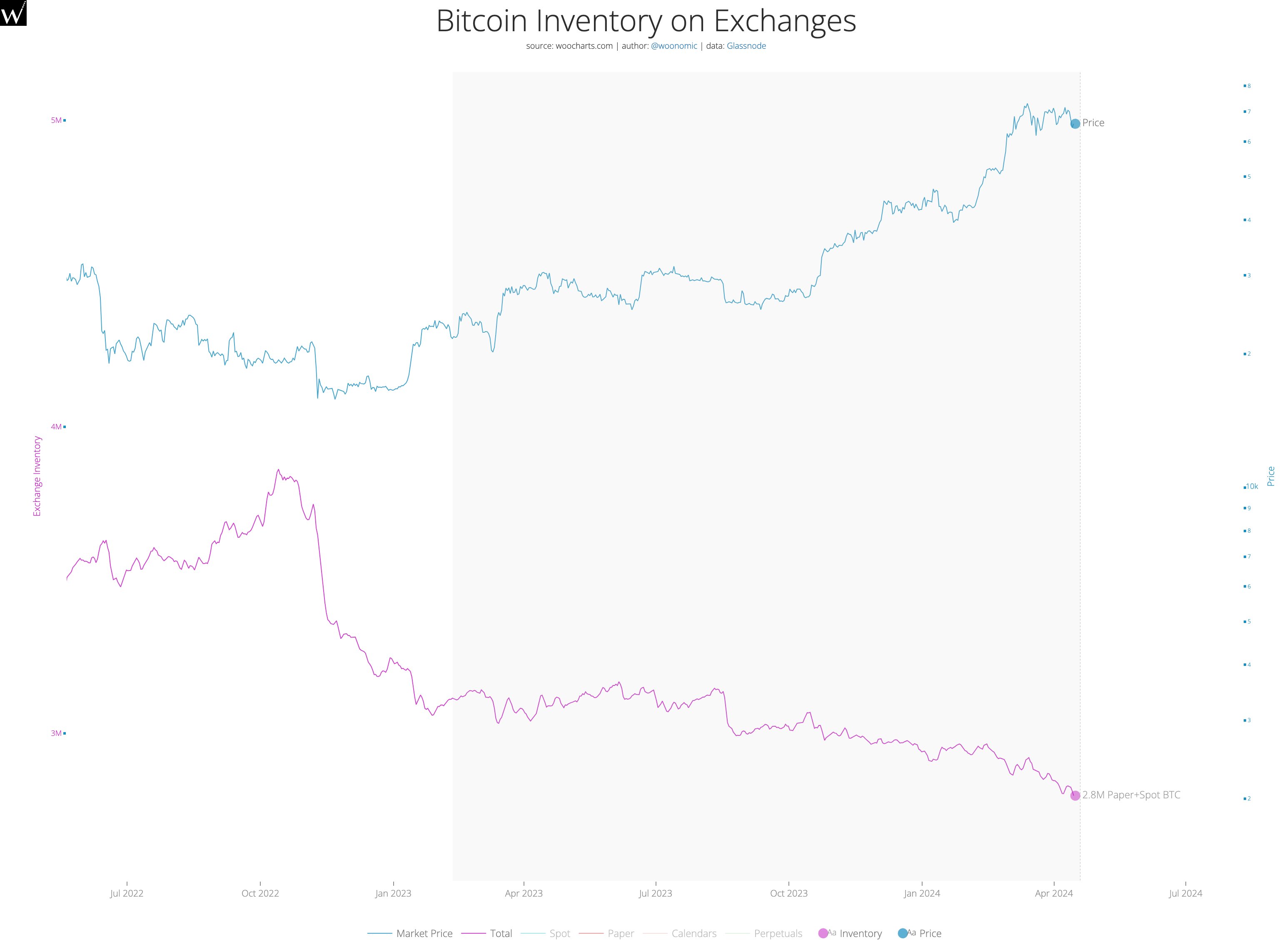

Woo is also keeping a close eye on the amount of Bitcoin supply available on crypto exchanges. According to the analyst, BTC’s inventory on exchanges has been on a downtrend since October 2022, suggesting that it’s only a matter of time before demand overwhelms supply and pushes Bitcoin to new all-time highs (ATH).

“Looking at views of demand and supply, this chart being only one of them, it’s just a matter of time before the accumulation happening throughout this consolidation squeezes us past ATH. Patience is key, don’t be degenerate.”

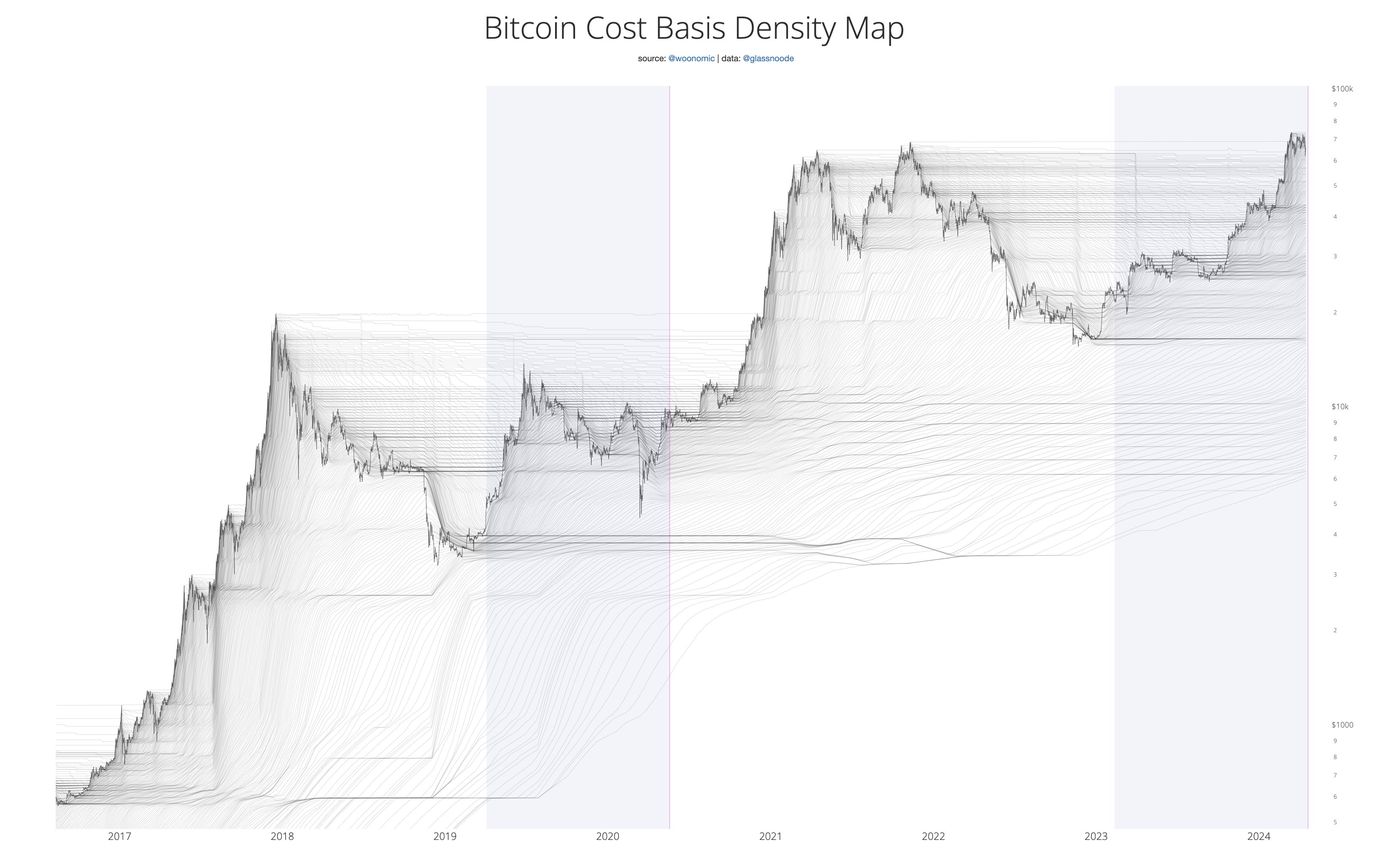

Woo also highlights that the current consolidation around the all-time highs is creating a solid support level for BTC. According to Woo, the ongoing accumulation between $60,000 and $70,000 is establishing a base of buyers that will secure BTC’s place as a trillion-dollar asset.

“Remember: the longer BTC consolidates around ATH, the more coins that change hands between investors cementing its price discovery.

This creates formidable long-term support once we break it.

Bitcoin as a trillion-dollar asset class is here to stay.

This is a good thing.”

At time of writing, Bitcoin is trading for $63,272, down nearly 4% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next appeared first on The Daily Hodl.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Google Pixel 8a vs. Pixel 8 — biggest expected differences

Google Pixel 8a vs. Pixel 8 — biggest expected differences

Our Google Pixel 8a vs. Pixel 8 comparison looks at likely differences between the two phones based on what Pixel 8a rumors say about the upcoming budget handset.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Which colors repel wasps? Here’s what the experts say

Which colors repel wasps? Here’s what the experts say

Experts say these are the colors to avoid if you want to keep your garden wasp-free this summer.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Billionaire Elon Musk has announced plans to charge new users on his social media platform, X (formerly Twitter), aiming to combat spam and scam bots.

However, this move has sparked considerable skepticism within the crypto community.

Why the Crypto Community Does not Like the Idea of Charging New X Users

After purchasing Twitter for $44 billion in 2022, Musk has frequently addressed the challenges posed by fake accounts and automated bots. On April 15, Musk explained on X that the platform would charge a small fee to tackle the bot accounts. He indicated that this fee might soon apply to basic functions such as posting, replying, and bookmarking.

“Unfortunately, a small fee for new user write access is the only way to curb the relentless onslaught of bots. The onslaught of fake accounts also uses up the available namespace, so many good handles are taken as a result,” Musk wrote.

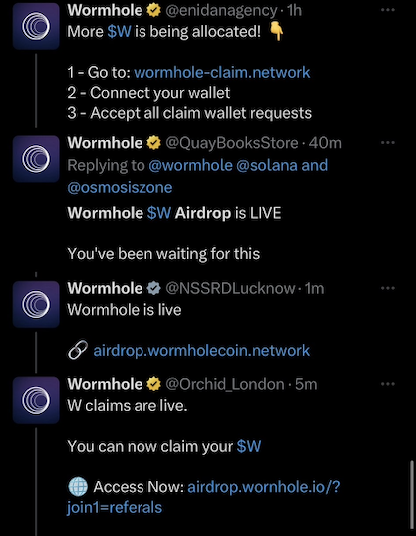

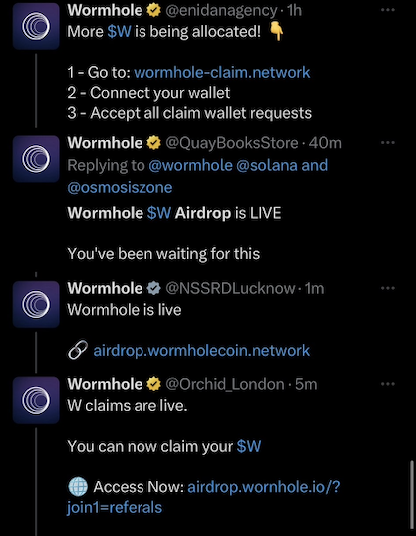

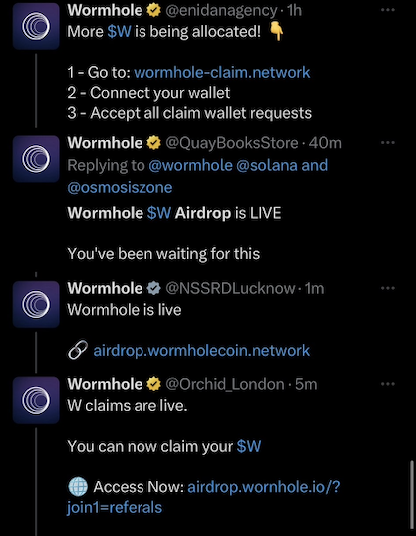

Despite these efforts, including a trial ‘Not A Bot’ subscription that charges $1 for new users in New Zealand and the Philippines, doubt remains. On-chain sleuth ZachXBT highlighted the persistence of scam operations, noting that the fees might not stop scammers. He stressed that scammers often pay significant amounts to obtain verified status, suggesting that a small entry fee is unlikely to deter them.

Moreover, some scammers also use government account badges. ZachXBT claims that there is an entire black market for it.

“There are hundreds of business verified scam accounts every week which scammers pay thousands of dollars for,” ZachXBT stated.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

Scammers Using Organization Verification Badge. Source: X (Twitter)

Scammers Using Organization Verification Badge. Source: X (Twitter)

Furthermore, crypto influencer Ansem criticized the plan’s effectiveness, arguing that stronger measures are necessary to address the problem effectively. He believes that while the fee might reduce casual spam, it does little to stop well-funded scammers and organized crime rings capable of treating such costs as business expenses.

“These scammers are printing infinite daily. They do not give af about paying pennies to make 5 figs+,” Ansem wrote.

Additionally, DeFi researcher Ignas suggested that Musk’s approach might prioritize financial gain over solving the issue. Since Musk took over Twitter, he has initiated various steps to cut costs and increase the platform’s profitability. Notably, he introduced the $8 fee for a verified X account.

Read more: Crypto Social Media Scams: How to Stay Safe.

Meanwhile, Musk’s other business, Tesla, is also undergoing significant financial adjustments. Amid a downturn in electric vehicle demand, Tesla has reportedly announced plans to reduce its workforce by “more than 10 percent.” This decision aims to eliminate duplication of roles and streamline operations.

The post Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate appeared first on BeInCrypto.

Published in B&T Latest News · Business Features 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft said it would invest $1.5 billion in G42, an Emirati company with ties to China, as Washington and Beijing maneuver to secure tech influence in the Gulf.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on What gardening zone am I in? Here’s how to check

What gardening zone am I in? Here’s how to check

Knowing what gardening zone you are in can help you choose the best plants for where you live, ensuring they have the best chance to thrive and survive.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Hong Kong’s leading bank, HSBC, is set to expand its footprint in tokenization of real-world assets. This move aims to provide customers with innovative digital products.

As part of its strategic plan, HSBC seeks to position the city as a forefront runner in digital finance, reinforced by recent government initiatives to increase public access to digital assets.

HSBC Wants to Stay Away From Crypto

This strategic expansion was highlighted following the introduction of the HSBC Gold Token. It stands as the first retail product of its kind in Hong Kong.

At a recent media roundtable, HSBC CEO Noel Quinn shared insights into the advantages of tokenization.

“Tokenisation is a more efficient trading mechanism and provides liquidity to that asset. In theory, you can tokenize anything. The key criterion for me is whether there is substance behind the token. Has it got predictability? Does it exist?,” Quinn said.

Tokenized products digitally represent assets on blockchain platforms. This method allows direct access for investors or distribution through intermediaries. The Securities and Futures Commission of Hong Kong has recognized that the tokenization of real-world assets is essential for modernizing trading and financial practices.

Read more: What is Tokenization on Blockchain?

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Focusing on tangible assets such as gold and bonds, HSBC deliberately avoids cryptocurrencies.

“A cryptocurrency may be based on similar technology but is more volatile and unpredictable. HSBC would be staying away from crypto,” Quinn argued.

However, public blockchains like Ethereum require cryptocurrency to maintain transparency and decentralization. These are critical for powering decentralized financial systems, contrasting with the centralized models of traditional banks.

Moreover, as a part of a broader global movement, the Bank for International Settlements (BIS) and seven central banks have embarked on Project Agorá. This project aims to merge digital and traditional financial systems to optimize global financial operations.

The project addresses long-standing inefficiencies in cross-border payments by integrating tokenized commercial and central bank funds on a unified ledger. It enhances financial controls like anti-money laundering efforts.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Simultaneously, UK Finance is advancing its experimental ledger pilot to track banking payments involving major banks like Barclays, Lloyds, and Citigroup. This pilot is a step towards a commercial system that could use tokenized assets to make cross-border transactions smoother, faster, and more secure.

The post Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy appeared first on BeInCrypto.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on The best Amazon AU deals in April 2024

The best Amazon AU deals in April 2024

We’ve rounded up the top Amazon deals this week, from Amazon devices to phones, computing gear, home appliances, wearables and more.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

A widely followed on-chain analyst thinks that Bitcoin (BTC) bears are about to get wiped out following last week’s crypto correction.

Analyst Willy Woo tells his 1.1 million followers on the social media platform X that the most recent Bitcoin retracement to $60,000 flushed out leveraged longs.

Woo says he doesn’t see Bitcoin going down in a straight line as he believes that BTC bulls will defend the “formidable” short-term holder (STH) at $59,000. According to the analyst, the odds are higher that BTC will bounce and liquidate traders who shorted at around $70,000.

“We flushed out long leverage down to $60,000.

To liquidate lower, price would have broken the formidable $59,000 STH support, and a strong sign of a bear market.

More likely short liquidations to $71,000-$75,000 is next.

Short-term price is a walk of liquidations.”

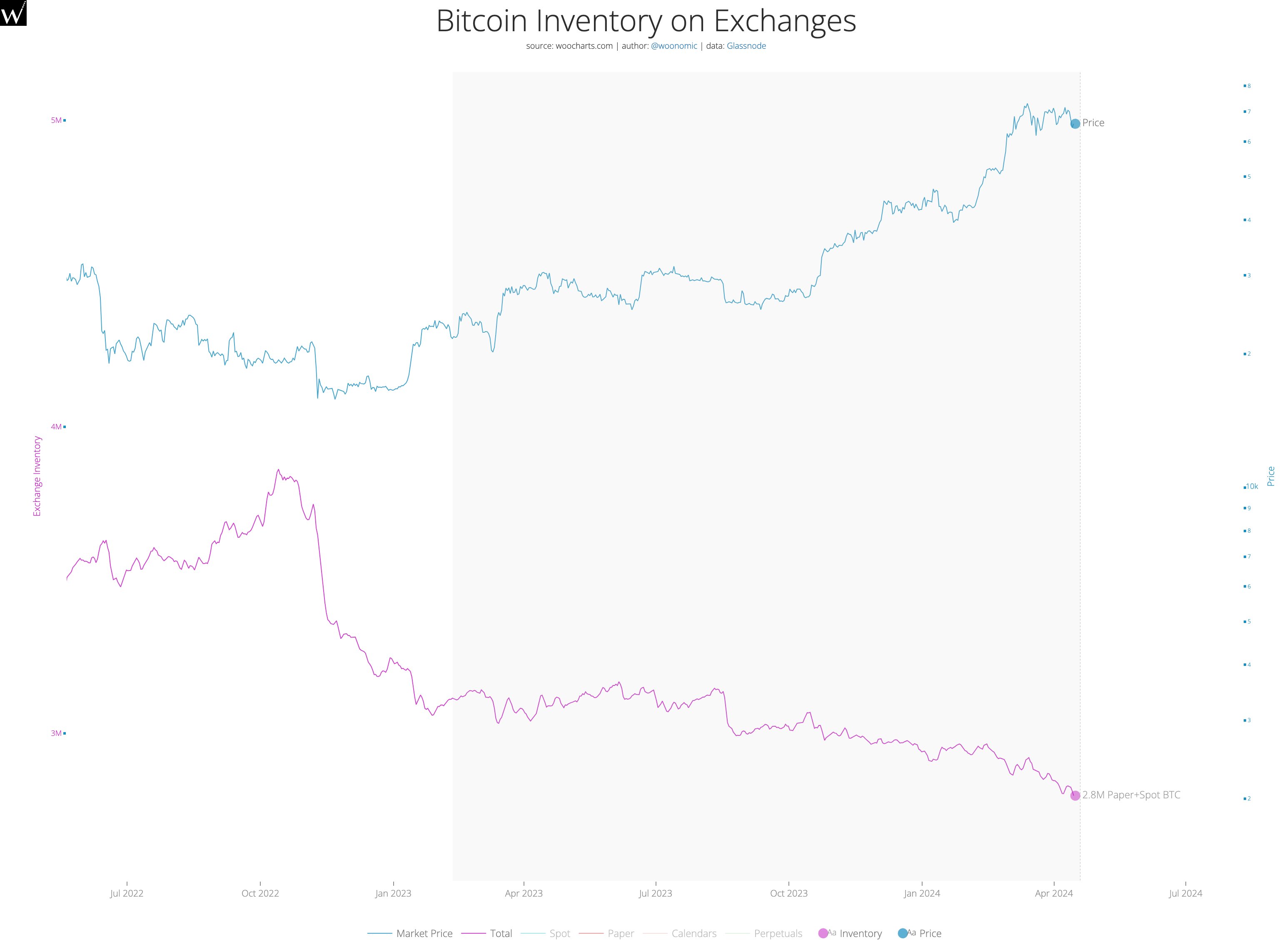

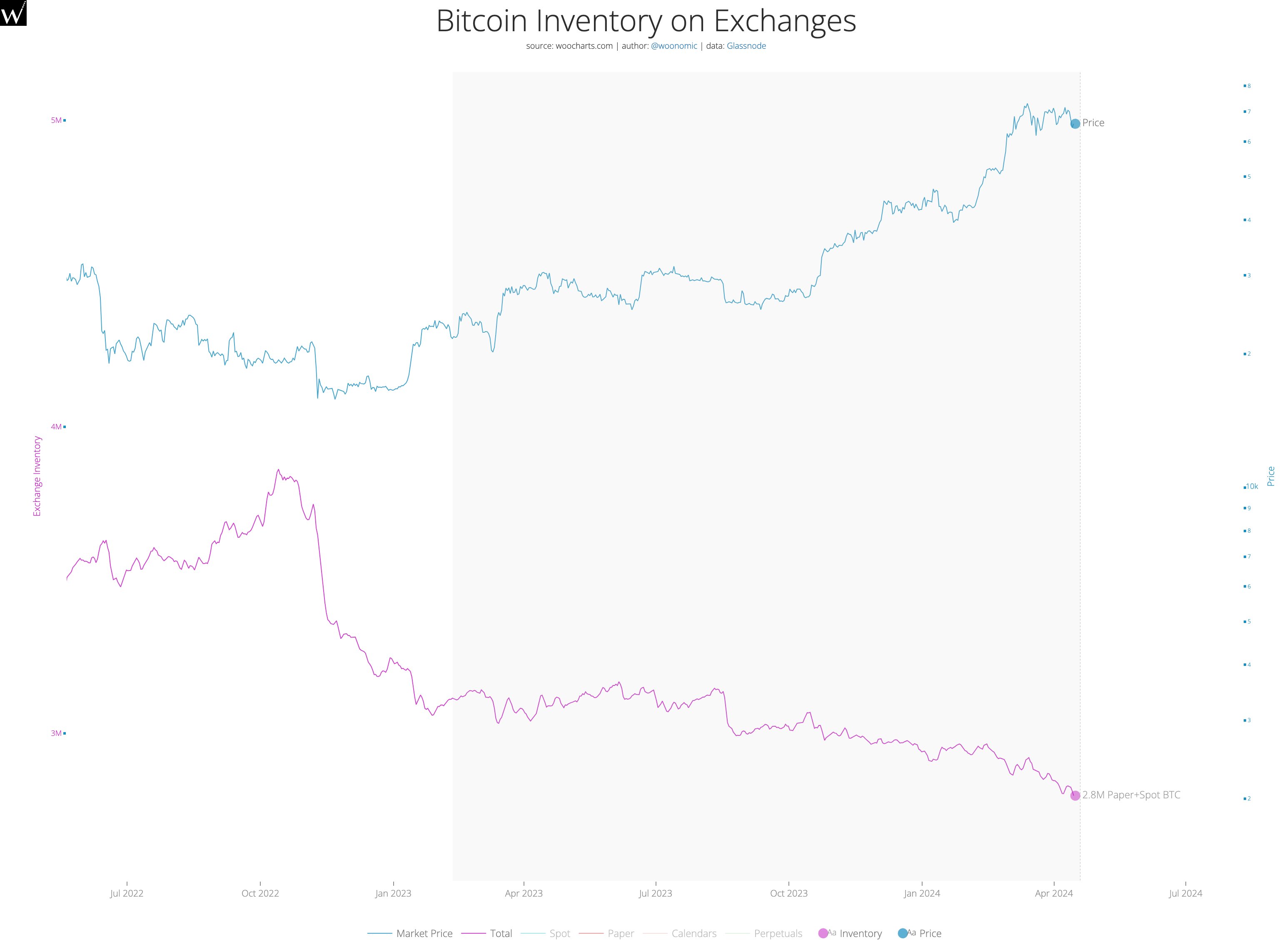

Woo is also keeping a close eye on the amount of Bitcoin supply available on crypto exchanges. According to the analyst, BTC’s inventory on exchanges has been on a downtrend since October 2022, suggesting that it’s only a matter of time before demand overwhelms supply and pushes Bitcoin to new all-time highs (ATH).

“Looking at views of demand and supply, this chart being only one of them, it’s just a matter of time before the accumulation happening throughout this consolidation squeezes us past ATH. Patience is key, don’t be degenerate.”

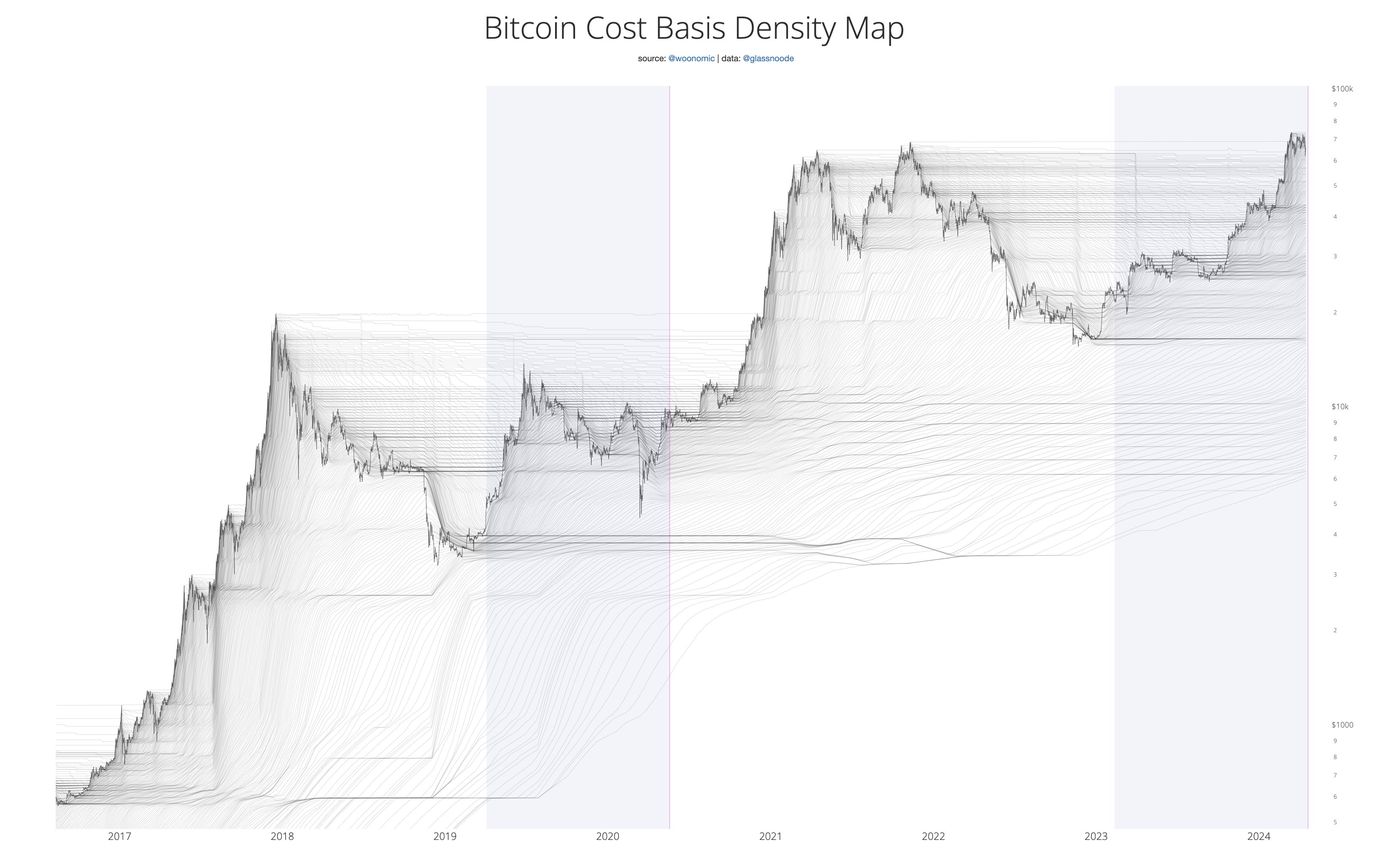

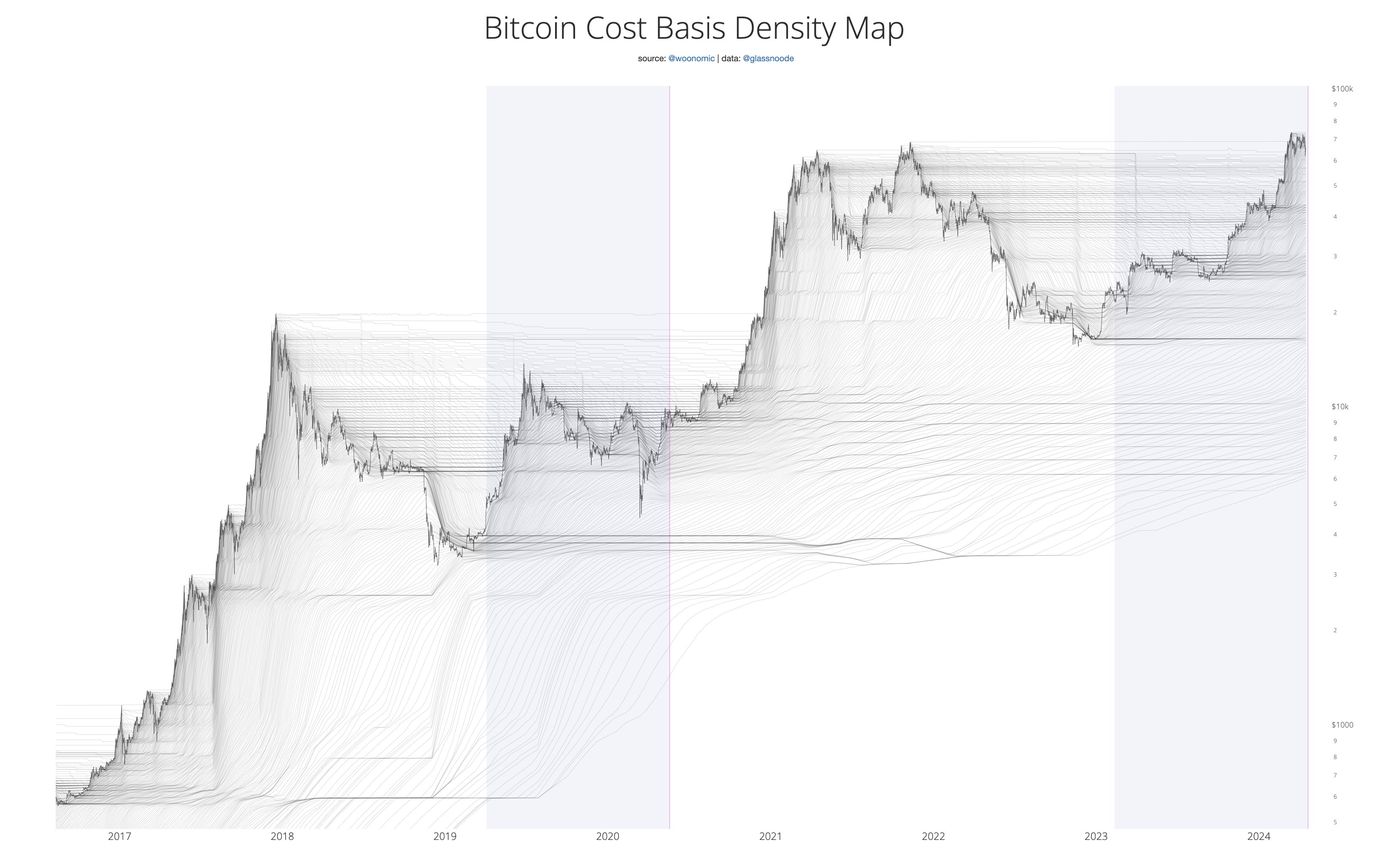

Woo also highlights that the current consolidation around the all-time highs is creating a solid support level for BTC. According to Woo, the ongoing accumulation between $60,000 and $70,000 is establishing a base of buyers that will secure BTC’s place as a trillion-dollar asset.

“Remember: the longer BTC consolidates around ATH, the more coins that change hands between investors cementing its price discovery.

This creates formidable long-term support once we break it.

Bitcoin as a trillion-dollar asset class is here to stay.

This is a good thing.”

At time of writing, Bitcoin is trading for $63,272, down nearly 4% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next appeared first on The Daily Hodl.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Google Pixel 8a vs. Pixel 8 — biggest expected differences

Google Pixel 8a vs. Pixel 8 — biggest expected differences

Our Google Pixel 8a vs. Pixel 8 comparison looks at likely differences between the two phones based on what Pixel 8a rumors say about the upcoming budget handset.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Which colors repel wasps? Here’s what the experts say

Which colors repel wasps? Here’s what the experts say

Experts say these are the colors to avoid if you want to keep your garden wasp-free this summer.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Billionaire Elon Musk has announced plans to charge new users on his social media platform, X (formerly Twitter), aiming to combat spam and scam bots.

However, this move has sparked considerable skepticism within the crypto community.

Why the Crypto Community Does not Like the Idea of Charging New X Users

After purchasing Twitter for $44 billion in 2022, Musk has frequently addressed the challenges posed by fake accounts and automated bots. On April 15, Musk explained on X that the platform would charge a small fee to tackle the bot accounts. He indicated that this fee might soon apply to basic functions such as posting, replying, and bookmarking.

“Unfortunately, a small fee for new user write access is the only way to curb the relentless onslaught of bots. The onslaught of fake accounts also uses up the available namespace, so many good handles are taken as a result,” Musk wrote.

Despite these efforts, including a trial ‘Not A Bot’ subscription that charges $1 for new users in New Zealand and the Philippines, doubt remains. On-chain sleuth ZachXBT highlighted the persistence of scam operations, noting that the fees might not stop scammers. He stressed that scammers often pay significant amounts to obtain verified status, suggesting that a small entry fee is unlikely to deter them.

Moreover, some scammers also use government account badges. ZachXBT claims that there is an entire black market for it.

“There are hundreds of business verified scam accounts every week which scammers pay thousands of dollars for,” ZachXBT stated.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

Scammers Using Organization Verification Badge. Source: X (Twitter)

Scammers Using Organization Verification Badge. Source: X (Twitter)

Furthermore, crypto influencer Ansem criticized the plan’s effectiveness, arguing that stronger measures are necessary to address the problem effectively. He believes that while the fee might reduce casual spam, it does little to stop well-funded scammers and organized crime rings capable of treating such costs as business expenses.

“These scammers are printing infinite daily. They do not give af about paying pennies to make 5 figs+,” Ansem wrote.

Additionally, DeFi researcher Ignas suggested that Musk’s approach might prioritize financial gain over solving the issue. Since Musk took over Twitter, he has initiated various steps to cut costs and increase the platform’s profitability. Notably, he introduced the $8 fee for a verified X account.

Read more: Crypto Social Media Scams: How to Stay Safe.

Meanwhile, Musk’s other business, Tesla, is also undergoing significant financial adjustments. Amid a downturn in electric vehicle demand, Tesla has reportedly announced plans to reduce its workforce by “more than 10 percent.” This decision aims to eliminate duplication of roles and streamline operations.

The post Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate appeared first on BeInCrypto.

Published in B&T Latest News · Business Features 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft said it would invest $1.5 billion in G42, an Emirati company with ties to China, as Washington and Beijing maneuver to secure tech influence in the Gulf.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on What gardening zone am I in? Here’s how to check

What gardening zone am I in? Here’s how to check

Knowing what gardening zone you are in can help you choose the best plants for where you live, ensuring they have the best chance to thrive and survive.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy

Hong Kong’s leading bank, HSBC, is set to expand its footprint in tokenization of real-world assets. This move aims to provide customers with innovative digital products.

As part of its strategic plan, HSBC seeks to position the city as a forefront runner in digital finance, reinforced by recent government initiatives to increase public access to digital assets.

HSBC Wants to Stay Away From Crypto

This strategic expansion was highlighted following the introduction of the HSBC Gold Token. It stands as the first retail product of its kind in Hong Kong.

At a recent media roundtable, HSBC CEO Noel Quinn shared insights into the advantages of tokenization.

“Tokenisation is a more efficient trading mechanism and provides liquidity to that asset. In theory, you can tokenize anything. The key criterion for me is whether there is substance behind the token. Has it got predictability? Does it exist?,” Quinn said.

Tokenized products digitally represent assets on blockchain platforms. This method allows direct access for investors or distribution through intermediaries. The Securities and Futures Commission of Hong Kong has recognized that the tokenization of real-world assets is essential for modernizing trading and financial practices.

Read more: What is Tokenization on Blockchain?

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Growth Potential For Real-World Asset Tokenization Market. Source: BCG

Focusing on tangible assets such as gold and bonds, HSBC deliberately avoids cryptocurrencies.

“A cryptocurrency may be based on similar technology but is more volatile and unpredictable. HSBC would be staying away from crypto,” Quinn argued.

However, public blockchains like Ethereum require cryptocurrency to maintain transparency and decentralization. These are critical for powering decentralized financial systems, contrasting with the centralized models of traditional banks.

Moreover, as a part of a broader global movement, the Bank for International Settlements (BIS) and seven central banks have embarked on Project Agorá. This project aims to merge digital and traditional financial systems to optimize global financial operations.

The project addresses long-standing inefficiencies in cross-border payments by integrating tokenized commercial and central bank funds on a unified ledger. It enhances financial controls like anti-money laundering efforts.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Simultaneously, UK Finance is advancing its experimental ledger pilot to track banking payments involving major banks like Barclays, Lloyds, and Citigroup. This pilot is a step towards a commercial system that could use tokenized assets to make cross-border transactions smoother, faster, and more secure.

The post Tokenization at the Forefront: HSBC Bank Leads with New Digital Asset Strategy appeared first on BeInCrypto.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on The best Amazon AU deals in April 2024

The best Amazon AU deals in April 2024

We’ve rounded up the top Amazon deals this week, from Amazon devices to phones, computing gear, home appliances, wearables and more.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next

A widely followed on-chain analyst thinks that Bitcoin (BTC) bears are about to get wiped out following last week’s crypto correction.

Analyst Willy Woo tells his 1.1 million followers on the social media platform X that the most recent Bitcoin retracement to $60,000 flushed out leveraged longs.

Woo says he doesn’t see Bitcoin going down in a straight line as he believes that BTC bulls will defend the “formidable” short-term holder (STH) at $59,000. According to the analyst, the odds are higher that BTC will bounce and liquidate traders who shorted at around $70,000.

“We flushed out long leverage down to $60,000.

To liquidate lower, price would have broken the formidable $59,000 STH support, and a strong sign of a bear market.

More likely short liquidations to $71,000-$75,000 is next.

Short-term price is a walk of liquidations.”

Woo is also keeping a close eye on the amount of Bitcoin supply available on crypto exchanges. According to the analyst, BTC’s inventory on exchanges has been on a downtrend since October 2022, suggesting that it’s only a matter of time before demand overwhelms supply and pushes Bitcoin to new all-time highs (ATH).

“Looking at views of demand and supply, this chart being only one of them, it’s just a matter of time before the accumulation happening throughout this consolidation squeezes us past ATH. Patience is key, don’t be degenerate.”

Woo also highlights that the current consolidation around the all-time highs is creating a solid support level for BTC. According to Woo, the ongoing accumulation between $60,000 and $70,000 is establishing a base of buyers that will secure BTC’s place as a trillion-dollar asset.

“Remember: the longer BTC consolidates around ATH, the more coins that change hands between investors cementing its price discovery.

This creates formidable long-term support once we break it.

Bitcoin as a trillion-dollar asset class is here to stay.

This is a good thing.”

At time of writing, Bitcoin is trading for $63,272, down nearly 4% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Analyst Willy Woo Says Bitcoin As Trillion-Dollar Asset Here To Stay, Sees Liquidation of BTC Bears Next appeared first on The Daily Hodl.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Google Pixel 8a vs. Pixel 8 — biggest expected differences

Google Pixel 8a vs. Pixel 8 — biggest expected differences

Our Google Pixel 8a vs. Pixel 8 comparison looks at likely differences between the two phones based on what Pixel 8a rumors say about the upcoming budget handset.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Which colors repel wasps? Here’s what the experts say

Which colors repel wasps? Here’s what the experts say

Experts say these are the colors to avoid if you want to keep your garden wasp-free this summer.

Published in B&T Latest News 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate

Billionaire Elon Musk has announced plans to charge new users on his social media platform, X (formerly Twitter), aiming to combat spam and scam bots.

However, this move has sparked considerable skepticism within the crypto community.

Why the Crypto Community Does not Like the Idea of Charging New X Users

After purchasing Twitter for $44 billion in 2022, Musk has frequently addressed the challenges posed by fake accounts and automated bots. On April 15, Musk explained on X that the platform would charge a small fee to tackle the bot accounts. He indicated that this fee might soon apply to basic functions such as posting, replying, and bookmarking.

“Unfortunately, a small fee for new user write access is the only way to curb the relentless onslaught of bots. The onslaught of fake accounts also uses up the available namespace, so many good handles are taken as a result,” Musk wrote.

Despite these efforts, including a trial ‘Not A Bot’ subscription that charges $1 for new users in New Zealand and the Philippines, doubt remains. On-chain sleuth ZachXBT highlighted the persistence of scam operations, noting that the fees might not stop scammers. He stressed that scammers often pay significant amounts to obtain verified status, suggesting that a small entry fee is unlikely to deter them.

Moreover, some scammers also use government account badges. ZachXBT claims that there is an entire black market for it.

“There are hundreds of business verified scam accounts every week which scammers pay thousands of dollars for,” ZachXBT stated.

Read more: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

Scammers Using Organization Verification Badge. Source: X (Twitter)

Scammers Using Organization Verification Badge. Source: X (Twitter)

Furthermore, crypto influencer Ansem criticized the plan’s effectiveness, arguing that stronger measures are necessary to address the problem effectively. He believes that while the fee might reduce casual spam, it does little to stop well-funded scammers and organized crime rings capable of treating such costs as business expenses.

“These scammers are printing infinite daily. They do not give af about paying pennies to make 5 figs+,” Ansem wrote.

Additionally, DeFi researcher Ignas suggested that Musk’s approach might prioritize financial gain over solving the issue. Since Musk took over Twitter, he has initiated various steps to cut costs and increase the platform’s profitability. Notably, he introduced the $8 fee for a verified X account.

Read more: Crypto Social Media Scams: How to Stay Safe.

Meanwhile, Musk’s other business, Tesla, is also undergoing significant financial adjustments. Amid a downturn in electric vehicle demand, Tesla has reportedly announced plans to reduce its workforce by “more than 10 percent.” This decision aims to eliminate duplication of roles and streamline operations.

The post Elon Musk’s New Anti-Bot Strategy: Charges for New X Users Stir Debate appeared first on BeInCrypto.

Published in B&T Latest News · Business Features 16 April, 2024 by The bizandtech.net Newswire Staff Comments Off on Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal

Microsoft said it would invest $1.5 billion in G42, an Emirati company with ties to China, as Washington and Beijing maneuver to secure tech influence in the Gulf.

Published in Business Features 28 March, 2024 by The bizandtech.net Newswire Staff Comments Off on When It Comes To TikTok Hyperventilation, Financial Conflicts Of Interest Abound

When It Comes To TikTok Hyperventilation, Financial Conflicts Of Interest Abound

Earlier this month we noted how despite all of the sound, fury, and hyperventilation surrounding the push to ban TikTok, most Americans don’t actually support such a move (you know, the whole representative democracy thing). Support is particularly lacking among young Democrats, a demographic the Biden administration has struggled to connect with in the wake of the ongoing carnage in Gaza.

The fact that this Congress is too corrupt to agree on anything of substance (but was able to quickly get a TikTok ban through the House) already spoke pretty loudly to TikTok creators. But it probably speaks louder still given that data reveals the House Reps that voted for the ban personally own between $29 million and $126 million worth of stock in competing tech companies that directly stand to benefit.

Of the 352 members of the House of Representatives who voted “yes” on the bill, 44 reported they own shares of companies including Amazon, Google, Meta, Microsoft, and Snap. Tracking their exact stock ownership total is tricky, in part, because Congress successfully crushed efforts to make their financial disclosures more easily searchable, notes Quartz:

“Some members file their financial disclosures by hand, and that information isn’t present in the data set. There are several other caveats to consider. Members of Congress have to report stock transactions within 45 days and disclose their overall stock holdings annually. Because there’s a grace period in both cases, the most recent information dates back to earlier this year, before the TikTok vote. Officials also don’t have to report the exact value of these investments, but instead have to disclose a range ($15,001 to $50,000 of Microsoft stock, for example). The value of the stocks has also changed since reports were filed.”

A TikTok ban also benefits military contractors and tech companies keen on seeing greater and broader animosity between the United States and China in order to sell more weaponry, automation, and surveillance technology.

The Intercept, for example, notes that Jacob Helberg, an extremely vocal supporter of the ban TikTok movement, is both a former advisor to Google, a member of the U.S.–China Economic and Security Review Commission, and a current advisor at the military contractor Palantir.

Helberg’s rhetoric on TikTok is not subtle:

“TikTok is a scourge attacking our children and our social fabric, a threat to our national security, and likely the most extensive intelligence operation a foreign power has ever conducted against the United States.”

There’s a large segment of these folks who freak out about TikTok, but ignore not only the same type of abuses by U.S. companies, but the same kind of abuses from international companies where U.S. interests might financially tethered; including the vast data broker industry whose ethics-optional monetization of consumer location, behavior, and other data is the source of endless scandals.

Unfortunately it’s an era where even being marginally transparent about your financial conflicts of interest has become… passé:

“It is a clear conflict-of-interest to have an advisor to Palantir serve on a commission that is making sensitive recommendations about economic and security relations between the U.S. and China,” said Bill Hartung, a senior research fellow at the Quincy Institute for Responsible Statecraft and scholar of the U.S. defense industry. “From their perspective, China is a mortal adversary and the only way to ‘beat’ them is to further subsidize the tech sector so we can rapidly build next generation systems that can overwhelm China in a potential conflict — to the financial benefit of Palantir and its Silicon Valley allies.”

Getting the greater gerontocracy in DC agitated about China has long been trivial for lobbyists, as one such hill advisor noted back in 2012 during the sustained freak out about Huawei (a not insubstantial chunk of which was driven by telecom competitors like Cisco):

“What happens is you get competitors who are able to gin up lawmakers who are already wound up about China,” said one Hill staffer who was not authorized to speak publicly about the matter. “What they do is pull the string and see where the top spins.”

It’s also relatively trivial for these kinds of folks to publish various op-eds at outlets like The Hill without disclosing financial conflicts of interests. Lawyers working for law firms doing lobbying and policy work routinely publish missives under their own name, while doing lobbying work on the side. That their arguments frequently stem from an obvious financial conflict of interest is, apparently, of no note.

Facebook has seen success for several years seeding various moral panics about TikTok around DC with the help of policy and PR firms like Targeted Victory. It’s pretty clear Facebook’s interest isn’t in privacy or national security, but in using both concerns as bludgeons to eliminate a direct competitor the company has, so far, proven incapable of out-innovating in the short-form video space.

That’s not to say that there aren’t meaningful national security issues at play, or people in DC who pursue national security issues in good faith. But they’re certainly and clearly outnumbered.

It’s clear that if lawmakers really cared about national security, they wouldn’t be supporting a multiple-indictment facing NYC real estate con man for President. If Congress really cared about consumer privacy, they’d pass a privacy law that applies to all companies and regulate data brokers, who routinely sell U.S. consumer data to foreign intelligence agencies.

Instead you sort of get a sort of lobbyist-driven, vibes-based, legislative process where the public interest is a distant afterthought, and even the most rudimentary transparency is simply a bridge too far.

Published in Business Features 26 March, 2024 by The bizandtech.net Newswire Staff Comments Off on Which Crypto Will Explode in 2024? (Top Picks for Investors)

Which Crypto Will Explode in 2024? (Top Picks for Investors)

The post Which Crypto Will Explode in 2024? (Top Picks for Investors) appeared first on Coinpedia Fintech News

As we venture further into 2024, the burning question on every investor’s mind is: “Which crypto will explode next?” There are countless options to choose from, but making the right choice can yield significant returns.

Cryptocurrency has become a popular investment choice for many due to its potential for high returns. However, with so many options available, it can be overwhelming to determine which one is worth investing in. With the right research and knowledge, investors can make informed decisions that could pay off in the long run.

In this article, we will explore some of the top picks for investors looking to capitalize on the potential growth of certain cryptocurrencies in 2024. Stay ahead of the curve and maximize your investment opportunities with these top picks.

Which Cryptocurrency Will Explode in 2024 (Top Picks for Investors)

As the world of cryptocurrency continues to evolve, investors are always on the lookout for the next big opportunity. While it is impossible to predict the future of any cryptocurrency with certainty, certain coins have shown great potential for explosive growth in the coming years.

Here are some top picks for investors who are looking to capitalize on the cryptocurrency market in 2024.

1. Pikamoon (PIKA): A relatively new player in the crypto market, Pikamoon aims to revolutionize the gaming industry by leveraging blockchain technology. With a strong development team and partnerships with major crypto figures, Pikamoon has the potential to explode in popularity as more gamers embrace cryptocurrency.

2. Avalanche (AVAX): Avalanche (AVAX) is a highly scalable blockchain platform that aims to rival Ethereum. With a focus on decentralized finance (DeFi) applications, AVAX has gained significant attention from investors and developers alike. Its advanced technology and strong community support make it a promising investment option for 2024.

3. Cardano (ADA): Built on a proof-of-stake blockchain, Cardano has gained a reputation for its commitment to scientific research and peer-reviewed development. With smart contract functionality expected to be released in the near future, Cardano could see explosive growth as it attracts more developers and users.

4. Fetch.Ai (FET): Fetch.Ai is an artificial intelligence-powered blockchain network that aims to revolutionize the way we interact with the digital world. With a focus on decentralized machine learning, Fetch.Ai has the potential to disrupt various industries, such as supply chain management and data sharing.

5. Solana (SOL): Solana is a high-performance blockchain platform that aims to scale globally and handle thousands of transactions per second. With strong backing from major investors and partnerships with prominent projects, Solana is well-positioned to explode in popularity in the coming years.

6. Render Token (RNDR): Render Token is a decentralized cloud rendering network that aims to transform the way computer-generated imagery (CGI) is created and distributed. With an innovative approach to rendering technology, Render Token has the potential to revolutionize the entertainment and gaming industries.

7. Fantom (FTM): Fantom is a fast, scalable, and secure blockchain platform that aims to enable decentralized applications (dApps) and smart contracts. With partnerships with major players in the blockchain space and a growing ecosystem, Fantom has the potential to explode in popularity and attract more developers and users.

8. Arbitrum (ARB): Powered by Ethereum, Arbitrum is a layer 2 scaling solution that aims to significantly increase the scalability and throughput of the Ethereum network. With Ethereum’s growing popularity and the need for scalable solutions, Arbitrum has the potential to become a game-changer in the cryptocurrency space.

9. Basic Attention Token (BAT): Basic Attention Token is a decentralized advertising and rewards platform that aims to bring transparency and fairness to the digital advertising industry. With a strong team and partnerships with major companies, BAT has the potential to see explosive growth as more advertisers and users embrace its innovative approach.

10. Kava (KAVA): Kava is a cross-chain DeFi platform that aims to bring decentralized financial services to users across multiple blockchain networks. With a focus on interoperability and scalability, Kava has gained attention from investors looking for exposure to the rapidly growing DeFi market.

What Causes a Cryptocurrency to Explode in Price?

1. Adoption and Utility: The first factor that can cause a cryptocurrency to explode in price is its level of adoption and utility. When more people start using a particular cryptocurrency for transactions or investment purposes, its demand increases, leading to a surge in price. Additionally, if the cryptocurrency has real-world applications and solves common issues, it gains value, attracting more investors and driving its price upwards.

2. Hype and Celebrity Endorsements: The power of hype cannot be underestimated in the cryptocurrency market. When a cryptocurrency project gains attention and publicity through media coverage, social media hype, or celebrity endorsements, it can experience a sudden and significant price surge. The endorsement of a well-known figure can create confidence and drive widespread interest, leading to a frenzy of buying and causing the price to skyrocket.

3. Tokenomics: The tokenomics of a cryptocurrency project can greatly impact its price trajectory. Factors such as the total supply, scarcity, and distribution can affect the demand-supply dynamics, leading to price explosions. For example, if there is a limited supply of tokens, coupled with high demand, the price is likely to surge as investors rush to acquire a piece of the limited availability.

4. Macroeconomic Events: Cryptocurrency prices are not immune to macroeconomic events. Global economic turmoil, political instability, or significant policy changes can drive investors towards cryptocurrencies as a safe haven or alternative investment. In times of uncertainty, cryptocurrencies such as Bitcoin have witnessed explosive growth due to their perceived store of value characteristics.

5. Whale Positioning: The presence and actions of large investors or so-called “whales” can have a significant impact on cryptocurrency prices. A whale’s ability to buy or sell large quantities of a particular cryptocurrency can create price movements. When a whale accumulates a huge amount of a cryptocurrency, it can drive up the price, encouraging others to follow suit and potentially causing an explosion in value.

In summary, a cryptocurrency can explode in price due to factors such as increased adoption and utility, hype and celebrity endorsements, tokenomics, macroeconomic events, and the influence of large investors. These factors contribute to the demand and perception of value, leading to significant price surges in the cryptocurrency market.

Detailed Analysis of The 10 Cryptocurrencies That Will Explode in 2024 & You Don’t Want to Miss Them

With the explosive growth of the cryptocurrency market in recent years, investors are eagerly seeking opportunities to identify the next big winners.

As we look ahead to 2024, this section aims to go into the details of ten cryptocurrencies that have the potential to explode in value and bring significant returns. By examining various factors such as technological advancements, market demand, and industry trends, these emerging digital currencies have been carefully selected as the ones that may offer the most promising opportunities for savvy investors.

Whether you are a seasoned cryptocurrency enthusiast or a curious beginner, read on to discover the ten cryptocurrencies that you don’t want to miss in 2024.

Pikamoon’s trajectory in the cryptocurrency realm is marked by notable achievements and milestones, positioning it as a standout contender for explosive growth in 2024. The presale of Pikamoon tokens witnessed unparalleled success, with allocations selling out fast. This remarkable feat underscores the overwhelming demand and investor confidence in Pikamoon.

Securing listings on tier-1 exchanges like Uniswap, Bitget, and MEXC further solidifies Pikamoon’s legitimacy and impressiveness within the crypto space, a rare accomplishment that speaks volumes about its potential. Global influencer campaigns have played a pivotal role in driving significant momentum, both during the presale phase and post-token launch. The bullish sentiment among influencers reflects the robust community backing and the promise of Pikamoon’s real product, including the Beta platform.

We have 100+ Crypto Influencers partnered with #Pikamoon  Published in Business Features

15 March, 2024 by The bizandtech.net Newswire Staff Comments Off on Microsoft is stuffing pop-up ads into Google Chrome on Windows again

Published in Business Features

15 March, 2024 by The bizandtech.net Newswire Staff Comments Off on Microsoft is stuffing pop-up ads into Google Chrome on Windows again

Microsoft is stuffing pop-up ads into Google Chrome on Windows again

Screenshot by Tom Warren / The Verge

Microsoft is once again injecting pop-ups into Google’s Chrome browser in a bid to get people to switch to Bing. The software giant first introduced malware-like pop-up ads last year with a prompt that appeared over the top of other apps and windows. After pausing that notification to address “unintended behavior,” the pop-ups have returned again on Windows 10 and 11.

Windows users have reported seeing the new pop-up in recent days, advertising Bing AI and Microsoft’s Bing search engine inside Google Chrome. If you click yes to this prompt, then Microsoft will set Bing as the default search engine for Chrome. These latest prompts look like malware, and once again have Windows users asking if they are legit or nefarious. Microsoft has…