Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Small Businesses Face Uphill Battle in AI Race, Says AI Index Head

Small and medium-sized businesses will struggle to keep pace with tech giants like OpenAI in developing their own artificial intelligence (AI) models, according to a new report from Stanford University.

In an interview, Nestor Maslej, the editor-in-chief of Stanford’s newly released 2024 AI Index Report, highlighted the study’s findings on the growing AI divide between large and small companies. While tech behemoths pour billions into AI R&D, smaller firms lack the resources and talent to compete head-on.

“A small or even medium-sized business will not be able to train a frontier foundation model that can compete with the likes of GPT-4, Gemini or Claude,” Maslej said. “However, there are some fairly competent open-source models, such as Llama 2 and Mistral, that are freely accessible. A lot can be done with these kinds of open-source models, and they are likely to continue improving over time. In a few years, there may be an open, relatively low-parameter model that works as well as GPT-4 does today.”

A study from PYMNTS last year highlighted that generative AI technologies such as OpenAI’s ChatGPT could significantly enhance productivity, yet they also risk disrupting employment patterns.

Surging Costs of AI

A major takeaway from the report is the possible disconnect between AI benchmarks and actual business requirements in the real world.

“To me, it is less about improving the models on these tasks and more about asking whether the benchmarks we have are even well-suited to evaluate the business utility of these systems,” Maslej stated. “The current benchmarks may not be well-aligned with the real-world needs of businesses.”

The report indicated that while private investment in AI generally declined last year, funding for generative AI experienced a dramatic surge, growing nearly eightfold from 2022 to $25.2 billion. Leading players in the generative AI industry, including OpenAI, Anthropic, Hugging Face and Inflection, reported substantial increases in their fundraising efforts.

Maslej highlighted that while the costs of adopting AI are considerable, they are overshadowed by the expenses associated with training the systems.

“Adoption is less of a cost problem because the real cost lies in training the systems. Most companies do not need to worry about training their own models and can instead adopt existing models, which are available either freely through open source or through relatively cost-accessible APIs,” he explained.

Pushing Standards for AI

The report also calls for standardized benchmarks in responsible AI development. Maslej imagines a future where common benchmarks allow businesses to easily compare and choose AI models that match their ethical standards. “Standardization would make it simpler for businesses to more confidently ascertain how various AI models compare to one another,” he stated.

Balancing profit with ethical concerns emerges as a key challenge. The report shows that while many businesses are concerned about issues like privacy and data governance, fewer are taking concrete steps to mitigate these risks. “The more pressing question is whether businesses are actually taking steps to address some of these concerns,” Maslej noted.

Measuring AI’s impact on worker productivity across different industries remains complex. “It is possible to measure productivity within various industries; however, comparing productivity gains across industries is more challenging,” Maslej said.

Looking ahead, the report highlights the need for businesses to navigate an increasingly complex regulatory landscape. On Tuesday, Utah Sen. Mitt Romney and several Senate colleagues unveiled a plan to guard against the potential dangers of AI. These include threats in biological, chemical, cyber and nuclear areas by increasing federal regulation of advanced technological developments.

Maslej emphasized the importance of staying vigilant. “Navigating this issue will be challenging. The regulatory standards for AI are still unclear.”

As public awareness of AI grows, Maslej believes that businesses must address concerns about job displacement and data privacy. “As people become more aware of AI, how can businesses proactively address nervousness, especially regarding job displacement and data privacy?” he posed as a crucial question for the industry to consider.

The 2024 AI Index Report is meant to guide businesses and society in navigating the rapid advancements in artificial intelligence. Maslej concluded, “The AI landscape is evolving at an unprecedented pace, presenting both immense opportunities and daunting challenges.”

The post Small Businesses Face Uphill Battle in AI Race, Says AI Index Head appeared first on PYMNTS.com.

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Home Equity Loans Issued by Homium on Avalanche

Homium, Inc., a home equity mortgage lender and securitization platform, has launched its tokenized home equity loans on Avalanche. Homium’s shared appreciation home equity loans “provide homeowners with a novel way to borrow against their home equity without increasing their monthly debt burden.” Homium’s launch… Read More

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Fintech Nium Reportedly Registers as Financial Services Provider in New Zealand

Nium, the global enabler of real-time, cross-border payments, announced that it is now registered as a Financial Services Provider in New Zealand. This pivotal step marks Nium’s entry into the dynamic financial landscape of New Zealand and reinforces its commitment “to delivering innovative financial solutions… Read More

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Top 4 accounting firm turns to Ethereum for blockchain-based business contracts

Big Four accounting firm Ernst & Young (EY) unveiled its new service for managing enterprise contracts via blockchain technology called OpsChain Contract Manager (OCM) on April 17.

The tool is designed to manage complex, multi-party business agreements with enhanced security and privacy via blockchain technology. The service is currently running on the Polygon proof-of-stake (PoS) blockchain and is slated for a future upgrade to the Ethereum mainnet.

OCM

OCM is designed to facilitate the secure handling of business contracts on a public blockchain, ensuring privacy by utilizing zero-knowledge proofs to maintain contract integrity and confidentiality while also improving time efficiency and reducing costs.

It integrates with existing enterprise systems through a standardized API and supports various contract types, including volume purchase agreements and price models dependent on market data feeds.

While the service is currently promoted as operating on Ethereum, it actually utilizes Polygon PoS to capitalize on the lower transaction fees that are attractive to EY’s industrial user base, based on a report by the Block.

Paul Brody, the head of EY’s blockchain division since 2016, said Nightfall — the technology behind the service — originated on Ethereum and has been tested on its test network. The forthcoming update will transition Nightfall to Ethereum’s mainnet and might include a Layer-3 upgrade to improve scalability and functionality.

Benefits of public blockchains

Brody also commented on the operational advantages of the OCM, noting that contract automation can significantly reduce cycle times and administration costs.

He emphasized the scalability and neutrality benefits of deploying on a public blockchain, which prevents any single party from controlling the network. Brody also noted that the future of corporate blockchain applications is increasingly leaning towards public blockchains, as they provide superior privacy and transparency compared to private blockchains.

The development comes in the wake of increased blockchain adoption by major financial players. Notably, BlackRock recently launched a tokenized fund on Ethereum, marking a significant step toward institutional engagement with blockchain technologies.

With the introduction of OpsChain Contract Manager, EY aims to improve how enterprises manage contracts, enhancing process efficiency and transparency through blockchain technology. The initiative positions EY as a pioneer in integrating blockchain into conventional business practices, setting a benchmark for the industry’s movement toward embracing this technology in routine operations.

The post Top 4 accounting firm turns to Ethereum for blockchain-based business contracts appeared first on CryptoSlate.

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Ripple (XRP) Price Analysis: 13% Recovery or 13% Decline – What Comes Next?

Ripple’s (XRP) price is likely exhausting the pessimistic sentiment noted in the past few days.

In the future, XRP holders will mostly opt to hold on to their assets or attempt to initiate a buying spree to prevent a bearish outcome.

Ripple Investors Exhibit Patience

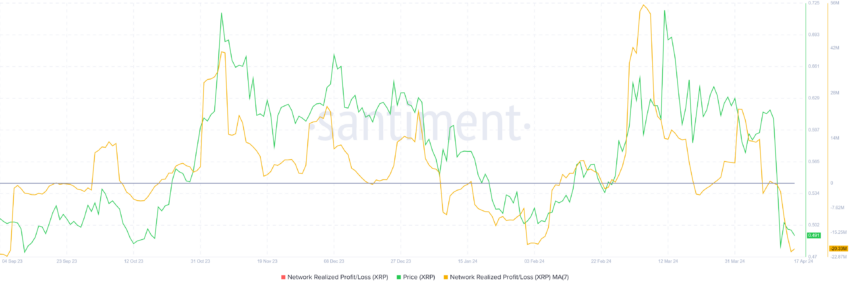

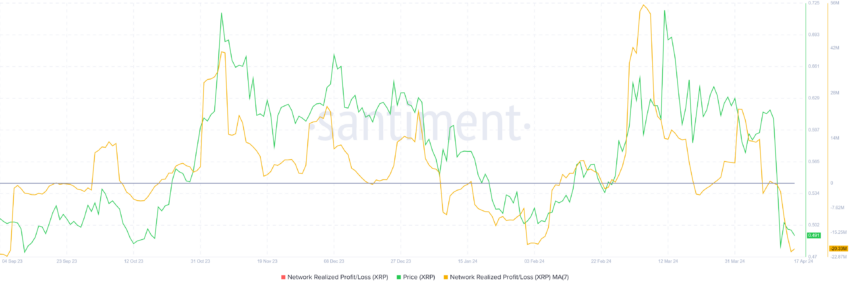

XRP price taking a turn for the worse was expected, given it was following a bearish pattern. However, investors have shown resilience by opting not to sell their holdings. The network realized profit/loss indicator shows that the investors are largely witnessing losses following the price decline.

Such instances are usually followed by accumulation or HOLDing. This is because the extent of losses is such that investors prefer to refrain from participating in the network over increasing their losses.

Ripple Network Realized Profit/Loss. Source: Santiment

Ripple Network Realized Profit/Loss. Source: Santiment

Read More: Everything You Need To Know About Ripple vs SEC

This resilience is further substantiated by the Mean Coin Age (MCA) indicator. This indicator represents the average age of all coins in a cryptocurrency network. It provides insight into the network’s activity level and potential for market movements.

Ripple Mean Coin Age. Source: Santiment

Ripple Mean Coin Age. Source: Santiment

The incline in this indicator is a sign of investors HOLDing their assets, while the decline hints at XRP moving among addresses, i.e., potential selling. This resilience will drive investors to act bullishly, pushing the price back up.

XRP Price Prediction: Defeating the Bears

XRP price drawdown was part of the descending triangle pattern’s bearish outcome. A 25% correction was likely per the pattern, which would have sent the Ripple token to $0.42. However, the altcoin halted its decline at $0.47.

Trading at $0.48 at the time of writing, the altcoin now stands 13% above the anticipated bearish target. On the other hand, the XRP price is only 13% away from reclaiming the crucial support of $0.60.

XRP/USDT 1-day chart. Source: TradingView

XRP/USDT 1-day chart. Source: TradingView

Considering the above factors, the likely outcome is bullish, with XRP price rising by 13%, which would help it reclaim $0.60, potentially pushing it further.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the support of $0.47 is lost, the 13% decline would be registered, invalidating the bullish thesis and validating the descending triangle.

The post Ripple (XRP) Price Analysis: 13% Recovery or 13% Decline – What Comes Next? appeared first on BeInCrypto.

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Tesla Seeks to Revive Musk’s $47 Billion Pay Deal With New Shareholder Vote

The company’s directors are asking shareholders to again approve the multibillion-dollar compensation plan and to move the company’s registration to Texas, from Delaware.

Published in B&T Latest News · Business Features

17 April, 2024 by The bizandtech.net Newswire Staff

Colorado Bill Aims to Protect Consumer Brain Data

In a first, a Colorado law extends privacy rights to the neural data increasingly coveted by technology companies.

Published in B&T Latest News

17 April, 2024 by The bizandtech.net Newswire Staff

Why Bitcoin Price dropped below $60K ? Will BTC Price Plunge to $55K This Weekend ?

The post Why Bitcoin Price dropped below $60K ? Will BTC Price Plunge to $55K This Weekend ? appeared first on Coinpedia Fintech News

Bitcoin has lost all the gains it made last Saturday, now trading under the critical $60,000 level as of this Wednesday morning. Following a short-lived rise above $64,000 earlier today, it tumbled down to a low of $59,900—a sharp drop of over 3% within just 24 hours, reaching its weakest point since the start of March. At press time, it’s lingering at around $60,400.

Current Trading Dynamics

On the Binance exchange, the most active Bitcoin trading pair (BTC-USDT) shows a huge number of buy orders stacked below $60,000. This outweighs the sell orders, suggesting a strong market demand at these lower levels which might prevent further immediate losses.

Nonetheless, Bitcoin has fallen over 15% from its most recent peak, and altcoins have not been spared either, experiencing dips ranging from 40%-50%. Such declines mirror typical behaviors in previous bull market corrections, according to data from Glassnode. But despite the visible buy zones, major investors appear hesitant to buy the dip.

Technical Analysis and External Factors

The Wyckoff method, a popular technical analysis tool, also points to potential further declines. Stockmoney Lizards’ recent analysis via a tweet indicates that Bitcoin is currently in what is termed as the “sign of weakness” phase of the Wyckoff Distribution Model; a stage often characterized by a reduction in demand leading to a possible price drop.

Read Also : What Next for Bitcoin Price: Crash or Pump? Top Analyst Sounds Alarm

This is made worse by external economic factors such as the Federal Reserve’s ongoing high interest rate policy and increasing tensions from the Iran-Israel conflict, which are making investors risk-averse.

Since the onset of the Iran-Israel conflict on April 12, Bitcoin ETFs have seen nearly $150 million in outflows, indicating a broad-based flight from riskier assets.

On the technical front, the price has been pushed back from the $70,000 resistance level and is heading towards a retest of the $60,000 support zone. Breaking below this could likely lead to a steep decline toward the $55,000 level.

Read More : Why Bitcoin Price is Crashing? Here Are Top Factors Influencing BTC Price

Conversely, if Bitcoin can surge past $68,000 again, reaching new heights could be just around the corner. However, with the Relative Strength Index (RSI) currently below 50%, the likelihood of a breakdown remains high and could potentially lead to severe market consequences.

Ripple Network Realized Profit/Loss. Source:

Ripple Network Realized Profit/Loss. Source:  Ripple Mean Coin Age. Source:

Ripple Mean Coin Age. Source:  XRP/USDT 1-day chart. Source:

XRP/USDT 1-day chart. Source: